Don’t Worry About Your Temporary Score Decrease

You might be worried about your score decreasing, even by a few points. You are still telling future lenders that you can successfully fulfill your financial obligations by paying off the loan. This activity could help you qualify for a future auto loan or other types of credit. Many lenders don’t look solely at your credit score. Instead, they look at your credit report as a whole. A prior car loan could be more important than your credit score, depending on the lender.

Consider Your Loan Term

While you might reduce your monthly payment by lengthening the term of your auto loan, it will cost more over time. Interest rates are typically lower for shorter terms .

Long-term loans come with the risk of negative equity, which is when you owe more on your loan than the car is worth. This can happen if you have an accident or other damage to your vehicle early in the life of your loan.

Buying Used Could Mean Higher Interest Rates

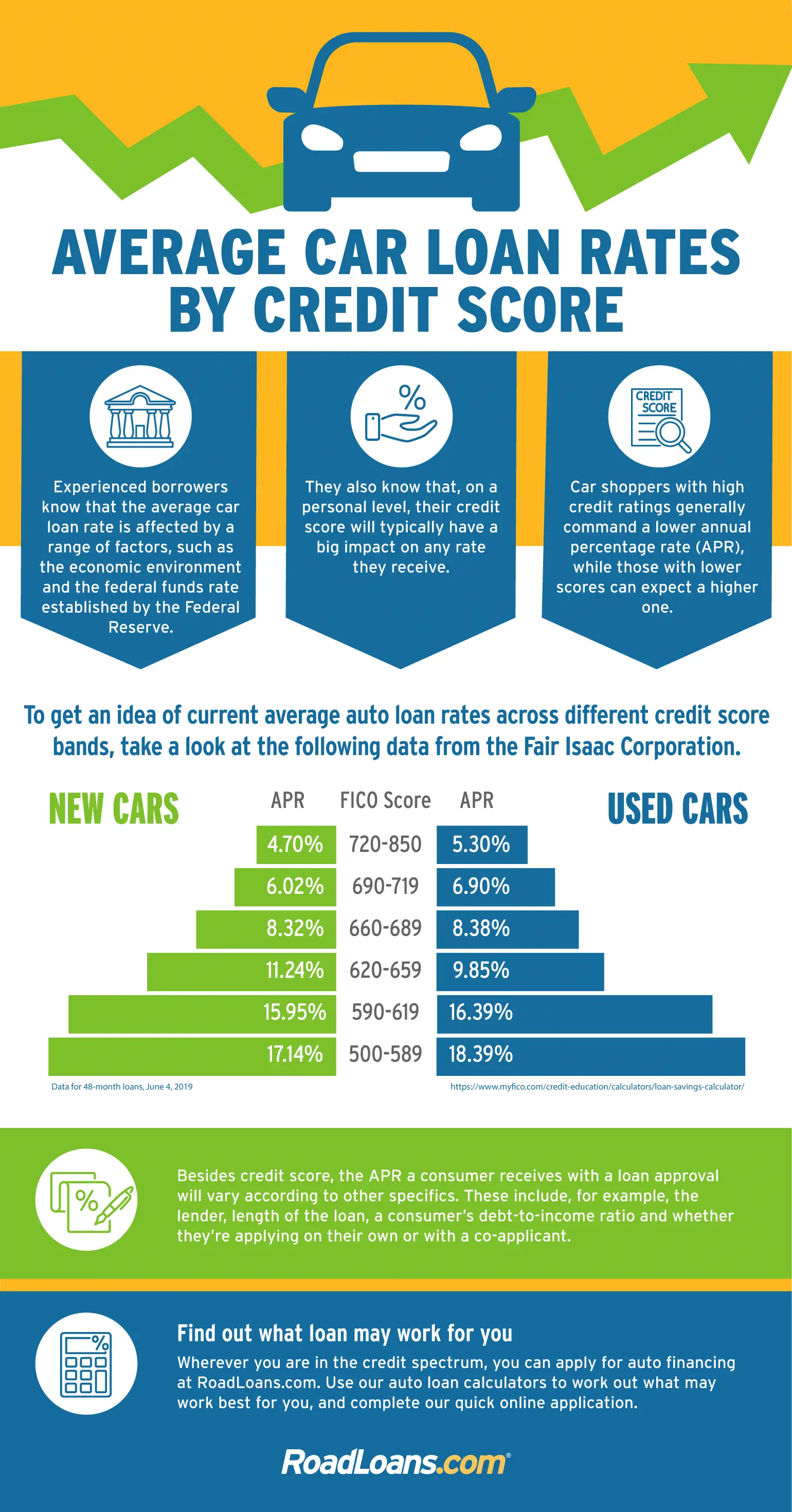

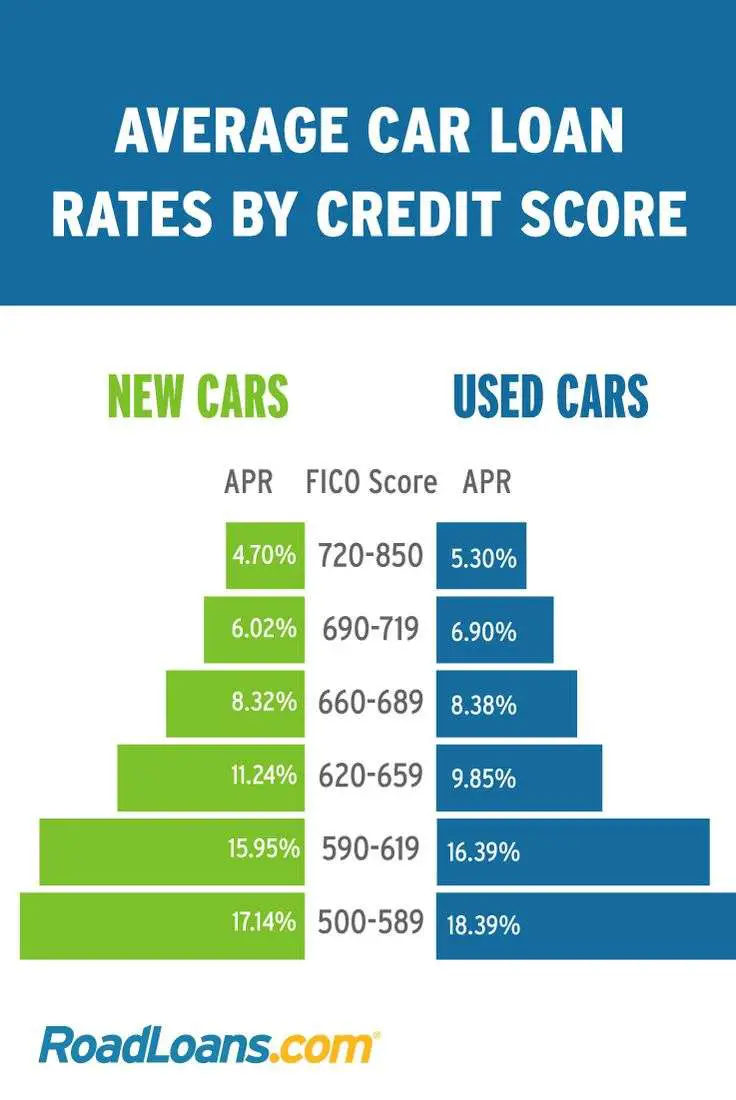

Buying a new car may be more expensive, all in all, than buying used. But, new and used auto loan interest rates are rather different, no matter your credit score. Based on Experian data, Insider calculated the difference between new and used interest rates. On average, used car financing costs about four percentage points more than new financing.

| Super Prime | 1.32% |

The gap between how much more a used car costs to finance narrows as credit scores increase, but even for the best credit scores, a used car will cost over 1% more to finance than a new car.

Used cars are more expensive to finance because they’re a higher risk. Used cars often have lower values, plus a bigger chance that they could be totaled in an accident and the financing company could lose money. That risk gets passed on in the form of higher interest rates, no matter the borrower’s credit score.

You May Like: Upstart Early Payoff Penalty

What Credit Score Is Used When Buying A Car

Different car lenders check different credit scores, so you won’t know for sure which one they will look at when determining your auto loan application. Your best bet, however, would be to check something called an industry-specific score.

FICO provides industry-specific scores that consumers can refer to when making certain purchases like a car or home. Just like a standard credit score, your industry-specific score helps determine future loan terms and interest rates.

The FICO Auto Score considers your usual credit behaviors but puts more emphasis on how you’ve managed auto loan payments in the past. It considers things like: have you consistently made your loan payments, and on time? FICO Auto Scores range from 250 to 900 and have several versions, including FICO Auto Scores 2, 4, 5 and 8. The easiest way to check all four FICO Auto Scores at the same time is through FICO’s credit monitoring service.

Knowing your auto-related credit score can be useful when financing a car, since it can affect your loan terms and rates. Any increase in your interest rate can lead to a higher monthly payment and paying thousands of dollars more over the course of a loan.

Proof Of A Steady Income

Being able to prove that youll be steadily earning income shows that you will be able to make your monthly payments. And in addition to a steady income, you may have to earn at least a certain amount of money per year.

The exact proof of employment youll need to show may depend on the credit union. For instance, it could be your pay stubs from the past month or a W-2 form. If youre self-employed, the credit union may ask for two to five years of tax returns. If you receive Social Security, you may need to include this information with your financial statements as well.

Speak to your credit union ahead of time and ask what documents are required. That way, youll already have them ready to go and be able to speed up the process. If you have additional sources of income or additional assets, take proof of those with you as well. Those may help you improve the terms of your loan.

Read Also: Va Home Loan Benefits 2020

What Determines Average Auto Loan Rates

The most important factor that decides your auto loan rates is your credit score. The better your score, the lower your APR will be. The best rates are reserved for those with credit scores above 800, but according to Equifax, any score above 670 makes you a low-risk borrower and opens the door to lower average auto loan rates.

However, your credit score isnt the only determining factor. Employment status, income, and the type of vehicle you purchase also affect rates. Having a steady income stream and purchasing a newer vehicle will result in better auto loan rate offers.

How Do I Increase My Chances Of Car Loan Approval

To increase your chances of getting approved for a car loan, it will be critical for you to research the car loan market in detail, finding out about the types of lenders youâre most interested in working with, and how their terms and options fit with your financial needs.

If you have a bad credit score, have insufficient credit history, or are simply unsure whether you will qualify for a car loan approval, we recommend the following options:

-

Get a co-signer

-

Make a bigger down payment

-

Shop around for better deals

-

Improve your credit score

Get a Co-signer

A co-signer is someone who has agreed to pay your car loan debts if you default on the loan or are otherwise unable to make payments. Typically, co-signers fall into the good or excellent credit score categories and have good credit standings, along with a reliable payment history.

When getting a co-signer for a car loan, however, it is very important to weigh its pros and cons. Carefully assess the impact on your relationship with the co-signer should you default, the responsibilities of the individual co-signing, the terms associated with the car loan, and the potential impact of the new loan on the co-signer’s credit score.

Make a Bigger Down Payment

Shop Around for Better Deals

Improve your Credit Score

Also Check: Usaa Used Auto Rates

Wed Like To Introduce Ourselves

Were Kasasa® a financial and technology services company. We believe that small banks and credit unions supply critical resources to drive the growth of businesses and families. Nobody knows your communitys needs the way you do.

At Kasasa®, we also partner with institutions like yours, providing our relationship platform, Kasasa, as a comprehensive strategy. It begins with innovative banking products and includes marketing, training, compliance, research, support, and consulting.

Together we can show the next generation of banking customers an experience the mega-banks will never match.

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Recommended Reading: Usaa Pre Qualify

Average Auto Loan Interest Rates By Credit Score

Home MediaUp to 722.25%

- Low rates for good credit customers

- Strong industry reputation

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- A+ BBB Rating

- A leading provider in refinance loans

- A+ BBB rating

Up to 723.99%

- Financing for customers with bad, limited, or no credit

- Offers special military rates

- Average monthly savings of $145

- Online Application

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

While many factors play a role in the interest rates youre offered for car loans, your credit score is the most influential. Knowing average auto loan interest rates by credit score can give you an idea of what you might qualify for and help you determine whether youre getting a good rate on your vehicle loan.

In this article, we at the Home Media reviews team break down auto loan interest rates by credit score for new and used car loans. We also examine how auto loans work and where you can find the best auto loan rates for your credit profile.

Which Credit Bureau Is Most Used For Auto Loans

Buying a car should be an adventure: You feel joyous at the prospect of getting a new car and excited to see how the vehicle will perform on the open road. But when you have to add your credit score to the entire calculation, it can suddenly seem like a lot less fun. What do car dealers look for in credit reports? Which credit score will the car company check? Which credit bureau is most used for auto loans?

Suppose you subscribe to a service that monitors your credit. In that case, you already have enough help to get the answers to the questions above. But, if you are buying a car on your own, youve got your work cut out, as there is a lot of seemingly conflicting data out there.

For example, there are multiple credit scores on one side and the FICO score on the other. FICO scores themselves have several versions. Then, there are the three credit bureaus. Each one uses its score system, which makes an auto loan credit check sound like rocket science. Not to mention that car dealers might be in contact with all three credit agencies or perhaps just one of them when assessing your creditworthiness.

Worry not. Weve gathered all the tips and tricks youll need to turn those credit checks to your advantage. By the time youre done reading, your expertise will rival that of the auto loan companies.

Recommended Reading: Usaa Auto Loan Application

What Credit Score Do You Need To Buy A Car In 2020

Rather than asking, “What credit score do you need to buy a car?” it’s a better idea to ask, “What credit score do you need to get a good deal on an auto loan?”

Its always in a dealerships advantage to sell you a car, so the salespeople are going to do everything to secure financing for you, even if your credit isnt stellaralbeit sometimes at ridiculous interest rates.

Typically, a will put you in a good position to find favorable auto loan terms. If your credit score is lower, youll probably be offered a higher interest rate. And the lower it is, the more youre likely to pay. If your credit score is very poorless than 450then you may not be able to get a car loan.

Which Credit Score Is Used For Car Loans

Credit-scoring models from FICO and VantageScore are most commonly used for auto loans, but lenders may also use the industry-specific FICO® Auto Scores.

With the FICO Auto Scores, FICO first calculates your base scores your traditional FICO scores then adjusts the calculation based on specific auto risks. These scores help lenders determine the likelihood youll make your auto loan payments on time. FICO Auto Scores range from 250 to 900 points.

Read Also: How Many Aer Loans Can I Have

Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

What Loan Term Length Should I Choose

Avoid stretching out your loan term to keep your auto loan payment as low as possible. Youll not only pay more in interest you may also end up having negative equity, meaning you owe more on the car than its worth, for an extended period of time. Choose the shortest loan term you can manage while balancing other expenses like housing, savings and repaying other debts.

Also Check: How Long Does Pmi Stay On Fha Loan

Keep Credit Card Accounts Open

Dont close old credit cards. If you have old credit cards that you arent using, its still a good idea to keep them. Closing old accounts can hurt your score by shortening your average account age and reducing your overall credit limit.

When youre ready to buy a car, deal with that first before you consider financing for anything else. Its also best to do your rate shopping relatively quickly so it doesnt look like youre applying for a bunch of new loans.

Remember, no matter how tempting it may be to go with a fancier car, you have to be able to afford your monthly payments. After all, being late or overdue will only hurt your credit score and your chances of better rates on future loans.

Example Credit Score Ranges Interest Rates And Monthly Payments For A $32000 New Car Loan

Note: Average interest rates based on Experian datafor Q2 2019 monthly payments estimated using FICO online calculator, based on five-yearloan term.8,9

Used car loans. American car buyers reportedly financed more than 55% of used vehicles in the second quarter of 2019, with loans averaging a little over $20,000. On average, people who bought used cars had lower credit scores than new-car buyers: the average credit score was 656 for all used cars, or 680 for used cars acquired from a franchised car dealer.10 The accompanying table shows how buyers credit scores could translate into interest rates and monthly payments for paying off the average $20,000 used-car loan over five years.

Don’t Miss: Usaa Graduate Student Loans

What Credit Score Do You Need To Get Approved For A Car Loan

Lets face it, owning a car makes life a whole lot easier. Whether youre single and need a way to get to work or you have a wife and four kids, owning a car will save you both time and stress. Unfortunately, many Canadians believe that their subpar credit score will stop them from getting approved for a car loan. The truth is, most Canadians with a monthly income of at least $2000 will be able to obtain a car loan despite their credit score.

While having a great credit score certainly helps to obtain better financing terms, its not a requirement to get car financing. In this article, well talk about the minimum credit score required to get approved for financing, how better credit can get you a better loan, things to consider when evaluating lenders and give you some tips on how to improve your credit.

When Is It Better To Keep Your Loan

Some people might be better off paying their auto loan as scheduled. Aside from the issues mentioned earlier about precomputed interest or prepayment penalties, you should consider other factors. If you are close to the end of your loan, you won’t be saving a significant amount of interest. It may be better for your credit to continue making on-time payments each month.

Do you have an emergency fund? If not, you should allocate any extra money to establish some savings.

Don’t Miss: Usaa Car Refinance

What Credit Score Do You Need To Buy A Car

In some cases, you may be able to get a car loan with a credit score as low as 500. This would be considered a subprime loan and likely requires a very high-interest rate . Youre more likely to get a more reasonable rate with a minimum credit score of 660 when applying for a car loan.

To understand why, heres an example looking at two borrowers who need a loan for the same amount but at different interest rates.

Lets say these two people are buying a quality used vehicle with a $10,000 loan. Lets assume the borrower with excellent credit gets a 4.3% interest rate while the subprime borrower has to pay 13.2%.

Loan 1 :

- Monthly payment: $229

- Total repayment cost: $13,713

As you can see with the math here, the borrower with excellent credit pays $43 less per month. Over a five-year loan, that adds up to saving $2,582 by having great credit. You can do your own analysis using an online calculator like those provided by Bankrate or myFICO.

What Does That Mean For You

In general, it means that although different lenders use different measures, people with exceptional credit scores may qualify for the lowest rates, while people with lower credit scores will often qualify only for loans with higher rates.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate

Recommended Reading: Penfed Credit Score Requirement Auto Loan