How To Find Old Mortgage Loan Records

How to find old mortgage loan records? This homeowner wants to find proof of old mortgage payments made before they refinanced and modified their loan.

Q: I purchased my home back in 2004 and got a mortgage with a lender that has since been purchased by one of the huge banks. I made all of my payments owed to the original lender and then also made extra payments on the loan.

In 2005, I lost my job, filed for bankruptcy and refinanced my loan with the original lender. They refinanced us with an adjustable rate loan that was then sold off to the bank that wound up buying them. Several years later, I was finally able to get a loan modification.

Our mortgage is now serviced by a different loan servicer. This servicer only has records going back to 2005 and not 2004. How would I prove the payments I made against the loan back in 2004? I was told by the banks that I should shred all old documents as they are no longer valid. I did that. So, what are my options now?

Manage And Track Borrowers Monthly Payments

Mortgage servicers must provide borrowers with a statement for each billing cycle. The statement must show the current payment due, the previous payment made, any fees the servicer has charged , any transaction activity and the servicers contact information.

In lieu of statements, the mortgage servicer may give the borrower a coupon book if the loan has a fixed interest rate.

When you send your monthly payment to your mortgage servicer, it sends your principal and interest to the mortgage holder. If youre paying mortgage insurance premiums, the servicer collects that money and sends it to the right place, as well. When you have enough equity to cancel private mortgage insurance, youll work with your servicer to get that taken care of.

Missing Mortgage Payments: Default And Foreclosure

Usually, if you miss one or more payments on your mortgage loan, your loan is considered to be in default, but you might have special rights during the during the COVID-19 pandemic. To learn more, read these resources from the Consumer Financial Protection Bureau: Mortgage forbearance during COVID-19: What to know and what to do and CARES Act Mortgage Forbearance: What You Need to Know.

In other circumstances, the servicer might order default-related services to protect the value of the property like inspections, lawn moving, landscaping, and repairs. The servicer will charge your loan account for these services, which can add up to hundreds or thousands of dollars.

If the lender decides to move ahead with foreclosure, that process can also add hundreds or thousands of dollars in additional costs to your loan. That can make it even more difficult for you to keep up with payments, make your back payments, and keep your home.

If youre facing foreclosure, stay in touch with your servicer and try to work out a plan to pay the back payments you owe, modify your loan, enter into a repayment plan, or get a temporary reduction or suspension of payments. If your loan was in default when your new servicer took over, they might be considered a debt collector and you may have additional rights.

Recommended Reading: Usaa Refinance Rates Auto

Freedom Mortgage Loan Modification Problems And Complaints

Getting in touch with someone at Freedom is really difficult.

Freedom has not adjusted to the increased call volume associated with the COVID Forbearance plans.

If you have the ability to retain an attorneys help in dealing with them, you should if only so you dont have to stress about trying to get in touch with them.

If youre going to go at it alone, make sure you understand what youre up against and do what you can to avoid their most common communication problems.

Problem: You can expect to be on hold for an hour or more just to get an update on your file

Solution: Try calling them before 7:30am. Dont call on a Monday or a Thursday.

Problem: It is not easy to get transferred to a supervisor

Freedom Mortgages customer service representatives and trained to block you from being able to speak with a supervisor. The supervisors at Freedom actually do have the authority and ability to help move your file forward but they are very hard to get a hold of.

If you ask for a supervisor, you can expect to be told that you will be transferred to a Voicemail and that a supervisor will call you back.

Problem: Freedoms supervisors CAN email you and put things in writing but they will try to do everything they can to AVOID doing that

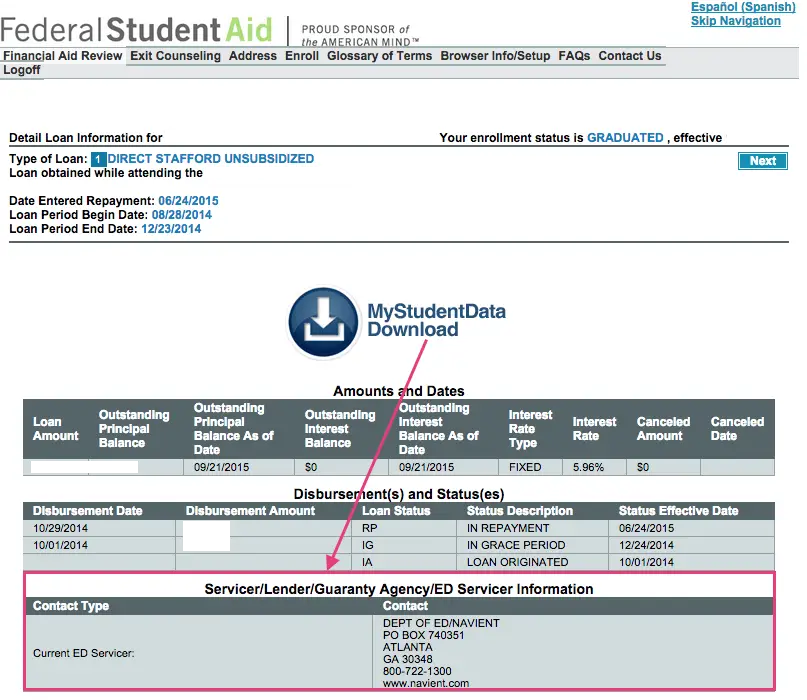

First Things First: Whats A Servicer

Before you learn how to find the company that services your loan, you need to understand the difference between a servicer and a loan owner.

The servicer is the hands-on manager of your loan. A servicer handles the day-to-day management duties associated with mortgage loan accounts. These duties include collecting payments, sending billing statements, managing escrow accounts, communicating with borrowers, reviewing borrowers applications for loss mitigation options, and overseeing foreclosures when borrowers stop making payments.

The servicer might be the loan owner, but more likely it is a separate company that receives a fee in exchange for managing the loan.

The owner of the loan might be different than the servicer. The servicer might be the loan owner, but more likely it is a separate company that receives a fee in exchange for managing the loan. The loan owner is also called the “holder.”

Recommended Reading: Capital One Auto Loan Approval

Can I Choose A Different Mortgage Servicer

No, you cant choose your mortgage servicer that decision is made by the lender or investor that owns your loan. The only two ways to stop having your loan serviced by a particular company are:

- NEW TRANSFER

Which Option Is The Best For Your Unique Situation

While there are plenty of loan programs available to homeowners, they all boil down to being in one of two categories. Whether the interest rate is fixed for the term of the loan or adjusts is something you decide based on your needs.

- A fixed-rate mortgage offers you peace of mind because the principal and interest payment will not change throughout the term of the loan. If you lock in today with a historically low rate, it will never change.

- An adjustable-rate mortgage or ARM offers you a lower starting interest rate for a specified period of time. Once that is up, the rate will adjust annually based on current market conditions.

- How long do you plan to stay in the property?

- Whats important to you in terms of monthly payments?

- What do you know about the current market trends and how they might affect interest rates?

Which one is right for you?

That is where our professionally trained loan officers come in. We will ask the right questions upfront so that we provide you with a loan that meets both your long and short-term goals. We help you make the best decision for you.

Don’t Miss: Can I Refinance Fha Loan

Servicing Your First Mortgage

Servicing a mortgage simply refers to making your home loan repayments. Before a lender will approve your home loan application, theyll want to be confident that you can comfortably service the repayments without being at too much risk of financial stress if your personal situation were to change.

Using an online calculator, you can estimate how much the repayments on the mortgage you have in mind may cost, and see how these may fit into your household budget. As a rough guideline, if more than one third of your household income is going towards servicing the repayments on your first mortgage, you may be at risk of mortgage stress.

You can use the same online calculator to estimate your borrowing power, using the repayments you can afford to find your potential maximum loan size. Of course, theres no guarantee that a lender will approve an application for a home loan of that amount.

Another calculator can help you find how much you can borrow based on your income and expenses. Using a similar process to many mortgage lenders, this calculator includes buffers to help reduce the risk of ending up in mortgage stress, providing a closer estimate of how large a home loan a lender may approve .

The simplest ways to improve your ability to service your first mortgage is to increase your income and lower your expenses if only it were that easy!

Check On Your Account After A Servicer Is Changed

After your mortgage servicer has changed, carefully examine your mortgage statements, making sure all payments have been recorded and taxes and insurance premiums have been paid on time. Retain copies of letters, canceled checks and other paperwork relating to your mortgage and payments in case you need to document any dispute.

Read Also: Usaa Used Car Loan

How Will My Loan Be Serviced After Closing

-

Better Mortgage will service your loan after it closes. During this time, payment administration and collection will be handled by our sub-servicing partner, called The Money Source .

At some point, we might transfer your loan to a permanent servicer. We have a large roster of reputable servicers and mortgage investors including major US banks, government-sponsored entities, publicly-traded mortgage companies, and specialized servicing firms. We collect third-party reviews and survey our borrowers post-transfer to ensure the permanent servicers are quality partners.

TMS will notify you if and when your loan is being transferred. In the event your loan is not transferred you will continue to make payments to TMS.

Ready to get pre-approved?Get started

Related questions

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate employs real estate agents and also maintains a nationwide network of partner brokerages and real estate agents . Better Real Estate Partner Agents work with Better Real Estate to provide high quality service outside the service area covered by Better Real Estate Agents or when Better Real Estate Agents experience excessive demand.

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

Read Also: What Car Can I Afford With My Salary

Why Do I Need To Know The Servicer

You need to know who services your loan and how to contact them if, for example:

- you want specific information about your accountlike how much your payment is, when your next payment is due, or what late fees you owe

- youre having trouble making your payments and you want to work out a short-term solution, like a forbearance or repayment plan, or

- youre having trouble making your payments and you want to apply for a long-term solutionlike a modification, short sale, or deed in lieu of foreclosure.

If youre in foreclosure, though, you might want to find out who owns your loan. You could potentially have a defense to the foreclosure if the foreclosing party doesnt actually own your loan or cant prove that it owns your loan through a proper chain of promissory note endorsements and mortgage assignments.

To learn who owns your loan, you can:

- send an official lettercalled a request for informationto your servicer asking who owns the loan

- check to see if Fannie Mae or Freddie Mac owns your loan by using the Fannie Mae and Freddie Mac loan-lookup tools online , or

- go to the MERS website.

Mortgage Lender Vs Mortgage Servicer

- The bank or mortgage lender processes and funds the home loan

- Once it closes it may be sold off to a loan servicer or retained in portfolio

- The job of a loan servicer is to collect monthly mortgage payments

- And manage escrow accounts if your home loan has impounds

As noted, a mortgage loan servicer, also known simply as a loan servicer, is the company that collects your monthly mortgage payments.

They also manage your escrow account if your home loan has impounds, collecting a portion of property taxes and homeowners insurance each month, before making those payments on your behalf when due.

So really, theres a good chance youll deal with your loan servicer a lot more than your mortgage lender, who may have only been in the picture for a month or so while your loan was originated.

You see, many mortgage lenders focus on loan origination as opposed to servicing, so theyre happy to fund your loan and quickly sell it off for a profit, then rinse and repeat.

The same goes for mortgage brokers, who fund your loan on behalf of a wholesale mortgage lender, which also may sell off the loan to a different servicing company shortly after it closes.

Further complicating all this is the fact that your mortgage lender could also be your loan servicer because some big banks and mortgage companies can profit from it.

One thing mortgage companies figured out in recent years was that keeping in touch with their past customers was a great way to generate repeat business.

You May Like: Loaning Signing Agent

Why Did My Lender Choose Shellpoint To Service My Mortgage

We service mortgages for some of Americas top banks, mortgage companies, and real estate investment firms. One of the main reasons they trust us to manage their mortgages is our reputation for creating an outstanding mortgage servicing experience for homeowners. Our Customer Care team is dedicated to serving you with dignity, respect, and compassion.

Cookie And Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

Google Webfont Settings:

Also Check: Does Usaa Refinance Auto Loans

What Mortgage Servicers Do

The primary job of your mortgage servicer is to collect your monthly payments and allocate them correctly to your principal, interest and escrow. Mortgage lending, by contrast, consists of advertising, working with potential borrowers, underwriting mortgage applications to see if borrowers can afford to repay the loans theyre requesting and advancing loan funds to borrowers so they can buy homes.

Lets go into what mortgage servicers do in a bit more detail.

We Provide Financing From The Ground Up

We offer access to two programs designed to take some of the worry out of building your dream home and you can use them together for even more advantages.

Lock in your interest rate for up to 240 days at no cost with SmartLock if rates go lower, you get to take advantage. It offers peace of mind in uncertain rate environments while you build your home.

DreamBuilder gives you home financing during construction to build the home youve always wanted.

When you use them together:

- Lock in your rate for 240 days and take advantage if rates go down

- Financing for a 12-month construction period

- Borrow up to 80% of the homes purchase price

- Only pay for the portion of the funds you use

Building your dream home? Count on us to make it easier.

Read Also: How Long Does Sba Loan Take To Get Approved