How Much Does A Student Loan Cost

The costs of a student loan depend on 3 variables, the size of the loan, the interest rate, and the terms.For example, if a student borrowed $30,000 with an interest rate of 5.5 with a 10-year term.The monthly payment would be $325.58, and the total interest cost would be $9,069.46 after 10 years of payment. The interest payment is almost one-third of the amount borrowed.The longer the term or the interest rate, the most costly it gets. Therefore, you may want to pay off your student loan faster.

How Loan Payments Work

Most loans require monthly payments over a set periodâthe loan term. These payments go toward the loan principal and the interest . The amount of your monthly payment depends on the terms of your loan, including the interest rate, repayment term and amortization schedule.

The main factors that impact loan payments are:

- Principal. The loan principal is the total amount you borrowed.

- Interest rate. Interest is what lenders charge consumers to borrow money. Annual percentage rates include annualized interest as well any fees or additional costs of borrowing, like origination fees. Interest rates are more competitive for borrowers with excellent credit because they pose less risk to lenders.

- Fees. Depending on the lender, additional fees may include origination fees, late fees, insufficient funds fees and prepayment penalties.

- Repayment term. A shorter loan term means higher monthly payments, but interest has less time to accrue. A longer loan term comes with lower monthly payments but more interest overall.

Pay More Than The Minimum

One of the best ways to pay off student loan balances early is to pay more than the minimum required. Each student loan lender calculates your monthly loan payment based on the loan amount, your interest rate, and the term of repayment. This generates a minimum required payment due each month.

Paying more than the minimum helps expedite your loan repayment term, ultimately allowing you to pay off the balance faster by reducing your balance at a faster rate.

You May Like: What States Require Commercial Loan Broker License

What Are The Requirements And Terms Of Your Loan

In any area of the US economy, a loan is money or a tangible item that is given to you under an agreement that youll make payments on the money or the item. If you have received money, you will be expected to repay the full amount plus an additional sum of money called interest.

You may have heard about a loan term. This is the amount of time the loan is supposed to last if you make the minimum amount of your loan payment every month. From the time you receive the loan until it is fully paid off is the loan term in years. This may be 10, 20, or 30 yearshowever long your student loan is supposed to last is your loan term. If you make the exact payment required every month, your loan will last until you have sent in that final payment.

Extra Payments The Right Way

You must let the lender or servicer know if you want extra payments to go toward the principal. Otherwise, the money may go toward the next months interest payment.

Contact your lender or servicer to find out how you can ensure extra payments will be applied to your principal. Here are some ways you may be asked to do it:

-

In writing. Some lenders require a written request for extra payments to go toward the principal.

-

On the phone. If you make a payment by phone, you may need to ask verbally.

-

On your check. If you send a check by mail, add apply to principal to the memo line.

You May Like: Where To Send Loan Forgiveness Application

Refinancing Can Save You Money

You could save even more by using this student loan calculator to estimate your savings from refinancing your student loans.

Using the same scenario, lets say youre able to refinance your $75,000 debt down to a new 4.5% interest rate and continue paying $1,000 each month.

Youd pay off your total debt within 88 months and only pay a total amount of interest of $13,229. In that scenario, youd yield a savings of $11,674 in interest over the life of the loan alone due to a lower refinancing rate and higher monthly loan payment.

Plug in your own student loan numbers and see how much you can save in different scenarios.

Other Ways To Pay Off A Mortgage Early

Paying off a mortgage early requires you to make extra payments. But theres more than one way to pay off the mortgage early:

-

Add extra to the monthly payments, as discussed in this article.

-

A structured way to add extra: Divide your monthly principal payment by 12, then add that amount to each monthly payment. You end up making 13 payments, instead of the required 12 payments, every year.

-

A variation of the above tip: Deposit one-twelfth of the monthly principal payment into a savings account each month, then use that money to make a 13th payment.

-

Pay half a mortgage payment every two weeks. You make 26 half-payments, equivalent to 13 full payments a year. If you want to try this, first make sure your mortgage servicer is set up to receive biweekly payments.

-

Make a lump-sum payment toward the principal. You might do this after receiving a bonus, inheriting money or winning a lottery prize any time a large sum lands in your checking account. Coordinate with your servicer to ensure that the money goes toward reducing principal.

-

Refinance to a shorter term. If you can refinance with a lower interest rate, for a shorter term, its a win-win. For example, you could refinance a 30-year mortgage into a 15-year loan. The monthly payments will almost certainly be higher, and youll pay closing costs, but your overall interest expense will be dramatically lower.

You May Like: How Do I Find My Student Loan Lender

Recommended Reading: How To Find The Best Car Loan Rate

How The Loan Payoff Calculator Works

To use the loan payoff calculator, youll start by entering two critical pieces of information: the remaining loan balance and the youll be paying.

From there, youll have the option to calculate by monthly payment or calculate by payoff time. Click the bubble next to the one you want to tinker with first.

Lets take a look at each.

How To Pay Off Student Loans Fast

A typical student loan can last anywhere from 10 to 25 years. The longer the term, the more costly it gets as the borrower would pay more in interest payment.One way to pay off student loans faster is to make extra payments. Extra payments allow borrowers to pay off their student loans faster and earlier. They can save thousands of dollars in interest payments depending on the size of the loan and the number of extra payments that you make.Let’s look at our previous example, where a borrower has a $30,000 loan with a 5.5% interest rate and a 10-year term.The monthly payment is $325.58.The total interest payments are $9,069.46The payoff time is 10 yearsIf the borrower increases his monthly payment by $100, which is the extra payment. He would pay off the loan in a little over 7 years, and the total interest payments will be reduced to only $6,316.11.The monthly payment with extra payment is $425.58The total interest payments with extra payments are $6,316.11The payoff time with extra payment is a little over 7 years.Before you start to make extra payments, make sure you talk to the bank first. The extra payments have to be paid towards the principal balance instead of the next month’s interest payment.Let your lender know in writing that the extra payments will be applied to the principal so that you have proof of payments.

Don’t Miss: When Do I Start Paying Back My Student Loan

How Extra Payments Help Pay Off Loans Faster

The most direct way to pay off your student loans more quickly is to simply pay more than the minimum balance you see on the bill or on your computer screen. Even if you can only pay $75 extra per month, that will speed up the lowering of the principal balance. This is the most effective way of paying your bill of more quickly. Even if you cant pay $100 or more, any amount is good.

Refinancing your student loans may also allow you to reduce your debt more quickly. Depending on your career or job, you may be able to apply for student loan forgiveness. However, youll have to meet certain criteria in full to qualify. If you are an employee in a federal agency, a medical professional, lawyer, automotive worker, or public servant, you may qualify for this advantage. And dont forget about using tax credits or deductions, either.

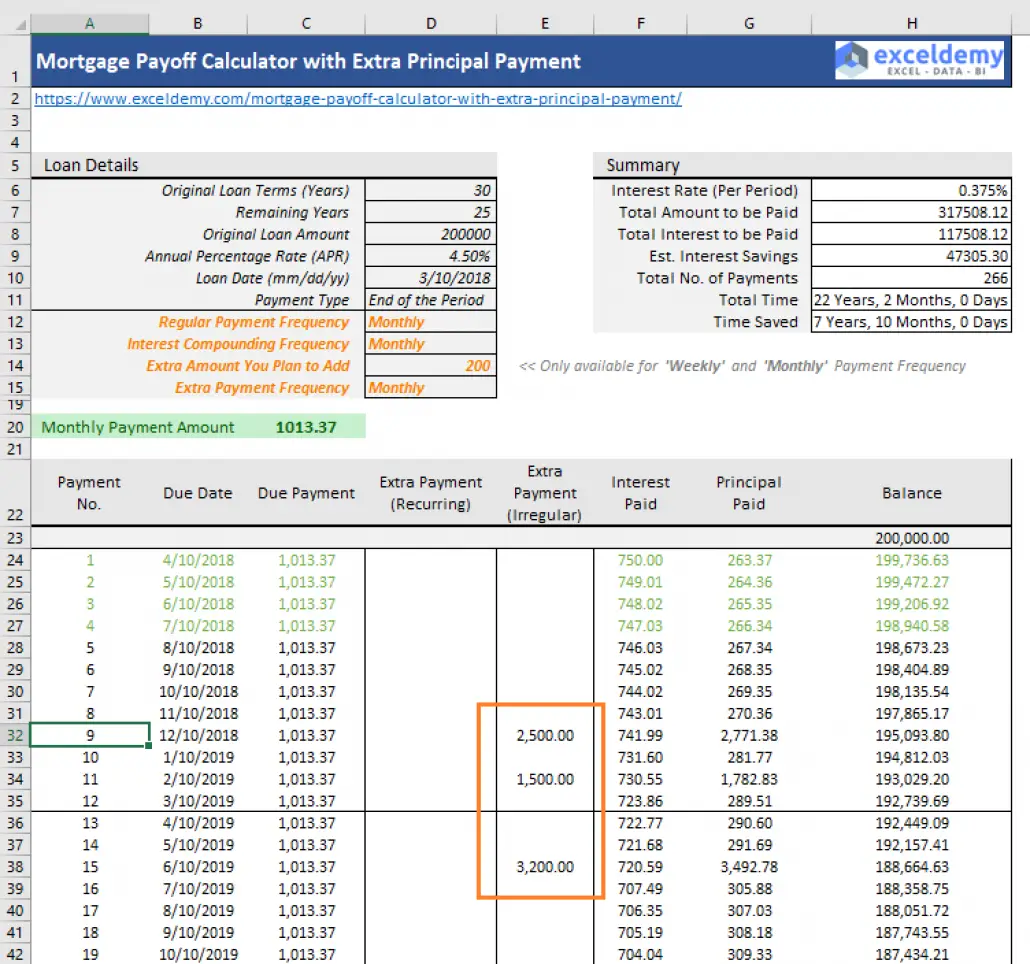

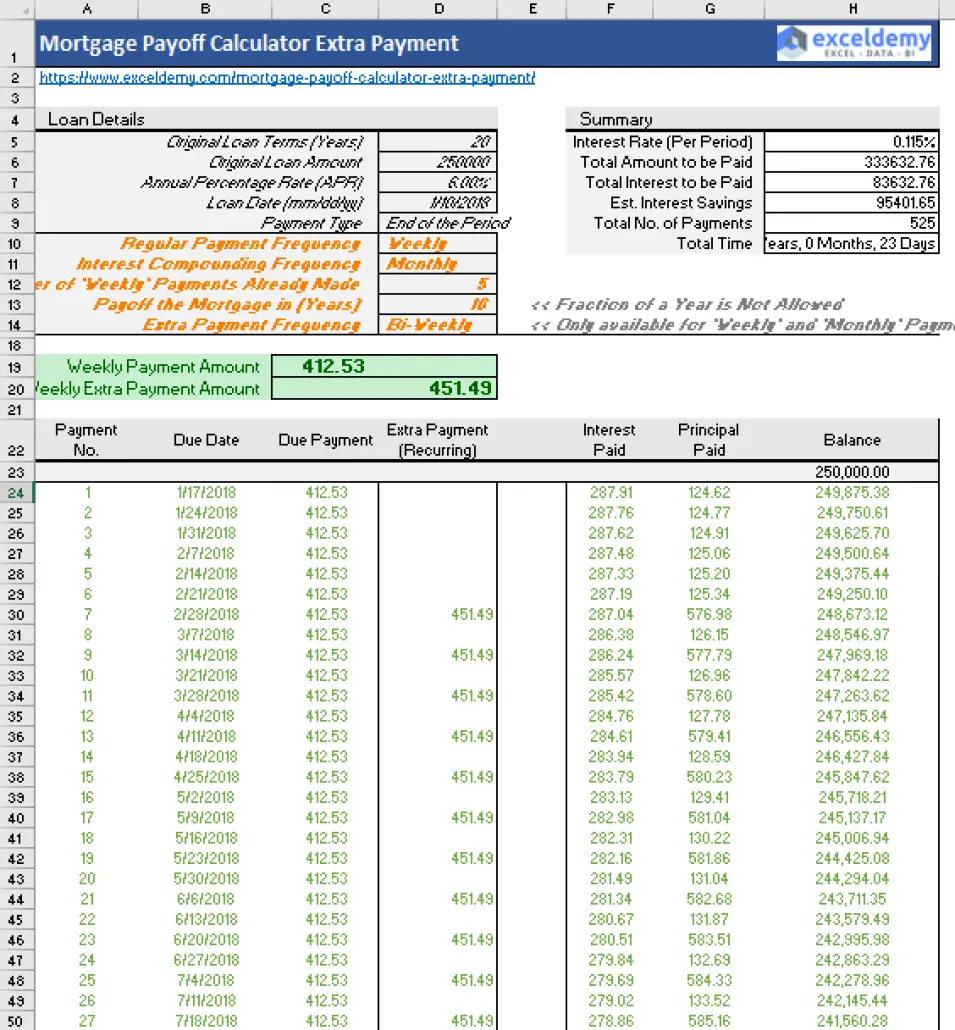

How To Calculate Extra Mortgage Payments

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loans lifetime.

Recommended Reading: Navy Federal Career Starter Loan

College Board Student Loan Calculator

This tool reminds borrowers of the actual annual borrowing limits by academic year for federal education loans, in addition to being able to input other loan types and corresponding interest rates. It also allows users to plug in their anticipated year of college graduation and estimated starting salary as part of the calculation process.

How Do You Change Student Loan Repayment Plans

There are several federal student loan repayment options in addition to the standard repayment plan, including graduated repayment plans, extended repayment plans, and IDR plans.

If you want to change your federal student loan repayment plan, contact your loan servicer. You might also be able to apply for a new repayment plan online.

There are generally fewer private student loan repayment options, and available repayment plans will depend on your lender. You can typically only change your repayment plan by refinancing your private student loans.

Recommended Reading: How To Get Out Car Loan

What Will My Repayment Schedule Be

Your repayment term, or the amount of time it takes to pay off student loans, depends on the type of loan you took out and the payoff plan you choose. Federal student loans come with a standard repayment term of 10 years, but you can opt for a 20- or 25-year term if you choose an income-driven repayment plan, which ties monthly payments to your income. Private loans often come with terms of five, 10 or 15 years.

Student Loan Payment Calculator

The student loan payment calculator is a simple tool that computes the monthly payment or final payoff date of your student loan. It also includes extra payment options, in case you come into some additional money and like to pay off your loan sooner. This calculator’s main use is to find one of these three things:

- Loan term: by setting the time remaining between a given day and the final payment, you will receive the monthly payment, with the exact day you pay off the loan.

- Monthly payment: by providing the amount of money you would devote monthly towards refinancing your student loan, you will get the precise day you pay off the loan.

- Desired payoff date: by choosing a particular day you wish to finish paying off your student loan, you will obtain the monthly payment required to meet such a date.

Besides these main outputs, you will also receive complimentary results – the total payment amount and the interest charged. What’s more, you have an option to set extra payments from a given date, or a one-time extra payment on a particular day, and check their effect on the figures. In this way, you can easily compare different payment scenarios. The additional dynamic graphs and payment schedules provide other details, and further facilitate your assessment of each style of repayment.

If you read further, you can learn how to calculate student loan interest, as well as find some information on the average student loan debt and average student loan interest rate.

Don’t Miss: How Long Does Loan Pre Approval Take

Student Loan Repayment Options

It is not uncommon for new graduates to struggle to repay their student loans. Unfortunate circumstances such as flaccid job markets or recessions can exacerbate situations. For federal student loans, there are some alternative solutions that can aid in dwindling down student loan payments. Income-based repayment plans can potentially cap the amount that students repay each month based on available income if they find that their student loans become increasingly harder to pay off. These plans prolong the life of the loans, but they relieve the burden of large monthly payments. There are also graduate repayment plans that slowly ramp up monthly payments over time, presumably in conjunction with projected salaries as people progress through their careers. Extended graduated repayment plans allow borrowers to extend their loans for up to 25 years. For some income-linked plans, in the end, the remaining balance may be forgiven, especially for those in public services.

The major repayment plans for federal student loans are listed below.

| Plans | |

| Low-income borrowers with Federal Family Education Loans | No |

* Loan forgives tax-free after 120 qualifying loan payments for these in public services. It is not income tax-free and only forgives at the end of the loan term for others.

What Types Of Student Loans Are There

The two types of student loans available are federal loans, provided by the federal government, and private student loans, made by financial institutions like banks and credit unions. Federal student loans typically come with lower interest rates and more consumer protections than private loans. So its best to borrow those up to the maximum allowed, if necessary, before considering private loans.

Don’t Miss: How To Get Better Interest Rate On Car Loan

How Long Is The Grace Period On Student Loans

Depending on what type of loans you have, you might not have to start making payments until six months or more after graduation this is known as a grace period.

Heres the grace period you can expect for a few types of student loans:

- Direct Subsidized and Unsubsidized Loans: Six months

- Grad PLUS Loans: No grace period

- Parent PLUS Loans: No grace period

- Private student loans: Depends on the lender

Keep in mind:

If you have private student loans, you might have to make payments while youre in school. Be sure to review your loan agreement to see when your payments will begin.

See: What Is a Student Loan Grace Period?

How Much Extra Should You Pay To Payoff Your Mortgage Early

You dream of paying off your mortgage early.

You long for the day when you are debt free.

But how do you do it?

How much must you pay each month to be out of debt by a certain date?

What if you wanted to pay off your mortgage in 15 years instead of 30? How much would you save?

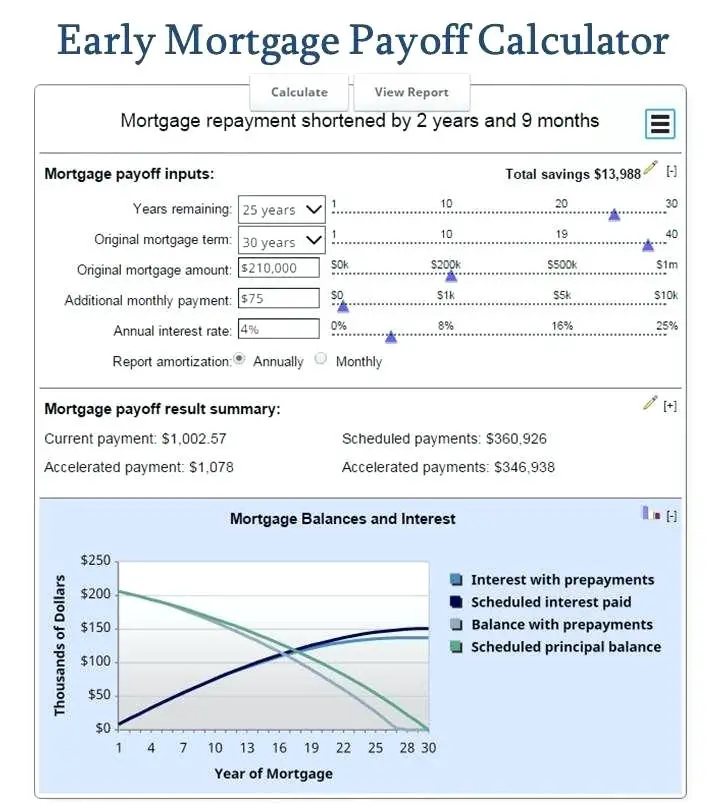

The good news is this mortgage payoff calculator makes figuring out your required extra payment easy.

You choose how quickly youd like to pay off your mortgage, and the calculator will tell you the required extra monthly payment to get it done. It will also tell you how much interest youll save!

However, before you start making your extra payments, there are a few factors youll want to consider first . . . .

Don’t Miss: How Much Will My Student Loan Monthly Payment Be

Measure Impact Of Refinance On Student Loan Payoff

You should always check for refinancing offers on your loans.

Suppose you find a lender that is willing to refinance your student loan at a lower rate, for example, 5.25%. Enter 5.25 in the whats your refinance rate field.

Hit the RE-CALCULATE button to see the impact of refinancing.

We observe that based on the lower interest rate of 5.25%, the new monthly payment is $449.44, down from $542.11.

A 2% lower interest rate enables you to save $27,800 in total interest!!!

Perks Of Paying Off Your Student Loans Faster

Paying off your student loan debt as soon as possible can result in many benefits. Borrowers can save thousands of dollars in interest and free up funds to put toward your savings and retirement plan, for example.

Plus, youll lower your debt-to-income ratio, which can be important if youre trying to buy a home or take out a business loan, not to mention the peace of mind youll get from not carrying around a massive amount of debt.

One way to get out of debt sooner as you can see above is student loan refinancing.

You can check to see if you could get a lower interest rate in minutes at a lender like Earnest below. Plus, you can get bonuses of hundreds of dollars for applying through Student Loan Planner®.

You May Like: What Is The Best Bank For Mortgage Loan

How Do I Pay Off My Mortgage Early

One way to pay off your mortgage early is by adding an extra amount to your monthly payments. But how much more should you pay? NerdWallets early mortgage payoff calculator figures it out for you.

Fill in the blanks with information about your home loan, then enter how many more years you want to pay it. The calculator not only tells you how much more to pay monthly to pay down your principal faster it also shows how much youll save in interest.