Your Total Balance Can Increase

It is possible for student loans to be negatively amortized under the income-driven repayment plans. Negative amortization occurs when the loan payments you are making are less than the new interest that accrues that month. This causes the loan balance to increase.

This wont matter much, if the borrower eventually qualifies for loan forgiveness. But, still, borrowers may feel uneasy seeing their loan balance increase, since they will be making no progress in paying down their debt.

What Are The Pros Of Ibr

If youre struggling to make your monthly student loan payments, IBR might be an option for you. Here are some of the benefits you can expect:

- Affordable payments: Depending on your discretionary income, enrolling in IBR could lower your monthly payments by hundreds of dollars. That could add a lot of breathing room to your budget every month.

- Loan forgiveness: Enrolling in IBR ensures your loans will be forgiven after 20 to 25 years.

- Flexibility: If your situation suddenly changes, you have the option to switch plans at any time. But if you stick with IBR, youll never pay more than you would on a Standard Repayment Plan, no matter how much your income increases.

Strategies To Qualify For Forgiveness

Because 2020 and 2021 are the measuring years, most borrowers will not be able to prepare for loan forgiveness at this time. Their income was either insufficient or it was not during those years. Individuals who did not qualify based on their 2020 earnings but have yet to submit their 2021 taxes may still utilize a few planning techniques to qualify for forgiveness.

If you own a business and can still make deductible contributions to a retirement plan for 2021 , consider doing so. Reducing AGI enough to fall below the applicable threshold could save you money in the long run.

If youre a married couple with student debt, and the thresholds for single filers also apply to individuals who file separate returns, you should analyze whether filing separately for 2021 makes sense even if you normally file joint returns. If the amount of debt forgiven for one spouse exceeds what it would cost them in taxes by filing separately, then overall it would be beneficial.

You May Like: Can I Refinance My Mobile Home Loan

Student Loan Payment Freeze Ending In December 2022

Borrowers of Federal student loans have benefitted from a temporary moratorium on student loan payments and interest since the early days of the COVID-19 pandemic, when former President Donald Trump issued an executive order in March 2020 first establishing the payment freeze. Subsequent extensions prolonged it for more than 2 ½ years, and though the freeze was set to expire at the end of August 2022, the Biden administrations Student Loan Debt Relief Plan has added one final extension to the payment freeze, pushing the end date back 4 months from August 31 to December 31, 2022.

But, unlike previous instances when final extensions were announced only to be re-extended further, the combination of this extension with the debt relief package makes it seem likely that this really will be the end of the line, and that Federal student loan borrowers will resume their payments in January 2023 after nearly three years of frozen payments and 0% interest.

Eligibility For Biden Student Forgiveness Is Based On Taxpayer Income Levels

The maximum amount of student loan debt that can be forgiven is $10,000, or $20,000 for Pell Grant recipients. High-income earners are not eligible for this form of relief. Its important to wonder who falls into the category of a high-income earner for tax purposes.

The Department of Educations press release states that the income threshold for forgiveness is $250,000 for Head of Household filers, contradicting previous White House Fact Sheet claims that single individuals must make at least $125,000 and married couples must earn at least $250,000 to qualify.

The individual $125,000 threshold amount also applies to other filing statuses not mentioned, including married couples who file separately. This could be particularly significant for the large number of married borrowers using certain IDR repayment strategies and filing separately in order to reduce their monthly loan payments.

The definition of income has not been publicly solidified, but income-driven repayment plans generally use an individuals adjusted gross income . AGI would be the leading candidate for the definition of income.

We cannot know for certain when income matters, but we have a general idea. According to the White House Fact Sheet and U.S Department of Education Press Release, an administration official has confirmed that 2020-2021 are the relevant tax years for borrowers incomes.

Example 1:

Ryan is a single taxpayer and has $20,000 of outstanding student loans .

Example 2:

Also Check: How To Apply Loan In Sss

Key Problem: Borrowers Face Administrative Challenges Accessing And Retaining Affordable Payments In Income

Both quantitative and qualitative data reveal major procedural obstacles to accessing income-driven plans. These obstacles include a lack of information and assistance from loan servicers, problems with the application process, and difficulties with the required annual recertification of income and family size. These barriers can lead to real consequences for borrowers, including delays in entering plans or payment increases when borrowers miss recertification deadlines.117

Loan servicers have been criticized for inadequately informing borrowers about income-driven plans. In a 2019 audit, the Department of Educations Office of the Inspector General found recurring instances at all servicers in which servicers did not sufficiently inform borrowers about their available repayment options.118 An earlier investigation from the Government Accountability Office found that servicers communications did not include information about how these plans work or what their eligibility requirements were.119

Borrowers also report application delays, the rejection of incomplete applications without an opportunity to fix them, being placed in the wrong repayment plans, and difficulty transitioning into these plans after defaulting on their loans.132 Some borrowers indicated that they did not receive notices for recertification, while others received them but said that the notices did not clearly explain the recertification process or state the deadline.133

Biden Seeks To Eliminate Student Loan Forgiveness Tax Associated With Idr Plans

Whenever a debt is reduced, forgiven, or cancelled, the borrower may have to pay income taxes on that forgiven balance. Federal law can create exceptions to this taxation event. For example, student loan forgiveness under the Public Service Loan Forgiveness program is exempt from taxation under federal law.

But student loan forgiveness under IDR plans can be considered a taxable event. This may have enormous consequences for student loan borrowers, particularly given that many borrowers on IDR plans may not have payments that are high enough to cover monthly interest accrual, leading to runaway balance growth.

The American Rescue Act the stimulus bill that President Biden signed into law last year exempts all federal student loan forgiveness from taxation, including loan forgiveness under IDR plans. But that relief is temporary, and it is set to sunset in December 2025.

However, last month Biden included a proposal in his budget plan that would permanently eliminate federal taxation on student loan forgiveness, including IDR student loan forgiveness. The proposal would have to pass both the House and the Senate to become law, so its future is far from certain. But if enacted, it would provide a huge relief for millions of borrowers repaying their loans under IDR plans.

Read Also: What Is The Best Company To Refinance Auto Loan With

Affordable Care Act Premium Tax Credits

For those of you who purchase, or will purchase, health insurance from the marketplace at healthcare.gov, this law extends the tax credits available to help subsidize the costs of these plans.

The current subsidy program in place for healthcare obtained under the Affordable Care Act has been extended to 2025.

This is an incredibly valuable tax planning strategy for those who qualify. We encourage those who are retiring before age 65 to reach out to us to see if you can benefit from these tax credits.

Where Can I File A Complaint About A Servicer

If you continue making IBR payments for 25 years, any debt that remains is canceled. This canceled amount will be taxed as income. However, you may not have to pay taxes even if the forgiven amount is considered taxable income. For example, you may be able to claim insolvency status using I.R.S. Form 982. It is a good idea to consult a tax professional for more information.

Don’t Miss: How To Remove Mip From Fha Loan

Your Family Size And Location

To determine your discretionary income, the Education Department finds the federal poverty guideline for your location and family size. Location wont affect your payments unless you live in Alaska or Hawaii, but the larger your family, the less youll pay under an income-driven plan.

For example, lets say your adjusted gross income is $40,000, you live in New York and youre single. Under PAYE, youd owe $177 a month. If you got married increasing your family size to two your payments drop to $122. Had a child? With a family size of three, payments shrink to $67.

Updating info early can reduce payments

Since you last recertified your income-driven plan, see if youve had any life changes like having a baby. Other examples could be taking a lower-paying job or losing your job altogether. In these instances, you can submit updated information at studentloans.gov or to your servicer and ask for an immediate payment adjustment.

You Need To Qualify Every Year

There is an annual paperwork requirement. Borrowers must recertify their income and family size every year. If you miss the deadline, your loans will be placed in the standard repayment plan. If you file the recertification late, the accrued but unpaid interest will be capitalized, adding it to the loan balance.

See also:How Do I Recertify for Income Driven Repayment for Student Loans?

Also Check: Can You Give Your Va Loan To Your Child

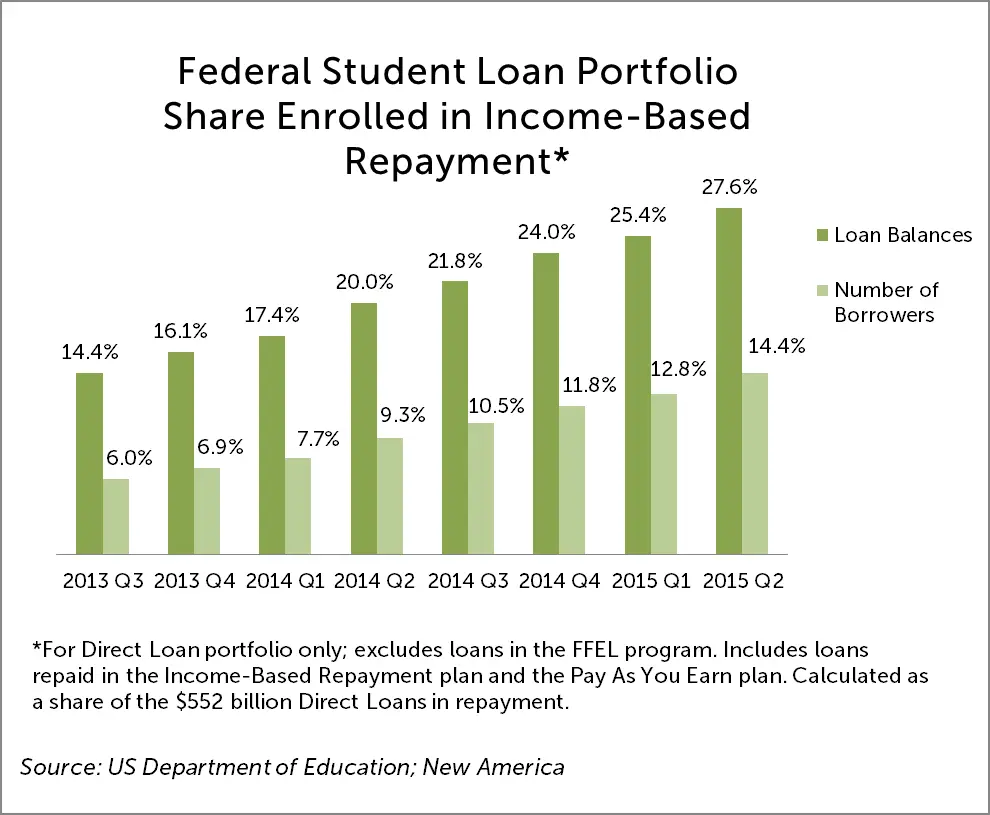

More Research And Data On Income

Despite the desire for action among many groups to reform IDR plans, surprisingly little data is available to help researchers, advocates, and policymakers consider elements of plan design, how and which borrowers use these plans, and trade-offs involved with potential changes.

For example, the best source of data on borrowers in income-driven plans is the Department of Education, which records detailed borrower information in the National Student Loan Data System. However, analysts and researchers typically are not permitted to use this data, primarily due to privacy concerns. The department could make more data securely available without significant changes to its existing procedures. Department staff routinely extract random, de-identified samples of several million borrowers for use by its Office of Budget Service and could share those extracts, or other anonymized data, with researchers to enable them to assess the repayment status of struggling borrowers and identify potential interventions to reduce delinquency and default.188 The department could also collect and publish data from loan servicers, which may include more detail about borrowers payment and delinquency histories. In addition, the department should provide more aggregate data on the characteristics of borrowers enrolled in IDR plans, improving what is available in the Federal Student Aid Data Center.189

What Types Of Loans Are Eligible For Income

The following loans can be paid back using the income-based repayment plan:

- All direct loans, subsidized and unsubsidized

- All FFEL loans, subsidized and unsubsidized

- Direct and FFEL PLUS loans taken out by students

- Direct and FFEL consolidation loans taken out by parents

- Consolidated Federal Perkins loans

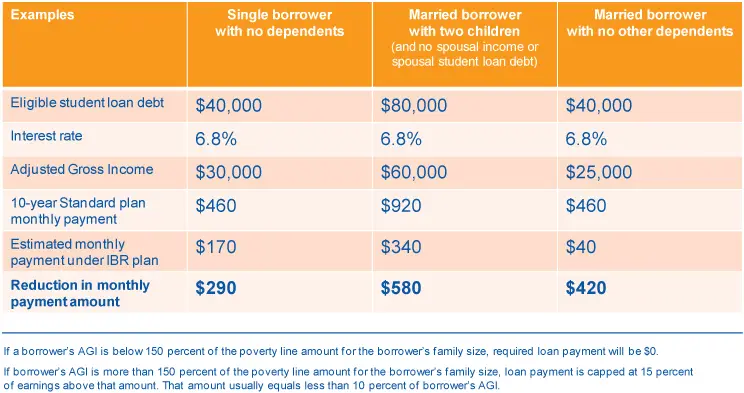

In addition to this, the income-based repayment plan is offered only to those borrowers who are facing a partial financial hardship. The definition of partial financial hardship is satisfied if the outstanding balance on loan is greater than 15% of the difference of borrowers adjusted gross income and 150% of the poverty line. Poverty line is determined on the basis of borrowers state of residency and their family size.

Read Also: Debt Loans For Bad Credit

All You Need To Know About Income

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If your federal student loan payments with the standard 10-year repayment plan are high relative to your income, an income-based repayment plan may be an option.

You might want to weigh the pros and cons before enrolling.

How Does The Repayment Work

In income-based repayment plan, the borrower can repay the loan in small monthly payments. The amount of payment is determined by the borrowers monthly income and their family size, and is capped to 15 percent of their discretionary income. For borrowers who took out a Direct loan on or after July 1st, 2014 and who have no outstanding balance on FFEL or Direct Loan, they can pay back the loan in monthly payments capped at 10 percent of their discretionary income.

Monthly payments can be adjusted every year, and any remaining balance is forgiven after 25 years of qualified monthly payments.

Recommended Reading: Which Bank Is Good For Mortgage Loan

Calculating Your Payments In 2022

Once you determine your discretionary income, divide that number by 12. The new number is your monthly discretionary income. In our example, it would be $1,000. That means that if you were on IBR, your monthly payment would be $150, and if you were on PAYE or REPAYE, your monthly payment would be $100.

Note: the exact calculation will vary depending on how you verify your income with your lender. Some people use their two most recent pay stubs while others use last years taxes. If you use your most recent tax form, it will use your Adjusted Gross Income or AGI.

One of the most useful tools for calculating monthly payments is the Federal Loan Simulator. This tool allows you to use your actual loan information in generating the estimated monthly payments. It also helps with student loan forgiveness planning.

What Is An Income

Income-Based Student Loan Payment is the most generally available and widely utilized income-driven repayment program for borrowers of federal student loans. IBSLP supports retain monthly loan payments reasonable according to each borrowers monthly income.

Your student loan payment in an income-based student loan payment built on your discretionary income, rather than your loan balance. This can usually express that a borrower will have a $0.00 monthly payment on their student loan, and this number counts as actual payment.

Don’t Miss: Does Home Loan Include Down Payment

Public Service Loan Forgiveness

Public Service Loan Forgiveness is a federal program that forgives the remaining balance on student loans for those who have made 120 qualifying monthly payments while working full-time in an eligible nonprofit or government organization. Qualifying borrowers must also be enrolled in a qualifying repayment plan, such as Income Based Repayment and not be in default.

The Public Service Loan Forgiveness Program was created by Congress to encourage individuals to enter and continue public service careers. It provides relief from the financial burden of repaying certain types of federal student loans through partial or complete forgiveness after 10 years of eligible employment with qualified employers, including 501 organizations and other non-profit organizations engaged exclusively in charitable activities.

n Forgiveness is a federal program that helps those who have taken out student loans and are working in public service jobs to repay their debt. The PSLF program offers loan forgiveness for borrowers who work full-time at a qualifying nonprofit organization or government entity, including 501 organizations. To qualify for the Public Service Loan Forgiveness Program, you must make 120 monthly payments on your eligible federal student loans while employed by an eligible employer . You may also qualify if you’re serving as a volunteer with AmeriCorps or Peace Corps.

The eligibility requirements include:

Copyright 2022, all rights reserved.

Lawmakers And Advocates Are Pushing Biden To Go Further On Reforms

In December, Biden announced reforms to income-driven repayment plans that included allowing borrowers to self-report their incomes rather than submit tax documentation to apply for or recertify the plans through July 31. In April, the department proposed fixes to the plans and said it would conduct a one-time revision of past payments.

However, an Education Department spokesperson told Insider on Thursday that an improved repayment plan will not be included in the upcoming regulatory proposal, and after NPR published its findings, lawmakers on both sides of the aisle urged the Education Department to take the reforms a step further.

Sen. Patty Murray and Rep. Bobby Scott, the chairs of the Senate’s and House’s education committees, wrote a letter in April urging the secretary of education, Miguel Cardona, to establish a new income-driven repayment plan “that keeps payments affordable, prevents debts from ballooning over time, and provides a reliable pathway out of perpetual repayment.”

Also in April, 117 advocacy groups urged Cardona to create a waiver for income-driven repayment plans that would retroactively allow any payment a borrower has made to count toward loan forgiveness, among other proposals.

The student-loan company worker said she hopes that’s the case.

Read Also: What’s The Difference Between Refinance And Home Equity Loan

Student Loan Repayment For Borrowers Living On Social Security

Income-driven repayment plans often mean $0 per month payments and eventually loan forgiveness for borrowers living on social security.

The repayment of student loans can be a huge challenge. Living on social security can be a huge challenge. Living on social security AND repaying student loans might appear to be impossible.

Fortunately, borrowers can do both.

The key to success is to utilize programs like income-driven repayment plans and student loan forgiveness. These programs can provide excellent assistance to borrowers on social security. Many social security beneficiaries can eliminate all future student loan payments.