Low Credit Fha Loan Rates

The interest rates on FHA loans are frequently lower than those offered by traditional lenders. While this is true, if your credit scores are terrible, your FHA rate will be somewhat higher than if you applied with much better credit.

You should still anticipate a low-interest rate for an FHA home loan with the low credit to be competitive. To discover what your current mortgage rate will be and to get pre-qualify.

Tips To Boost Your Credit Score

And, of course, you can boost your credit score through your own efforts. Read How to raise your credit score fast for helpful tips.

A few of the most impactful steps you can take to raise your credit prior to applying for a mortgage include:

You should also order a copy of your credit report from AnnualCreditReport.com. That site is owned by the Big 3 credit bureaus. And youre legally entitled to a free copy of your report each year.

Many reports contain errors. And it can take months to get them corrected. So start the process early.

What Is Bad Credit

From a lending perspective, the answer may vary depending upon the loan program. For FHA loans, bad credit is the point where some lenders opt out of approving FHA loans.

Although the FHA will insure loans for those who have credit scores as low as 500, many FHA lenders prefer not to work with borrowers who have scores that low. They will often overlay their own restrictions which is why you may find some lenders will choose not to work with you if your score is below 620.

In addition to your credit scores, FHA guidelines have restrictions on lending to individuals who have a recent bankruptcy or foreclosure. There are waiting periods of 2-3 years which may also prevent you from getting an FHA loan.

Read more about FHA credit requirements to completely familiarize yourself with the FHA guidelines around credit, collections and anything else related to credit that may impact your ability to get approved.

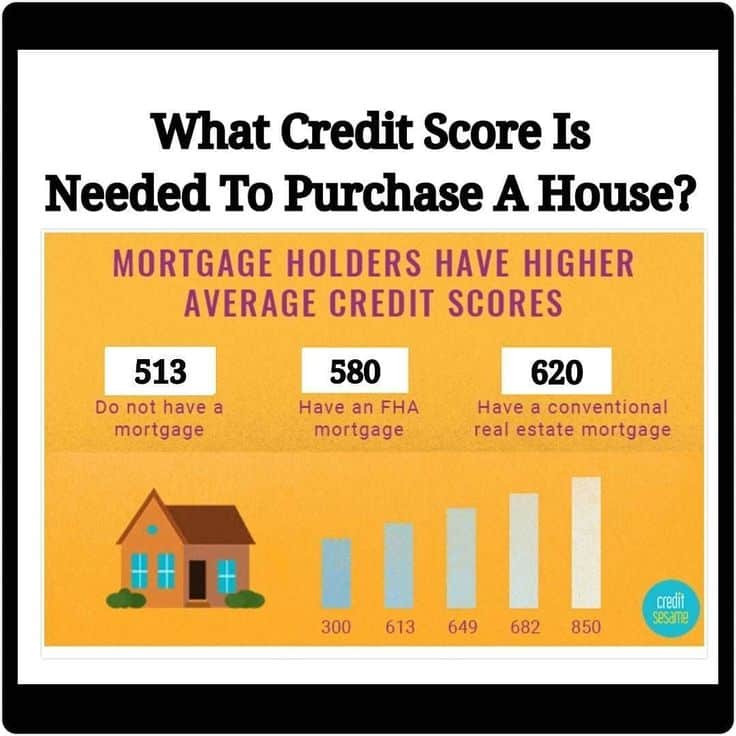

Below is a chart which will outline the credit score minimums and what your down payment will be.

Don’t Miss: How To Calculate Debt To Income Ratio For Mortgage Loan

Can You Get A Home Loan With A Low Cibil Score

Since home loans are secure loans your house acts as collateral against the loan banks offer home loans to borrowers with not so impressive credit scores, too. However, in this case, they may charge a risk premium.

Let us look at SBI home loans as an example to understand this better. SBI, Indias largest lender, is currently offering the best home loan interest rate of 6.7% to applicants who have a CIBIL score of 750 and above. In case your CIBIL score ranges between 700 and 749, SBI will charge 6.8% interest on your home loan. This means that you will be paying 10 basis points more on your loan interest. For applicants with no credit history, i.e., no CIBIL score, SBI will charge 6.9% annual interest on home loans.

What should your SBI CIBIL score be, to get a home loan?

What Are The Risks Associated With Private Home Loans

In general, the biggest risk youll face when you take a bad credit home loan is being unable to make the monthly mortgage payment. The result may be the loss of your home through foreclosure. Some mortgages are especially risky, including those that charge adjustable rates or interest only,

To avoid this kind of fate, you want to know all the facts concerning a subprime mortgage or home equity loan.

The Home Ownership and Equity Protection Act of 1994 was enhanced in 2013 by a new rule meant to protect consumers who take out high-interest home loans. The 2013 Rule applies to lenders who charge high interest rates .

The Rule applies to mortgages, refinancings, home equity loans, and home equity lines of credit .

The HOEPA was created in 1994 to protect borrowers who take out high-interest mortgages.

Under the 2013 Rule, high-cost lenders must disclose certain information, such as prepayment penalties and other fees. In addition, these lenders must recommend borrower counseling.

A recent study found that certain lenders price their interest charges right below the mortgage rate threshold that triggers the Rule. The study indicates that certain lenders are willing to forego higher interest rates to skirt the HOEPA rules.

The advice to prospective borrowers is to read the fine print before agreeing to a subprime mortgage contract.

Don’t Miss: What Happens If I Refinance My Car Loan

How To Qualify With Va Loans With Low Credit Scores

Just home buyers are Veterans of the United States Armed Forces with a Certificate of Eligibility does not automatically guarantee them a VA Loan. Do need good credit. Borrowers can also qualify for VA Loans With Low Credit Scores.

Here are other VA Mortgage Lending Requirements to qualify for VA Loans with low credit scores:

- Can qualify for VA Loans with low credit scores as low as 500 FICO

- VA does not have a minimum credit score requirement nor a maximum debt-to-income ratio cap

- Must be a Veteran of the United States Military with a valid COE, Certificate Of Eligibility

- Properties eligible are condos, townhomes, single family homes, and one to four-unit properties

- Needs to be primary residence owner occupant properties

- Second homes, investment homes, and commercial properties are not eligible

- The borrower needs to have documented income

- Need to have timely payments in the past 12 months

- There is no debt-to-income ratio requirements

- Borrowers need to meet VA Guidelines

The borrower needs to get approve/eligible per Automated Underwriting System.

Buying A House Is A Big Investment But It Can Also Turn Into A Financial Disaster If You End Up With The Wrong Mortgage

Homeownership can help you build wealth. But if high interest rates and unfavorable terms mean youll struggle to repay your mortgage or worse, default on the loan buying a home could actually undermine your financial well-being.

Its possible to find a manageable mortgage with bad credit, but you need to know what to look for and how to avoid loans that will be difficult for you to repay.

Well review what you should consider and some different types of loans that may be a good fit depending on your circumstances.

You May Like: How To Get Business Loan In India

Types Of Mortgage Loans

There are a number of different mortgage programs that may offer more lending options for borrowers with poor credit scores. Be sure and ask your lender about which program you might be eligible for as a home buyer. Here are some standards to consider:

FHA LoanA home buyer may qualify for an FHA mortgage loan with a credit score as low as 500, as long as they put at least 10% down on the property. Otherwise, a minimum credit score of 580 is required for the lowest possible FHA down payment of 3.5%.

VA LoanThe minimum credit rating for a VA loan may range from 580-620, depending on the lender. A VA mortgage borrower can qualify for a zero down payment loan. However, VA loans are only available to active military service members, retired veterans and surviving spouses who meet specific eligibility requirements.

USDA LoanThese loans are available to low-to-medium income borrowers in approved rural areas. In fact, there are some Georgia counties outside of Atlanta that meet the geographic eligibility requirements. A minimum credit score of 640 is generally required.

Conventional LoansBorrowers with moderate-to-good credit can qualify for a conventional mortgage loan with a credit rating of 620 or higher.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Remove Late Student Loan Payments

How To Improve Your Credit Scores Before Buying A Home

Even if you really want to buy a home right away, it might make more sense to work on your credit first. Particularly if you’re already struggling with bills, taking on a new, large financial commitment could stretch you beyond your means.

There are many ways to improve your credit scores. Here are a few tips :

If you have bad credit but aren’t at the very bottom of the score range, you may still be able to qualify for a home loan, but you likely won’t get a great rate. Consider your mortgage options and look for loan assistance programs to help you get as good of a deal as possible. However, if you’re able to put off the purchase while you work to improve your credit scores, that could save you a significant amount of money over time.

Want to instantly increase your credit score? Experian Boost® helps by giving you credit for the utility and mobile phone bills you’re already paying. Until now, those payments did not positively impact your scores.

This service is completely free and can boost your credit scores fast by using your own positive payment history. It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report.

Best For Low Down Payments: Citibank

- Offers mortgages nationwide

- You can complete your application online after speaking to a mortgage representative

- Citibankâs HomeRun mortgage allows eligible borrowers to put as little as 3% down with no mortgage insurance

- Minimum credit score and down payment displayed are for FHA mortgages.

The bottom line: Citibank’s HomeRun mortgage is an affordable option for borrowers looking for a mortgage that accepts non-traditional credit.

While many lenders offer mortgage options that allow 3% down payments, Citibank’s HomeRun mortgages allow 3% down with no mortgage insurance requirement, meaning you’ll save money each month on your mortgage payments. You can also use non-traditional credit to apply for one of these loans, though you’ll need to put at least 5% down if you plan to do so.

Citibank doesn’t list its minimum FHA score requirements online, but you may be able to get a mortgage with a score as low as 580 if your finances are otherwise in good shape, according to a loan officer who spoke with Insider.

Citibank has an F rating from the BBB due to unanswered and unresolved complaints and government action against the business.

Though this lender is rated poorly by the BBB, it earned the No. 3 spot in customer satisfaction on J.D. Power’s 2021 study.

- Charges an origination fee of $995

- Lends in 42 states and Washington, DC

- Minimum credit score and down payment displayed are for FHA mortgages.

Don’t Miss: Does Bank Of America Loan Money

Make A Larger Down Payment

Even if you have a less-than-perfect credit score, some lenders might give you a pass if you make a large down payment. You can also check if you qualify for down payment assistance programs nationwide.

Generally, it’s good to save up a down payment of at least 10%. Lenders will find you less risky if you have more money to spare before taking out the mortgage.

What Is A Good Credit Score

Here is a range of how most mortgage lenders will determine if your FICO score is good, bad or somewhere in between:

Below 580 = Bad credit score

580-669 = Fair credit score

670-739 = Good credit score

740 or higher = Excellent credit score

There are some Atlanta home buyers who may qualify with credit scores as low as 500. It all depends on the lender, the type of mortgage loan and the other financial factors as noted above. Lenders will review everything and help you find a mortgage solution thats best for your financial situation.

Also Check: Can I Switch My Car Loan To Another Bank

How Do Va Loans Work

VA home loans are only limited to Veterans who have an honorable discharge with an active Certificate of Eligibility or COE.

Here are the basics on VA Loans:

- Up to 4% of sellers concessions

- There are no maximum loan limits on VA loans

- Any VA loan higher than the conforming loan limit of $647,200 is called VA high balance loans or VA jumbo loans

- The United States Department of Veteran Affairs, or VA, is not a mortgage lender and does not originate, fund, or service VA Loans

- The Department of Veteran Affairs guarantees VA Loans to lenders

Guarantees all VA Loans will be paid and insured if the homeowner defaults on his or her Loan and goes into foreclosure.

Does A Large Down Payment Offset Bad Credit

With a big down payment, it is possible to get a home loan with bad credit. Keep in mind that loan programs have their own minimum credit score requirements . But if you are unable to qualify for something now, there is a good chance that making minimal changes to strengthen your credit will allow for better mortgage options in the future.

Read Also: What Is An Interest Only Home Loan

Diversify Your Credit Mix

The more types of credit you have, the better your score will be. Credit cards and installment loans are great ways to build good habits and make paying off debts on time easier. They also help you build an overall picture of how responsible you are with money, which is important when applying for a mortgage or even just getting a new car loan down the road!

If possible, aim for having 10% or more in each category before applying for any type of mortgage applicationthis way if something goes wrong with one particular piece of information during processing , not everything will suffer because theres still room left over after fixing whatever issue occurred earlier on down payment timeline.

How To Buy A House With Bad Credit But Good Income

A home is one of the largest purchases a person will make in their lifetime. Most people cant afford to pay cash for a house, which means using a mortgage loan to borrow money to fund the purchase.

If you have bad credit, it can be hard to qualify for a loan. However, if you have good income, there may be options for you if you want to buy a home.

You May Like: Can I Transfer My Car Loan To My Business

What Is The Minimum Credit Score Required For A Home Loan

Of course, private lenders are free to set their own credit score requirements, so there is no hard and fast rule specifying the minimum FICO score for a conventional loan. A survey of different lenders indicates that the minimum score may be around 620.

If you want an FHA or VA loan, youll need a credit score of at least 580. However, if you are willing to put down 10%, you can get an FHA home loan with a score as low as 500.

If your credit score is below 500, you may want to take steps to improve your credit, such as credit repair or debt management.

The process involves combing through your credit reports, which you can get for free from AnnualCreditReport.com, the only source authorized by federal law. Common mistakes include unknown accounts, unauthorized credit checks, and incorrect balances.

While DIY credit repair is possible, it is time-consuming and requires good organizational skills. Many consumers prefer to use credit repair companies to do all the heavy lifting with a credit bureau.

Typically, charge between $50 and $150 per month, depending on the level and aggressiveness of service. The usual subscription period is six months, but you can cancel or extend it as you see fit.

While these companies cant guarantee success, they commit to challenging a set number of questionable items each month. Your score should improve within two months after removing derogatory items that dont belong on your credit reports.

What Do Mortgage Lenders Consider A Bad Credit Score

What constitutes a bad credit score will vary between mortgage lenders. But, as a rule of thumb, the FICO scoring model considers scores beneath 580 to be poor or bad.

- Below 580: Bad credit

- 580 to 669: Fair credit

- 670 to 739: Good credit

- 740 or above: Excellent credit

Still, some home buyers may qualify for a home loan with scores as low as 500, depending on the loan program.

Read Also: Can I Refinance My Home Loan And Get Cash Back

Research Home Loans For Bad Credit Online

Home loans for bad credit are available to consumers with . This article makes it easy to find out more about our recommended lenders by clicking on the START NOW link in each summary box.

While government-guaranteed loans may be your best choice, they are not your only choice. Banks and credit unions are now offering home loans that directly compete against guaranteed loan programs and, in some ways, beat them.

Homeownership remains the American dream. If you have a job or another source of steady income, you may qualify for a mortgage despite your bad credit score. The nice thing is, it costs nothing to find out.