How Much Va Loan Am I Eligible For

When applying for a VA loan, one of the most important factors to consider is how much you are eligible to borrow. The VA will guarantee up to 25% of your loan, up to the conforming loan amount for your area, so you shouldn’t have to provide a down payment.

The amount of your loan will depend on several different factors, such as your income level and credit score. In addition, the lender will also consider your monthly expenses, including housing costs and any debts that you may have.

To calculate your eligibility for a VA loan, you can use an online calculator or contact a VA approved lender for assistance. Whatever method you choose, it is important to be realistic about how much you can afford in terms of monthly mortgage payments.

Va Service Requirements For Veterans

- World War II : 90 days total

- Post-World War II : 181 days continuous

- Korean War : 90 days total

- Post-Korean War : 181 days continuous

- Vietnam War : 90 days total

- Post-Vietnam War : 181 days continuous

- Pre-Gulf War : 24 months continuous or 181 days of active duty

- Gulf War, Iraq War and War in Afghanistan : 24 month continuous or 90 days of active duty

Broadly speaking, the VA offers more lenient requirements for people who served during a time of war compared with peacetime.

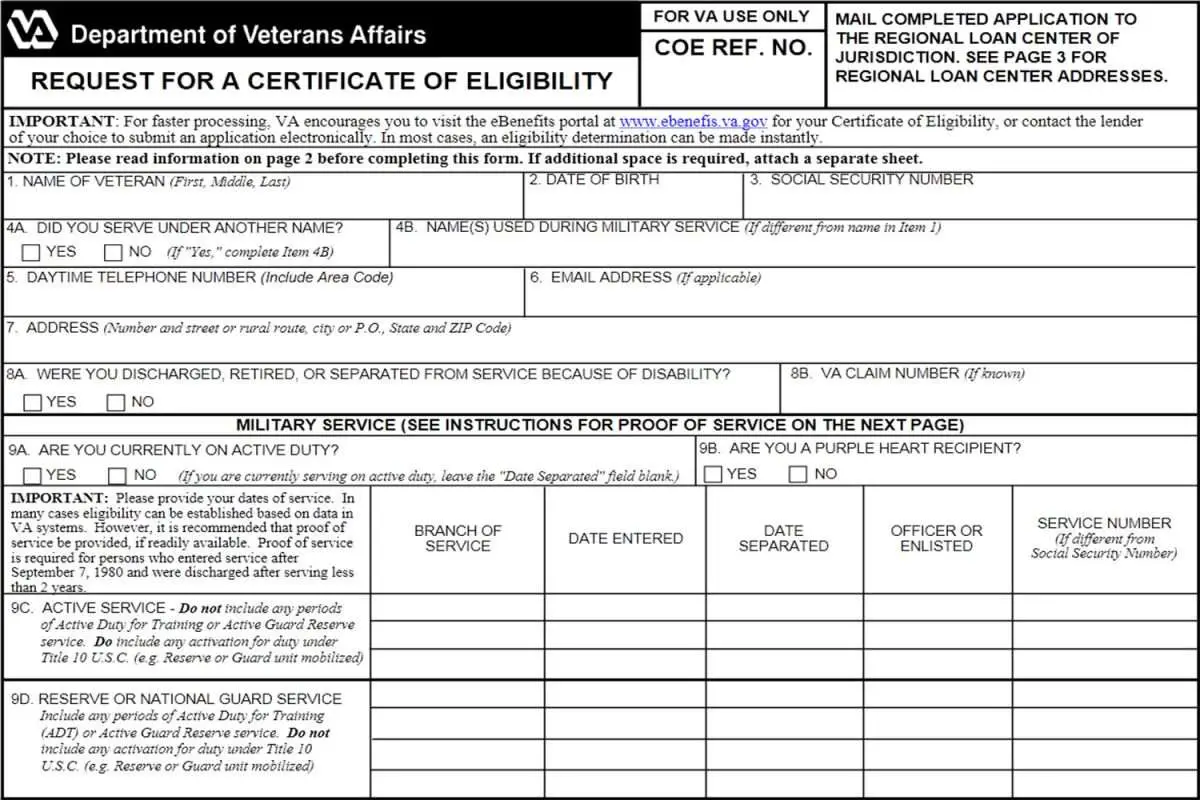

Loan Certificate Of Eligibility

A certificate of eligibility is a form issued by the Department of Veteran Affairs to indicates that a borrower is eligible for a VA loan. To get the COE, you must meet specific requirements.

- For one, you must have 181 days of service during peacetime.

- Ninety days of service at wartime.

- You a surviving spouse of a veteran.

Applying for a COE is not difficult. You can get the forms from the VA website. Alternatively, you can also work with your lender to get the certificate of eligibility. Remember to make sure you bring along proof of service and fill the DD Form 214.

You May Like: Autosmart Becu

What If I Dont Meet The Requirements

If you dont know if you meet the service or financial requirements for a VA loan, be sure to reach out to an experienced loan officer for help. There are a number of eligibility exceptions depending on your specific circumstances, and a loan officer can work with you to make sure you get the best deal on your loan.

To learn more about PenFed loans or determine which loan is right for you:

How To Apply For A Va Loan

Veterans and service members don’t need to know if they’re eligible for a VA loan to try and start the process. You’ll get a good handle on your ability to land a VA loan during the first step â loan preapproval.

The VA loan process typically takes 30 to 45 days once you’re under contract on a home, although every buyer’s situation is different. Applying for a VA loan doesn’t obligate you in any way to a particular lender or to move forward with the homebuying process.

Here’s a look at the three basic steps to applying for a VA home loan:

Recommended Reading: Bayview Loan Modification

Take The Eligibility Test To Find Out Who Qualifies For A Va Loan And Learn If You Make The Cut:

- Are you an active duty service member who has served for 90 continuous days?

- Are you a veteran with a record of 90 to 181 days of continuous service ?

- Are you a National Guard or Reserve member with a record of six years of service? Did you receive an honorable discharge, continue to serve in the Selected Reserve, transfer honorably to Standby Reserve or transfer to the retired list?

- Are you the un-remarried surviving spouse of a veteran or service-member who died as a result of military service or of a service-connected disability? Or the un-remarried spouse of a service-member who is missing in action or a prisoner of war? Or a surviving spouse who remarried after turning 57, on or after December 16, 2003?

If you made it through that list and you answered yes to one of the questions, you could be the proud owner of a VA loan. The VA loan guidelines allow anyone who meets one of the above descriptions to apply for a VA home loan.

Va And Partners Proudly Serving Veterans

- Since 1944, VA and private industry partners have helped deliver the dream of homeownership to generations of Veterans and Servicemembers. VA Loan Guaranty Service employees and representatives of the private industry describe the benefits of the VA Home Loan and why they serve Veterans.

- For more on the VA Home Loan program, go to:

After establishing that you are eligible, you will need a Certificate of Eligibility . The COE verifies to the lender that you are eligible for a VA-backed loan. This page describes the evidence you submit to verify your eligibility for a VA home loan and how to submit the evidence and obtain a COE.

You May Like: Fha Title 1 Loan Lender

How Long Does It Take To Get A Coe

The way you choose to apply for your COE will dramatically impact your timeline.

The eBenefits portal application should confirm your eligibility and provide a COE within a few minutes. But if you choose to go the snail mail route, it could take 4 to 6 weeks to receive your VA COE in the mail.

As you begin shopping for a home, keep these timelines in mind. It is a smart move to secure your Certificate of Eligibility as early as possible in the home buying process. With the documentation lined up, you can move on to the next steps of your home search confidently.

Whats The Maximum You Can Borrow

Theres no limit set by the VA on how much youre allowed to borrow for a home. But the VA does cap the amount of insurance provided to the lender, and most lenders limit the loan amount as a result. You can find out the limit in any U.S. county through the VA website.

The maximum loan limit varies from one lender to another, so this is another reason to shop around.

If youve already received a VA loan, the amount youre allowed to borrow with no down payment may be smaller.

Also Check: Should I Choose Fixed Or Variable Student Loan

Why Cant I Get My Va Loan Eligibility Restored

If your restoration application is rejected, it may be due to an outstanding balance on your original loan. For example, if you foreclosed on your original loan and still have a remaining balance due, or if you gave up the deed to the home instead of foreclosing, you may be ineligible for full restoration.

If this is the case, dont forget to check if you have remaining entitlement money if you didnt use your entire entitlement on your first home, then you can put it towards a second loan.

You May Like: Capital One Auto Loan Private Party

Restoring Your Va Loan Eligibility

Lately weve gotten several questions about restoring VA loan eligibility. Some readers want to know if they need to restore their eligibility or if its done automatically once a VA home loan has been paid in full.

Others want to know if they need to have eligibility restored if they got a VA Certificate of Eligibility , never used it, but now cant find the form to use the first time. Still others want to know how to apply for their eligibility or restoration of it.

Applying for eligibility or restoration of it can be as simple as working with the lender. A borrowers eligibility is still available even if a replacement form or electronic proof of it is requireda borrower who got his or her COE but never used it would still have the eligibility to work withthe lender will need proof of eligibility, but its definitely still available if it has not been used.

What do VA home loan rules say about getting VA loan eligibility restored after first-time use? In VA Pamphlet 26-7, we find the following under the heading, Restoration of Entitlement. In essence, VA loan eligibility can be restored for a borrower to purchase another home with a VA mortgage if the following applies:

How do you request VA loan entitlement restoration? Remaining entitlement and restoration of entitlement can be requested through the VA Eligibility Center by completing VA Form 26-1880.

Also Check: Usaa Auto Loan Rates Used Cars

You May Like: How To Get Leads As A Loan Officer

Refinancing To Restore Va Loan Entitlement

Restoration looks different when we talk about refinance. The big reason why is that you arent disposing of the property when you refinance.

A VA homeowner can refinance into a non-VA loan and pay off their original VA loan in full. But because youre holding onto the property instead of handing it over to a new buyer, entitlement restoration options get narrower. Otherwise, VA buyers could potentially purchase home after home, refinancing each new VA loan and fully restoring their entitlement each time.

The VA loan program is meant to help veterans purchase primary residences they live in full time, rather than amass a bunch of investment properties.

To that end, the VA allows veterans a one-time opportunity to refinance their loan, keep their home and fully restore their entitlement, which well explore in the last section.

I Got My Coe How Do I Use It To Get A Va Home Loan

Get excited! You now officially meet the criteria to apply for a VA home loan . Once you have your COE, youll still need to complete a loan application with your lender.

Your lender will look at five key sections of your COE that break down your VA home loan eligibility:

- Entitlement codes

- Funding fee

- Previous VA loans

- Available entitlement

- Conditions

All these factors, plus standard financial criteria like your credit score, will help the lender build the best loan for you. Whether youre refinancing your current loan or purchasing a new home, our team is ready to help you through the process.

Once you have your Certificate of Eligibility, the next step to getting your VA home loan is an appraisal.

Have questions, kudos, or VA home loan experiences to share? Wed love to hear from you on or !

Don’t Miss: How To Transfer A Car Loan To Someone Else

How Long Does It Take To Receive A Coe

If you apply online and your eligibility is easy to verify, getting your COE can be a relatively quick process: roughly 30 days. If you can, though, apply early, and leave six weeks for processing.

In rare cases, verifying service and eligibility can take time. For example, if your discharge was classified as less than honorable, you can go through the VAs Character of Discharge review process, which can take up to a full year.

How Many Times Can You Use A Va Loan

Looking at the total number of VA loans you might use over a lifetime, the issue of VA entitlement rears its head yet again. Most service members who qualify for a VA loan will receive full entitlement from the outset, but that dollar figure goes down whenever you take out a mortgage through this program. Youll need to replenish your entitlement by repaying your VA loan if you want to use it for future home purchases.

In other words, the number of VA loans youll be able to use over the course of your life depends on your ability to repay your mortgage and restore your VA entitlement. Beyond that logistical constraint, though, the VA doesnt put a cap on the number of home loans you can use through its financing program.

Recommended Reading: How Much Do Loan Officers Make In Commission

Why Can’t I Get My Va Loan Eligibility Restored

If your restoration application is rejected, it may be due to an outstanding balance on your original loan. For example, if you foreclosed on your original loan and still have a remaining balance due, or if you gave up the deed to the home instead of foreclosing, you may be ineligible for full restoration.

If this is the case, dont forget to check if you have remaining entitlement money if you didnt use your entire entitlement on your first home, then you can put it towards a second loan.

Next Steps For Getting A Va Direct Or Va

Requesting your COE is only one part of the process for getting a VA direct or VA-backed home loan. Your next steps will depend on the type of loan youre looking to getand on your lender .

The lender will request a VA appraisal of the house. An appraisal estimates the houses market value at the time of inspection. An appraisal isn’t a home inspection or a guaranty of value.

The lender reviews the appraisal and your credit and income information and decides if they should accept your loan application.

If they decide to accept your application, the lender will work with you to select a title company to close on the house.

Don’t Miss: Usaa Auto Loan Approval

Remember These Rules For Your Future Home

Before you break out the champagne and toast your VA loan eligibility, its important to make sure the home you want to finance meets VA loan requirements. Thats because the second kind of VA loan requirement limits which properties are eligible for financing through VA loans. Its not just a question of who is eligible for a VA loan. Its also a question of which homes are eligible for VA loans.

To get approved for a VA loan, your home will have to pass the VA appraisal process. Why would a home not pass? If the house is too run down, youll have a hard time getting the OK from a VA appraiser. The point of a VA appraisal is to make sure that the home a veteran wants to finance meets the VAs Minimum Property Requirements . Sorry, that means no broken windows, no leaky roof, no faulty wiring and no pest infestations. If you have your heart set on a real fixer-upper youll need to look elsewhere for financing.

VAs Regional Loan Centers and individual states have their own specific requirements for the houses whose loans theyll guarantee. For example, you wont need to prove that your home is termite-free if you live in Alaska.

Does My Va Loan Eligibility Ever Expire

No, as long as you meet the qualifying service requirements, your VA loan benefits never expire. You can use them on your first home purchase and any subsequent home purchases after that.

There is, however, a limit to your loan entitlement or how much the VA will guarantee. Fortunately, once you sell a home and pay off the VA loan attached to it, your entitlement resets and can be used for a new piece of property.

Recommended Reading: Upstart Early Payoff Penalty

How Do I Check My Va Loan Eligibility

Loans from the Department of Veterans Affairs, commonly known as VA loans, are some of the most attractive home loans out there — offering the potential for zero down payments and qualification with credit scores as low as 620. If you served in any branch of the U.S. military and separated under any condition that is not dishonorable, you might qualify for a VA loan.

In addition, if you served in the National Guard or Reserves and served active duty for the full period upon which you were called, you might also quality for a VA loan. Active duty service members, as well as the surviving spouses of veterans are also eligible.

Next Steps For Applying For A Va Loan

The process of applying for a VA Loan may seem daunting to some borrowers. However, it becomes easier to comprehend the process when broken down into simple steps.

- Make sure your lender is VA-approved

- You need to get a Certificate of Eligibility

- Check your loan amount pre-qualification

- The lender orders a VA appraisal and processes the application

- Getting Your Loan Closed

Recommended Reading: Credit Score For Usaa Auto Loan

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Applying For Your Va Certificate Of Eligibility For A Va Mortgage

Depending on the nature of your military service, you may have different requirements to obtain your COE. The first thing you will need to do is gather your documents which will include VA Form 26-1880 or its electronic equivalent.

You can apply by mail, the VAs web portals such as eBenefits, or apply with the help of your participating lender.

If you are retired or separated you will need to submit copies of your retirement or separation paperwork. For active-duty military members, this will be your DD Form 214, for others such as Guard or Reserve members, the paperwork may be different.

Guard and Reservists should be prepared to show current points statements where applicable, and any relevant discharge paperwork for prior service, current service where applicable, etc.

Currently serving military members typically require a statement from their chain of command indicating that the military member is in good standing, how much active duty service commitment remains on the current commission or enlistment, when you started active duty, total years of service, any lost time, plus personal data such as full name, Social Security Number, etc.

You should ensure that any such letter is written as an official communication including any letterhead that might be used in such correspondence. The verification letter should not be treated as a casual document but rather one that could make or break loan approval.

Read Also: Capitol One Car Loan