How Many Times Can You Refinance A Car

Legally, you can refinance a car as many times as you want if you find a different lender willing to extend you a new loan. Auto lenders may be apprehensive about refinancing if they see multiple past refinances on your vehicle and even if you get approved, there are other financial risks to consider.

Repeated refinances and loan term extensions increase the risk of going upside-down on your loan, which means your loan balance is greater than the market value of your car. You may also end up paying more than the original loan amount, just in interest rates.

When Should I Not Refinance My Car Loan

While refinancing a car loan can be a smart opportunity to save money, there are some situations in which refinancing is not financially sound:

How We Determined The Best Car Loans

These lenders were chosen based on interest rate for various credit scores, whether you’re buying new or used, and loans for a specific need like refinancing or lease buyouts. Insider gathered data from NerdWallet, MagnifyMoney, and , and from the lenders themselves. This list only considers loans that were available in most of the US, and does not include captive lenders lenders owned by auto companies.

Read Also: How To Lower Interest Rate On Car Loan

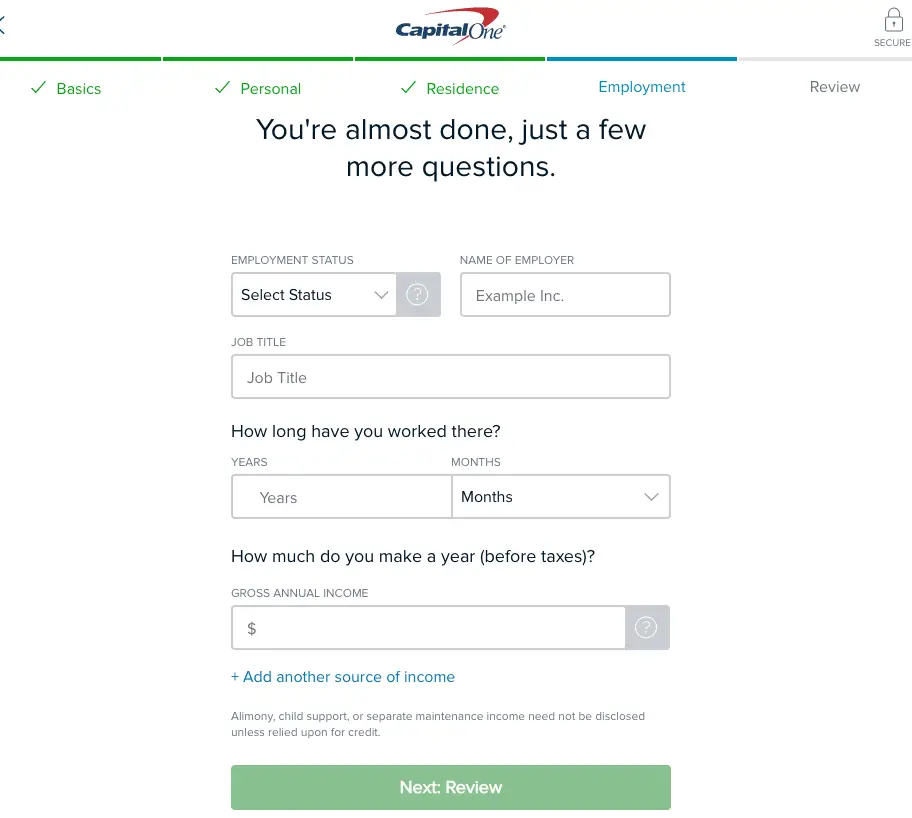

Capital One Auto Finance Review: 35 Stars

Capital One has a convenient prequalification process that does not require a hard credit check. Its auto loan terms are reasonable, and the lender can be a good option for those with poor credit. Overall, we give Capital One auto loans 3.5 stars.

If you are trying to purchase a car or refinance an existing vehicle, Capital One auto financing is worth a look, as there are no downsides to applying for auto loan prequalification.

| Motor1 Rating |

|---|

| Average customer service |

Is Capital One Trustworthy

Capital One is rated an A by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company.

Capital One does have one recent controversy. The US Treasury Department fined Capital One $80 million after the Office of the Comptroller of the Currency said the bank’s poor security around its cloud-based services helped to account for a 2019 data breach in which a hacker accessed over 140,000 social security numbers and 80,000 bank account numbers.

Also Check: How Much Can I Loan From Bank

Capital One Auto Refinance Review

We give Capital One auto refinance a score of 8.3 out of 10.0. Since it is part of an established and reputable bank, the financial institution offers large loan amounts to refinance your car. However, the company has many negative reviews on the BBB. Note that this number is low compared to the number of consumers it serves, and reviews encompass all of Capital Ones financial products.

| Overall Rating | |

| Availability | 9 |

While its best known for its credit card offerings, Capital One also provides financial services including refinancing auto loans. Capital One auto refinance allows you to prequalify to refinance your vehicle without hurting your credit score. This makes it an excellent choice for borrowers who want to explore all of their options.

In this article, we at the Home Media reviews team will explain how Capital One auto refinancing works, how long the application process takes and who typically qualifies. We recommend reaching out to several providers to find the best auto loan and refinancing rates.

Headquarters: McLean, Va.Better Business Bureau rating: A-

Capital One was founded in 1994 in Richmond, Va., as a credit card company. In 2020, it became the nations sixth-largest retail bank and the largest auto loan provider in the banking industry. Borrowers can get auto loans or refinance existing auto loans through Capital One. However, auto loan services arent available in Alaska or Hawaii.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How To Get 0 Apr Car Loan

Can You Refinance A Car Loan

If you arent happy with your current car loan, you can refinance into a loan with a different interest rate and new terms.

Refinancing a car loan means taking out a new loan that replaces your existing loan. Its a brand-new loan that you often get from a different lender. Depending on the new lenders requirements, you might be able to keep the length of the loan the same, shorten it, or extend it.

When you refinance, your new loan amount will generally be the balance you have left on your current loan. However, some lenders allow for a cash-out refinance. Just keep in mind that taking out cash on a car with limited equity could cause you to owe more on the vehicle than its worth.

Dont Miss: How Do I Get My Student Loan Number

How To Refinance Your Car

Here are 8 simple steps for how to refinance your car loan in Canada.

Step 1: Review your current car loan.

Check your loan statement or log in to your account to find the following information:

- Monthly repayment

- Prepayment penalty, if any

- Lenders customer service number

While youre reviewing your loan documents, weigh any fees youll be charged for paying off your loan early against potential savings from refinancing an auto loan to make sure its worth it.

Step 2: Check the value of your car.

Your cars current value will determine how much you need to borrow and if refinancing your auto loan is a viable option. To get an idea of how much your car may be worth, visit sites the Canadian Black Book or Autotrader.ca. Your vehicles make, model, mileage and condition, as well as where you live will all impact its overall value.

If your car is worth less than the amount you want to borrow, you could end up paying much more for your car than its worth. Instead, you might want to consider selling it privately or trading it in at a dealership for a less-expensive alternative.

Step 3: Check your credit and eligibility.

Factors like your credit score, debt-to-income ratio, current loan amount and vehicle will all play a role in whether your application to refinance your car loan is approved.

Use a free online tool to check your credit score and calculate your DTI ratio to get an idea of lenders you might qualify with.

Step 4: Compare your car loan refinancing options.

Also Check: When Will I Receive My Student Loan

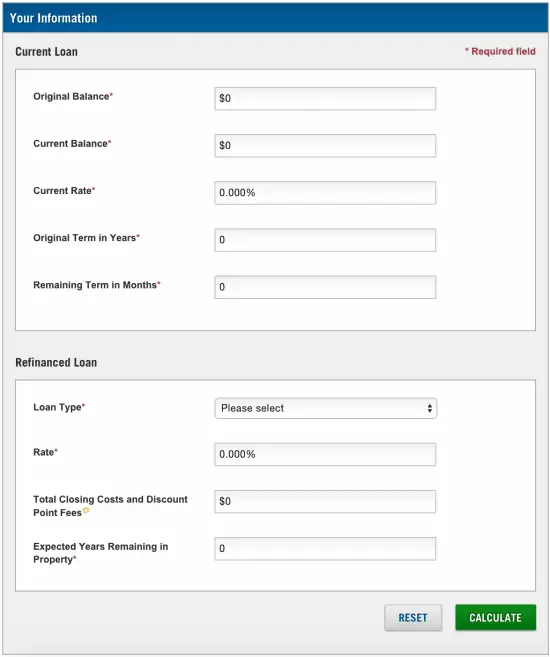

How Much Does It Cost To Refinance My Car Loan

Just like with any loan, an auto refinancing loan has added costs, including potential fees and charges to close the refinancing.

- Transaction fee: This might also be labeled processing or application fee and can be charged by both your current lender and the new refinancing lender. Always ask the lender if theyll waive this fee its not uncommon for them to do so.

- Title transfer fee: Some states charge you to move the title from your old lender to the new one.

- Registration fee: You might be required to re-register your car when you refinance. Check with your state DMV.

- Late payment fee: Your lender can penalize you when youre late with a payment. Note your due date and how long the grace period is. Anything past that is considered late and will likely cost you.

- Early termination fee: Not as common, but some lenders charge an early termination fee, or prepayment penalty, if the loan is paid off early.

Capital One Auto Refinance Reviews

Capital One has average customer ratings but performs well across consumer studies. The company has a 1.1-star rating out of 5.0 on the BBB from over 900 customers. It has also closed more than 9,000 customer complaints through the BBB over the past three years. While this may seem like a lot, Capital Ones BBB profile encompasses all its financial services, not just auto refinance.

In the J.D. Power 2021 U.S. Consumer Financing Satisfaction Study, Capital One Auto Finance ranked second behind Ford Credit for overall customer satisfaction for a mass-market lender. This study measures customer satisfaction through the application and approval process, the billing and payment process and the customer service experience.

Our team reached out to Capital One for a comment on its scores and negative reviews but did not receive a response.

Also Check: Where To Loan Money With Low Interest

Capital One Auto Finance May Be A Good Fit For Those Who:

-

Want to compare rates: Pre-qualification with a soft credit check will not affect an applicant’s credit score. It enables borrowers to shop loans and compare Capital One rates and monthly payments to offers from other lenders.

-

Want to shop for cars online: Capital One Auto Navigator enables car buyers to find a vehicle online, pre-qualify and present that offer when at the car dealership, speeding up the car buying process. Pre-qualifying is not a commitment to finance with Capital One if the dealership finds a lower-rate loan offer.

-

Have other Capital One accounts: Existing Capital One customers may find it more convenient to manage their auto loan and make payments in Capital Ones online banking and mobile app, where they view and manage other accounts. Capital One doesn’t offer an auto loan rate discount for setting up automatic payments from a Capital One account.

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what is known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Recommended Reading: Apply Online For Personal Loans

How The 2022 Fed Hikes Impact The Cost To Finance A Car

The July meeting of the Federal Open Market Committee raised the benchmark rate to 2.25-2.5 percent, this is up from the June meeting and is working towards the goal of controlling growing inflation. For drivers already dealing with new vehicles costing an average of over $48,000 in July 2022, according to Kelley Blue Book, and the price to fill up at the pump hitting record highs, the added burden of higher rates feels daunting.

The benchmark rate doesnt directly shift auto rates, but it affects the number that auto lenders base their specific rates on. This means that it is possible you will be met with steeper costs to borrow money for vehicle financing due to the Fed hike, but the hike itself is only one part of that increase.

Even with higher costs across the board, there are still a few ways to prepare and save money, regardless of movements made by the central bank.

Auto Loans: New & Used Car Loan Options & Rates

Never underestimate the power of financing to help keep your car payments on the easy side and save you money in the long run. We can approve your new or used

Get pre-approved for a Wings auto loan today and shop with confidence, knowing how much you can spend on your new vehicle. We make it easy to apply online,

Buy your next new or used car, truck or motorcycle with a low-rate auto loan. · New Vehicle · Used Vehicle · Find Your Rate & Apply Its Easy! · 1 · 2 · 3 · Online

Rates starting at. 3.89% APR · as of 9/23/2022. Check My Rate Car Shopping Made Easy. Car. All of the tools you need to find your next car online with AutoSMART

Easy Auto Financing | Bad Credit Auto Loans Guaranteed https://www.ezautofinance.nethttps://www.ezautofinance.net

Seacoast Auto Loan Features · Rates as low as 3.94% APR · Simple and quick application and decision process in one day or less · Safe and easy online document

When it comes to your auto loan, we offer an easy & secure online application. Weve also been voted as the BEST Auto Loan Provider by The San Diego Union-

The Benefits of a Coastal Auto Loan · Simple application and quick approval process · 45 Days1 to first payment · No Pre-Payment Penalty

Online auto loans make it easy to shop for new or used car financing. Simple tools help you find a lender after completing a few minute online auto loan

Also Check: Who Is Qualified For Student Loan Forgiveness

Compare Auto Refinance Loans

Before applying for an auto refinance loan, you should be sure to compare quotes from multiple different providers. Some factors to take into consideration include:

- Loan amounts: Most lenders have minimum and maximum loan amount requirements, usually somewhere between $7,000 and $100,000. Make sure that the loan you want to refinance is in between these limits.

- Rates: One of the main goals of refinancing an auto loan is to lock in lower rates. Make sure to compare rates from multiple different providers to ensure youre getting the best possible deal.

- Repayment terms: Whether you want to pay off your loan faster, or need a longer term length with smaller monthly premiums, look for an auto refinance loan with repayment terms that meet your needs.

- Some lenders have minimum credit score requirements for borrowers. If your credit score isnt where you want it to be, consider holding off on applying until you raise your score.

- Car requirements: Not all lenders will issue auto refinance loans for all cars. Make sure that your car meets the requirements for any lenders that youre interested in.

Capital One Rates Fees And Terms

Capital One rates start at 3.99% APR for borrowers with excellent credit. However the rate you get can be affected by factors such as your credit score, credit history, debt-to-income ratio as well as the type of car you choose. It isnt clear what fees you could be charged or the maximum APR it offers.

But unlike many lenders, its upfront about the amount you can borrow. You can finance as little as $4,000 through Capital One, and loan terms last anywhere from 36 to 72 months.

Don’t Miss: How Long Does It Take For Sba Disaster Loan Approval

Capital One Auto Finance Customer Reviews And Ratings

Capital One is accredited and holds an A rating from the Better Business Bureau . It was named one of the best places to work by Fortune magazine in 2017 and is well regarded within the financial services industry.

Despite this, Capital Ones online customer review profile is average. It has a 1.1 out of 5.0-star customer rating on the BBB website and a Trustpilot score of 1.3 out of 5.0 stars. Its important to note a few things about these low ratings. First, many customer reviews mention Capital Ones banking services, not its auto loans. Second, although auto loans are only a small part of Capital Ones business, complaints from banking customers may still speak to the overall quality of the company.

Finally, keep in mind that Capital One is a large company with many products and services, millions of customers, and billions of dollars of revenue. Though there are thousands of complaints online, these represent a small fraction of total Capital One customers.