Is The Student Loan Interest Tax Deduction Worth It

Another argument for allocating extra money away from student loan debt is the income tax deduction the IRS allows for interest paid on school debt. Since youâre saving a little on your taxes, the argument goes, why be in a hurry to repay it?

For doctors, this deduction does not offer many incentives. For starters, itâs only available for those who earn less than $80,000 a year for single filers and $160,000 for joint filers. And you donât get the full deduction if you make more than $65,000 . Plus, the maximum deduction you can take is $2,500.

You might also like:

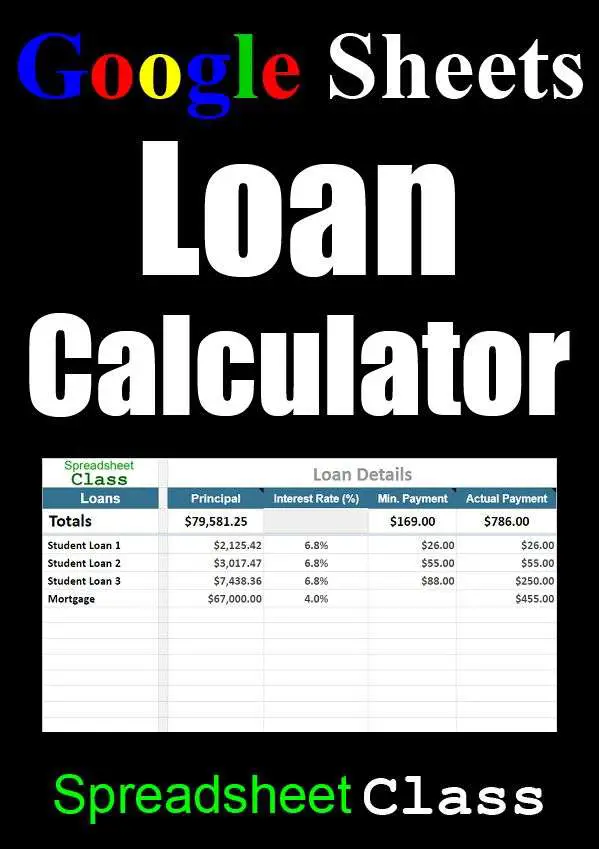

How The Loan Payoff Calculator Works

To use the loan calculator, youll start by entering two critical pieces of information the Loan Amount and the Loan APR youre paying.

From there, youll have the option to Calculate by Loan Term or Calculate by Monthly Payment. Click the bubble next to the one you want to calculate first.

Lets take a look at each, starting with the assumption of a $10,000 loan amount and a 7% loan APR.

Refinancing Your Heloc Into A Home Equity Loan

HELOC payments tend to get more expensive over time. There are two reasons for this: adjustable rates and entering the repayment phase of the loan.

HELOCs are variable rate loans, which means your interest rate will adjust periodically. In a rising-rate environment, this could mean larger monthly payments.

Additionally, once the draw period ends borrowers are responsible for both the principal and interest. This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. Sometimes the new HELOC payment can double or even triple what the borrower was paying for the last decade.

To save money, borrowers can refinance their HELOC. Here well take a look at two options and how they work.

You May Like: Usaa Proof Of Residency Request Form

How Long Should It Take To Pay Off A Mortgage

âThe faster you pay off a mortgage, the more you save in interest,â says Louis-François Ethier, product manager at National Bank.

The truth is, paying off a $100,000 mortgage in a short period of time is extremely difficult without both a sizable and stable income, and relatively few expenses. A small regular payment stretched out over a longer amortization period is usually considered an expensive strategy. This is because mortgage payments mostly cover interest and little of the principal until the interest is paid, so it can take decades to pay off the balance.

âThe amount of your mortgage payments should be based on your overall budget,â says Louis-François Ethier.

What Repayment Plan Qualifies For Student Loan Forgiveness

Some federal student loan forgiveness programs require you to make payments under an eligible repayment plan.

For example, to potentially qualify for Public Service Loan Forgiveness, youll need to work for 10 years at a government or nonprofit agency while making qualifying payments under an IDR plan.

You could also qualify for loan forgiveness under an IDR plan itself. Depending on the plan, your loans could be forgiven after 20 to 25 years of payments. There are four plans to choose from:

Keep in mind:

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

How Can You Pay Off Student Loans Faster

Here are a few ways that might help you pay off your loans faster:

- Pay extra on your loans. If you can afford it, make extra payments toward your loans. This could save you money on interest and cut down your repayment time.

- Refinance your loans. This could get you a lower interest rate. If you also choose to shorten your loan term, you could pay off your loans more quickly with fewer interest charges.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Is A Mortgage Discharge

A mortgage is a loan secured by property, such as a home. When you take out a mortgage, the lender registers an interest in, or a charge on, your property. This means the lender has a legal right to take your property. They can take your property if you dont respect the terms and conditions of your mortgage contract. This includes paying on time and maintaining your home.

When you pay off your mortgage and meet the terms and conditions of your mortgage contract, the lender doesnt automatically give up the rights to your property. There are steps you need to take. This process is called discharging a mortgage.

How Can You Lower Your Monthly Student Loan Payments

There are several ways to potentially lower your student loan payments. A few of these strategies include:

- Signing up for an income-driven repayment plan: If you have federal student loans, you might be able to sign up for one of the four IDR plans. Under an IDR plan, your payments are based on your discretionary income, which might reduce your monthly payment amount even to $0 in some cases.

- Consolidating your loans: You can consolidate multiple federal student loans with a Direct Consolidation Loan. With this type of loan, you can extend your repayment term up to 30 years, which could lower your payments. Just remember that the longer your repayment term, the more youll pay in interest over time.

- Refinancing your debt: If you refinance your student loans, you might qualify for a lower interest rate. Or you could choose to extend your repayment term. Either scenario might get you a lower monthly payment. Keep in mind that while you can refinance federal student loans, youll lose your federal benefits and protections, including access to IDR plans and student loan forgiveness programs.

Tip:

If you decide to refinance your student loans, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from our partner lenders in the table below in two minutes.

| Lender |

|---|

| Trustpilot |

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Is It Better To Pay Off Student Loans Quickly

Yes, paying off your student loans early is a good idea. Paying off your private or federal loans early can help you save thousands over the length of your loan since youll be paying less interest. If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans.

Pay Off Your Mortgage Faster

Six ways to pay off your mortgage early

Page reading time: 2 minutes

Paying off your mortgage early will save you money and take a financial load off your shoulders. Here are some ways to get rid of your mortgage debt faster.

If you’re having trouble making repayments, there is help available. Contact your lender and talk to them about applying for financial hardship.

Recommended Reading: Usaa Certified Auto Dealers

Talk To Your Lender About A New Payment Plan

If you have federal student loans and are currently on an income-driven, graduated or extended repayment plan, you can switch to a different plan to pay them off faster. The standard 10-year plan is the fastest way to pay off your federal student loans. Ask your loan servicer how to switch to this plan and what your new payments would be.

If you have multiple loan servicers, make sure to switch your repayment plan with each company. If you have private student loans, the only way to switch to a new term may be to refinance your student loans, but this depends on your particular lender. Contact them and ask if you can change to a different payment plan without refinancing.

Budget More For Savings

You may assume that paying off your loans faster isnt a possibility, but have you really looked at how much money you have left over each month? To find out how much more you can pay toward your loans, start by tracking your expenses with a monthly budget.

Monitoring your expenses will show any areas where your spending could be reined in, allowing you to put more money toward your loans. For example, you may discover that youre spending $100 a week on take-out or delivered food. Reducing that amount can free up more money with little effort required.

If you receive a raise, move to a cheaper apartment or get a roommate, take the savings difference and add it to your student loan payments. When you get a random windfall, like a tax refund or work bonus, apply the bulk of it to your student loans if you can.

Recommended Reading: How To Find Your Student Loan Number

How Extra Payments Pay Off Loans Faster

Say, for example, you borrow $20,000 in student loans with an interest rate of 5%. Your monthly payment for 10 years would be $212 and you would pay $5,440 in interest.

What if you paid $100 a month more toward that loan? Your monthly payment would rise to $312 but you would pay about $2,000 less in interest and be debt-free nearly four years earlier.

The more payments you can tack on, the less youll pay in interest and the closer youll get to freedom from student debt. If it feels like you have no cash to spare, try making biweekly student loan payments instead its a simple way to trick yourself into making one full extra payment each year.

The standard repayment plan takes 10 years to pay off a student loan. But repayment can last longer if you change your repayment plan for example, income-driven options can last up to 25 years.

You can pay off a student loan as quickly as you’re financially able to. There’s never any penalty for prepaying a student loan, and paying off your loan quickly will result in paying less overall.

You can calculate your student loan payoff date based on your current loan balance, the loan’s interest rate and the amount you pay each month. If you’re on an income-driven repayment plan, your student loan will be paid off when the amount you owe is paid in full or your repayment term reaches its end, whichever happens first.

Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this tool, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. Full disclaimer. This tool is here purely as a service to you, please use it at your own risk.

You May Like: How Much Do Mortgage Officers Make

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

How Long Does It Take To Pay Off Student Loans

Mohammed

Loans

Student loans are generally seen as a burden by borrowers. They are given to students who are financially challenged and need financial assistance to pursue their education.

The average cost of tuition has risen over the years which means that student loans are more expensive now than they were in previous years. Student loans are often combined with other loans which makes it difficult for people to repay them.

The amount of time it takes to pay off student loans depends on the type of loan, the amount borrowed, the interest rate, and whether or not you make payments on them consistently.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Much Home Equity Loan Can I Get +

The amount of money you can get for a Home Equity Loan is chiefly determined by how much equity your home currently has. Your equity, in turn, is arrived at by subtracting the amount you owe in mortgage loans from the current value of your home. Most lenders offer only 75-90% of your current home equity up for borrowing.

Line Of Credit Payoff Calculator

A home equity line of credit can be handy, but it also can be very difficult to figure out what your payments might be or how long it will take you to pay the loan off. Because HELOCs are adjustable-rate loans during their draw period, the rate can fluctuate, sending your payments up or down. The way HELOCs are set up further complicates the picture. Maybe you want to start paying your balance off while you’re still in the draw period, before repayment is required. What if you want to start paying the loan off but anticipate making further draws down the road? That’s a fairly common situation for people who use the HELOC as a cash-management tool to balance out an uneven cash flow.A regular mortgage or home equity loan calculator can’t deal with all those issues. But those are exactly what this Line of Credit Payoff Calculator is designed to do. It allows you to take all those various factors and crunch them into a single formula to figure out what your payments are likely to be.

Don’t Miss: What Car Loan Can I Afford Calculator

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Using The Line Of Credit Payoff Calculator

The calculator is fairly straightforward. However, some of the terms used may not be self-explanatory. So to use the calculator, enter the following

- Current balance: The amount you presently owe on your line of credit

- Interest rate: Where the interest rate on your line of credit currently stands

- Rate change: How much you expect your rate to increase or decrease per year

- Payoff goal: How quickly you’d like to pay off your loan balance.

- Current monthly payment: How much you’re presently paying toward your line of credit. This will be used to show how much faster your new payments would pay down the loan.

- Additional monthly charges: How much extra you’re paying toward the loan each month on top of your minimum payments .

- Annual fee: What your lender charges each year to maintain your line of credit.

Below this is another section, labeled “future draws from line.” You may need to click the plus symbol to make this window open up. When you do, you will be presented with options for entering amounts for up to four additional draws against your line of credit, of varying amounts and at different times.

When all your information is entered, the monthly payment required to pay off the line of credit will show at the top of the page. The graph will illustrate how fast you’d pay off the loan with the new payment compared to your current payments.

You May Like: What Car Loan Can I Afford Calculator

Use A Lump Sum To Pay Off Your Loan Faster

Tax refund, bonus, commission, inheritance, yard sale, gift or lottery win? Whatever it may be, an unexpected windfall can be used to pay off a chunk of the principal in one fell swoop.

So there you have it. Check out our loan payoff calculator to see how overpayments can help you save money in the long run.

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

You May Like: What Kind Of Loan Do I Need To Buy Land