Are Health Care And Retirement Benefits Paid By The Employer Eligible Costs For Loan Forgiveness

For employees

Health care and retirement benefits paid or incurred during the covered period are eligible for forgiveness as payroll costs. Expenses paid by employees for such benefits are not eligible for forgiveness. Expenses for future periods that are accelerated into the covered period are also not eligible for forgiveness.

For self-employed individuals and general partners

Employer health insurance contributions and employer retirement contributions made on behalf of self-employed individuals or general partners are not eligible expenses.

For owner-employees of S-corps

Employer health insurance contributions are not included for owners having at least a 2% stake of an S-corp. Employer retirement contributions made on behalf of an owner-employee of an S-corp are eligible and do not count toward the cash compensation cap of $20,833 per individual, and are capped at the amount of 2.5x their monthly employer retirement contribution in the year that was used to calculate the loan amount .

For owner-employees of C-corps

Employer health insurance contributions and retirement contributions are eligible expenses. Retirement costs are capped at 2.5 x monthly employer retirement contribution in the year that was used to calculate the loan amount . These payments do not count toward the $20,833 cap per individual.

How Can I Prepare To Apply For Loan Forgiveness

Once you determine which SBA Loan Forgiveness Application Form you will use, we recommend that prior to applying online through Bank of America for PPP loan forgiveness, you carefully review and fill out the applicable form, and gather any required documentation specified in the instructions:

For borrowers applying for loan forgiveness using SBA Form 3508EZ and SBA Form 3508, please note:

- During the PPP loan forgiveness process you may need to resubmit documentation that you provided during the PPP loan application process.

- Our online forgiveness application portal for 3508EZ and 3508 forms are not currently able to accept the following non-payroll costs, which were recently added by the SBA to the list of forgivable expenses: covered operational expenditures, covered property damage costs, covered supplier costs and covered worker expenditures. We will begin accepting these costs in several weeks and will email you when these updates are made. If you want to claim these expenses, you may want to wait until the updated online application is available.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

When Is The Latest I Can Apply For Forgiveness

If you have a Second Draw loan, you must submit your forgiveness application for your First Draw loan either before or simultaneously with your Second Draw loan forgiveness application.

The latest date you can apply for loan forgiveness is the maturity date of the loan. If you have not submitted a complete loan forgiveness application within 10 months after the end of the maximum 24-week covered period, payments will be due.

If you complete your application after you start making payments and receive a forgiveness determination that exceeds your outstanding principal balance, a settlement process will occur for any overpayment.

Don’t Miss: Fha Loan Limits Texas

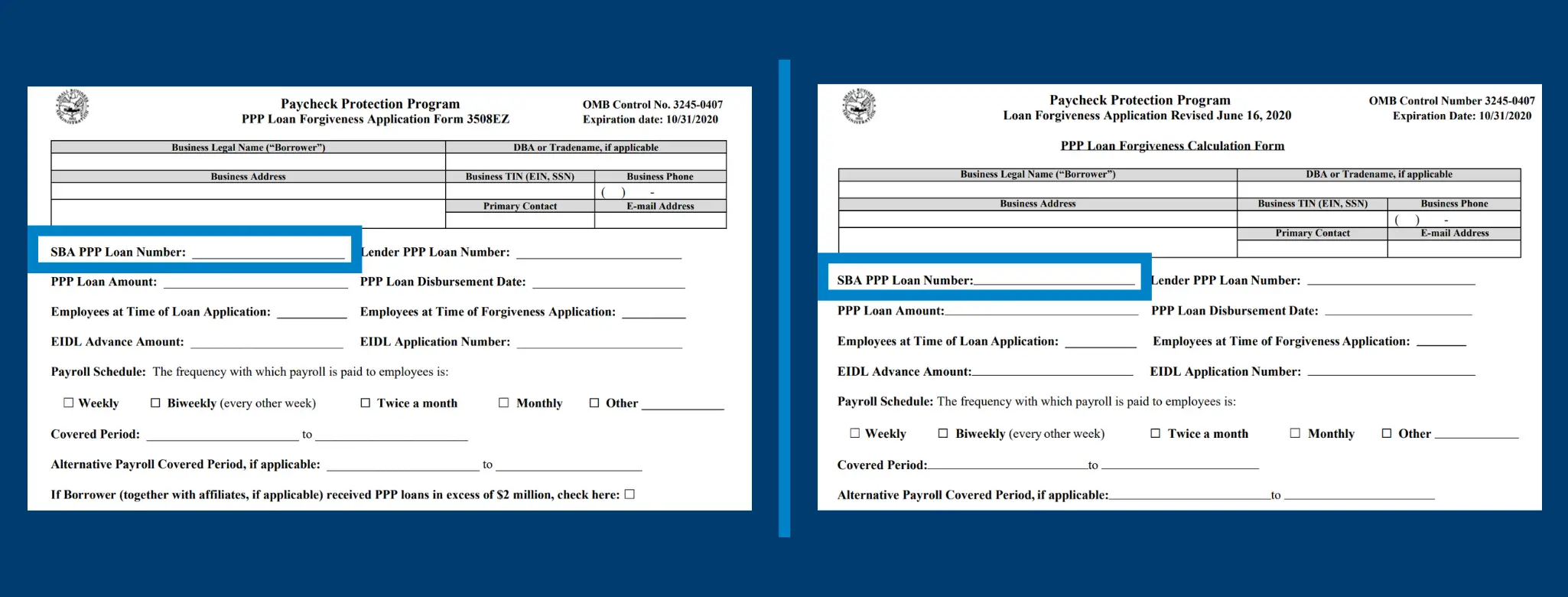

How Long Is My Ppp First Draw Sba Loan Number / What Does My Ppp First Draw Sba Loan Number Look Like

As part of the Second Draw Borrower application, Applicants must enter the SBA loan number of the First Draw PPP loan .

According to the SBA, PPP First Draw Loan Numbers have the following format to help borrowers identify the SBA loan number of their first PPP loan: XXXXXXXX-XX . Womply has also seen lenders providing the PPP First Draw Loan Number as 10-digits .

Either way, your PPP First Draw SBA Loan Number is a ten digit number with no letters. The SBA has asked all PPP lenders to make SBA loan numbers easily accessible to their borrowers, so be sure to work with your lender to obtain your ten digit PPP First Draw Loan Number.

What Documentation Will Be Required To Demonstrate The 25% Revenue Reduction

Quarterly âgross receiptsâ for one calendar quarter in 2020 and the âgross receiptsâ for the corresponding calendar quarter in 2019. Per the U.S. Treasury borrower guidance for Second Draw loans, the following are the primary sets of documentation that can be provided to substantiate your certification of a 25 percent gross receipts reduction :

- Quarterly financial statements for the entity. If the financial statements are not audited, the Applicant must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. If the financial statements do not specifically identify the line item that constitute gross receipts, the Applicant must annotate which line item constitute gross receipts.

- Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. The Applicant must annotate, if it is not clear, which deposits listed on the bank statement constitute gross receipts and which do not .

- Annual IRS income tax filings of the entity . If the entity has not yet filed a tax return for 2020, the Applicant must fill out the return forms, compute the relevant gross receipts value , and sign and date the return, attesting that the values that enter into the gross receipts computation are the same values that will be filed on the entityâs tax return.

Read Also: Fha Loan Refinance Requirements

Which Types Of Payroll Costs Are Eligible For Loan Forgiveness

Eligible payroll costs include the following, if paid or incurred during the covered period:

- Gross salary, gross wages, gross tips, gross commissions, paid leave , and allowances for dismissal or separation

- Payments for employer contributions for employee health insurance, including employer contributions to a self-insured, employer-sponsored group health plan, but excluding any pre-tax or after-tax contributions by employees

- Payments for employer contributions to employee retirement plans, excluding any pre-tax or after-tax contributions by employees

- Payments for employer state and local taxes assessed on employee compensation , excluding any taxes withheld from employee earnings

- Payroll costs may include bonus and hazard pay, and may include salaries paid to furloughed employees.

Limitations for individual employees

The total amount of cash compensation eligible for forgiveness may not exceed a pro-rated annual salary of $100,000. This means the maximum you can claim for cash compensation is $46,154 for any individual employee during a 24-week covered period – the maximums are lower for periods of less than 24 weeks.

Eligible payroll costs are limited to employees whose principal place of residence is the United States. Payments to independent contractors are not eligible.

Limitations for owner-employees, self-employed, and general partners

For self-employed individuals

For general partners

For owner-employees of S-corps

For owner-employees of C-corps

In all cases

How Long Will It Take Before I Know If My Ppp Loan Has Been Forgiven

After submission of a complete and signed application, including required documentation, we will begin our review process. The U.S. Bank review process can take up to 60 days. We will contact you if there are any issues with your application.

Following the completion of our review, we will submit a decision on your loan forgiveness application to the SBA for their final review we will also notify you of that decision. From our submission date, the SBA has up to 90 days to provide us with the final forgiveness amount. When the SBA renders their final review results, we will let you know. Additionally, if the SBA requests more information one of our verification specialists will be in touch. Please note, in some cases we have not received the SBAâs final payment decision within the 90 days. The SBA has notified us that they are doing everything they can to review loan files in a timely manner. We will notify customers when we receive the SBAâs rendered decision.

Don’t Miss: Bayview Loan Servicing Dallas Tx

When Should I Apply For Ppp Forgiveness

You must apply for forgiveness within 10 months after the end of the ‘Covered Period. ‘ which is the 24-week period that starts when you received your PPP loan. The lender has 2 months to process your loan forgiveness application then SBA has three additional months to approve your forgiveness.Nov 27, 2020

Should I Fill Out The Sba Paper Application

No. We request that you do not attempt to submit the paper forms from the SBA. Through our digital forgiveness application portal, we are able to auto-populate and pre-fill fields from your loan. You will be notified when you are eligible to apply for forgiveness and provided directions on how to access our forgiveness portal. Please contact your banker if you have questions or would like to submit a request for early access.

Don’t Miss: Usaa Preferred Car Dealers

How Do I Calculate My Ppp Loan

How PPP loans are calculated. PPP loans are calculated using the average monthly cost of the salaries of you and your employees. If you’re a sole proprietor, your PPP loan is calculated based on your business’ net profit. Your salary as an owner is defined by the way your business is taxed.Feb 24, 2021

What Are The Consequences Of Unresolved Issues

Per the SBAs January 14, 2021 Interim Final Ruling Protection Program Second Draw Loans, if your first draw PPP loan has an unresolved issue, which we now know may be due to hold codes or compliance check error messages, the SBA will notify the lender and no SBA loan number will be issued until the original loan request issue are resolved.

An unresolved issue does not prohibit a borrower from receiving a second draw loan but it may affect the timing of a second draw funding to a borrower with economic need, if not resolved in a timely manner.

- If a second draw borrowers application is submitted by a lender and the borrower has hold code from its 2020 first draw loan, then the application will automatically move to research status and the platform will provide the lender an opportunity to resolve the outstanding issue.

- Similarly, if a borrowers application for a first or second draw loan submitted by a lender receives a compliance check error message, the application will also automatically move to research status and the platform will provide the lender an opportunity to resolve the outstanding issue.

Once the issue are resolved, loan requests will automatically move to the next stage of the process and should not require re-entry by the lender.

Also Check: Sss Loan Application

If Not A Lender What Is Lendios Role With Ppp

We match qualified borrowers with SBA-approved lenders. Our single online application makes it easy to apply to our network of SBA-approved lenders. Once a borrower applies for a PPP loan, we work with them to ensure that the application has everything it needs to be deemed complete by the SBA, match the borrower with an appropriate lender, and then the lender takes care of the rest.

Add New Requirements For Business Information

On the same Business Information page of the application, you need to complete these new required fields.

- Business start date: This must be the same as the date on your Secretary of State filing.

- Industry: Start typing in your industry, then select it from the menu options that appear. If you dont see your exact industry, pick 1 that matches the closest. Applications cannot be approved by the SBA without an industry.

Don’t Miss: Usaa Car Financing

Ppp Payoffs And Payments

Can I start making PPP loan payments early?You can begin making payments early, if you’d like. Please visit your local store to make a loan payment through the drive-thru or make an appointment to make a payment in the store.

How do I pay off my PPP loan?If you wish to pay off your PPP loan, please call your local Store Manager or Relationship Manager for assistance.

If I don’t apply for forgiveness, when is my first payment due?Customers who haven’t applied for forgiveness will have to begin making payments on their loan starting 10 months after the end of their 24-week covered period.Customers who apply for forgiveness will have to start making payments on any portion of their loan that is unforgiven once the SBA sends the approved forgiveness amount to TD Bank or informs the bank that the loan does not qualify for forgiveness. Interest accrues on PPP loans even during the deferral period. Customers should prepare to make payments on any unforgiven portion of their loan. Any portion of a PPP loan which is forgiven, plus the interest accrued on that portion, does not have to be repaid.

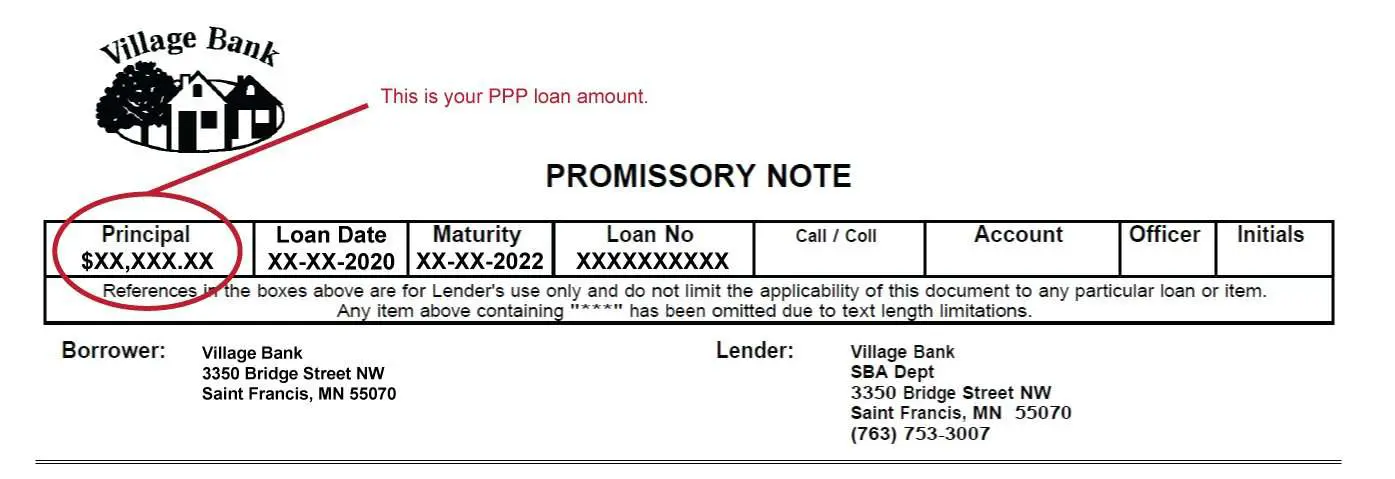

How Do I Find My Sba Ppp Loan Number

If you do not know your SBA Customer ID number, you may find it by doing a Small Dynamic Business Search from the CCR Home page . On the search form, enter your EIN or Duns number and click on the Search button.

Also Check: How Does Getting Pre-approved For A Car Loan Work

Webbank Loan Number For Ppp Loan Forgiveness

Thanks for the reply…actually the problem was that that WebBank loan number was NOT on the final doc. I had to do some sleuthing and found the number that I needed on the LoanBuilders site. Good news is I have some updated info via a direct phone call to WebBank. They gave me a new phonethat connects to a newly set up info desk specifically for the SBA FORGIVENESS LOANS. I spoke with Derrick who was very helpful and reduced my stress level. Hope this helps someone else.

When Will The Ppp Extension End

Thanks to a recent extension, the Paycheck Protection Program will now end on May 31, 2021, or until funds are exhausted, whichever happens first. After that date, the SBA will have through June 30, 2021 to process qualified, completed applications as long as they were submitted to the SBA prior to the May 31, 2021 deadline.

We recommend you apply for PPP early to ensure that your application has enough time to move through processing by the lender and be submitted to the SBA prior to the May 31, 2021, deadline.

You May Like: Www Capitalone Com Auto Pre Approval

How To Check Ppp Loan Status

The PPP extended forgivable emergency loans that provided funding to cover payroll and other eligible expenses related to ensuring employees could maintain their ability to earn a living during the pandemic. Application acceptance for both the first and second draws of the loan ended on March 31, 2021, but businesses that have already received loans can still apply to have their loans forgiven.

The lender partner servicing a PPP loan may be a valuable resource for determining application status. Many of the biggest banks, such as Wells Fargo, US Bank, Chase and Bank of America, have created online portals on their websites specifically for PPP applicants to access. If youre a business owner, you can establish login credentials with the specific bank that disbursed the funds to you and use these portals to check your SBA application status.

Entrepreneurs can also check their status with the SBA directly. You can email an inquiry including your name and loan number to [email protected], or you can call the SBA office for your region to learn more. This tool helps you identify SBA district offices by region.

How Do I Find My Ppp Loan Number

Glad to see you here in the Community, @imgtoct1993.

You’ll have to reach out to your preferred local lender to get the PPP loan number. They’ll provide you with the information.

If you processed it with Intuit, I’d recommend reaching out to our Customer Support Team. This way, the agent can provide you the details.

Here’s how:

- Through phone – You can follow the steps in the What is QuickBooks Capital article.

- Through chat – You can check our Small Business Loans for QuickBooks Customers webpage, then click Live Help at the bottom.

I’ll also include some articles that will help you with gathering the documents for PPP:

Don’t hesitate to drop a comment below if you have other questions. We’re always here to help. Take care!

Also Check: Usaa Credit Score For Auto Loan

How Can I Check My Sba Loan Status

about the application process, the status of your loan, or with any other questions you may have.02-May-2020

- The following includes several effective sources to check your SBA loan status: If you submitted your application online, you can check the status of your loan through the SBA website. This is the quickest, easiest way to verify the status of your EIDL.

What Are The Different Application Forms

The SBA issued several different forgiveness application forms. Below summarizes each form, based on the versions published January 19, 2021.

Form 3508S – For borrowers with loans of $150,000 or less. Benefits include a simplified application and no supporting documentation required in most cases.

Form 3508EZ – For businesses who did not reduce employee compensation by greater than 25% during the covered periods compared to the most recent full calendar quarter before their covered period and also meet one of the following criteria:

- They did not reduce the number of employees or the average hours per employee between January 1, 2020 and the end of the covered period .

- They were unable to operate during the covered period at the same level of business activity as before February 15, 2020, due to compliance with COVID-19 guidance or requirements issued between March 1, 2020 and December 31, 2020 by HHS, CDC, or OSHA including shutdown orders and requirements to operate at reduced capacity from state and local government.

Benefits include:

- Borrowers do not complete the PPP Schedule A or PPP Schedule A Worksheet or equivalent

- Borrowers certify that their forgiveness amount is not subject to potential adjustments due to decreases in FTE and certain employee compensation, so information on those topics is excluded from the application

Don’t Miss: Directloantransfer