Do Sba Loans Actually Work

Next, you need to decide if these are the right choice for you. If youre an entrepreneur looking for the best way to fund your growing business, you might be wondering if an SBA loan will help you get where you want to be.

Do SBA loans work? Have they helped others? For many businesses, the answer is yes.

We went right to the source for more information and exchanged emails with the SBA Office of Communications and Bill Manger, associate administrator for the SBAs Office of Capital Access. Manger relayed a few impressive true SBA loan success stories:

-

Chobani Yogurt, which had a valuation as high as $5 billion in 2016, used a 504 loan to start the company, according to Manger.

-

Vidalia Denim Mills, a denim manufacturing company located in northern Louisiana, recently got a $25 million loan from the United States Department of Agriculture and a $5 million loan from the SBA to grow their operations. The company will be exporting its denim and employing more than 300 full-time workers thanks to its product and the partnership between the USDA and SBA, Manger says.

-

Laundry City, a laundry pickup and delivery service based in Baltimore, benefited from a $3.5 million SBA 504 loan. The loan allowed to company to grow and increase the number of its employees, Manger explains.

Sba Loans For Your Startup

Find money today for your new business with this review of the SBA’s top three loan programs.

Entrepreneur

Despite what you might see on late-night infomercials or some websites, none of the SBA‘s loan programs involve free money, government grants or no-interest loans. In fact, the SBA doesn’t even lend funds directly to entrepreneurs–you’ll need to strike up a relationship with a loan officer at your local bank, credit union or nonprofit financial intermediary to access the programs.

Do Sba Loans Come With Fixed Rates

Some SBA loans carry fixed rates while others come with the option of fixed or variable ratesor have a combination of the two. For example, all loans available through the EIDL program have a fixed rate of 2.75% or 3.75%, depending on whether the borrower is a for-profit business. SBA 7 loans, on the other hand, may carry a fixed rate or a variable ratewith variable rates requiring explicit SBA approval.

Don’t Miss: Are Quicken Loan Rates Competitive

How Sba Express Loans Work

As with other types of loans within the SBAs 7 program, SBA Express loans are issued by a network of SBA-approved lenders, with a certain percentage backed by the SBAup to 50% for Express loans and up to 90% for Export Express loans. Borrowers must apply for loans through individual lenders using SBA Form 1919 and any other forms and procedures required by the specific financial institution.

In general, loans under the SBA 7 program require a down payment of 10%, but it may be higher for startups. Express loans over $25,000 also come with a collateral requirement, while Export Express borrowers must comply with their individual lenders collateral requirements.

The SBA responds to Express loan applications within 36 hours and to Export Express loans within 24 hours, but eligibility decisions and credit decisions are made by individual lenders. Likewise, funding speeds vary by lenders, with Express lines closing within 30 to 60 days, on average.

Export Working Capital Program

Under this program, the SBA guarantees short-term working capital loans made by participating lenders to exporters.

Proceeds of loans guaranteed under this program may not be used to purchase fixed assets, but can be used to finance the acquisition and production of goods and services being exported, or the accounts receivable of export sales.

Proceeds guaranteed under this program can be used for single or multiple export sales, and the underlying loan can be a revolving one. The maximum maturity is one year.

Eligibility requirements with respect to the size of the borrower, the amount of the guarantee and the loan are the same as for the SBA’s regular guaranty program. The borrower must have been in business for at least 12 continuous months before filing an application.

Also Check: How To Lower My Interest Rate On Car Loan

Sba Export Express Loan

Unlike standard Express loans, SBA Export Express loans are reserved for exporters who need funds to support export development activities. The maximum loan amount is still $500,000, but 75% of the loan is guaranteed by the SBA for loans larger than $350,000, and 90% is backed for those less than $350,000. As with standard Express loans, approval times are abbreviatedthe SBA takes only 24 hours to respond to applications.

Trust Your Business To A Preferred Sba Lender

As part of our commitment to the growth of small businesses nationwide, U.S. Bank is proud to be an SBA Preferred Lender specializing in providing Small Business Administration loans. When your small business is looking to grow or expand, SBA loans can have many benefits such as smaller down payments, fixed and variable rate options and full amortization.

With over 40 years of experience, U.S. Bank will partner with you to find the best possible financing options for you.

Also Check: What Kind Of House Loan Can I Get

What Do You Need To Be Eligible For An Sba Loan

To get an SBA loan, youre required to provide extensive financial documentation about your company to both the bank and the SBA. This allows the SBA to determine your eligibility and to see if the loan is a good fit for both the agency and your business.

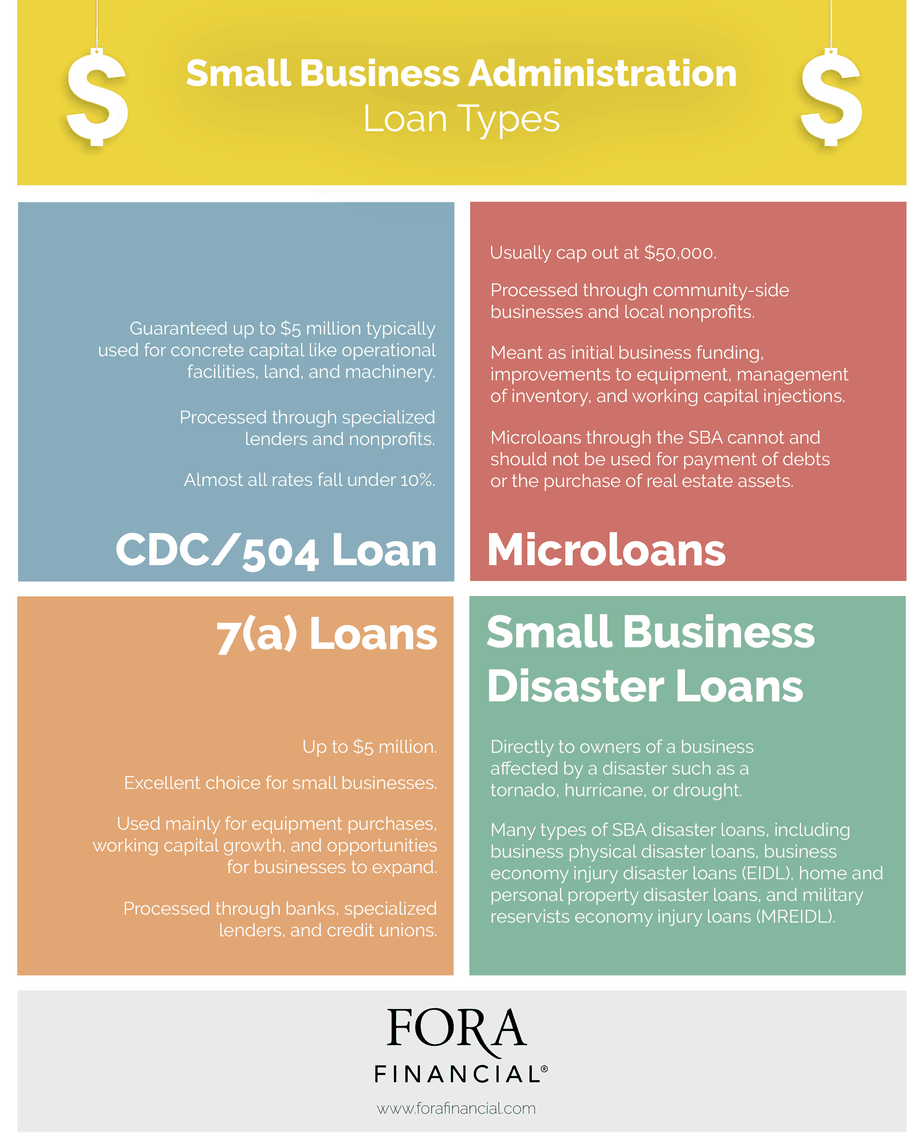

The SBA has different qualifications for each of its loans. While there are numerous loan types available from international trade loans to veteran-focused lending programs the most common SBA loans are the 504 and 7. Regardless of which loan you decide to pursue, there are some major benefits to getting an SBA loan.

The Sba 7 Loan For Startups

The SBA 7 loan can be an excellent option for startups looking to inject some cash into the ledger. These government-backed loans aim to help small businesses like yours, without sufficient external funding sources, get off the ground and running with enough capital to really succeed. Money shouldnt be the thing thats standing between your startup and success.

Recommended Reading: What Is The Maximum Fha Loan Amount In Texas

Using The Sba 7 Loan For Startup Funding

Being a startup means going your own way, being free to innovate in your industry and, often, facing severe money shortages and funding challenges. Thats why the Small Business Administration has been making loans to companies like yours possible for decades. You deserve to see your dreams come to life, even if you lack the startup funding that your competition may have.

The most common loan guaranteed through the SBA for companies like yours is the SBA 7 loan. It doesnt come directly from the SBA, but they guarantee a portion of the balance. This reduces the risk to banks, making it easier for your business to get approved with lower credit and financial standards. Its a big win for everybody, because startups often face some fierce financial challenges.

Apply For Your Sba Loan

After youve received the offer you like the best, well help you put together your full loan application package. By working with Guidant, youll have an experienced hand helping you through this complex process. Our streamlined process makes it much easier to apply, improves your funding chances, and most of the time doesnt cost you anything.

In most cases, Guidant doesnt charge you for our SBA loan services . We ask for a small deposit at the start of the loan application process, so we know youre serious about getting your SBA loan. If your loan is over $200,000 or you also use 401 business financing, we return your deposit as soon as your loan closes, or in the rare situation where we cant find a lender for you.

You May Like: How To Get Loan Without Interest

But First: What Is An Sba 7 Loan

The SBA 7 loan is a government-backed loan provided by financial institutions like banks and credit unions. The SBA doesn’t lend directly, but they insure these loans in case a borrower defaults. This makes the SBA 7 loan an attractive option for lenders, since it reduces some of the risk involved. You can use the SBA 7 loan for a variety of things, including the purchase of real estate or land, equipment, working capital, refinancing debt, and of course buying a business!

Because your lender will need to get approval from the SBA to back your loan, the application process and paperwork for an SBA 7 loan can be lengthy. However, these loans typically boast better terms than traditional small business loans, and sometimes even come with counseling to ensure your business runs efficiently.

What Is The Microloan Program

Again, like the Microloan program, one of the reasons that Community Advantage loans are great for startup funding is they dont require a number of years in business to qualify.

Instead, youll need to be able to prove that youâre a responsible borrower and that your business idea is a good one. Along these lines, youll want to be able to show that you have a vision for the future, that you have experience in your businesss field, and that you have average credit, or better.

Of course, some of the more specific SBA startup loan requirements will vary based on the community lender you work with.

Read Also: Which One Is Better Fha Or Conventional Loan

Make Sure Your Business Is Eligible

If your business has been in operation for at least two years, has at least $100,000 in annual revenue, and your personal credit score is at least 680, you may be eligible for an SBA loan. You can check your credit score for free through an online service or your credit card provider. This wont hurt your score because it only requires a soft credit check.

United States Department Of Agriculture

USDAs business programs provide financial backing and technical assistance to stimulate rural business creation and growth. Loans, loan guarantees and grants are available to individuals, businesses, cooperatives, farmers and ranchers, public bodies, non-profit corporations, Native American Tribes and private companies in rural communities. For more information, please visit the USDA website.

Also Check: How To Get Startup Loan

The Huntington National Bank

Huntington is the #1 lender nationwide for SBA loans in terms of number of loans made. It makes 7, SBA Express and 504 loans. Its primary focus is in its SBA footprint states of OH, MI, IN, WV, PA, KY, IL, WI, and FL and it is expanding into MN and TN in 2020. Huntington also offer SBA Practice Finance Loans in all states east of the Mississippi for dental, veterinary and medical customers. It has dedicated teams who specialize in the intricacies of SBA programs and all customers follow an identical triage process to be placed in the best product for them based on where they are in their business lifecycle, making Huntington a good choice for borrowers looking for an experienced SBA lender.

How Do You Apply For An Sba Loan

Step 1: Check Eligibility

Review the general SBA loan requirements and lender requirements. Heres a recap:

General SBA Loan Requirements: Do I Meet the Following Loan Requirements?

Underwriting Requirements: Am I Likely to Meet Lender Requirements?

While requirements and exact loan terms may differ slightly between lenders, most will look at the following:

Step 2: Choose Your SBA Loan Based on Your Financial Needs

Ask yourself the following questions:

Step 3: Find a Suitable SBA Lender

Find a suitable lender using the SBAs match tool. Heres how it works:

Don’t Miss: Does Student Loan Consolidation Lower Payments

Prepare Your Sba Application

To achieve the greatest chance of loan approval, its imperative to highlight the following information in your loan application.

- Your business plan, including strong management experience, current activity and results, and your understanding of the marketplace.

- How much money you need. How you plan to use it, and your efforts to repay it.

- Also, be prepared to look into your credit history, personal and business financials, requests about collateral, equity considerations, and usual business documents .

Top 4 Financial Challenges For Startups

Owning a startup gives you the freedom to create and innovate in a space with nearly no boundaries provided you can maintain your funding. Keeping the books balanced and the money flowing are some of the most significant challenges for startups. This is why half of all startups will be out of business by their fourth year, and 71% wont make it through their first decade.

Really successful startups become that way because of what they bring to the market and what theyre doing behind the scenes to keep the business end healthy.

An SBA 7 loan can help properly fund operations or to focus efforts in top problem areas, like:

Sales and marketing. Its one thing to hang out your shingle and wait for customers to find you, and yet another to pound the pavement and start paying for advertisements. The first can result in a trickle of business that may leave you unable to pay the electricity bill. The second may land you in serious debt but ultimately pay off big time.

Contingency planning. Hope is a thing with feathers and something that every startup owner needs. Having hope doesnt mean that you shouldnt also have a plan in case something goes wrong. Like the weather, some things you simply cannot control, and this can have huge repercussions for your business. Contingency planning that includes some kind of monetary cushion will help you ride out the worst storms, even as your competition tatters in the wind.

Recommended Reading: Does Applying For Home Loan Hurt Credit

What Is The Sba

The SBA was created in 1953 and is a U.S. federal government agency tasked with providing access to capital, along with counseling, exporting and contracting expertise for entrepreneurs. SBA loans are just a part of what it offers. Small business owners can also get free counseling through resource partners such as Small Business Development Centers, SCORE, Veterans Business Outreach Centers and Womens Business Centers. It also provides assistance and expertise for businesses that want to qualify for government contracts or export to other countries. It is funded by taxpayers through Congressional appropriations. That means your tax dollars help it help small business owners, so be sure you take advantage of what it has to offer.

Get Matched to the Right Loan For Your Business

Let our experts match you to lenders based on your unique business metrics.

The Sba Microloan Program

The SBA takes a different approach with microloans than it does with its other popular loans. With microloans, the SBA does not back a lender in case of default. Instead, the SBA provides money to non-profit organizations who lend to small businesses at their own discretion.

As a result, the requirements for these loans vary greatly. The only overall restriction on microloans is a maximum principal of $35,000 with a term of 6 years. Rates are generally observed between 8% and 13% and an average loan size of $13,000.

Pros and Cons of SBA Microloans

Pros

- SBA Microloans are Usually Distributed Quickly: The application process for many SBA loan programs can take months to complete. However, SBA Microloans can be distributed in about 1 month. In some situations, funds can be distributed even faster than that.

- SBA Microloans Can Be Used to Offset a Wide Variety of Business Costs: SBA Microloans can be used to pay for inventory and supplies. In addition, you can buy machinery, furnishings, equipment, and as working capital.

Cons of SBA Microloans

Businesses SBA Microloan Program caters for

- SBA Microloans are the perfect option for the self-employed, one-man-shows. Since sole proprietorships have only personal credit to loan against , the microloan is a good fit.

- Startups that have their sights set on smaller goals will find the SBA Microloans useful.

- SBA Microloans are also specifically earmarked for use in nonprofit child care centers.

Don’t Miss: What Do I Need To Get Personal Loan

Sba Loan Interest Rates

The biggest draw: SBA loans offer low interest rates. The rates are amazing, says Bob Coleman, publisher of The Coleman Report, the leading SBA intelligence report for lenders. For a patient entrepreneur who has her ducks in a row and is willing to go through the process, its a lot cheaper capital, he explains. Interest rates may be fixed or variable, and are pegged to the prime rate, the LIBOR rate, or an optional peg rate. The SBA sets a maximum interest rate that may be charged, but beyond that, interest rates on SBA loans can often be negotiated between the borrower and the lender. SBA loan interest rates vary by program.