Top Factors That Affect Small Business Loan Interest Rates

Whether you have been in business for several years or are launching a start-up, your business requires funding to be successful and to thrive. But did you know that you might not be offered the same interest rate as the business next door?

Seeking a loan may be required to fund the new equipment, space, supplies or more employees required to reach your goals. But not everyone gets offered the same interest rate from their conventional lender.

Though banks advertise an interest rate to get you to apply, there are several factors that affect the interest rate you may actually receive.

Personal Loan Weekly Rates Trends

The chart above shows average prequalified rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender.

For the month of September 2022:

- Rates on 3-year personal loans averaged 11.65%, down from 15.03% in August.

- Rates on 5-year personal loans averaged 15.60%, down from 16.52% in August.

Rates on personal loans vary considerably by credit score and loan term. If you’re curious about what kind of personal loan rates you may qualify for, you can use an online tool like Credibleto compare options from different private lenders. Checking your rates won’t affect your credit score.

All Credible marketplace lenders offer fixed-rate loans at competitive rates. Because lenders use different methods to evaluate borrowers, its a good idea to request personal loan rates from multiple lenders so you can compare your options.

Factors That Affect Business Loan Interest Rates

The factors that affect business loan interest rates are as follows:

Nature of Business

The lender usually classifies the loan under Priority Sector and Non-Priority Sector. Loans that fall under Non-Priority Sector have a higher rate of interest, as compared to the priority sector loans. Hence, the nature of your business determines the interest rate on your business loan.

Business Existence

The longer your business is in existence, the better it is for you. However, irrespective of the nature of the business, the minimum business operation of 2 years is mandatory. With more years in business, you have a higher possibility of getting loans at lower interest rates.

Monthly Turnover

The monthly turnover of your business decides if your business is making a profit or incurring losses. In short, it remains a key factor in determining your eligibility to avail a business loan. There are times when the turnover keeps fluctuating. However, maintaining consistency is highly crucial, as it helps your lender to determine the loan amount and repayment terms.

Credit score evaluates your creditworthiness and is based on your credit history. In case you have availed a loan in the past and repaid it on time or if you pay credit card bills on time, you will have a good credit score. And, if you have a good credit score , it will work in your favor while applying for a loan. A good credit score will give you more benefits like lower interest rates and flexible tenure or repayment terms.

Recommended Reading: How To Calculate Home Loan Approval

Online Loans: 7% To 100% Apr

Online loans are offered through online lenders, fintech, and business financing marketplaces. These loans tend to be very accessible and boast better-than-average approval rates.

Funding amounts can be high and the approval process can take up to a couple of business days sometimes 24 hours or less. In exchange for these benefits, borrowers will have to pay higher interest rates on most financing products.

How Much Money Do I Need To Fund My Small Business

The amount of working capital a small business needs to cover day-to-day operations depends on a variety of factors, like equipment, inventory and payroll costs, monthly revenue and other expenses. Startups typically have many one-time, up-front costs based on details like the specific industry, type of business, local and/or federal regulations. While actual amounts vary widely, recent reports suggest that microbusiness startup costs are around $3,000, while home-based small businesses can range from roughly $2,000 to $5,000.1 Keep in mind that the maximum business loan amount that startups and other small businesses may qualify for varies based on details like the credit type, the borrowers personal credit history and the lender.

Don’t Miss: Is Fast Loan Advance Safe

Is Getting A Business Loan A Good Idea

Whether or not a business loan is a good idea really depends on your specific situation.

If youre using your business loan to do something that will increase your revenuelike hire a new employee or two, boost your inventory, or invest in marketingthen a business loan can make a lot of sense. Well, as long as it fits in your budget.

But if youre getting a business loan to avoid financial disaster or bankruptcy, you should think carefully before submitting a loan application. The last thing you want is to end up with more debt you cant paynot to mention your business and personal assets at risk .

The Benefits Of An Alternative Lender

So, what are the benefits of an alternative lender or online lender? Well, loan approvals typically take less than a few hours and funds are provided in less than a week. Alternative lenders also have the easiest eligibility requirements and less rules for the use of the funds. Which brings us to the downside of using alternative or online lenders to make up for how quick you can get approved and funded, they typically offer the highest interest rates and fees compared to other types of lenders. But because it’s so easy to get funding, alternative lenders are best for startups or business owners without high revenues. Obviously, we recommend you to apply on our website!

You May Like: Easy Online Loans With Bad Credit

What Is A Good Business Loan Rate

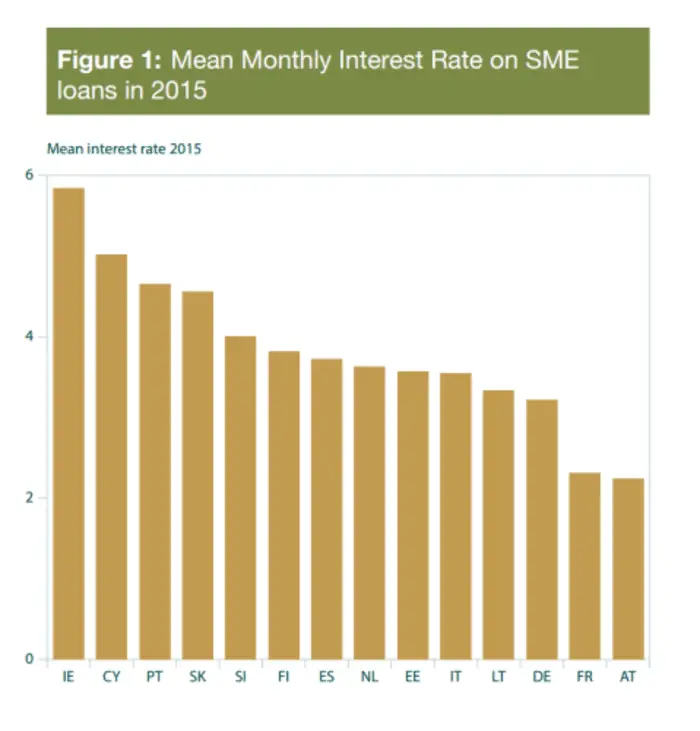

The average business loan rate is between 2.5% to 7%, but you may still be getting a good deal even if the rate you receive is slightly higher.

In most cases, a good business loan rate is assessed on a case by case basis. What may constitute a good loan rate for your business may not be the same for another business. Much comes down to your own credentials. For example, if your credit history is lacking or if youre a younger business, your benchmark for a good business loan rate will be higher than for more established firms.

Its important to keep in mind that the term of loan has an enormous influence on the entire cost. For instance, even though merchant cash advances have higher interest rates, theyre typically repaid quickly. Its possible that the total cost of a merchant cash advance may be equal or even lower than a business loan with a seemingly lower rate but longer repayment term.

It can be difficult to assess whats a good loan rate for your business on your own. Its much more helpful to consult with lending professionals, such as a Business Financing Advisor at National, who can walk you through market rates in real-time and whats realistic for your situation.

What Are Current Sba Loan Rates

Typical rates for SBA small business loans in October 2022 are as follows:

- Current rates for SBA 7 loans: 8.5%-11%

- Current rates for SBA CDC/504 loans: Approximately 5.8%-5.97%

- Current rates for EIDL loans for COVID relief:

- 3.75% for for-profit businesses

Don’t Miss: Which Type Of Loan Has The Highest Interest Rate

What Is The Maximum Sba Loan Interest Rate

The maximum SBA loan interest rate varies by loan program and loan amount, but the highest rate currently set by the SBA is on SBA 7 fixed-rate loans up to $25,000. Similarly, the SBAs Express loan program features a rate maximum of 10% for loans up to $50,000, and 8% for loans over $50,000 . Other SBA loan programs have lower maximum rates, like 504 loan rates that vary based on the current five- and 10-year U.S. Treasury rates.

Small Business Loans: The Ultimate Guide

There are many reasons why you may be interested in getting a loan for your business. To start the business, for working capital, for cash flow, for equipment, for emergencies the list goes on and on. So, let’s start by understanding the types of lenders and loans available to you. The age of your business, the revenues of your business and how fast you need the cash will influence which lender and type of loan will be the best for your business.

Also Check: How Long Are Land Loans

More On Small Business Loan Rates & Fees

Small business loans comprise an enormous range of products and services, each with its own rates and fee structures. When you have a sense of the type of loan youre considering, you can dive into the gory details of how those loans work and what theyll cost you.

Your Free Corporate Card

Ramp offersa free corporate card and finance management system for small businesses. Start earning rewards with your corporate spending today.

And start earning

Affordable Small Businesses Funding

National Funding offers affordable small businesses funding with reasonable rates, zero collateral, and fast deposit upon approval.

Requirements: Credit score 600+, $250,000 per year revenue, 6 months in business

Find Loan Options For Your Small Business

Easier borrower qualifications that help you build business credit. Fast turnaround: as little as 1-2 days.

Requirements: 600+ credit score, 12+ months in business and $100,000+ revenue

Dont Wait To Look At Your Financing Options

Shawn Hessinger: For anyone watching the show, what would be your main piece of advice?

Chris Hurn: The biggest thing I always say to small business owners is to not wait to look at this when its too late. There are a lot of different financing options out there for the typical small business owner.

Not everybody has a bank loan, not everybody has an SBA loan. Some people factor the receivables, some people have rigid cash advances, some people have hard money loans, but anything thats sort of above conventional pricingso any of those latter three ought to be things that a typical small business owner looks at refinancing noweven though rates are going up, youre going to feel it much more so with those higher-priced options.

So, if you can take a look at refinancing your interest rates, you know its going to be higher perhaps than some of them. But you also probably will be able to lower your effective borrowing costs. And youll be re-amortizing the debt as well, which means that your monthly payment should go down. And thats something that will really help the monthly cash flow for a typical small business owner.

The other thing I would tell you, Shawn, is that times like these are when a lot of the conventional lending options sort of go to the sidelines the banks, the credit unions, they get very nervous when the economy is slowing down, which is clearly what the Fed is trying to do here because in slowing down the economy, it will reduce inflation.

Recommended Reading: Home Loans First Time Buyers

What Factors Affect Business Loan Rates

Every lender looks at different factors to determine eligibility for term loans, but most, particularly banks and SBA lenders, look first at your creditworthiness. They may look at both personal and business credit scores, and they may have a threshold you have to meet to qualify. The lower your scores, the higher interest rates you may be offered.

Additionally, how long youve been in business may determine whether you qualify for financing or not. Startups may have difficulty getting bank loans because they havent been in business long enough to prove financial stability.

For some types of loans, like commercial real estate loans, you may also be required to provide collateral to secure financing.

Other types of loans, such as merchant cash advances, short-term loans, and invoice factoring, may not consider your credit at all, and may instead look at your monthly or annual revenues.

What Is The Interest Rate On A Commercial Loan

Commercial loans have a range of rates ranging from 5% to 178%. Rates on conventional commercial mortgages are currently between 60.08% and 9.05% Market index rates are calculated using the Key Market Index. INTEREST RATES20 in the Eurozone. A year SBA 504 refinance loan with a closing rate of 63%. This SBA 504 refinance resulted in a reduction of 26.360% rows for the year.

Look For A Commercial Property Loan With Interest Subsidies To Save On Taxes

The interest payment on commercial property can be exempt from taxation by a few lenders. HDFC Bank offers interest subsidies of up to 8% p.a. on loans of this type. ICICI Bank offers interest rates lower than 7.5%. It is critical to seek commercial property loans that allow for tax exemptions on interest payments if you are interested in purchasing commercial properties. Several of Indias largest commercial property lenders provide interest subsidies of up to 8% p.a. and 7.5% p.a. on loans of up to $850,000.

You May Like: Sba Loans For Self-employed

What Is A Business Loan

Business loans can take different forms, including installment loans, lines of credit, equipment loans and commercial real estate loans. They can work like personal loans that are used for business expenses such as office leases and employee pay. But there are also types of business loans that work a bit differently, such as accounts receivable financing, which is when a business uses the money it’s owed as collateral to get a loan.

Since business loans are borrowed by businesses and not people, the business’s finances and credit are what’s scrutinized by a lender. These factors help determine if the business qualifies for a loan, how much it can borrow and the rates and terms it’s offered.

A business loan’s interest rate can be impacted by:

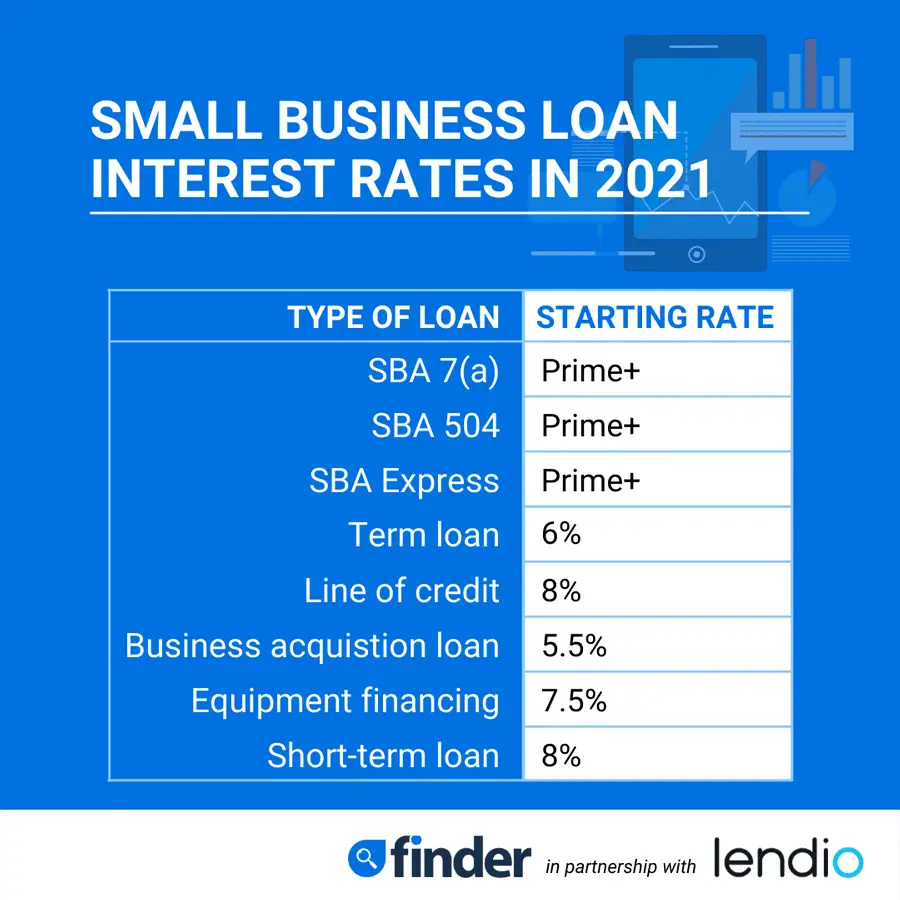

Small Business Loan Interest Rates By Loan Product

According to huffingtonpost.com, todays small businesses are seeking alternative funding solutions, online, for short-term capital needs.

Sometimes you can find a loan through the Small Business Association other times, its best to go through an alternative lending institution that offers a solution that fits your needs and limits your repayment risks, even if the loan rate is slightly higher.

The idea is that its better to get a loan you need with terms you can handle than to struggle with a loan product that does not fit your business.

You May Like: How To Get Good Interest Rate On Car Loan

What Is The Interest Rate On A Business Loan

- The lender.Bank small-business loans typically have the lowest rates but tough qualifications. Online lenders have looser eligibility requirements but cost more: Interest rates on some types of online business loans can range from 7% to 99%.

- The loan type. Lenders offer many types of small-business loans, and rates vary by product. The best deal is often on loans backed by the U.S. Small Business Administration. SBA loan rates range from 8.511%.

- Your financial situation. The lender will look at traditional business loan requirements like your credit score, your time in business and your business income. If you appear to be a risky borrower, the rate you’re offered will likely be higher.

- Your collateral. Lenders may offer you a better rate if you secure your loan with business collateral, such as inventory or property. This reduces the lender’s risk because it can seize these assets for nonpayment.

Small Business Loan Interest Rates

REDUCING BALANCE/ DECLINING BALANCE EQUAL INSTALMENTS LOANSView EAIR FAQ

EAIR means effective annual interest rate. All commercial banks, merchant banks and building societies are required to disclose this rate, irrespective of any other interest rate used.

The presentation of interest rates using the EAIR will not change our clients weekly/fortnightly/monthly repayments.

|

PRODUCT SUITE |

ADD ON/FLAT INTEREST RATE LOANS

EAIR means effective annual interest rate. All commercial banks, merchant banks and building societies are required to disclose this rate, irrespective of any other interest rate used.

The presentation of interest rates using the EAIR will not change our clients weekly/fortnightly/monthly repayments.

|

PRODUCT SUITE |

|

| 38.57% 39.11% |61.68% 71.10% | |

| Biz Grow | 33.89% 52.14% |33.43% 85.32% |

| Personal Loans | 38.57% 52.14% |51.07% 85.32% |

EAIR means Effective annual interest rate

APR means Annual percentage rate

*Conditions Apply.

Effective March 14, 2022

Rates and all information above are subject to change without notice. Rates may vary depending on term and security

Services

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Cookie in use:

Don’t Miss: How To Transfer Credit Card Balance To Personal Loan

Fixed Vs Variable Interest Rates

Business loan interest rates can be fixed or variable. A fixed interest rate stays the same over the lifetime of the loan, so the borrower can rely on making the same payments year after year. A variable interest rate can change during the loan term, depending on the market if prime rates or other indexes go up or down, it will change the interest rate you pay.

Fixed interest rates:

- Often start out higher than variable rates

- Come at a lower risk to borrowers

- Offer predictable monthly payments

What Is An Interest Rate On A Business Loan

Unfortunately, lenders arent in the business of handing out loans for freethey earn money by charging borrowers interest and fees. Interest is the amount of money, represented by a percentage, that lenders charge you to borrow money from them.

When you take out a small business loan, the total interest you pay is determined by multiplying your total loan amount, or your principal, by the interest rate youre approved for. Youll repay your principal and interest over the course of your loan term.

Due to amortizationwhich is the process of scheduling out a fixed-rate loan into equal paymentsyoull make the same payment throughout the loan term, with the first portion of the payment going toward interest and the remaining amount paid against the outstanding loan principal. More of each payment goes toward principal and less toward interest until the loan is paid off.

Also Check: How To Get Approved For Hud Home Loan