Can I Get A Loan For A Used Boat

You can get a loan for a used boat, but there are some limitations. The lender usually requires that the boat be no older than a certain age, and most lenders wont finance a boat that was built before 2000 or 2001. However, some will finance boats of any age and price range, but you may end up paying a higher rate and making a larger down payment.

Different lenders have varying requirements when it comes to financing used boats. Some require an inspection and an appraisal while others will only finance up to 85% LTV and expect a down payment.

Financing a used boat is usually more affordable than financing a new boat, but its important to know the condition of the boat so you dont end up with unexpected repair costs.

Compare And Shop Financing

It’s a good idea to compare rates and terms offered by several loan sources to determine the financing best suited for the intended purchase. Lenders include:

- Banks – Many local, regional, and national banks offer boat loans directly to their customers. Start with your own bank and call them or check their Website to see if they finance boat purchases. Inquire about rates and how long a loan term is available for the boat you are considering. Some banks advertise in boating magazines and publications. They seek your business and will have boat-savvy people available to address your needs.

- Financial Service Companies – Financial service companies maintain relationships with local, regional, and national lenders, giving them broad access to finance programs. They are experts in the marine lending field. You will see their advertisements in boating publications, so call for rates and terms and get an idea of anticipated application turn around and funding time.

- – If you are a member of a credit union that makes boat loans, be sure to contact them. They usually have attractive rates for their members, and many are interested in making boat loans. If they have marine lending specialists on staff, they should be able to offer a competitive loan.

How Do I Apply For A Boat Loan

While every lender will have its own unique application process, in most cases, youll need to provide the same information when applying for a boat loan.

Once you have financing, you can start to shop for a boat that suits your needs just dont let a salesperson talk you into buying more than you can afford.

Will I need to know what boat I want before I apply?

It depends on the lender. Some might ask for a model and make, while others might allow you to apply for a ballpark amount, based on your budget. If youre unsure, ask your lender whats required ahead of time.

Read Also: What Is An Interest Only Loan Called

Secured Boat Loans From Banks

Youre more likely to find secured loans from banks. Banks may offer perks to existing customers, like discounts and favorable loan terms. If your bank offers boat loans, its a good place to start.

Bank of the West

Bank of the West offers boat loans in all 50 states, but not in Washington, D.C. You can submit your application online. You’ll then be assigned a sales representative who will work with you to close the loan.

Loan amount: $10,000 to $5 million.

Rates: 4.24% to 10.49%.

» MORE: Read NerdWallets Bank of the West review

U.S. Bank

U.S. Banks boat loans are available in the 25 states where the bank has branches. You may have to visit a branch to close a boat loan, but the bank says it can make same-day preapproval decisions.

Loan amounts: $25,000 to $150,000.

Rates: Starting at 5.24%.

» MORE: Read NerdWallets U.S. Bank personal loan review

USAA

USAA works primarily with military members and their families. Though you can apply online, you must call USAA to complete your application.

Loan amounts: $5,000 to $500,000.

Rates: Starting at 6.20%.

» MORE:Read NerdWallets USAA Bank personal loan review

Truist

Truist Bank has locations primarily along the East Coast, and existing account holders can apply by phone. Those without accounts will need to apply in person.

Loan amounts: Starting at $3,500.

Rates: 6.30% to 8.52%.

» MORE:Read NerdWallets Truist Bank personal loan review

Consumer Boat Buying Guide

Homes and cars represent some of the most expensive single-item purchases individuals make during their lifetimes, but spending doesnt always cease at the shoreline. Boats add to the cost of living for water sports enthusiasts, who eagerly take-on the cost of ownership. And though boat buying is born of passion for the open water, a prudent approach makes the most of recreational budgets and ensures affordability.

As you prepare to take the plunge, due diligence guarantees a smooth transition to boat ownership. From choosing the best boat for your needs to securing reasonable financing, weigh your options carefully before making commitments.

Also Check: Which Is Better Parent Plus Loan Or Private Loan

Boat And Marine Loans From Banks

RBCBoat And Marine Loans

As mentioned, plenty of big financial institutions sell marine vehicle loans in Canada, For example, the Royal Bank of Canada offers financing for boats and RVs with:

- Flexible Payment Options Choose from several payment plans , with no penalties for prepayments.

- Competitive Interest Rates RBC offers competitive interest rates when you finance your boat through one of their affiliated marine dealerships.

- Adjustable Terms & Conditions If youre a qualified applicant, you could be eligible for financing terms as long as 20 years on boats and RVs that are no more than 10 years old.

TDBoat And Marine Loans

TD Canada Trust is another popular bank with its own flexible marine vehicle financing program. They have an expansive network of dealers and offer many benefits, like:

- Long Terms & Extensions Payment terms can last up to 240 months on newer vehicles and youll have the option of extending .

- Additional Financing Available If necessary, TD can also offer you financing for other marine vehicle costs, like warranties, gap insurance, and storage fees.

- Competitive Interest Rates You could qualify for a competitive fixed or variable financing rate for most marine crafts.

- Payment Options Loans can be paid early with a lump sum, penalty-free.

Scotiabank

- Payment Breaks If you follow your financing plan responsibly, youre allowed to postpone one payment each year that your marine craft loan is active.

The Best Boat Loans Of September 2021

| Lender |

| Check rates > > |

*With auto-pay discount

The best boat loan depends on your budget, the type of boat youre purchasing, and the age of the boat. From financing for small ski boats to full-size yachts, theres a loan out there for most things that float. But theyre not all the same.

Once youve narrowed down the type of boat youre interested in buying and what model year youre looking for, you can start shopping for a boat loan. Many lenders will only finance certain types of boats, or require a boat to be newer than a certain model year. To make sure you make the most of your shopping, know this going into it.

There arent as many lenders offering boat loans as there are auto loans. But there are still a few to choose from.

Popular Articles

Here are Insiders top picks for boat loans in September 2021.

Types of boats financed: LightStream doesnt list any specific requirements

4.29% to 10.39% APR, with auto pay discount

Loan amounts available: $5,000 to $100,000

Watch out for: High credit score requirements. LightStream only works with borrowers with good or better credit, so anyone with a low credit score may not qualify.

LightStream boat loans are a strong option for most borrowers looking for an inexpensive boat and fast funding.

LightStream is an online lender backed by Truist . With a completely online experience, same-day funding available, and many loan types offered, LightStream is one of our picks for the best RV loans and best personal loans.

You May Like: What Does Va Loan Stand For

Get Boat Financing Through A Boat Dealer

If you want to own a boat but don’t want to get a traditional boat loan, explore the option of financing a new or used boat through the dealership.

Many boat dealers have finance managers who work to secure financing for buyers. They’ll collect personal information about your finances, pull your credit report and approach the dealer’s lending partners about getting financing on your behalf.

Boat dealers may be able to save you time shopping for a loan, and specific boat brands or models may come with built-in financing deals that other lenders can’t easily match. Dealers may also be able to help you gain access to extended warranty programs to help pay for future repairs.

Look for perks like a delayed first payment, lower rates for a limited time or no interest for a specified time.

How Can I Find A Good Deal

Comparing offers from lenders is the best way to find the best deal you can qualify for. Asking yourself the following questions as you shop around can help:

- What is the APR? This includes interest and fees you pay each year you have your boat loan and is the quickest way to compare costs.

- What kind of APR is it? Is it fixed or variable? Most boat loans are fixed, but theres a chance youll get a variable rate that changes over time.

- Do I need a down payment? Make sure you have enough saved up to meet a lenders minimum down payment requirements.

- How long are the terms? Boat loans can come with terms as long as 20 years, though typically those are only available for the highest loan amounts.

- How much does my boat cost? Make sure the amount you need to finance falls within a lenders range.

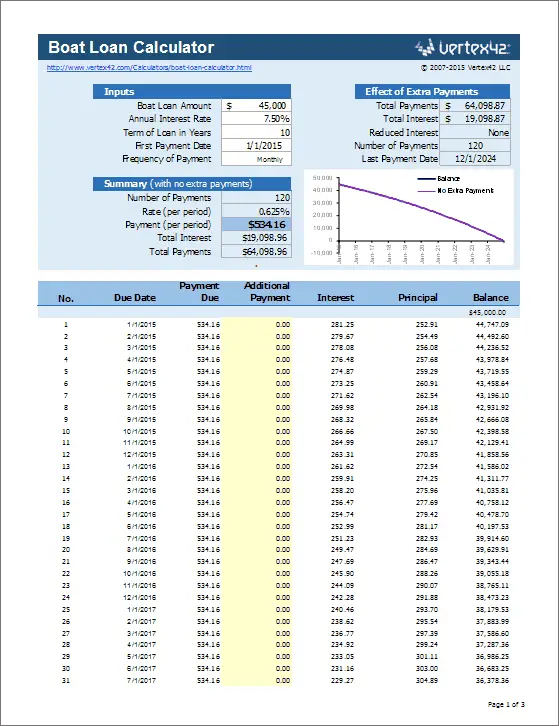

- How much will I pay each month? Once you have an idea of the loan amount, APR and term, use a boat loan calculator to learn how much your loan will cost each month.

Don’t Miss: How To Cancel Your Student Loan

What Is A Good Interest Rate On A Used Boat Loan

While used boat loans can occasionally have rates higher than those offered for new boats, this isnt always the case. In fact, many lenders offer the same competitive rates whether youre buying used, new, or even refinancing. Because of this, applicants can expect to find used boat loans with rates in the 4% to 5% APR range.

For instance, Bank of the West our overall top pickoffers interest rates starting at 3.74% APR for watercraft over $50,000, whether the boat is new or used.

Private Boat And Marine Lenders

Money Line Capital

Because we have so much accessible water, Canada can also be a good place to start a business based around watercraft, like a fishery, retailer, or tour company. In that case, any vehicles you want to buy or lease may qualify as business equipment. Luckily, equipment financing and leasing is exactly what Money Line Capital specializes in.

Money Line Capital is an alternative business lender based in Ontario. They have a 95% approval rate on their commercial equipment loans and leases, which come with:

- Fast funding times

- Financing amounts starting at $5,000

- Flexible payment terms of 18 84 months

- Interest rates of 4.99% 24.99% APR

Sparta Finance

Headquartered in Victoria , Sparta Finance is an alternative lender that specializes in financing for used recreational and marine vehicles. Their entire inventory is listed on Kijiji and they work with many different charities to collect donations for less privileged Canadians, such as the BC Cancer Foundation and Edmontons Foodbank.

Sparta Finance is also partnered with a number of popular sports vehicle retailers and financial institutions, like CanAm, Capital One, Yamaha, Refresh Financial and Kawasaki. Through their partnerships Sparta Finance is able to offer:

- Interest rates between 0% 29.9%

- Terms between 3 months to 240 months

- Open-ended loans

Don’t Miss: How To Lower My Interest Rate On Car Loan

Protect Your Loan Your Boat & Your Good Name

The world is unpredictable. We know that accidents happen, and illnesses can spring up that can prevent you from working. When the unexpected happens, youll be happy that you have one of these add-on loan protection products from Seattle Credit Union. Ask one of our friendly loan experts about how to add one or both of these products to your loan by calling

How Much Does It Cost To Own A Boat In Canada

Watercraft come in all shapes, models, and prices, so it can be tough to calculate how much your own vehicle would cost you in the long run. Youll also have to decide whether youd like to purchase a used or new model. Obviously, a full-sized houseboat will end up costing much more than a dinghy with an outboard motor.

For the sake of argument, lets say youre trying to purchase a regular leisure-style motorboat for fishing, water skiing, and other activities. In that case, you would have to consider these kinds of basic costs:

Read Also: What Happens After Sba Loan Is Approved

Boat And Marine Vehicle Licensing Rules

Before you try to finance a boat, its essential to understand that some marine vehicles with motors require special licenses to operate. For example, you need a valid Pleasure Craft License to legally pilot any boat with an engine of 10 or more horsepower. You must have the license on you whenever youre driving the vehicle to avoid penalties.

There are certain elements that the boat itself needs as well, including:

- Hull Serial Number The boat must have a serial number on its hull, which proves that it meets Canadas minimum safety standards for construction.

- Registration Any qualifying boat also needs to be registered with the Canadian Register of Vehicles to confirm that its not been stolen or manufactured poorly.

- Trailer Registration According to government regulations, most boat trailers are deemed as motor vehicles, so they have to be registered and licensed too.

- Canadian Compliance Notice This is another way to identify a boats build quality. While boats bought from other countries may not require this notice, they must still comply with Canadas minimum construction standards before being used.

Down Payment May Be Required

Boat loan lenders often want to see a down payment, generally between 10% and 20%, depending on factors including the lender and the cost of the boat. Some lenders offer 0%-down loans but keep in mind that making a down payment can hedge against the boats depreciation, or loss of value over time, and help prevent a situation where you owe more on your boat loan than the boat is worth. A down payment may also lower your monthly payment and reduce the total amount of interest you pay on the boat loan.

Read Also: How Do You Pay Back An Equity Loan

Factors To Consider When Choosing A Boat And Marine Loan

As fun as it can be to own a boat or other watercraft, its also important to understand that a loan is a significant financial obligation and must be handled responsibly in order to avoid any debt-related problems.

So, prior to applying for any form of boat or marine vehicle financing, there are several factors that you should consider, such as:

The Down Payment One way of receiving good loan conditions and paying down your debt faster is to offer a respectable down payment of 10% 20% of the vehicles total cost. Depending on the asking price, that down payment can be beyond your budget, especially when coupled with your future payments.

The Interest Rate Your interest rate can make your payments more pricey than you were expecting. Remember, the best way to receive an affordable rate is to apply with healthy finances or some collateral. You may also be able to choose a fixed rate or a variable rate .

The Length of Your Loan/Term Larger boat and marine loans are often separated into several terms, so you may be in debt for a number of years. Being unable to afford your installments during that time, for whatever reason, could lead to financial damage, so if the loan terms your lender offers seem too long, you may have to look elsewhere.

Additional Reading

Use A Home Equity Loan

If you own your home and have enough equity, you can take out a home equity loan and use the cash to buy a boat outright. Although the loan won’t be secured by your boat, it will be secured by your house.

With a secured boat loan that uses the purchased watercraft as collateral, the lender repossesses your boat to recover some of its money if you fail to make payments. If you use your home as collateral to get the money and fail to make payments on time, the lender can foreclose on your home.

Recommended Reading: How To Find My Student Loan Account Number Online

How To Use This Boat Loan Calculator

Not only will our calculator show your monthly repayments, but also how much youll pay in interest over the life of your loan.

Is Financing A Boat A Bad Idea

As a general rule of thumb, you should ensure that any purchase you finance will be paid down faster than it depreciates. If the purchase’s value decreases at a faster rate than your loan balance, you run the risk of going “upside down” on the loan, or dealing with negative equity.

While this is most often talked about in terms of new cars, it’s also a concern with watercraft, especially since boats are quickly depreciating assets.

Negative equity can be a serious concern with a high-value investment such as a boat. If the boat were to be stolen, totaled, etc., you would be on the hook for the difference between the remaining loan balance and the insurance company’s valuation/payout. Negative equity can also come back to bite you if you ever want to trade in the boat or sell it, as you’ll wind up owing your lender out-of-pocket in order to finalize the transaction.

Lastly, it’s important to recognize that financing a purchase will cost you more than the sticker price, no matter how competitive the interest rate you obtain. Between loan processing fees and finance charges, the added expense can be significant.

While financing a boat is not a bad idea in and of itself, it’s important to strike a balance between your purchase price, down payment amount, and loan repayment terms. This will help maintain a healthy loan-to-value ratio and ensure that you don’t pay significantly more for your purchase over time than if you’d paid in cash.

You May Like: Can My S Corp Pay My Student Loan