How Negative Mortgage Points Work

Contrary to positive points, negative points can increase your interest rate but reduce closing costs. For example:

If you take 1 negative point, your lender could increase your rate by .25% but give you 1% of the loan as credit to help pay it off.The downside of negative points is even with reduced closing costs you still pay a higher monthly rate. In addition, negative points cannot be used towards a down payment, so borrowers will still need to find the funds to cover that amount.

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Overall, borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Do Mortgage Points Affect Taxes

Mortgage points may be tax deductible as home mortgage interestbut that still doesnt make them worth buying. In order to qualify, the loan must meet a slew of qualifications on a lengthy list of bullet points, all of which are determined by the IRS.

If youve already bought mortgage points, check with a tax advisor to make sure you qualify to receive those tax benefits.

Also Check: Investment Property Loans For Veterans

What Is A Loan Discount Fee

Discount fees, or otherwise known as rate buydown fees, are costs that are typically customer directed to lower their interest rate. The Consumer Financial Protection Bureau actually defines discount fees are requiring to actually lower the interest rate, in other words, lenders cant charge you discount points without actually improving your terms. To better understand this, we will discuss how mortgage interest rates are derived.

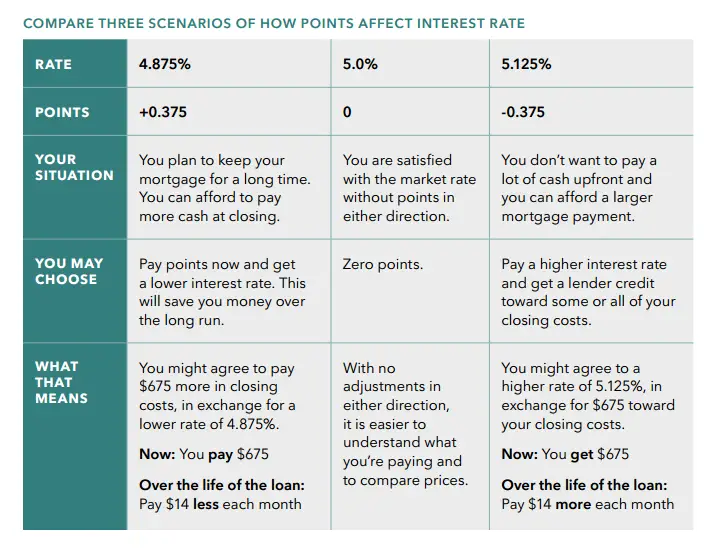

The central point of interest rates is discussed as PAR, meaning no cost and no credit to obtain the rate. Refer to the hypothetical table below:

| 3.500% |

| 101.500 |

In this hypothetical chart, the PAR rate would be 3.875%, again meaning there is no lender credit or buydown cost to obtain the rate. If a customer wanted to buy down their interest rate, they could determine how much they wanted to pay to obtain the lower rate. Each price is the difference between 100, so a 3.5% rate would cost 1.5 points to obtain that rate. Conversely, you could also take a slightly higher rate and the lender pays you a credit to take a rate that is currently above the par rate. In this case, 4.125% would pay you a credit of 1.5 points back to you as a credit to cover any closing costs on the loan.

Are Mortgage Points Tax Deductible

Because the cost of discount points represents prepaid interest, points are deductible for taxpayers who itemize. Though, the loan must be secured by your main home and meet some other criteria. You generally have to deduct them over the life of the loan though sometimes, you can deduct the points in the year you pay them. But you can usually only deduct points paid on up to $750,000 of mortgage debt .

Example. Say you take out a $1,000,000 mortgage loan and purchase one point for $100,000. You’ll only be able to deduct $75,000 the remaining $250,000 isn’t tax-deductible.

In some cases, the seller will agree to pay for points to incentivize a buyer. Points are deductible in this situation, too.

According to the IRS, origination fees are also tax-deductible, but points paid for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, and attorney fees, aren’t.

Also Check: Fha Loan Maximum Texas

Make Sure To Comparison Shop Carefully Among Lenders

Knowing exactly what are mortgage points means you can decide whether it makes sense to buy points. You can also make certain you’re comparing apples-to-apples when you take out a mortgage loan.

When you shop around the best mortgage lenders, let’s say one lender offers you a loan at 3.00% with no points and the other offers you a 3.00% loan but charges you one point to get that rate. Obviously the first loan is a much better deal. With the second lender, you’d be paying 1% of the entire cost of your mortgage just to get the same rate the first lender is giving you for free.

The Final Word On Origination And Discount Points

Origination fees and discount fees have their advantages, but they will vary based on the individual. If youre considering buying down your interest rate or negotiating your origination fees, keep these pointers in mind. Knowing the difference between the two and how they affect your mortgage rate is important when shopping for lenders, and for understanding how they may affect your monthly payment.

Also Check: Usaa Approved Car Dealerships

Points Are Tax Deductible

The cost of mortgage points does not differ by type. If one lender has a one-point origination fee and one-point discount fee for a certain rate and a second lender has no origination fee and a two-point discount fee, the cost is the same. The one difference for the borrower is that origination-fee points are not tax-deductible and discount points may be tax-deductible. Buying down a mortgage using points will result in interest savings several times greater than the cost in points if the mortgage is paid in full.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Usaa Car Refinance Calculator

Tips For Buying A Home

- Buying a home is no small feat, so it can be helpful to work with a financial advisor to figure out your finances beforehand. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Before you fall in love with your dream home, figure out what prices are actually within your budget. To help you out, check out SmartAssets how much home can I afford calculator. All you need to know is where youre looking for homes, your marital status, your annual income, your current debt and your credit score.

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

Recommended Reading: Usaa Used Car Loan

How Much Is A Mortgage Point

- Its just another way of saying 1% of the loan amount

- So for a $100,000 loan one point equals $1,000

- And for a $200,000 loan one point equals $2,000

- The higher the loan amount, the more expensive a point becomes

Wondering how mortgage points are calculated? Dont worry, its actually really easy. You dont even need a mortgage calculator! Or a so-called mortgage points calculator, whatever that is

When it comes down to it, a mortgage point is just a fancy way of saying a percentage point of the loan amount.

Essentially, when a mortgage broker or mortgage lender says theyre charging you one point, they simply mean 1% of your loan amount, whatever that might be.

Examples Of Bona Fide Discount Points In A Sentence

Bona fide discount points defined For purposes of clause , the term “bona fide discount points” means loan discount points which are knowingly paid by the consumer for the purpose of reducing, and which in fact result in a bona fide reduction of, the interest rate or time-price differential applicable to the mortgage.

Bona fide discount points are interest and are not subject to the two percent limitation.

Note that up- front fees a creditor charges consumers to recover the costs of loan-level price adjustments imposed by secondary market purchasers of loans, including the GSEs, are not considered bona fide third-party charges and must be included in points and fees. Bona fide discount points.

Bona fide discount points are those that reduce the interest rate based on a calculation that is consistent with established industry practices. The inclusion of originator compensation is a significant developmentit may dramatically shrink the headroom available under the points and fees test.

Bona fide discount points” means an amount knowingly paid by the borrower for the express purpose of reducing, and which in fact does result in a bona fide reduction of, the interest rate applicable to the Home Loan provided the undiscounted interest rate for the Home Loan does not exceed the conventional mortgage rate by two percentage points for a Home Loan secured by a first lien, or by three and onehalf percentage points for a Home Loan secured by a lien other than a first mortgage.

Also Check: Va Business Loan For Rental Property

How Mortgage Points Work

When you check current mortgage rates from lenders, youll often see three different numbers listed: interest rate, APR, and points.

Points also called mortgage points or discount points are fees specifically used to buydown your rate.

Each discount point costs 1% of your loan size and typically lowers your mortgage rate by about 0.25%.

This means when youre looking at a rate quote that includes points, youd have to pay extra upfront to actually get the rate shown.

For example, imagine youre taking out a $300,000 mortgage loan. Heres how your interest rate might look with and without mortgage points:

| Mortgage Points | |

| 3.0% | $155,300 |

Interest rates shown are for sample purposes only. Your own mortgage rate and fees will vary. Get a custom rate estimate here.

The cost of buying discount points adds up quickly. But as you can see in the example above, the longterm savings can be substantial.

However, if you only plan to stay in the home a few years, the upfront cost of buying mortgage points could easily outweigh the savings youd actually make by buying down your rate. So make sure you consider the amount of time you plan to keep your loan before deciding whether or not to pay for discount points.

On a settlement statement, discount points are sometimes labeled Discount Fee or Mortgage Rate Buydown. They are different from origination points which are fees a bank charges to set up your loan.

When Are Mortgage Points Worth It

If you are buying a home and have some extra cash to add to your down payment, you can consider buying down the rate. This would lower your payments going forward. This is a particularly good strategy if the seller is willing to pay some closing costs. Often, the process counts points under the seller-paid costs. And if you pay them yourself, mortgage points usually end up tax deductible.

In many refinance cases, closing costs are rolled into the new loan. If you have enough home equity to absorb higher costs, you can pay mortgage points. Then you can finance them into the loan and lower your monthly payment without paying out of pocket.

In addition, if you plan to keep your home for a while, it would be smart to pay points to lower your rate. Paying $2,000 may seem like a steep charge to lower your rate and payment by a small amount. But, if you save $20 on your monthly payment, you will recoup the cost in a little more than eight years.

The lower the rate you can secure upfront, the less likely you are to want to refinance in the future. Even if you pay no points, every time you refinance, you will incur charges. In a low-rate environment, paying points to get the absolute best rate makes sense. You will never want to refinance that loan again.

But when rates are higher, it would actually be better not to buy down the rate. If rates drop in the future, you may have a chance to refinance before you would have fully taken advantage of the points you paid originally.

You May Like: Usaa Auto Loan Interest Rates

What Are Origination Fees

Why do so many lenders quote an origination fee? To get a true no point loan, they must disclose a 1% fee and then give a corresponding 1% rebate. Wouldnt it make more sense to quote a loan at par and let the borrower buy down the rate?

The reason lenders do it this way is because of the disclosure laws in the Dodd-Frank Act. If the lender does not disclose a certain fee in the beginning, it cannot add that fee on later. If a lender discloses a loan estimate before locking in the loan terms, failure to disclose an origination fee will bind the lender to those terms.

This may sound like a good thing. If rates rise during the loan process, it can force you to take a higher rate. Suppose you applied for a loan when the rate was 3.5%. When you are ready to lock in, the rate is worse. Your loan officer says you can get 3.625% or 3.5% with the cost of a quarter of a point . If no points or origination charges show up on your loan estimate, the lender wouldnt be able to offer you this second option. You would be forced to take the higher rate.

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How do you calculate that breakeven point, you ask? Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 4.125% interest rate to a 3.75% interest rate saves you $43.07 per month. As mentioned earlier, the cost of 1.75 points on a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 82 months , which is equal to roughly 6 years and 10 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.

Read Also: Fha Building On Own Land