Is An Sba Loan Personally Guaranteed

SBA loans require a personal guarantee from anyone who owns 20% or more of the business applying for the loan. When you sign an SBA loan personal guarantee, you authorize the lender to seize any of your personal assets to repay the loan, if your business assets arent sufficient to cover loan payments.

The Types Of Sba Loans:

SBA loans are offered through three main programs: 7, CDC/504, and microloans.

- SBA 7 loans are offered up to $5 million and can be used for a variety of business purposes. This is the SBAs most popular loan program, as it provides broad funding solutions and more specialized options for a wide range of businesses.

If youre interested in an SBA Express Loan, youll need to meet the eligibility requirements for the 7 loan program.

- SBA 504 loans offer long-term, fixed rate financing up to $5 million or $5.5 million for businesses that are part of a community to obtain fixed assets.

- SBA Microloans are smaller loans that come in amounts up to $50,000. These loans are available to smaller businesses to fund their general business needs.

In addition to these main types of SBA loans, the SBA also offers some other specific loan types, they include:

- SBA Disaster Loans: Disaster loans are provided to small businesses in a declared disaster zone. In addition, many business owners qualified for disaster loans if they were economically affected by the COVID-19 pandemic. Business owners can receive a disaster loan if theyve already taken out an SBA loan, but the loans cant be consolidated.

- SBA Caplines: The SBA provides fixed or revolving lines of credit up to $5 million to help business owners meet short term needs.

How Student Loans Are Dispersed

When applying for student loans, you can either choose to apply for federal loans or private loans. When you apply for either type of loan, and are approved, there is a payout process. Typically, your lender will disperse the funds to cover tuition and fees to your school . After your college expenses are fulfilled, the financial aid office will send you the remaining balance to spend on things like living expenses, food, books or personal expenses.

In general, student loans are disbursed twice, in two annual payments, one per semester.

Once the cash hits your account, youre responsible for how you use it, says Leslie Tayne, an attorney with a focus on student loan debt.

Read Also: Va Loan Requirements For Mobile Homes

Do I Qualify For The Targeted Eidl Advance

To qualify for the full $10,000 targeted EIDL grant, a business must:

- Be located in a low-income community, and

- Have suffered an economic loss greater than 30%, and

- Employ not more than 300 employees

In addition, the business must qualify as an eligible entity as defined in the CARES Act:

- A small business, cooperative, ESOP Tribal concern, with fewer than 500 employees

- An individual who operates under as a sole proprietorship, with or without employees, or as an independent contractor or

- A private non-profit or small agricultural cooperative.

- The business must have been in operation by January 31, 2020

- The business must be directly affected by COVID-19

Economic loss is defined as the amount by which the gross receipts of the covered entity declined during an 8-week period between March 2, 2020, and December 17, 2021, relative to a comparable 8-week period immediately preceding March 2, 2020, or during 2019. The SBA will develop a formula for seasonal businesses.

The SBA has released an online tool to help borrowers understand if they are in a low-income area, noting that the business address must be located in a low-income community in order to qualify, so SBA encourages potential applicants to check the map to see if they meet the low-income community eligibility requirement before you apply.

Provisions Targeted To Individuals

The ARPA also includes enhancements to the earned income tax credit, child and dependent care credit and child tax credit. Most notably, the ARPA makes the first $10,200 of unemployment income for taxpayers with an AGI of less than $150,000 tax free in 2020.

Update 3/9/21

Some recent developments from the IRS with respect to the ERC and one PPP development.

You May Like: How To Transfer Car Loan To Another Person

I Applied To My Bank And Havent Heard Back

We recommend you begin an application with a second lender in order to increase your chance of receiving PPP funding. Consider a community bank or credit union in your city, as a portion of the new funding is reserved for those smaller lenders only. Online lenders such as Fundera, Kabbage, BlueVine, and Lendio are also options.

Is It Worth Getting An Eidl Loan

Hereâs what we like about the EIDL:

- It has a low interest rate. Traditional loans have higher rates, and depend heavily on your credit history and previous lender relationship.

- It has a long repayment term. Your monthly payments will be relatively low, so itâs less of a burden on your cash flow.

- Self-employed individuals qualify. Independent contractors and gig workers have a very difficult time getting a loan from other sources.

- Itâs easy to apply. The simplified application form only takes a few minutes, as long as you have your financial docs ready.

- Itâs government backed. A little cheesy, yes, but an EIDL loan represents a show of support from your government and taxpayers from across the US.

So if your business is in need of working capital to stay afloat, we think the EIDL is the best option out there.

Read Also: Va Loan For Modular Home And Land

Does A Business Loan Affect Personal Credit

You know that mortgage lenders pay close attention to your three-digit FICO® credit score. If your score is too low, you won’t qualify for a mortgage. And if you do, your loan will come with a higher interest rate. That leads to the big question: Can your business loan hurt or help your credit score?

The answer, not surprisingly, is complicated.

If you as a sole proprietor or partner in your business personally guarantee your small business loan, it can impact your credit score. Under such an arrangement, if your business fails to make its payments, the lender of your business loan can try to collect its missing dollars from you personally.

This makes you a co-signer on your business loan. This means that the debt can show up on your credit reports. The more debt you have, the worse it is for your credit score and your efforts to get into a new home.

If you rely on business credit cards to fund your small business, you can again impact your personal credit scores. This is especially true if you operate as a sole proprietor. In such cases, your business and personal credit will be the same.

This means that if you make your business credit card payments on time each month, it will help your credit score. But if you make payments 30 days or more past your due date, your score will drop because these payments will be reported as late to the three national credit bureaus of Experian, Equifax® and TransUnion®.

Keep An Eye On Mistakes

Pull your credit report from all three of the major credit bureaus and study it meticulously. Are there any errors? An estimated 25% of credit reports contain mistakes, so make sure your score isnt suffering due to someone elses error. Those mistakes such as an auto loan payment that is mistakenly listed as late when you paid it on time could cause your credit score to fall by 100 points or more.

If you do find mistakes on your credit reports, report them to the offending credit bureau.

You May Like: Does Va Loan Work For Manufactured Homes

Whats Not In The Bill

The latest proposal did not address the most pressing issues for current PPP borrowers whether existing PPP loans will be tax-free or whether there will be simplified loan forgiveness for some subset of borrowers, e.g., for those loans under $150K or $350K. We suspect these provisions, if they are to be included at all, will likely require agreement on a larger bill than the one proposed by the Problems Solvers Caucus.

Progress on a new stimulus bill continues to be slow. We have seen several bills come and go, it is unclear how much traction this bill has but we will continue to track it closely and report to you if it gets legs.

Update 9/16/20

Its been a while since our last update because things have been quiet on the PPP front. But we wanted to share some thoughts on an important concept: deductibility of PPP expenses:

PPP Loans Disallowance of Expense Deductions

This also has caused some fiscal year-end borrowers to consider whether they can choose which deductions to disallow so they can defer the taxation of the loan forgiveness amount until a later tax year.

Update 8/25/20

Its been almost two weeks since our last update, but with some news surrounding proposed changes to the PPP, we wanted to share a general update.

Update 8/13

General update on some new developments:

Update 7/29/20

General update on some new developments:

Update 7/21/20

Things have been relatively quiet. But we wanted to share a general update of where we are today:

Update 7/7/20

Moderate Standard Of Living Estimates By Family Size For 20182019 School Year

| Family Size | |

|---|---|

| 88,553 | 87,178 |

Note: Moderate standard of living is a measure of the costs of living for the parents of dependent students. The standard includes the costs for various family sizes for shelter, food, contribution to RRSPs, household operation, child care, furnishings and equipment, clothing, transportation, health and personal care, reading material, health and life insurance premiums, pension contributions, charitable donations and other miscellaneous expenses. .

Dont Miss: How To Reclassify A Manufactured Home

Don’t Miss: Rv Loan With 670 Credit Score

Eidl Frequently Asked Questions

Maximum loan amount?

$2 million

Is an EIDL loan forgivable?

No, an EIDL is not forgivable. Only if your business dissolves or is unable to repay the funds, it may be possible to default on the loan.

Is collateral required?

If the loan is under $25,000 no if itâs over $25,000 business property may be required as collateral, and if itâs over $200,000 then personal collateral will be required.

Is a credit check required?

Yes, there is a credit check as part of the application process.

When do I have to start making payments?

Payments have been automatically deferred. For loans received in 2020, payments are deferred for 24 months. For loans received in 2021, payments are deferred for 18 months.

Where do I apply for the EIDL?

Directly on the SBAâs application portal. EIDL is managed and processed entirely by the SBA .

What are the loan terms?

3.75% for Businesses, 2.75% for Not for Profits loan terms are long

Further reading: EIDL vs Paycheck Protection Program: The Breakdown

Compare Alternative Business Loan Structures

Like your mortgage lender, your business lender will do a hard pull on your credit when you apply for a business loan from a traditional bank. Again, this hard pull will only drop your score slightly, usually by 5 points or less, and for only a short time.

If you really dont want an extra hard pull on your credit reports, though, there are several alternative types of business lending that typically dont require a credit pull. These are two of the most popular:

- Invoice financing: With this option, lenders give you a cash advance of around 85% of the value of your outstanding invoices. They pay the 15% to you later, minus fees, after the client has paid up. Many invoice financing companies do not require a credit pull.

- Merchant cash advances: A lender will give you a fast cash advance in exchange for a portion of your businesss daily credit card proceeds. Some merchant cash advance companies do not require a credit pull.

You May Like: When Can I Apply For Grad Plus Loan

Find An Alternate Lender

Maybe the lending agency you chose wasnt the best fit for your business, financial situation, or a number of other reasons. Instead of throwing in the towel or reapplying, you can explore other approved lenders that may be a better fit. Maybe a fintech agency with fewer restrictions or working with a local bank or credit union would give you a better chance of being approved. There are plenty of options available that qualify as Disaster Loan lenders, it may just take a bit of research on your part to find the best one for you.

Loan Forgiveness Is Supposed To Be Easier

Since the inception of the PPP as part of the March 2020 CARES Act, the rules and eligibility qualifications surrounding the forgivable loan program have undergone multiple iterations and clarifications in an effort to expand the definition of who can qualify for a loan, as well as expanding the criteria for loan forgiveness.

The most recent guidance from the Small Business Administration says that forgiveness on a second draw PPP loan will be based on whether:

- Your business uses the money within an eight- to 24-week covered period following loan disbursement

- You have a maximum of 300 employees

- The loan is used for at least 60% of your payroll costs, and the number of employees on the payroll and their compensation levels remain the same during the covered period youre using the money

- You can show your business has experienced at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020

- Youre requesting no more than $2 million the amount granted will be based on an applicants payroll

- And, with the passage of the Coronavirus Response and Relief Supplemental Appropriations Act in December 2020, the IRS and Treasury confirmed that a forgiven PPP loan is not considered taxable income, eliminating concerns there could be a tax burden on those who took PPP funds.

Read Also: Does Fha Loan On Manufactured Homes

Do I Qualify For An Sba Disaster Loan

For most of these SBA loans, you or your business must be located in a declared disaster area to be eligible, with the exception of an MREIDL. Other requirements depend on the program you apply for.

- BPDL: Your business must be located in a declared disaster area and be physically damaged during the disaster.

- EIDL: Your business must meet the SBAs definition of a small business and show it hasnt been able to qualify for credit with another lender.

- MREIDL: You must meet the SBAs credit standards , have hazard insurance for loans over $50,000 and flood insurance if the business is located in a flood-prone zone. You also must prove your business wont survive without SBA assistance.

- Home and personal property loan: The home or property must be your primary residence located in a declared disaster area.

Improve Your Personal Or Business Credit History And Score

If your business does not have its own credit score then a lender used your personal credit score to decide whether to provide financing. A low personal credit score can disqualify you from an SBA loan. You can boost your personal credit score by:

- Sensibly managing the amount of debt you have and not using up all of your credit limits.

- Always making repayments on time and avoiding delayed payments.

- Having a longer credit history.

- Not defaulting loans and staying free of judgments, liens, and bankruptcies.

- Not applying for credit too often.

- Not having too few or too many credit accounts.

If you have a business credit score, you will use a similar process for improving it, specifically focusing on the debt and assets held on behalf of your business.

Recommended Reading: How Long For Sba Loan Approval

Beware Of The Belief That Rules Are Suspended In Times Of Emergency

The government is advertising that huge amounts of money are available to save our businesses. I recently sat in on a webinar run by a very reputable business consulting group that recommended that attendees get their SBA disaster loan applications in immediately, regardless of the facts or the actual needs of their business they said we could always modify our applications prior to taking the money. State unemployment websites are actually giving instructions, in writing, on how to mislead and circumvent the system in order to get approved. Dont take the bait! If you default two years from now, this good-meaning advice wont matter to prosecutors.

Practice point: Be truthful at all times.

Additional Business Planning Resources:

While we recommend using a tool like LivePlan to make business planning simple, we also have plenty of free resources to help you get started:

Business Growth and Management Guide: Resources and templates to help you make good strategic business decisions, track financial performance, and refine your strategy as you go.

Read Also: Genisys Credit Union Auto Loan Calculator

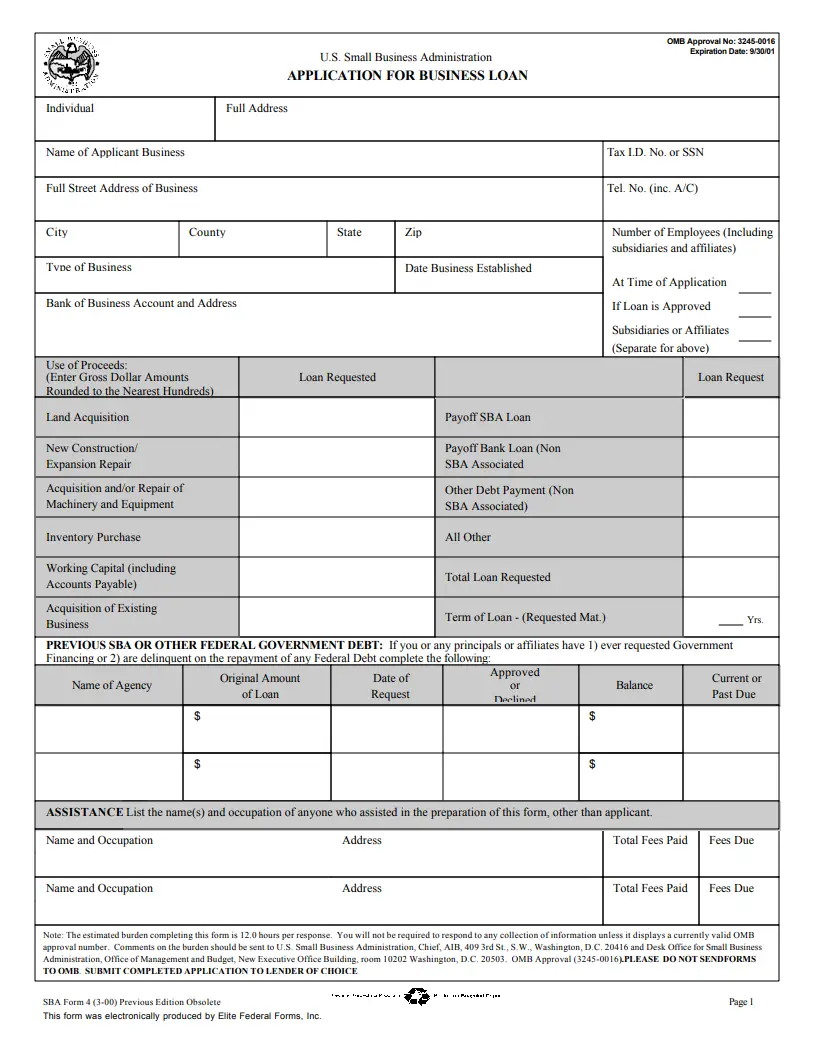

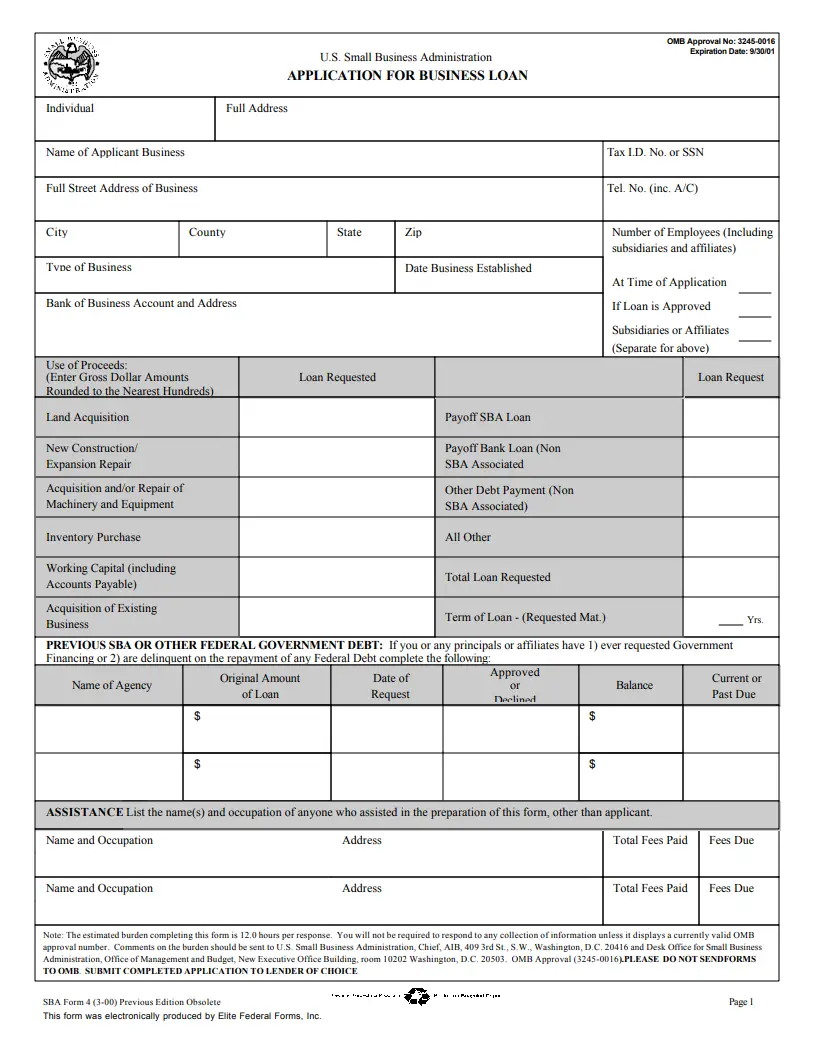

The Application Process In Order

- Apply at DisasterLoanAssistance.sba.gov.

- Receive loan quote.

- Choose your loan amount up to the loan quote maximum.

- A loan officer will review your application and ask for more information if needed.

- A decision will be made and you will either be approved or your application declined.

If approved:

- Your loan funds will be transferred to your bank within 510 business days.

If declined:

- You can request reconsideration in writing within six months of the date of the decline.

Eidl & Affiliation Rules

When you fill out an EIDL application youll need to answer a question about whether your business is owned by another business entity. If you answer yes, you will be asked to provide information about that business applicant parent entity. If a business applicant is owned by a business entity, that business entity must provide information as part of the application and must sign a guarantee. If you have multiple DBAs that operate under one LLC, its likely the LLC would apply for the loan but be sure to consult with your tax professional or a small business advisor to determine the best way to apply.

The application also then prompts all owners with at least 20% ownership to enter their information.

Be aware that while an owner with multiple businesses may apply for an EIDL, there may be additional scrutiny to determine whether affiliation rules apply. Multiple EIDL loan applications received from the same applicant for a single disaster event are called companion files. The loans themselves will generally be processed as separate case files, but the SBA does generally require the same loan officer to process companion files when possible. In addition, the SBA can consolidate applications from business concerns with identical ownership into a single case file.

Don’t Miss: What Car Loan Can I Afford Calculator