What Apr Does Bank Of America Auto Loan Offer On Its Car Loans

Bank of America auto loan offers a fixed apr car loan product but they do not disclose their rates.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Who Is Bank Of America Best For

An auto loan with Bank of America is best for a driver that intends to finance their vehicle through a dealership rather than fully online. Although the rates offered are competitive, to truly benefit you would have to be a preferred rewards member which requires you to hold a high deposit or investment balance.

If youre looking to skip the dealership and dont have $20,000 to keep in the bank to get the rate discount, you may find better deals elsewhere.

How Do Bank Of America Auto Loans Work

Bank of America Auto loans work the same as most banks, today. You will have the option of speaking with your local banks loan officer, or you can get approved for car financing online.

They offer a quick three step process and claim that they can give you a decision on your next auto loan in 60 seconds.

Recommended Reading: What Is The Current Sba Loan Interest Rate

Compare The Best Auto Loan Rates

| Lender | |||

|---|---|---|---|

| LightStreamBest Online Auto Loan | 3.99%* with Auto Pay & Excellent Credit | $5,000 to $100,000 | |

| Bank of AmericaBest Bank for Auto Loans | 3.59% | ||

| Consumers Credit UnionBest Credit Union for Auto Loans | 2.49% | ||

| Chase AutoBest for Used Cars | Not Advertised | ||

| myAutoloanBest for Bad Credit | 1.90% | ||

| CarvanaBest for Fair Credit | Not Advertised | Any Car They Are Selling | 36 to 72 months |

Bank Of America Auto Refinance Reviews

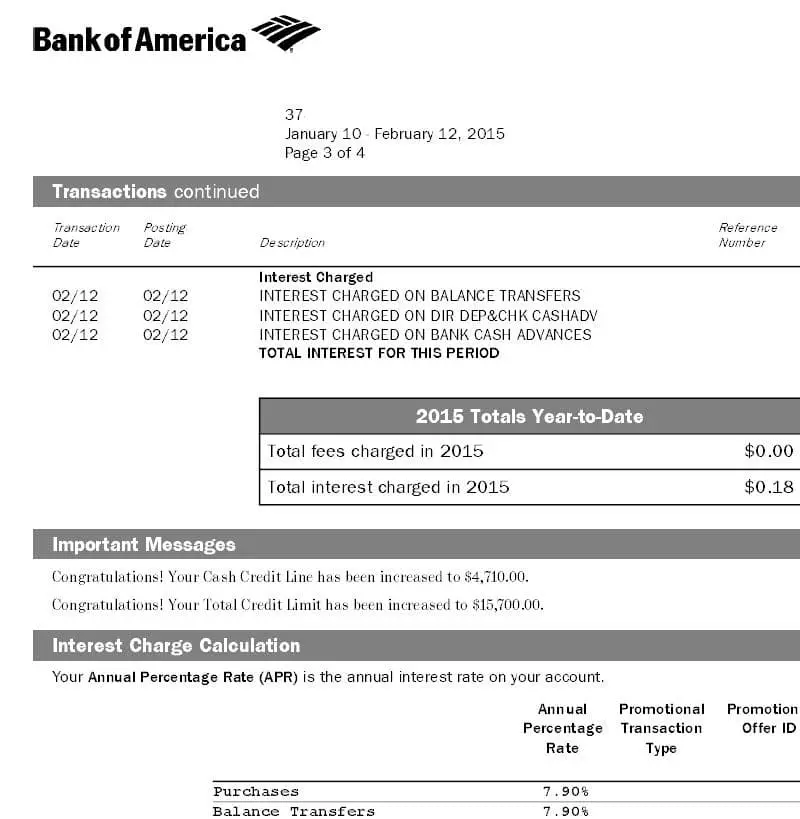

Bank of America auto loan reviews from customers can be found on the companys main BBB page. The bank holds a nearly 1.1-star rating out of 5.0 from more than 600 reviews on the site.

The bank has responded to and closed over 6,700 complaints in the last three years. While this may seem like a considerable number, its minimal compared to the 67 million users who are enrolled in Bank of Americas financial services.

In the J.D. Power 2021 U.S. Consumer Financing Satisfaction Study, the company scored fifth place for customer satisfaction among those who financed luxury vehicles, earning 861 out of a possible 1,000 points. It ranked below average in the same study for financing of mass-market vehicles. The study looks at overall customer satisfaction regarding the application and approval process, billing and payment process and customer service experience for financial institutions.

Our team reached out to Bank of America for a comment on its scores and negative reviews but did not receive a response.

Don’t Miss: What Is The Maximum Federal Student Loan Per Year

Let Ace Help With Your Money Matters

In California, we have payday loans online and in stores.

If approved, you may be eligible to receive instant funding to a qualifying debit card for online loans.

Instant Funding is funds available in an instant, loaded directly to your debit card account. Just complete your online application, including signing your loan agreement, and if approved for a loan and for instant funding, your loan will be ready for funding after you provide your debit card information. Instant funding may take a few minutes or up to 4 hours to process.2

No more extra trips to deposit cash in the bank, no waiting the next business day for your online loan funds to deposit. With Instant Funding, you can get access to your funds right away.

Who Is Eligible For Bank Of America Auto Refinance

Anyone 18 or older with U.S. citizenship or residency can apply to refinance their current loan with Bank of America. The financial institution only provides auto financing for vehicles less than 10 years old and with fewer than 125,000 miles. Additionally, Bank of America doesnt cover:

- Vehicles valued at less than $6,000

- Vehicles used for commercial or business purposes

- Salvaged or branded-title vehicles

- Gray market or lemon law vehicles

- Conversion or delivery vehicles

- Motorcycles, recreational vehicles , boats or aircraft

Bank of America doesnt list any minimum income or minimum credit score requirements. Borrowers with good or excellent credit history are more likely to be approved for auto refinancing, while those with poor credit may be turned down.

Recommended Reading: How Do They Determine Mortgage Loan Amount

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 3.59%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2021 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked 5th out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 3.59% for new vehicles. Used vehicle loans start at 3.79% APR, while refinances start at 4.79% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

You May Like: How To Find My Student Loan Provider

Bank Of America Car Loan Rates And Terms

Bank of America auto loan rates for the best applicants currently start at 3.69 percent over 60 months for new cars purchased through a dealer. Rates for used cars currently start at 3.89 percent. Bank of America doesnt provide loans for vehicles purchased from independent dealers other than CarMax, Hertz, and Carvana. Current Bank of America online banking customers may be eligible for financing when purchasing a car from an independent third party seller.

Rates on loans from private parties and independent sellers start at 5.24 percent at this time. Rate on auto loans for lease buyouts start at 3.89 percent at this time. Applicants may receive loan terms between 12 and 60 months.

The minimum loan amount is $5,000 in 48 states except for Minnesota and South Carolina, where the minimum loan amount is $7,500. The maximum loan amount depends on your credit, income, and the vehicle you want to purchase. In order to qualify for financing, the vehicle must have a value of at least $6,000. Cars that are more than 10 years old or have more than 125,000 miles are not eligible for financing through Bank of America.

How To Refinance Your Bank Of America Auto Loan

- Pennsylvania State Employees Credit Union

- and a few more.

Also Check: Who Do I Talk To About An Fha Loan

Payday Loans In Richmond Hill Ontario

Hard working Richmond Hill residents that are looking for some extra cash are in luck. Emergency expenses can arise unexpectedly and a cash advance can help a lot. Oftentimes, it is difficult to obtain a payday loan due to complex applications and long line ups. Further, if you have bad or poor credit the procedure can become even more difficult. Thankfully, payday loans in Richmond Hill can be obtained without having to wait in long line ups or dealing with complex applications.

Smarter Loans is your one stop shop for payday loans available all online. With a directory of loan providers at your fingertips you are able to get a cash advance fast and easily.

No more than 1 or 2 business days are all it takes to get money into your bank account regardless of bad or poor credit. Weve taken all the top local payday loan providers and placed them into our directory for your to search through and compare for the ideal match.

Below you will find our directory of local loan providers. Click on Apply Now next to the provider of your choice and complete their online application. Upon competition one of their friendly representatives will get in touch with you. In the alternative, you can also pre-apply with Smarter Loans and we will connect you with a local loan provider to process your application.

Is A Bank Of America Loan Right For You

![[Warning Government Action] Bank Of America Auto Loan Review (2020) [Warning Government Action] Bank Of America Auto Loan Review (2020)](https://www.understandloans.net/wp-content/uploads/warning-government-action-bank-of-america-auto-loan-review-2020.png)

Bank of Americas low starting interest rates for their auto loans make the products a good idea for most people. The loans get even more attractive if youre already a Bank of America customer. The extra discounts that can get tacked on will make your auto loan more affordable. If youre not a Bank of America customer and looking for a small auto loan you might want to look elsewhere, as Bank of Americas loans start at $7,500.

Make sure you shop around before making your decision about your auto loan. Look into at least three different lenders and see which product best fits your budget and needs.

Also Check: What Is My Auto Loan Credit Score

New Auto Purchase Loan Review

Not yet rated

-

Apply online, by phone, in a financial center or at an authorized dealership.

-

Offers rate discount for customers with qualifying account relationship.

-

Usually provides loan decision within 60 seconds of application submission.

-

Customer service available on Saturday.

-

Provides Spanish version of website.

Cons

-

Social Security number required to submit initial application.

-

Rate discount available only with deposit balances of $20,000-plus.

Best for applicants who qualify for a Bank of America Preferred Rewards rate discount or want the convenience of purchasing and financing a new car at a Bank of America-authorized dealer.

Is Bank Of America Trustworthy

Bank of America is rated an A+ by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company. Additionally, Bank of America does have some recent public controversies:

- Bank of America paid $75 million to settle a lawsuit accusing the bank of pulling excess overdraft fees and overcharging customers .

- The Department of Justice claimed that Bank of America unfairly refused home loans to adults with disabilities, even though they qualified for loans. Bank of America paid around $300,000 total .

- The Department of Labor required Bank of America to pay $4.2 million to people who claimed the bank discriminated against women, Black, and Hispanic applicants .

You might want to go with a different lender if these issues bother you.

Don’t Miss: Can You Use More Than One Va Loan

Richmond Hill At A Glance

- Average HI is $101,000.

- Based on the latest independent research, an average consumer debt in Richmond Hill is at $36,600. In this Richmond Hill is below Ontarios average.

- Employment rate: 60%.

- Based on the most recent independent research, an average Richmond Hill inhabitant makes $52,200 per month.

- Richmond Hills key hiring areas are professional, scientific and technical services, mining, quarrying, and oil and gas extraction, retail trade.

Our online portal helps you select local Payday Loan providers in Richmond Hill for your borrowing needs.

Check our catalogue of Payday Loan lenders to find the latest Payday Loan rates in Richmond Hill

Bank Of America At A Glance

-

Origination fee: None.

-

Personal information needed: Name, address, Social Security number, employment information, income, U.S. citizenship status and email address. Depending on the specifics of the loan, additional documents and information may be required prior to loan closing. Refinance loans and lease buyouts require specific vehicle information such as make, model, year, mileage and VIN.

-

Pre-qualification available: No. Rate quoted upon loan approval valid for 30 days from the date of original application submission.

-

Online, in-person or both: Apply online, schedule an appointment at a financial center or call 844-892-6002.

-

Approval speed: Most decisions available within 60 seconds of application submission.

-

Funding: Amount of time to fund a loan varies.

-

Minimum FICO credit score: Did not disclose.

-

Minimum credit history: Did not disclose.

-

Minimum annual gross income: Did not disclose.

-

Maximum debt-to-income ratio: Did not disclose.

-

Bankruptcy-related restrictions: Did not disclose.

-

States covered: All 50 states.

-

Assistance provided: Borrower works with a loan specialist whose phone number is provided on loan approval.

-

Availability: New customers call 844-892-6002 – MonFri 8 a.m.-midnight, Sat 8 a.m.-8 p.m. ET.Existing customers call 800-215-6195 – MonFri 9 a.m.-8 p.m., Sat 9:30 a.m.-6 p.m. ET.

-

Contact options: Call or visit a financial center. Customers can also send secure email through online banking.

Don’t Miss: Can You Roll Closing Costs Into Fha Loan

Types Of Bank Of America Auto Loans

Bank of America offers a wide variety of auto loan and refinancing options:

- Dealer purchase loans for new or used cars

- Refinancing for current auto loans

- Lease buyout loan

- Private party loans for when you buy a vehicle from an individual

- Access loans specifically for new or used accessible cars, vans, or light-duty trucks

- Business auto loans for cars, vans, and light trucks for small business use

Auto loans are available in all 50 states. The minimum loan amount starts at $7,500, or $8,000 in Minnesota. Bank of America doesnt offer auto loans for vehicles that are more than 10 years old or that have 125,000 or miles on them. Vehicles must be worth at least $6,000 and cannot be used for commercial purposes. Loans are not currently available for motorcycles or RVs.

If youre buying a car from a dealer, Bank of America loans are only for franchise dealerships rather than independent dealers. BofA provides loans for approved independent dealers, including online dealerships, Carvana, Enterprise Car Sales, Hertz Car Sales, and CarMax.

Loan terms range between 12 and 60 months.

Things To Consider Before Refinancing

Also Check: How Much Interest Is On An Unsubsidized Loan

Bank Of America Auto Refinance Review: Conclusion

We rate Bank of America auto refinance 8.9 out of 10.0 because of its competitive refinancing rates and streamlined application process. While there are many negative customer reviews on the BBBs site, almost none of them have to do with auto loan rates or auto refinancing. We recommend you search around and compare options to find the best auto refinance loans for you.

Helping You Grow Your Business

We’re focused on helping you recognize opportunities to free up capital, increase cash flow and maximize profitability. At TD Auto Finance , we’re all in.

Complement every aspect of your business with our standard and enhanced retail programs, floor-plan and commercial financing programs and remarketing services.

You May Like: How To Pay Loan Online

Bank Of America Auto Loan

Bank of America has settled multiple lawsuits for fraudulent activities brought by the U.S. Government. One of these settlements was for overcharging our military members on their loan fees. For a big bank, BofA has a flexible new and used auto loan program that includes the option to be pre-approved. If you are already a member of The Bank of America Corporation, you may qualify for their rewards program and receive a lower interest rate on your next loan.

How Bank Of America Compares To Other Lenders

For more car loan options, select your credit score and state, then click Show me my personalized options.

1 – 3 of 3

| Lease buyout | 3.29% |

You can borrow between $5,000 to $100,000 for your vehicle. Loan terms may last anywhere from 12 to 75 months, although its website only allows you to select a term of 48, 60 or 72 months. If you already have a BofA checking or savings account, you may also qualify for a rate discount of 0.25%, 0.35% or 0.5% provided you sign up from autopay.

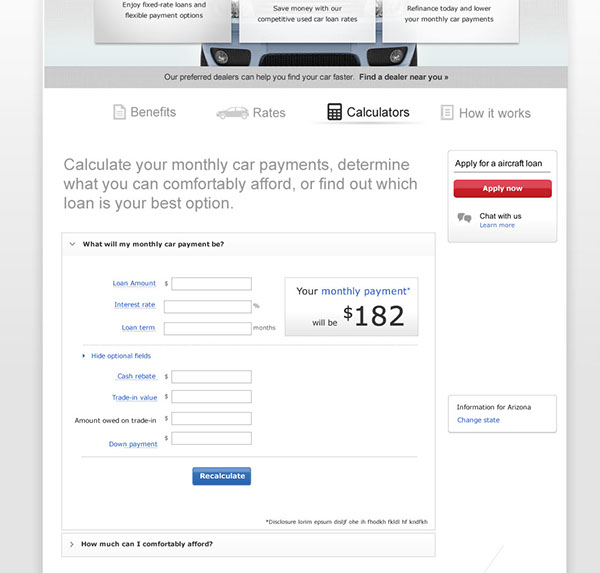

It isnt upfront about its maximum APR or other fees, so discuss these with your loan officer before signing any paperwork. Until then, you can use our calculator to estimate your monthly payments to see how much car you can afford.

Don’t Miss: How Much Do I Pay For Student Loan