Whats The Difference Between A Secured Or Unsecured Personal Loan

Secured loans are when you borrow money and you secure the loan against an asset such as a home or car. Secured loans usually come with lower interest rates than an unsecured loan because the lender would, in the event that you canââ¬â¢t pay back the loan, have the option to sell your asset to make up for the repayments you still owe.

AS SEEN ON

How To Use The Interest Calculator

Growws interest rate calculator is customized for ease of use. Here are the steps you need to remember.

Simply input the values of the loan amount, the interest rate and the loan tenure and the calculated value will be displayed instantly. You can check the interest accrued for a home loan, personal loan and car loan.

Home Loans And Credit Cards

Home loans can be complicated. It is smart to use an amortization schedule to understand your interest costs, but you may need to do extra work to figure out your actual rate. You can use our mortgage calculator to see how your principal payment, interest charges, taxes, and insurance add up to your monthly mortgage payment.

You might know the annual percentage rate on your mortgage, and keep in mind that APR can contain additional costs besides interest charges . Also, the rate on adjustable-rate mortgages can change.

With credit cards, you can add new charges and pay off debt numerous times throughout the month. All of that activity makes calculations more cumbersome, but its still worth knowing how your monthly interest adds up. In many cases, you can use an average daily balance, which is the sum of each days balance divided by the number of days in each month . In other cases, your card issuer charges interest daily .

Don’t Miss: How Long For Sba Loan Approval

What Is The Simple Interest Formula And Its Concept

Calculating the amount that you need to pay or receive after a certain period based on the interest is vital. Simple Interest Formula is the easiest method of calculating interest on the principal amount and works in the following situations.

- When you have borrowed money: If you have taken money from the Bank or your friends and family, you need to pay extra payment of interest along with the borrowed amount. SI formula can help you to calculate the cost of borrowing in the form of Interest.

- When you lend money: If you have given money to someone, then you can earn Interest Income in exchange for making money available to them. With the Simple Interest formula, you can get a clear picture of extra income in the form of Interest.

- When you invest money: Individuals who have invested their surplus money in investment schemes such as Fixed Deposit, Recurring Deposits etc. also receive attractive interests on their investments and can calculate such Interest Income with Simple Interest.

Calculating Credit Card Interest

With is similar, but it can be more complicated. Your card issuer may use a daily interest method or assess interest monthly based on an average balance, for example. Minimum payments will also vary by the card issuer, depending on the card issuers approach to generating profits. Check the fine print in the credit card agreement to get the details.

Also Check: How To Get A Loan Officer License In California

Compound Interest And Savings Accounts

When you save money using a savings account, compound interest is favorable. The interest earned on these accounts is compounded and is compensation to the account holder for allowing the bank to use the deposited funds.

If, for example, you deposit $500,000 into a high-yield savings account, the bank can take $300,000 of these funds to use as a mortgage loan. To compensate you, the bank pays 1% interest into the account annually. So, while the bank is taking 4% from the borrower, it is giving 1% to the account holder, netting it 3% in interest. In effect, savers lend the bank money which, in turn, provides funds to borrowers in return for interest.

The snowballing effect of compounding interest rates, even when rates are at rock bottom, can help you build wealth over time Investopedia Academy’s Personal Finance for Grads course teaches how to grow a nest egg and make wealth last.

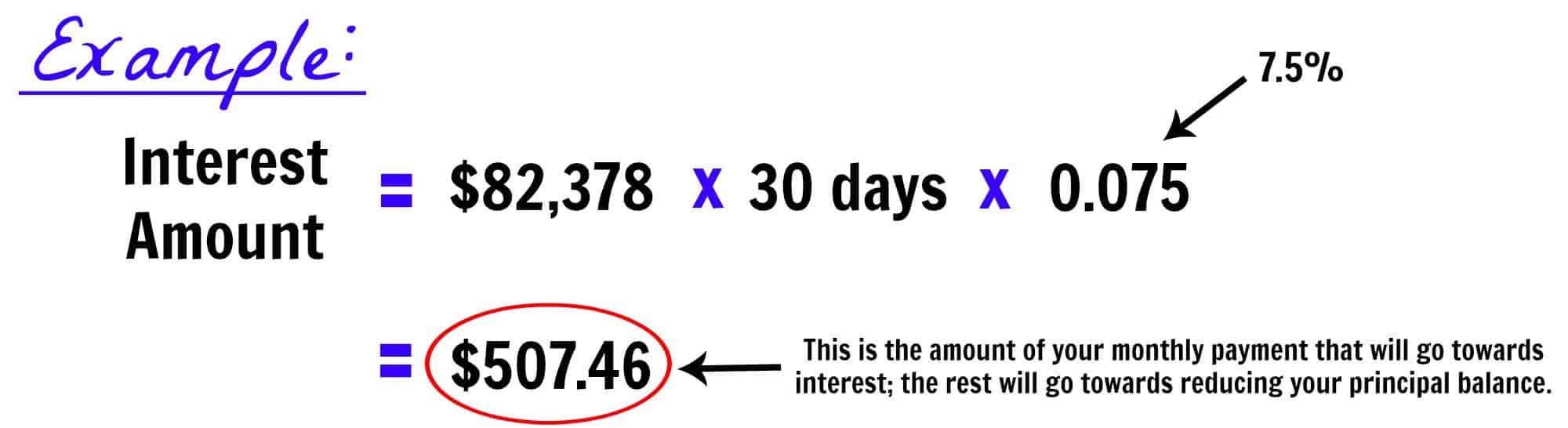

How Is Interest Calculated On A Loan

Interest on a loan, such as a car, personal or home loan, is usually calculated based on the daily unpaid balance of your loan. This typically involves multiplying your loan balance by your interest rate and dividing this by the 365 days in a year. This shows your daily interest charge. As interest is usually charged monthly, the daily interest amount is then multiplied by the number of days in the month.

As a hypothetical example, if you had a home loan balance of $400,000 at 3.52% p.a. , your monthly interest charge would be:

- $400,000 x 0.0352/365 = $38.575 daily interest

- $38.575 x 30 days in June = $1,157.25 interest for June

Keep in mind that your loan may be calculated in a different way depending on who you bank with. To get an estimate of how much interest youll pay over the life of a loan, you can use Canstars calculators for:

You can also use Canstars extra home loan repayments calculator to see how making extra repayments could save you time and interest on your home loan.

You May Like: Commercial Loan Rates Today

How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

Accrued Interest In Bonds

Accrued interest is also important to know in bonds. Issuers typically make payments on bonds every quarter or six months. In the meantime, the interest due in those payments accrues to you. If you sell the bond, the price you sell it for should take into account the accrued interest.

Let’s say you have a bond position worth $10,000. It has an annual coupon rate of 5% and it makes payments every six months. You want to sell it, but it has been two months since the last payment, so you need to calculate your unpaid interest as of the settlement date.

To do this, you’ll need to figure out the monthly interest owed and multiply it by two. The formula is $10,000 x .05 / 12 = $41.67. This means you have $83.33 of accrued interest. Make sure when you sell the bond that you take that number into account.

Also Check: Drb Student Loan Refinancing Review

This Formula Can Help You To Calculate Your Interest Rate

Calculating interest rate is not at all a difficult method to understand. Knowing to calculate interest rate can solve a lot of wages problems and save money while taking investment decisions. There is an easy formula to calculate simple interest rates. If you are aware of your loan and interest amount you can pay, you can do the largest interest rate calculation for yourself.

Using the simple interest calculation formula, you can also see your interest payments in a year and calculate your annual percentage rate.

Here is the step by step guide to calculate the interest rate.

How To Find The Best Interest Rates When You Need A Loan To Repair Your Car

If you are struggling to finance a major auto repair, taking a personal loan is a viable option. Compare the fees levied and interest rates offered by reputed lenders to arrive at an informed decision. Use the reliable car finance calculator provision on a trustworthy online banking platform to assess your monthly repayments.

Some extensive car repairs are not included in your insurance and warranty coverage. You may be falling short of cash, and postponing the repairs often worsens the situation. When you approach a dependable and efficient source, applying for the personal loan and receiving the funds on approval happens in record time.

Also Check: Becu Car Repossession

How To Calculate Principal And Interest On Home Loan

Renting means following the rules, not being able to decorate and having restrictions on pets. Starting a new loan is a very big decision. A personal loan calculator is a free too. Keep reading to learn more about annuities and how you can calculate the inter. Comparing interest rates and deciding if monthly payments are affordable can make your head spin, but there are valuable resources that can help.

What Is Interest On Loan

The term interest on loan refers to the amount that a borrower is obligated to pay or a depositor is supposed to earn on a principal sum at a pre-determined rate, which is known as the rate of interest and the formula for interest can be derived by multiplying the rate of interest, the outstanding principal sum and the tenure of the loan or deposit.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

Interest on Loan = P * r * t

where,

- r = Rate of interest

- t = Tenure of loan / deposit

In the case of periodic interest payment , the equation for interest payment can be derived by multiplying the rate of interest and the outstanding principal sum and then dividing the result by the number of periodic payments during the year.

Mathematically, Interest Payment is represented as,

Interest on Loan = P * r / N

where,

- N = number of periodic payment per year

Recommended Reading: How To Get An Aer Loan

Why Is The Annual Interest Rate Important

The annual interest rate is the figure on which all the other rates you need to know are based. Itâs your base rate, and while itâs not always the best way to compare different products across financial institutes, it does make up a big part of what youâll need to consider.

Youâll also need the standard interest rate if youâre planning to calculate interest on a loan yourself. Or, you can use our handy repayment calculators.

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Recommended Reading: How To Get An Aer Loan

Adopt A Practical Approach

Knowing what is wrong with your vehicle and the corresponding repair cost is the first step to addressing the problem. Serious car engine, transmission, and AC compressor issues warrant heavy expenses. In such cases, getting a loan to fund major car repairs becomes necessary.

Finding a personal loan with repayment terms and interest rates you can afford should be your priority. An online car finance calculator is such a boon at these times as it gives you an idea of your prospective instalment outgoings. On the lender approving your application, you receive the entire loan amount in one shot.

Immediate access to funds is what the personal loan route assures you of, especially when you qualify as a borrower. You are heavily dependent on your primary mode of transport, and the longer it is out of action, the more stressful your life becomes. A personal loan with customer-friendly and flexible features provides the necessary support.

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Recommended Reading: What Happens If You Default On Sba Loan

Accrued Interest Vs Regular Interest

The method for calculating interest payments on a loan or outstanding credit balance varies depending on the agreement.

Accrued interest agreements have fees calculated based on the current account balance and rate.

If you have a regular interest loan, also called a simple interest loan, the payment due will always be the same. A regular interest agreement establishes a set interest rate and usually a payment amount that spans the term of the loan.

The easiest way to think about the difference is a credit card versus a mortgage. With a credit card, you build up a balance and accrue interest that must be paid monthly. With a mortgage, there is an agreed-upon regular interest rate and you pay it while paying back the mortgage amount .

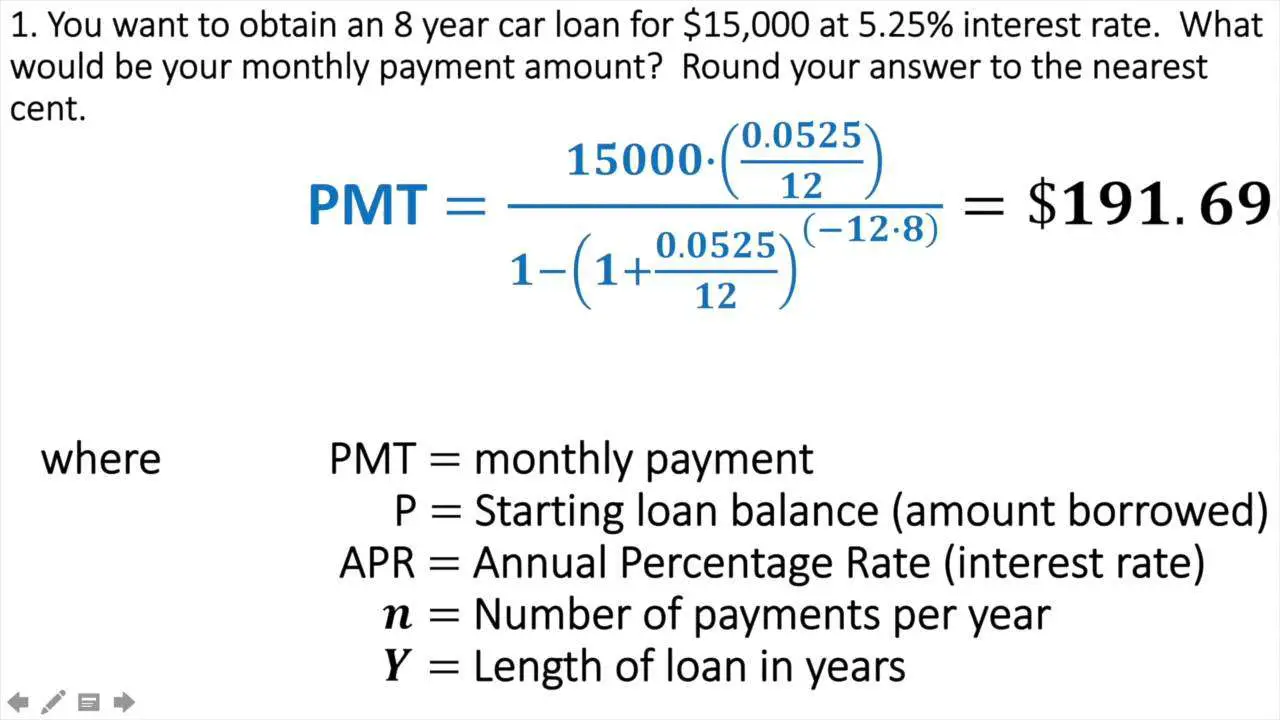

How To Calculate Loan Payments In 3 Easy Steps

Making a big purchase, consolidating debt, or covering emergency expenses with the help of financing feels great in the moment – until that first loan payment is due. Suddenly, all that feeling of financial flexibility goes out the window as you factor a new bill into your budget. No matter the dollar amount, it’s an adjustment, but don’t panic. Maybe it’s as simple as reducing your dining out expenses or picking up a side hustle. Let’s focus on your ability to make that new payment on time and in full.

Of course, before you take out a personal loan, it’s important to know what that new payment will be, and yes, what you’ll have to do to pay your debt back. Whether you’re a math whiz or you slept through Algebra I, it’s good to have at least a basic idea of how your repayment options are calculated. Doing so will ensure that you borrow what you can afford on a month-to-month basis without surprises or penny-scrounging moments. So let’s crunch numbers and dive into the finances of your repayment options to be sure you know what you’re borrowing.

Don’t worry – we’re not just going to give you a formula and wish you well. Ahead, we’ll break down the steps you need to learn how to calculate your loan’s monthly payment with confidence.

Don’t Miss: Usaa Credit Score

Effective Interest Rate On A Discounted Loan

Some banks offer discounted loans. Discounted loans are loans that have the interest payment subtracted from the principal before the loan is disbursed.

Effective rate on a discounted loan = /

Effective rate on a discounted loan = / = 6.38%

As you can see, the effective rate of interest is higher on a discounted loan than on a simple interest loan.

How To Calculate Interest On A Loan

One of the essential steps in any loan process is knowing and understanding the interest rate. Unfortunately, this can also be a very confusing step if youre not already familiar with how interest rates work. And we get it calculating interest for a loan, credit card, or line of credit is overwhelming. Luckily, CreditNinja is here to help you figure out how to calculate interest on your loan.

Interest is just one aspect of a loan or financial product. There are so many things to keep track of when youre considering a new loan. For instance, you should be familiar with the length of the repayment period, the late fees, the processing and origination fees, and of course, the interest rate.

If youve never taken out a large loan before, all of these things can be overwhelming.

So its best to do plenty of research and prep beforehand. Learning everything you can about interest rates will help you in the long run. And it will help when youre talking to the lender and trying to negotiate a good deal.

Read on to learn more about interest rates, interest payments, and the annual percentage rate.

You May Like: Refinance Avant Loan