Banks Withdraw Hundreds Of Mortgages: The Best Rates Still Available For Home Movers And First

Lenders are slowly starting to put their mortgage deals back on to the market, but rates are now higher than before.

More than 1,500 mortgages were withdrawn in the last week of September, resulting in average rates on two-year fixes rising to a 14-year high.

Here, we explain why banks pulled their deals and outline the cheapest mortgages still available for home movers and first-time buyers.

Be more money savvy

Get a firmer grip on your finances with the expert tips in our Money newsletter it’s free weekly.

This newsletter delivers free money-related content, along with other information aboutWhich? Groupproducts and services. Unsubscribe whenever you want. Your data will be processed in accordance with ourPrivacy policy

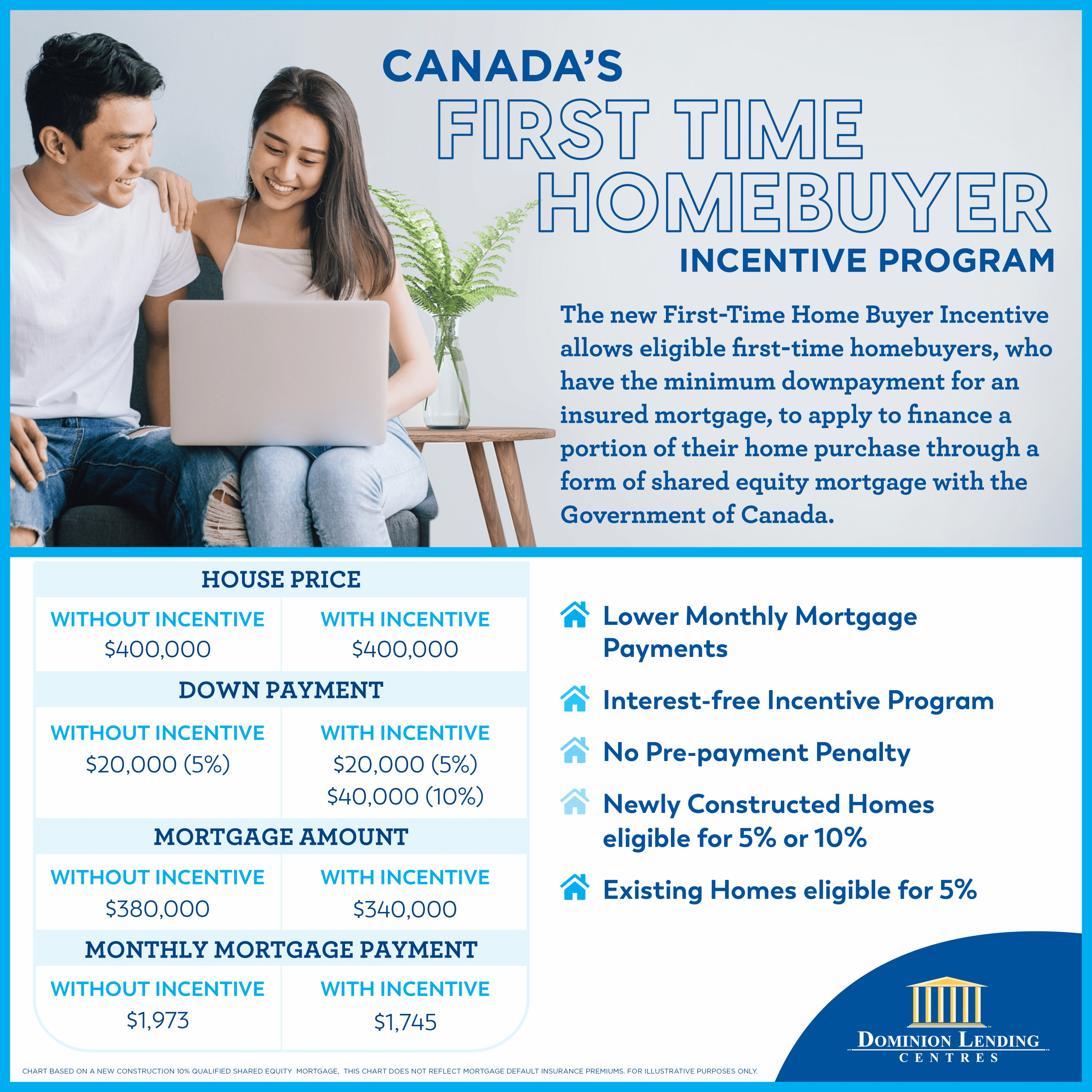

Down Payment Assistance Mortgages

Down payment assistance mortgages are loans that replace a home buyers typical cash down payment with borrowed money at favorable terms.

Access to down payment money at below-market mortgage rates is one form of down payment assistance. Instead of making a down payment using cash from a bank account, home buyers borrow money from a bank at 1 percent with ten years to pay it back.

Deferred mortgages are another form of home buyer down payment assistance.

A deferred mortgage is a loan that requires no repayment while you still live in the house that you bought. You repay the deferred mortgage only when you sell your home or refinance it.

For example, lets say you borrow $25,000 for a down payment using a deferred mortgage and choose to sell in five years because your homes value doubled. After your closing, you pay the $25,000 back to the lender and keep the rest of the profit for yourself.

Typically, down payment assistance mortgages are available through local foundations and municipal governments only. Theyre often limited to first-time buyers whose income falls below area averages and whose credit history shows a decent record of on-time payments. Learn more about down payment assistance programs.

Find out if youre eligible here.

Freddie Mac Home Possible Loan

- Minimum credit score: 660

- Minimum down payment: 3%

- Other requirements: Income cannot be higher than 80% of area median income

This conventional loan is not backed by the federal government but offers benefits for first-time homebuyers. The Freddie Mac Home Possible loan program only requires a 3% down payment but does require a minimum credit score of 660. To qualify, your home must be located in an underserved area or your income must be no greater than 80% of the median income for that area.

PMI is required if your down payment is under 20%. This can be canceled when you reach 20% equity in your home.

Also Check: Dept Of Education Student Loan Forgiveness

Calhfa Zero Interest Program

CalHFA Zero Interest Program, also known as ZIP, is a second mortgage that can work with certain CalPLUS loans. The program makes homeownership more affordable for low-income buyers by providing borrowers with a zero-interest loan amounting to 3% of a borrowers first mortgage.

And since this is a junior loan, payments for the loan can be deferred as long as you live in your house. However, keep in mind youll have to pay for the loan if you ever default on your mortgage, sell, refinance, or transfer the title to someone else.

No Down Payment Option

Many first-time homebuyers dont have enough savings for a down payment on a home purchase. And first-time homebuyers do not have proceeds from the sale of a prior home to put toward their real estate purchase.

VA home loans allow eligible borrowers to buy a home with as little as zero money down. When compared to most other mortgage programs, which may require 3.5% to 20% cash down, a VA-guaranteed mortgage can help first-time borrowers retain any savings they do have for future use.

Read Also: How Do I Refinance An Auto Loan

Fha Loans: For Buyers With Lower Credit Scores And Limited Savings

Federal Housing Administration loans are popular among first-time home buyers since they offer lower credit score and down payment requirements. They often have more flexible lending requirements than conventional loans. Even with a weaker credit score, you may only be required to put 3.5% down. Keep in mind, putting less down could result in a higher interest rate.

All FHA loans require mortgage insurance. It protects the lender against any loss if you fail to pay your mortgage. A mortgage insurance premium includes an upfront fee and a monthly cost . You may be able to roll the upfront fee into your mortgage if you dont have enough cash on hand to pay the upfront fee. But, your loan amount and the overall cost of your loan may increase.

What Can You Afford

While many of us would love a home with lots of space and amenities, its important to be realistic and keep your home aspirations in line with your income. Twenty-four percent of Canadians who currently want to purchase a home said a lack of available properties within their budget was preventing them from reaching their goal of buying a home now.

» FIND OUT:How much mortgage can I afford?

According to the Canada Mortgage and Housing Corporation , your monthly housing costs should not exceed more than 32% of your average before-tax monthly income. This is called your gross debt service ratio.

You can figure out what your GDS ratio is by using this calculation: Total housing costs / Gross family income x 100

Housing costs include things like mortgage payments, heating, 50% of condo fees , and property taxes.

Furthermore, the CMHC advises that a persons entire monthly debt load should not exceed more than 40% of their gross monthly income. This percentage is known as your total debt service ratio.

Figure out your TDS ratio with this calculation: / Gross family income x 100

In other words, your debt load includes your mortgage, property taxes, heat, 50% of any condo fees, as well as all your other debt payments, including for credit card debt or other loans.

Don’t Miss: How To Get Money Loan With No Job

Housing Finance Agency Loans

If youre a first-time buyer with low to moderate income, HFA loans can make homeownership more accessible and affordable. With these loans, state housing agencies partner with Fannie Mae or Freddie Mac to provide affordable financing.

Those who apply and qualify for an HFA loan can receive a lower monthly payment and assistance with their down payment and closing costs. Repeat buyers can also take advantage of this program.

To qualify, your income cant exceed your states HFA limit and youll likely need a 620 credit score or higher. In addition, youll be required to take a homebuyer education class.

The Bottom Line: A Federal Government Loan May Help You Reach Your Homeownership Goals

Government-backed loans often allow borrowers with lower credit to get the financing they need. Especially if youre a first-time home buyer, a government home loan can give you the chance to become a homeowner.

Get started today with Rocket Mortgage and see what government home loans you may qualify for. You can also give one of our Home Loan Experts a call at 326-6018.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: How To Figure Car Loan Payments

Va Loans Exist To Help Veterans Finance Their Homes

The Department of Veterans Affairs manages the VA loan program. As you might have guessed, only US veterans can apply for this program.

Purchase loans and Native American Direct Loan are two types of VA-backed loans. To qualify for a NADL, however, youll need to be not only a veteran, but be Native American and looking to buy or build a home on federal trust land.

The great thing about VA loans is that the VA is 100% financing, says Dierenfeld. It really levels the playing field for anyone interested in purchasing who may not have 10%20% to put down on a home.

Thats right, no down payment, as long as the homes sale price isnt higher than its appraised value. Other perks, according to the VA: no private mortgage insurance or mortgage insurance premiums required, fewer closing costs, and no penalty fee for paying the mortgage off early.

Help To Buy: Mortgage Guarantee Scheme

Announced in the 2021 Budget, the mortgage guarantee scheme offers lenders the option to purchase a guarantee on mortgages where a borrower has a deposit of only 5%.

The guarantee compensates mortgage lenders for a portion of net losses suffered in the event of repossession. The guarantee applies to 80% of the purchase value of the guaranteed property, covering 95% of these net losses. The lender therefore retains a 5% risk in the portion of losses covered by the guarantee. This ensures that the lender retains some risk in every loan they arrange.

Homebuy Wales supports households by providing an equity loan to help buy an existing property.

The scheme helps people who couldnt otherwise afford to buy a property.

Homebuy isnt available in all areas. And where it is available, the scheme will be subject to local residency and employment eligibility criteria.

Also Check: How Can I Get Government Assistance For Housing

Also Check: What Credit Score Do I Need For Home Equity Loan

How Much Money Do I Need For A Down Payment

The larger the down payment you are able to make, the less youll have to finance when you purchase a home. On a conventional mortgage, making a down payment of at least 20% will prevent you from having to pay for private mortgage insurance. The minimum down payment required varies based on the type of mortgage you obtain. In 2019, the median down payment for first-time buyers was 6%.

Am I Financially Stable Enough To Buy

To set yourself up for success, you want to make sure you can financially handle the responsibilities of homeownership.

- Do you have a secure job?

- Will your income stay the same or increase over the coming months and years?

- Does your co-borrower, if you have one, have a secure job too?

- Will you still be able to cover large upcoming expenses after purchasing a home?

You can always wait and spend the next few years squirreling away money.

Read Also: How Much Can The Bank Loan Me

So Youre Thinking About Buying A Condominium

Condominium living is a popular choice for many Canadians as it can be a relatively carefree housing option. About one million Canadian households own a condominium . Most major newspapers now include a condominium section, which recognizes the increasing number of people who already live in or want to live in a condominium.

This Guide will give you the basic background information you need to figure out if condominium ownership is really for you. It will identify key questions to ask and the people you should be asking before you make this important purchase.

Low Down Payment First

Not everyone will qualify for a zero-down mortgage. But it may still be possible to buy a house with no money down by choosing a low-down-payment mortgage and using an assistance program to cover your upfront costs.

If you want to go this route, here are a few of the best low-money-down mortgages to consider.

Don’t Miss: How To Apply For Pre Approved Home Loan

Can I Apply For A Va Loan If I Have Defaulted On A Previous Va Loan

It is possible for borrowers to apply for another VA loan even if they have defaulted on a previous loan, although their VA entitlement may be reduced. There may also be a required waiting period for a VA loan following a foreclosure, but the waiting period is significantly lower for VA loans than Conventional loans .

Recommended Reading: How Can You Get Rid Of Student Loan Debt

Low Down Payment Conventional Mortgages

These four programs from Fannie Mae and/or Freddie Mac are available for first-time home buyers and offer low down payments and low credit score requirements.

HomeReady: Backed by Fannie Mae, this 3 percent down payment mortgage has a 620 minimum FICO score requirement. Buyers using a HomeReady loan to purchase a HomePath property also receive a $500 closing cost credit. The HomePath Ready Buyer program enables buyers to qualify for a 3% cash contribution toward the mortgage or closing costs.

Home Possible: This 3 percent down payment mortgage has a 660 minimum FICO score. Freddie Mac backs Home Possible.

Conventional 97: Backed by Fannie Mae and Freddie Mac, the Conventional 97 mortgage requires 3 percent down and a 620 minimum FICO score.

Recommended Reading: How Many Personal Loan Can I Get

What Are The Benefits Of A Va Home Mortgage

Manageable qualification requirements

- Since these loans are financially backed by the Department of Veterans Affairs and thus lenders assume less risk, there are no credit checks for qualification and even when factoring interest rates, a borrowers credit score is less of an issue than with traditional home loans.

Down payments are not required

- For a lot of first time home buyers, saving thousands of dollars toward a down payment is daunting. This is the same for service members and veterans. With a traditional mortgage, a home buyer would need to put down a minimum of 5 percent toward the purchase price of their house and with Financial Housing Administration loans they would have to put down 3.5 percent.

- That means, if the home is $250,000, a traditional lender would require $12,500 down and an FHA lender would require $8,700. Knocking that number down to $0 allows service members and veterans an opportunity to buy a home they otherwise might not have had.

Monthly payments are lower than traditional home loans

10 Best VA Home Loans 2022

Compare 2022s Best VA Home Loans. Federally Insured. 0% Down. Active Duty, Vet & Family. Tap to Compare Rates. No Money Down.

Comparing is quick, easy, and free!

- Thanks to competitive interest rates available through the VA Loan program as well as the absence of a private mortgage insurance requirement, VA Loan borrowers are able to save thousands of dollars throughout the life of their home loan.

Home Loans Available To First

Key Takeaways

- First-time home buyers have access to grants or programs that can help reduce interest rates

- There are many loan options to choose from a Dash Mortgage Coach can help you find the best one

First-time home buyers are, obviously, individuals who have never purchased a home before. However, you may also qualify as a first-time home buyer if you havent owned or co-owned a home in the past three years.

While being a first-time home buyer can be nerve-wracking, being new to the real estate game has two advantages:

You May Like: How Do You Find Out Your Student Loan Balance

Finalize Your Home Loan & Close On A House

Key Takeaways

- Your lender may re-pull your credit so DO NOT buy any big purchases while closing on a home this can negatively impact your credit and stall your approval

- Once the closing documents are signed, the home is yours!

With the help of your mortgage lender, you can begin to finalize your home loan. During this step, loan underwriters will conduct another review of your information, ensuring all details are in order before they agree to the loan fully.

At this point, the lender may re-pull your credit, check that youre still employed, or ask for additional documents. However, this is less common if youve already gone through the full pre-approval process.

Very important: This is NOT the time to make big purchases. Buying a new car or taking out a personal loan can affect your credit score, impacting whether or not your loan is finalized. Failing to make payments could also affect mortgage approval.

Mortgage Credit Certificate Program

The Mortgage Credit Certificate Program provides up to $2,000 in tax credits for qualifying homebuyers. You must apply for an MCC before you buy the home.

The MCC is more complicated than other homebuyer programs. You are allowed to take up to $2,000 in tax credits every year that you pay mortgage interest. The amount you take is a percentage of your mortgage insurance, between 10% and 50%.

A tax credit will reduce the amount of taxes you owe, so it’s better than a tax deduction. Unfortunately, not every state offers the MCC tax credit. Contact your state’s Housing Finance Authority to find out if they issue MCCs. If you already have a mortgage broker, you can ask them if you qualify.

Make sure you’re also accounting for interest rates at the time of purchase. A mortgage expert can help you figure out how much house you can afford.

Recommended Reading: How Many Americans Have Student Loan Debt

Work With A Local Real Estate Agent

A local licensed real estate agent can help you find the right home for you and craft a winning offer. Find someone that is familiar with the type of home you want to buy and has experience in the neighborhoods youre considering living in. Having a professional on your team that understands the local market can give you a leg up on the competition, which is vital in todays competitive real estate market.

Also Check: Government Jobs People Over 50

What Are The Va Loan Terms For 2022

As of 2020, VA loan no longer have value limits for qualified borrowers. That means first-time VA loan borrowers will have no cap on the size of $0 down VA loans. The VA funding fees, which most borrowers have to pay when they close on their mortgage, remain the same as they were in 2020.

The funding fees range from 0.5 percent on some refinances to 3.6 percent for some home purchases. The exact fee varies depending on the value and type of your loan, how much you put down, and whether its your first VA financing.

These one-time fees help keep the loan program running. However, some borrowers may have to pay slightly more than the published rates in 2021. Veterans and service members will be charged the higher rates though National Guard and Reserve members will have their funding fee lowered to the same level as other military borrowers.

Veterans with service-related disabilities and some surviving spouses dont have to pay a funding fee. Purple Heart recipients on active duty are also exempt from the fee.

Don’t Miss: Which Loan Accrues Interest While In School