Alternative And Online Lenders

Online lenders provide an alternative to traditional banks, hence the name alternative lenders.

Alternative lenders usually provide faster funding than banks. Some, like Kabbage and Fundbox, even have automated loan application processes so you can get near-instant approval. Other online lenders have slightly longerbut still shortapplications, and most brag about getting you funded within a matter of days .

Plus, online lenders offer financing to people without perfect credit. While most lenders will still have some kind of minimum criteria for applicants, theyll ask for lower credit scores and annual revenue than most traditional banks.

These perks do come with higher interest rates, shorter terms, and lower loan amounts than you can get from a traditional bank. But dont fret too much about thatwith as many lenders and loan options as you have, you can probably find something that works for you.

Besides, if you really need financing but lack the credit history to get it from a traditional bank, settling for higher rates is probably a better option than simply not getting a loan.

Business.orgs favorite online lenders

| Name |

| Apply Now |

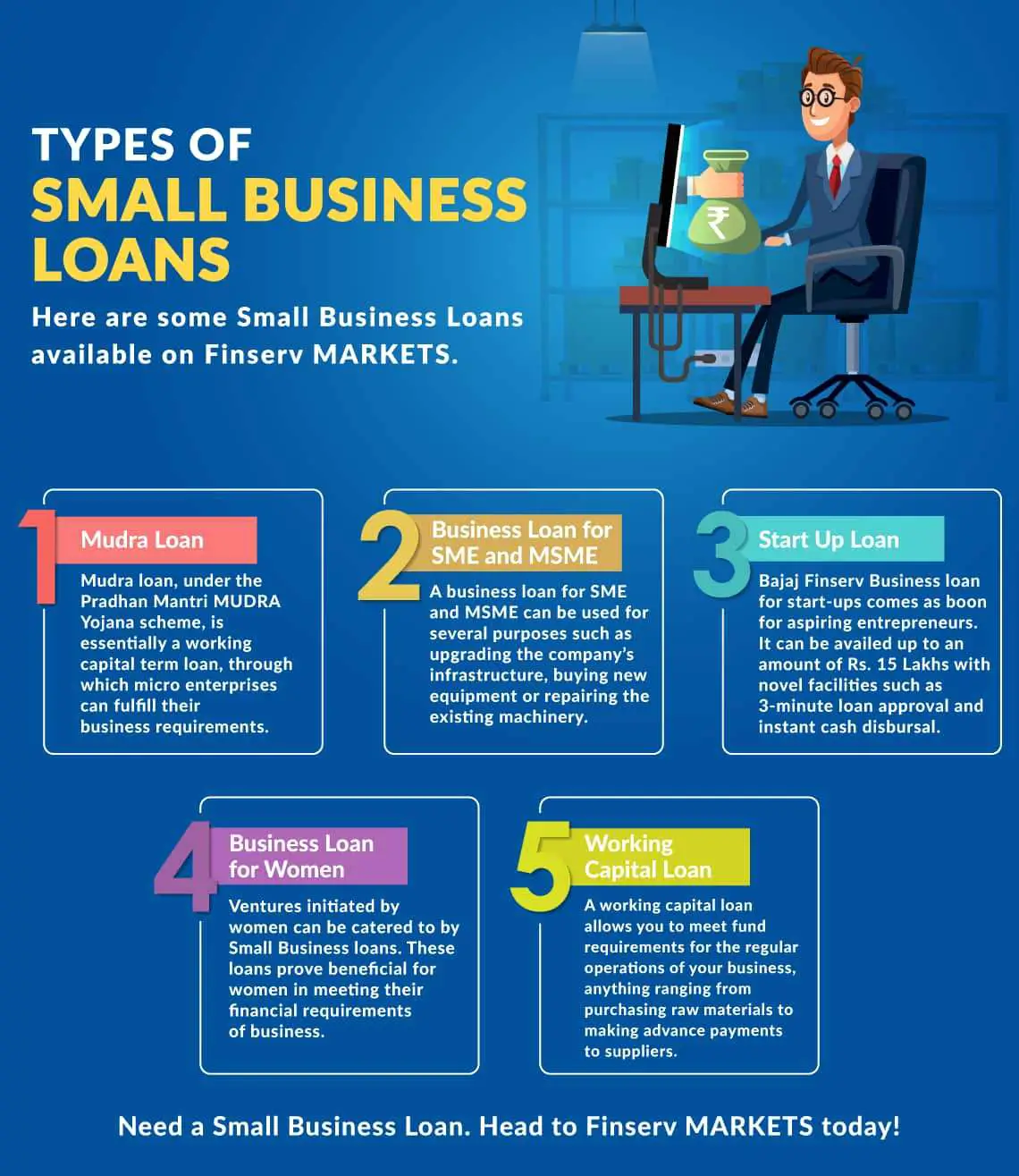

What Are The Types Of Business Loans Available For Small Businesses

Lenders offer a variety of loans for businesses depending on what the money is going to be used for and how companies are able to guarantee payment.

- Secured loans require collateral to back up the amount of the loan, meaning you could lose what you put up if you fail to pay in full.

- Unsecured loans are granted to companies with solid credit ratings and may offer lower interest rates than secured loans.

- Lines of credit work like a credit card, allowing you to borrow against a set amount as needed and only requiring interest payments on the money you use.

- Merchant cash advances are based on your volume of monthly credit card sales and are paid back using a percentage of each future sale.

- Accounts receivable loans use outstanding invoices as collateral to help pay off short-term debts.

- Equipment loans are granted specifically for the purchase of new equipment, using what you purchase as collateral.

- Construction loans provide funding to expand your existing location or build a new facility, and the building is considered collateral.

- Working Capital loans are granted to help fund daily operational tasks for businesses of all sizes.

Each loan type has a specific payment structure, term length, and interest rate. Some are more difficult to qualify for than others, and most require you to present detailed paperwork when applying. If your business qualifies, Small Business Administration loans can be advantageous, with lower rates and secure lending.

The Best Options For Government Business Loans

In a nutshell, The SBA 7 Loans, 504/CDC Loans, Paycheck Protection Program Loans, and SBA Microloans complete the list of the four most crucial government loan programs for small businesses. Therefore, one of these options will be your best option when looking for an ideal source of funding for your business. However, depending on your specific needs, you can leverage other government loan programs such as the Community Advantage Program, SBA disaster loan program, SBA microloan program, and many others. Lets take a look at some of them:

Also Check: Cc Connect Loan Payment Login

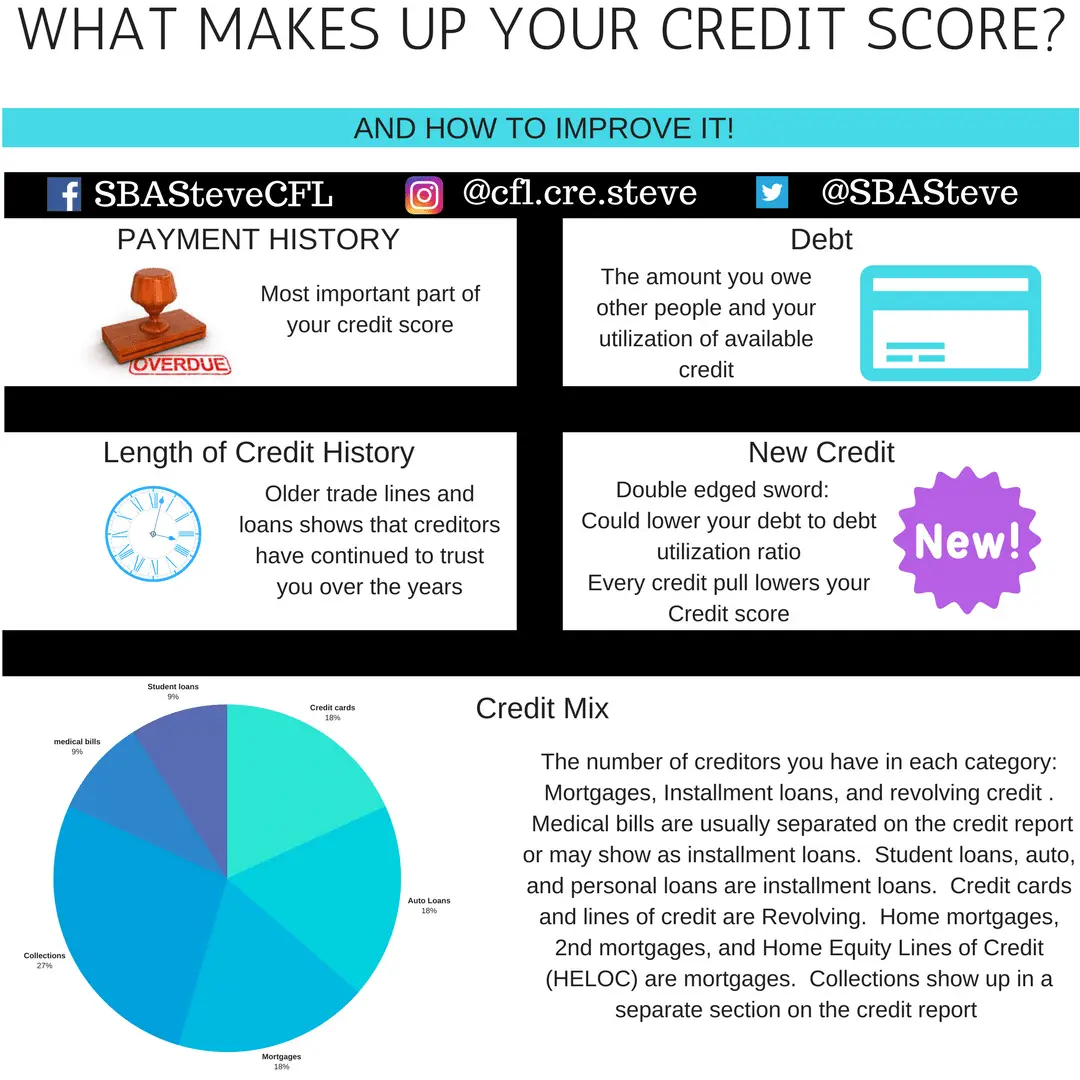

Anticipate How Lenders Will View Your Credit And Risk Profile

Lenders ultimately make a judgment call on whether or not to make a small business loan based on the borrowers credit and risk profile. Lenders will look at the following factors, so review them carefully and consider taking any appropriate remedial action:

- Lenders will review your credit report, credit score, and history of making timely payments under credit cards, loans, and vendor contracts. So review your credit report and clean up any blemishes.

- Outstanding loans and cash flow. Lenders will review your outstanding loans and debts to determine that your cash flow will be sufficient to pay existing loans and obligations as well as the new loan contemplated.

- Assets in the business. Lenders will review the assets in the business to see if there is a good base of assets to go after in the event of a loan default.

- Time in business. Lenders will tend to look more favorably on businesses that have been operating for several years or more.

- Investors in the company. Lenders will view the company more favorably if it has professional venture capital investors, strategic investors, or prominent angel investors.

- Financial statements. Lenders will scrutinize your financials, as set forth in the next section below.

Government Small Business Loans Overview

As we mentioned earlier, government agencies such as the Small Business Administration partner with banks and other lenders to provide much-needed funding for small business owners across the U.S.

SBA is a government entity whose primary duty is to support and assist small business access timely and adequate financing that guarantees their operations doesnt stall due to cash problems. Apart from their loan programs, SBA offers other services, including training and customized events designed to empower small business owners on the essential skills of running a business successfully.

Don’t Miss: Can You Refinance An Upstart Loan

Us Small Business Administration

The U.S. Small Business Administration has extended its disaster declaration, and businesses in Hillsborough, Pinellas, Sarasota, Manatee, Polk, DeSoto, Hardee and Highlands counties are eligible.

The deadline to return applications for physical damage is Nov. 28, 2022, and the deadline to return economic injury applications is June 29, 2023.

To apply, visit DisasterLoanAssistance.SBA.gov under SBA declaration #17644, or call 800-659-2955.

Hillsborough County business owners can also visit a business recovery center at the Chloe Coney Urban Enterprise Center, 1907 E. Hillsborough Ave. in Tampa, on Monday-Saturday from 9 a.m.-1 p.m.

Personal Background And Financial Status

Next, the 7 loan app will ask for your personal background and financial statements. The SBA specifically asks for you to complete forms 912 and 413, which include:

- Your detailed contact information, prior addresses, and criminal history.

- A detailed breakdown of your personal net worth, including income, assets, debts, real estate holdings, and other investments, down to how many shares of which stocks you own.

- Your outstanding debts and debtholders.

- Your unpaid taxes .

- Your life insurance.

Yeah, this stuff is detailed. Small business lenders really want to know who theyre lending to!

Read Also: How To Get Out Of Motorcycle Loan

Other Sources Of Funding

Most small-business owners turn to lenders for funding. But, surprise! You have other choices. These funding sources dont count as loans and dont come from lenders, but theyre definitely worth checking out.

Youve probably seen how crowdfunding sites work: someone pitches a product they want to produce, and interested people contribute money to the cause in return for some kind of reward. Its good money if you can get itbut youll have to create a slick pitch first, which often means creating professional videos and tempting reward offers.

Crowdfunding works especially well for businesses that cater to niche interests, which often translates to businesses that traditional lenders dont want to touch. As a bonus, you can get customer feedback on your product before launching. Just stay mindful of fees and taxes, which can vary from site to site.

It might sound gauche, but you can always ask family and friends to help you fund your business. These people, who know you personally and want you to succeed, may be willing to invest in your fledgling business even when banks shy away.

While many businesses get funded this way, we caution you to think carefully before accepting funds from your family and friends. Can you use their contributions to boost your business and make everyone proud? Or might you misuse that money and then have to deal with side-eye from Aunt Anna at every family dinner?

Grants

Gather The Right Financial Documents

Whichever type of lender you go with or type of loan you apply for, youll need to present financial documents that explain where your business stands financially.

Of course, lenders will typically look at your credit score . But your credit score isn’t enough information for lenders to determine whether or not you’re loan-worthy , which is why lenders typically require an assortment of the following documents:

- Financial statements, such as profit and loss statements, cash flow statements, and balance sheets

- Business and personal credit reports

- Business and personal tax returns for at least the last year

- Legal documentation, such as articles of incorporation, commercial leases, franchise agreements, etc.

Recommended Reading: How Many Americans Have Student Loan Debt

Can My Small Business Qualify For A Loan

Many small business owners rely on borrowed capital to start, run, and grow their business however they often believe they dont have good enough credit to get a loan. Depending upon the nature of the business need, a business credit profile, revenue, time in business, whether or not the business has adequate collateral, and other factors, there are more options available today than ever before. And each small business lender weighs each factor differently. The local bank has been small business traditional source for borrowed capitaland still remains a viable option for those businesses that can meet their potentially strict criteria. However, there are additional choices, which could make sense for your business, once you understand the landscape of potential loan options, including interest rates, loan amounts, and term lengths.

For < $50k Within Weeks: Sba Microloans

To elaborate, an SBA Microloan might be a better fit than a 7 if youre:

- Looking to borrow $50,000 or less.

- Need it faster than six months.

- Youre concerned about meeting the high requirements of a 7, notably years of cash flow and business credit history.

Unlike 7s which often come from big banks, Microloans are given out through SBA-approved non-profit lenders. Sadly that doesnt translate to a lower APR for you. Microloans have APRs between 8%-13%, which is a pinch higher than 7s because lenders are financing newer, riskier businesses.

Still, if youre just starting out or dont need such a massive cash deposit , an SBA Microloan may be the right choice.

You May Like: What Is The Loan To Value Ratio For Refinance

Create A Business Plan

Think of this as the roadmap to your businesss successincluding all of the business financing youll need to succeed. Having a plan that covers how youll fit into a market, attract customers, make money, etc. can help lenders see how their loan fits into your business needs. And be sure to show your working capital, market growth potential, and revenue plans since lenders are most interested in the money. Make it as detailed as you can to help show that youre going to be a good borrower.

How To Choose The Best Sba Loan

For many businesses, an SBA loan is a way to get a lower interest rate than a regular business loan.

There are 2 reasons for this:

-

First, the government caps fixed-rate SBA loans at a certain level.

-

Second, lenders are willing to take more risks when they know the government is there to bail them out.

Having said that, rates can still vary from lender to lender. Therefore, the first thing to look for when comparing SBA lenders is interest rate. In addition, we recommend comparing lenders by reputation, level of customer support, and ease of application process.

You May Like: What Type Of Loan Can Be Used For Debt Consolidation

Why Should You Get A Business Loan

Sometimes you need more than grit and elbow grease to achieve your business goals. You also need money. Business loans are a common way for small business owners to fund their operations when lacking cash flow.

In fact, the US Small Business Administration reports that over 61,000 loans were given out to small business owners in the 2021 fiscal year.

Not sure if a loan is for you? Here are a few telltale signs that you should consider one:

- Poor cash flow: If you dont have enough working capital to pay for inventory or basic operating expenses, a loan may work for you.

- Expensive equipment costs: Businesses often use loans to fund expensive equipment to help manufacture products.

- Advertising fees: Advertising is necessary for every small business, but it gets expensive fast. You may need a bank loan or business credit card to help pay for fees.

- Hiring: Strong team players contribute to your companys culture, operations, and successthey can also be expensive. A loan can help you hire the right people that help grow your business.

- Emergency funds: The unexpected can always occur, such as equipment failures or natural disasters. To keep your business running during these times, a loan may be helpful.

Applying for a business loan takes time. Regardless of what type of loan youre applying for, there are several steps you can take to prepare yourself before submitting an application.

At this stage, a little planning can save you a lot of effort later on.

How Much Can I Get For A Startup Business Loan

Startup business loans typically range from $1,000 to $250,000. However, the loan amount you receive depends on your and the business creditworthiness. Most lenders require businesses to have been in operation for at least six months to two years and meet minimum annual revenue requirements. Be sure to check with your desired lender to ensure your startup is eligible.

Recommended Reading: Capital One Refinance Car Loan

Gather Needed Business Loan Documentation

Business loan documentation is all the things generally required to have when applying for most small business loans. You need to have these items collected ahead of time to make the process of applying for a small business loan much easier.

Here are some items you may need to gather together before applying for a business loan:

- Loan application form

Recommended: Have bad credit, or dont know if you even have credit, learn how to get a business loan with bad credit.

Here are some things to keep in mind when applying for a small business loan:

Bad Credit Business Loans

There are many types of small business loans for business owners with bad credit. Some online lenders offer microloans, crowd-sourced loans, lending marketplaces, and more. These online lenders typically do not require as high of a credit score as a bank. Check out our list of best business loans for bad credit.

Also Check: Wells Fargo Car Loan Rates

What Monthly Payments Can You Afford

The best small business loans will provide you with bi-weekly, monthly, or even custom payment options, but typically lenders require monthly payments.

Here are a few things to consider when reviewing your loan options and loan terms:

- Consider your cash flow and how much you can apply towards repaying your business loan or even a line of credit each month.

- Review and understand the loan terms well, as some lenders might require unexpected things like daily loan repayments.

- A safe threshold to think about when repaying your loan each month is as follows. Your total income should be at least 1.25 times the amount of your total expenses. This should include the amount you have to repay on your loan each month.For example:

If income = $10,000 a month and expenses = $7,000 a month, your loan payment should be $1,000 a month.

$7,000 + $1,000 = $8,000 in total expenses

$8,000 x 1.25 = $10,000

Use this business loan calculator to estimate how much your loan will cost:

How To Apply For Government Small Business Loans

Because you will be working with a bank or other lender , SBA loans typically require several documentation. The application process can take a lot of time, and from the initial stage, the loans take 30 days or over before you receive funding. The application procedures and requirements may vary depending on your loan program and lender, but generally, you need to provide the following details:

Other mandatory documentation includes:

Read Also: How To Get Extra Student Loan Money

Find The Right Lending Options

Once you determine that you need a small business loan, you need to consider the main options available. Of course, there are traditional bank loans. But not every small business qualifies for that type of financing. You can also look into alternative lenders, online loan marketplaces, crowdfunding and various other financial resources designed to help underserved small businesses.

You may need to compare several financing options to find the solution that best fits with your needs and that you can actually obtain with your businesss resources and credit score. Start by considering the purpose of the loan. If you need money to cover an equipment purchase, you might consider equipment financing. If you just need to cover cash flow while you wait for clients to make late invoice payments, you could consider factoring.

Any lender will want to know what you plan on using borrowed money for, so start by determining the purpose and amount. Then you can work on finding a lender that meets those needs.

How To Get A Small Business Loan From The Government

Banks Editorial Team

Banks Editorial Team

If you are a small business owner struggling with the impacts of the COVID-19 pandemic on your business, you can take advantage of the government small business loans to help put your business back on track. The government small business loans are offered through banks and credit unions that partner with Small Business Administration and other government agencies.

Read Also: How Long Will It Take To Pay Off Loan