Car Loan Interest Rates Explained

Borrowers with credit scores of 660 and lower are typically considered bad credit borrowers. If your credit score is in this range, you may fall into one of three categories: nonprime, subprime, or deep subprime.

People in these three groups usually need to find auto financing through a subprime lender that can work with credit-challenged situations. However, there’s a price to pay for being financed with less than perfect credit higher interest rates.

Interest is the cost of borrowing money, and the rate you qualify for is mainly influenced by your credit score. Generally, the higher your credit score, the lower the interest rate. There are other factors that contribute to interest rates, of course, including the federal funds rate, the lender you’re working with, and the length of your loan.

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make payments on the principal of the car with no interest for a number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Can I Lower My Car Payment Without Refinancing

Yes, you can lower your car payment without refinancing. However, this treat arrives with the financial consequence it exposes you to pay higher interest rates. Nonetheless, it allows you the benefit of having money to spend and invest for returns.

Several borrowers consider refinancing as a good option for a car payment. It does not deny the fact that refinancing requires complex processes and the extension of a loan term.

Recommended Reading: How To Transfer A Car Loan To Someone Else

Trade It In To A Dealership

Trading in your car is best for when you dont want to sell the car yourself, refinancing isnt an option and you need lower payments for the long term. Almost all dealers accept trade-ins in exchange for a new car and some dealers, such as CarMax, will buy your car without you needing to buy one of theirs. Find the right dealer according to your purpose.

There are two numbers you should look up before you go:

- How much you owe. Again, call the lender to get the payoff amount, which is how much you still owe the lender. Youll want to sell or trade in the car for at least that much, so you wont have to make any more payments.

- How much its worth. Look up the trade-in value of the car on an industry guide, like Kelley Blue Book, Edmunds or NADAguides. You shouldnt sell the car for less than what its worth, and the goal should be to sell it for more than enough to cover what you owe.

How To Negotiate Lower Interest Rate

You can use any of the reasons we listed above about why a company might lower interest rates as a way to negotiate lower interest rates. Point out the interest rates a competitor offers. Explain how you cant make monthly payments at your current rate, offer to bundle other services with them, or as for a reward for consistent on-time payments.

Read Also: Fha Loan To Buy Land And Build Home

Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to provide car loans for fair or poor credit, even if they cant get approval from their bank though they may not get the lowest car loan rates available. Online lenders also tend to be the quickest to approve loans and disburse funds.

And This Financial Has Got The Best Car Finance Rates

Financial away from The united states already has got the reasonable speed with the auto loans . If you have excellent borrowing and you can a unique auto, you can purchase these types of costs. Other banks may offer lower pricing than the ideal automobile financing prices, however might be able to get a good rates.

Also Check: Usaa Loans For Bad Credit

Negotiate On The Price Of The Vehicle

Before you start negotiating the terms of your loan, try to get a bargain on the actual price of the car. A lower purchase price means taking out a smaller loan and paying less in interest. The sticker price isnt always the end of the story and theres nothing wrong with presenting a counter-offer. Word to the wise: dont just pull a number out of a hat. Find out what the vehicle youre interested in is selling for elsewhere and have some proof to back-up your offer. Every dealership is interested in making a sale. Reputable dealerships are interested in helping their customers find the right car at a price they can afford.

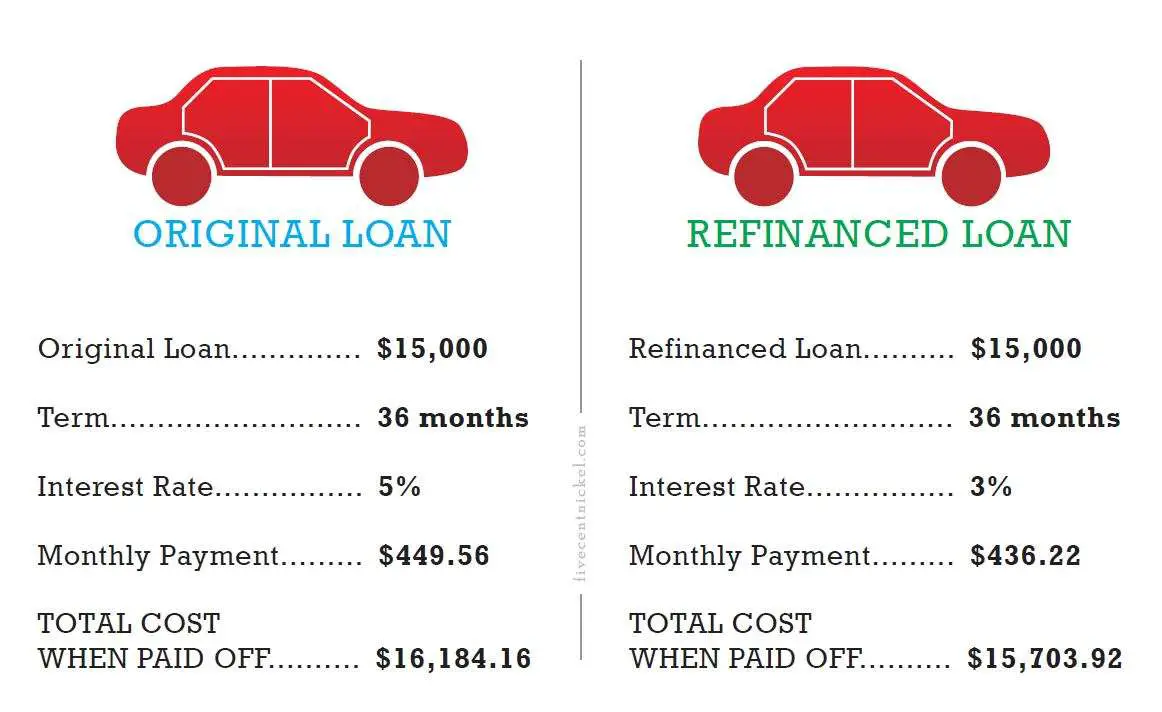

Refinance Your Auto Loan

Refinancing your existing loan might reduce your monthly payments. If interest rates have dropped since you got your original loan, your credit has improved, or you just arent confident you got the best possible rate to begin with, you may be able to get a new loan with a lower rate and better terms. Keep in mind that refinancing involves opening up a new loan with new terms that means the potential for brand-new loan fees on top of interest youd pay. And if you end up extending your loan term and are able to lower your monthly payments, youll be paying interest for longer.

Read Also: Usaa Auto Loan Payment Calculator

Research Auto Loans And Interest Rates

When you work with a dealer, their finance department can shop around for your vehicle loan, getting rates from multiple lenders so you don’t have to.

The downside is that dealers aren’t legally required to offer you the best rates you qualify for. In fact, the rate you’re quoted may include compensation for the dealer for arranging the financing between you and the lender.

This means it’s a good idea to shop around and compare interest rates for yourself before you even head to the dealership so you know what’s available based on your credit and income.

Many lenders offer what’s called a direct loan, which means they lend to you directly rather than working through a dealership.

You can also apply for car loans directly on lender websites, and some even prequalify you with just a soft credit check, which won’t hurt your credit score. Even if you do have to submit a loan application, credit scoring models typically combine auto loan hard inquiries if they’re all made around the same timetypically within 14 to 45 days of one another. This means your loan applications will have less of an effect on your credit scores.

This process of applying for and comparing auto loan rates and terms with several lenders can take time, but it’s time well spent if it can help you score a lower interest rate.

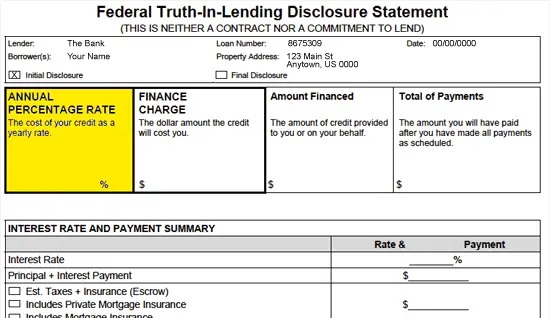

As you compare interest rates, make sure to look at the annual percentage rate , which represents the total cost of borrowing, including both interest and fees.

Reasons A Lender Might Lower Your Interest Rates

Many people might wonder why a lender might lower their interest rates for you. After all, interest rates are how lenders and creditors turn a profit, and no company wants to lower their profits. However, there are several good reasons a company might lower their rates.

First, a company would always rather you do business with them than the competition. If another company offers a similar product, then the company youre currently using might lower the rates theyre charging you to keep you from switching. Even though theyre making less money than they would if they kept your rates the same, theyre still making more money than they would if you took your business elsewhere.

Second, a company will always prefer to get some profit compared to no profit. If you cant afford your monthly payments because the interest rates are too high, then the company is losing money. Thats not in their interest, so theyll lower the interest rates on your products so that you can pay your bill.

Third, if you use the same company for multiple services and financial products, then their profits will go up. Thats why lots of different banks offer discounts on interest rates for loans and mortgages if you also have a checking account or savings account with them. Its the same reason many insurance companies will lower the cost of insurance if you insure multiple things with them, like your home and your car.

Don’t Miss: Auto Loan Self Employed

Check For Your Loan Modification Eligibility

Lenders each have requirements for borrowers to qualify for any loan modification. Find out what your lender requires and ascertain your stance. Meanwhile, you must have a clean debt repayment history.

If your repayment history is weak, the lender may not grant you the car loan modification. You should be expressive, disclose that adverse and unexpected events are the reason for your inability to repay.

For example, reveal the breakdown of your source of income, disaster, etc. These will not automatically grant your loan modification request, but increase the chances of reducing car payment.

Ways To Make Your Car Work For You

If you want to keep your car but need help affording it, use your car to make money. These solutions wont lower your payment instead, they increase your income so you can more easily make your payments. You might make more than enough to cover the car payment, so some extra cash goes in your pocket.

Each of these three options come with risks make sure you consider them carefully and have the right insurance.

Recommended Reading: How To Get Mlo License California

You Want Lower Monthly Payments

Are you having a difficult time covering your monthly payment?

Refinancing for a longer term can bring down your monthly costs and make balancing your checkbook more manageable.

The answer depends on your individual situation, but lets say your current loan balance is $20,000 at a 6% interest rate with a five-year payoff time frame.

Keep in mind that while lower monthly payments may help you in the short term, a longer-term loan could put you at more financial risk. You may be stuck paying off a large portion of your loan after your cars value has significantly depreciated.

If your immediate goal is to reduce your monthly expenses, an auto loan refinance could still be a good choice. Consider refinancing now but increasing your monthly payment once your financial situation has improved.

You can always enter your desired loan terms into an online debt repayment calculator to see if refinancing could reduce your monthly payments and how much your total interest cost could decrease.

Send In Extra Principle In Your Monthly Car Payment

Sending in extra principle has the effect of lowering your interest over the life of the loan.

When I bought my first car, I was a very savvy buyer looking to save money on my financing in every nook and cranny I could squeeze a few incremental dollars out of. I sent in extra principal with my car loan payments, which accelerated the payoff on my car from 42 months down to 36 months.

How do we do that? It’s all in the way mortgages and car loans work. In the early months of the loan you are paying almost no principle back and each monthly payment goes almost all to interest. But lucky for you folks, you can control this formula by forcing more principle down their throat with your monthly payments, which means you are paying the loan off sooner. Since you pay it off early, they don’t get to charge you all that interest anymore.

When I first bought my house, I sent in $300 to $500 extra principle each month. Then, before you know it, I knocked over 10 years off the life of my loan and saved tens of thousands of dollars.

There you have it, I bet you never thought you had so much control over the interest you will pay on your car loan. So remember, be patient and calm. If it takes a few more months, let it happen. Pay off all credit card balances if possible, finance online directly with lenders, refinance your existing car loans to lower rates, choose a shorter term auto loan and allow the lender to deduct your monthly payment directly from your bank.

Read Also: Reinstate Va Loan Eligibility

Consider Interest And Repayment Terms

Choose the loan that offers you the lowest interest rate and most acceptable payment terms. If its your existing loan company, ask for the new loan terms in writing and sign the new loan obligation. If youre changing companies, schedule an appointment with the new loan officer to complete your refinance.

Whats Considered A Low Interest Rate On A Car Loan

Generally, the lowest interest rates you can find on a car loan are around 2% or 3%. However, any car loan with a rate under 5% is considered low-interest and youll need good or excellent credit to qualify.

However, if you have less-than-stellar credit, the lowest rate you might be eligible could be upwards of 10%. Since car loans are usually secured, they typically come with lower rates than an unsecured personal loan.

Who actually qualifies for the lowest Rate?

Just because you see a low-interest rate advertised for a car loan with one particular lender, dont automatically think thats how much youll end up paying. Those ultra-cheap interest rates may only be available to you if you have excellent credit or if you are buying a certain type of car.

Recommended Reading: When To Refinance Fha Mortgage

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Are You Unhappy With Your Current Auto Loan Maybe Its Time To Consider Refinancing

The principle behind auto loan refinancing is simple: You take on a new loan to pay off the balance on your existing auto loan. If youre struggling with a high interest rate or an unaffordable monthly payment, refinancing could be the key to finding better, more favorable terms.

Refinancing your auto loan could help lower your monthly payments by lengthening the term of your repayment. Or it could help you save money through a lower interest rate.

| $364 | 60 months |

Your expected monthly payment would go down to $364, and youd pay a total of $1,830 in interest.

In this case, refinancing your auto loan would save you $23 per month and a whopping $1,366 over the remaining life of the loan.

Also Check: Usaa Car Loan Bad Credit

Lowering Interest Charges On Your Auto Loan

You dont have to refinance to save some money on interest charges, though. Auto loans are typically simple interest loans, which means youre charged interest daily on what you owe. This means that after each payment, theres less to be charged interest on. The faster you pay off the vehicle, the less interest youre charged.

Making some lump sum payments lowers your loan balance and decreases the amount youre charged interest on. Additionally, you could also pay a little extra each month when you can. Or, you can make extra car payments whenever youre able to. Anything you can do to lower your auto loan balance more quickly helps.

If youre about to take out a car loan, and you dont have the best credit, you can be proactive. A way to mitigate the amount of interest youre going to be charged is to prepare a sizable down payment and opt for the shortest loan term you can afford. Bad credit and long loan terms can spell lots of interest charges and often long loan terms mean paying way more than the vehicle is worth!

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Recommended Reading: How To Calculate Va Loan Amount