Do The Math For A Refinance

In many ways, refinancing a mortgage is much easier than purchasing a home, especially in this market. However, you should approach a mortgage refinance with the same due diligence as you would a home purchase. Paying attention to your refinance rate, the fees and also how long you plan to keep the new loan.

One general guideline to follow is to refinance your home loan when you can reduce your interest rate by 1% or more. However, there are other factors to consider on top of that. You want to make sure that youll be keeping your home long enough for the savings from refinancing to outweigh upfront closing costs. One way to calculate this is to take the upfront fees and divide them by your monthly savings. So if you had $10,000 in refinance closing costs and your monthly payment is $300 less, then it would take roughly 34 months, or just under three years, to break even.

The loans repayment term affects not only your monthly payment, but also your mortgage rate. Shorter-term mortgages typically have lower interest rates than longer-term loans. So a 15-year mortgage will have a better rate than a 30-year mortgage, if all else is equal.

The tradeoff with the lower rate you can get with a shorter mortgage term is that the monthly payment will be higher. Although, a higher monthly payment will allow you to pay off your mortgage more quickly. So ultimately, the decision needs to line up with your current financial situation and your long-term goals.

Is It A Good Time To Buy A Home

Whether its a good time to buy a house depends on who you ask. Many economists, forecasting low, stable interest rates and only modest rises in housing prices, say, unequivocally, yes.

Others, citing tight inventory of affordable housing nationwide, throw up a caution flag.

Still, home sales were at a record high in the spring of 2021, with many people anxious to take advantage of low interest rates and blind to the inflated price they paid.

But buying a house is an intensely personal experience in many ways, the ultimate microeconomic decision.

Whatever else is going on in the residential market space, whether its a good time for you to buy is dependent upon factors such as these:

- You have access to a substantial down payment .

- You are confident about the stability of your household income, not only to meet the payments, but also to take care of upkeep and weather financial surprises.

- Your credit score is in good shape.

- You can be happy for a number of years in the house and neighborhood you can afford.

Personal Loans Beyond The Interest Rate

It’s important to be aware of the personal loan interest rate you should aim for, and what you’re likely to receive based on your credit profile. But it’s even more crucial to make sure that a personal loan is the right fit for you, and that you can afford its monthly payment for the entire loan term. Manage a personal loan responsibly so that you’re in the best position possible to get other financial products at low rates in the future.

You May Like: Defaulting On Sba Disaster Loan

Things To Know Before Taking Home Loan

The most important thing that you have look at is the cost of the house and the way you plan to finance it. There are many banks in India that offer amazing home loan schemes at affordable rates of interest. If you are confused and unable to decide which scheme you should apply for, then you must follow the rules mentioned below:

What Does It Mean

This means that, from November, banks will have to test whether new borrowers can still afford their mortgage repayments if home loan interest rates rose to be 3 percentage points above their current rate.

In other words, if you applied for a mortgage with an interest rate of 2 per cent on November 1, the bank would be testing to see if you can afford to make repayments with a 5 per cent interest rate. If you could not, the loan application would be denied.

If they do not use this higher test, they will be financially penalised by having to hold more reserves against losses, which would reduce their profitability.

In practice, this means all regulated institutions will use the minimum 3 percentage-point buffer.

For home loan applicants, it means the maximum amount people can borrow relative to their income and expenses will be lower than it was under the old serviceability test of 2.5 per cent.

You May Like: How To Reclassify A Manufactured Home

Special Home Loan Offers Announced By Leading Banks As Part Of The Festive Season Offers

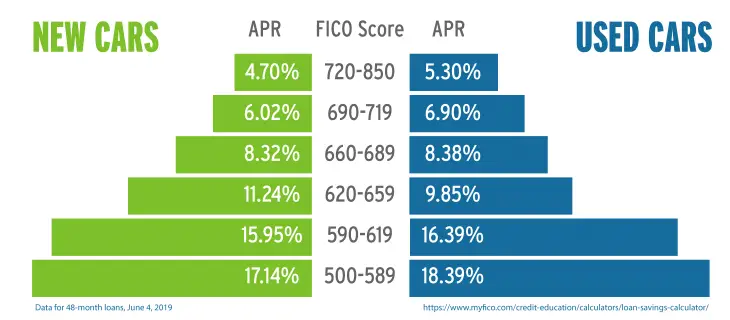

As part of the upcoming festive season in the country, leading banks are offering special home loan offers to attract customers to avail home loans. State Bank of India is offering attractive interest rates starting at 6.90% p.a. for home loans of up to Rs.30 lakh and 7.00% p.a. for home loans above Rs.30 lakh. Those applying through the banks YONO mobile application get an additional interest rate concession of 5 basis points. Applicants across 8 metro cities in India will get a concession in interest rate of 20 basis points for home loans of up to Rs.3 crore. In the rest of the country, this will be applicable for home loans ranging from Rs.30 lakh to Rs.2 crore. For home loans of above Rs.75 lakh, there will be an interest rate concession of 25 basis points. All interest rate concessions are also linked ot the credit scores of applicants.

23 October 2020

Check Your Credit Before Shopping For A Mortgage

- Dont chance it check your credit scores 3+ months in advance

- Aside from the importance of knowing where you stand

- It may take time to turn things around if you need to improve your scores

- Things like disputes may take months to complete and reflect in your scores

If you dont know your credit scores several months in advance of applying for a mortgage, you may not have adequate time to make any necessary changes. Trust me, surprises come up all the time when it comes to credit.

An erroneous late payment could deflate your credit scores substantially, even if its reporting in error.

And that lower score could increase your mortgage rate a percentage point or more. Yes, credit scores can make that much impact!

Disputing errors and/or addressing other credit missteps can take many months to complete, so dont hesitate to check your credit if you think youll be applying for a mortgage at any point in the near future.

Its good to know where you stand at all times, but especially before applying for a home loan. Dont just assume youve got excellent credit. Verify it!

The good news is the low mortgage rates should be around for a while, and could even move lower, so youve probably got time. If your credit scores need some TLC, take the time to improve them instead of settling for a higher rate today.

You May Like: What Is The Commitment Fee On Mortgage Loan

Mortgage Rate Predictions For Late 2021

Experts are split on their mortgage rate predictions for fall and winter of 2021.

Fannie Mae and the National Association of Home Builders see average 30-year rates staying below 3% through Q4 2021, while agencies like Freddie Mac and the Mortgage Bankers Association predict 30-year rates as high as 3.3 to 3.4% by the end of the year.

In any case, mortgage interest rates should stay in the low- to mid-3% range throughout the second half of 2021. No one is expecting a dramatic spike any time soon.

| Housing Authority |

How Much Can I Borrow

The amount you can borrow for your mortgage should depend on your annual income, lending terms, interest rate, and monthly debt. By good rule of thumb, you should only be spending 25% to 30% of your monthly income on housing each month.

The Federal Housing Administration and Fannie Mae set loan limits for conventional loans. By law, all mortgage loans have a maximum limit of 115% of median home prices. Currently, the loan limit for a single unit within the United States is $510,400. For high-cost areas, the limit is increased to $765,600 for a single unit.

Government-insured loans such as FHA have similar limits based on current housing prices. At the end of 2019, the FHA limit was increased to $331,760 in most parts of the country. VA loan limits were eliminated in early 2020.

Also Check: What Happens If You Default On Sba Loan

Make The Best Offer Youre Comfortable With

When youre competing against a dozen other people for a house it can be tempting to increase your offer or to waive certain buyer contingencies to make your offer more appealing. But you shouldnt do this without understanding the consequences.

If home prices are rapidly rising in your area, consider starting your home search with properties listed below your home buying budget. That way you can comfortably raise your offer amount without paying more than you can afford.

When making an offer you should also carefully consider what contingencies you will include or waive, if any. Waiving an appraisal contingency means that if the appraised value is less than your offer price, you could have to pay the difference out of pocket or risk losing your earnest money deposit. So be sure you fully understand and accept all of the risks associated with waiving contingencies beforehand.

Some Borrowers To Pay The Bill For A Higher Cash Rate

Finance sector analyst Martin North from Digital Finance Analytics said more than half of all mortgage holders in Australia currently have a variable home loan interest rate rather than a fixed rate, and they would be the ones likely receiving a rate rise notice from their lender if the cash rate goes up.

He expects existing variable rate customers would feel the pinch in particular from their bank, while cheaper teaser rates would continue to be served up to new borrowers only.

Irrespective of what the cash rate is doing, there are already pressures on banks from the end of June this year, which is when their cheap funding from the RBAs Term Funding Facility will run out. Canstar has already noticed several lenders increase longer-term fixed rates in the lead up to this.

The question is, how much elastic is in peoples budgets for a change to their home loan rate? Well, not much, according to Mr Norths analysis.

He said that on the whole, Australian borrowers have really big mortgages relative to their incomes and are very exposed to future rate rises, even though interest rates and repayments are low at this time.

His surveys show there are more people in mortgage stress right now than there ever have been before. Mortgage stress is when people struggle to meet their home loan repayments, and is an early measure of possible mortgage defaults.

Recommended Reading: Does Va Loan Work For Manufactured Homes

What Is A 15

A 15-year fixed-rate mortgage maintains the same interest rate and monthly principal-and-interest payment over the 15-year loan period.

While the loans provide a fixed principal and interest payment, youre not stretching out the payments for as long as the traditional 30-year mortgage and that saves a great deal of interest.

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Don’t Miss: How To Find Your Student Loan Number

Be Prepared And Know Your Credit Before You Apply

Before you begin looking at homes, consider asking a lender to preapprove you for a loan. This will tell you how big of a loan you qualify for, which will be a major factor in your home search. Mortgage preapproval won’t affect your credit scores.

When getting a preapproval, lenders will check your credit and other aspects of your finances to see what you can afford. If you don’t already know what your credit score is, it’s a good idea to check it on your own prior to talking to a lender.

Lenders will look through your report carefully, with an eye out for a record of on-time payments and whether you have any derogatory marks on your reports. Your will also be a key factor, as it tells the lender how much of your available credit you’re currently using.

Having a preapproval isn’t always required, but many sellers will not accept offers from buyers who have not been preapproved. In a busy real estate market, you could hurt your chances for getting the house you desire if you don’t have one.

If you check your credit and find that your score isn’t where you want it to be, take some time to improve it before talking to a lender.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Read Also: When Can I Apply For Grad Plus Loan

Closing Documents: What Can I Expect To Sign As A Home Buyer

Buying a home can be an exciting, yet overwhelming, experience. You will be required to sign numerous documents in order to complete the purchase of your new home. Whether you are a first-time buyer or just need a refresher, it helps to know what you can expect to sign at the closing. No two home sales are identical and you may have to sign additional documents, but these are the most common.

What To Do If I Have A High Foir

Well, there is not much you can do. One way is to close some of the existing loans. I understand that this may not be an option. The other option is to have a joint applicant with you. With a joint applicant , the EMI burden gets divided and the loan eligibility may increase.

Banks will do what they want to do. However, they do not know as much about you as you do. Moreover, they dont care much. If you dont repay the loan, they will take away the asset. You need to be very clear where you are headed. For instance, if you foresee lack of stability in your job, you should refrain from increasing your loan liability. Now, the bank may not be aware of this uncertainty and be ready to give you the loan but you need to be responsible. I have covered such aspects inthis post.

You May Like: What Is The Maximum Fha Loan Amount In Texas

How Much Housing Loan Can I Get

Among the factors determining the amount of the housing loan you are eligible for are your income, expenses and savings, the general interest rate level and the location of the home. When drawing down a loan, you should consider how big a monthly payment you could afford without it affecting your standard of living.

How To Get The Best Mortgage Rate

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Buying a home is an adventure. About 39% of Americans an impressive 99.3 million of them plan to purchase a home in the next few years, according .

If you’re one of them, your first step is to figure out . Then comes the search for a good lender and a great mortgage rate. And getting the best mortgage rate starts with knowing the answers to the six questions below.

Mortgages have either fixed interest rates or adjustable rates. lock you into a consistent interest rate that youll pay over the life of the loan. The part of your mortgage payment that goes toward principal plus interest remains constant throughout the loan term, though insurance, property taxes and other costs may fluctuate.

The interest rate on an can change over time. An ARM usually begins with an introductory period of 10, seven, five or three years , during which your interest rate holds steady. After that, the rate may change periodically.

» MORE:

ARMs usually offer lower introductory rates. But your ARM rate can rise after the introductory period ends, causing monthly mortgage payments to go up substantially, in some cases.

» MORE:

» CALCULATE:

» MORE:

» MORE:

» MORE:

Don’t Miss: Does Va Loan Work For Manufactured Homes