How Do You Get Student Loan Forgiveness Through Public Service Loan Forgiveness

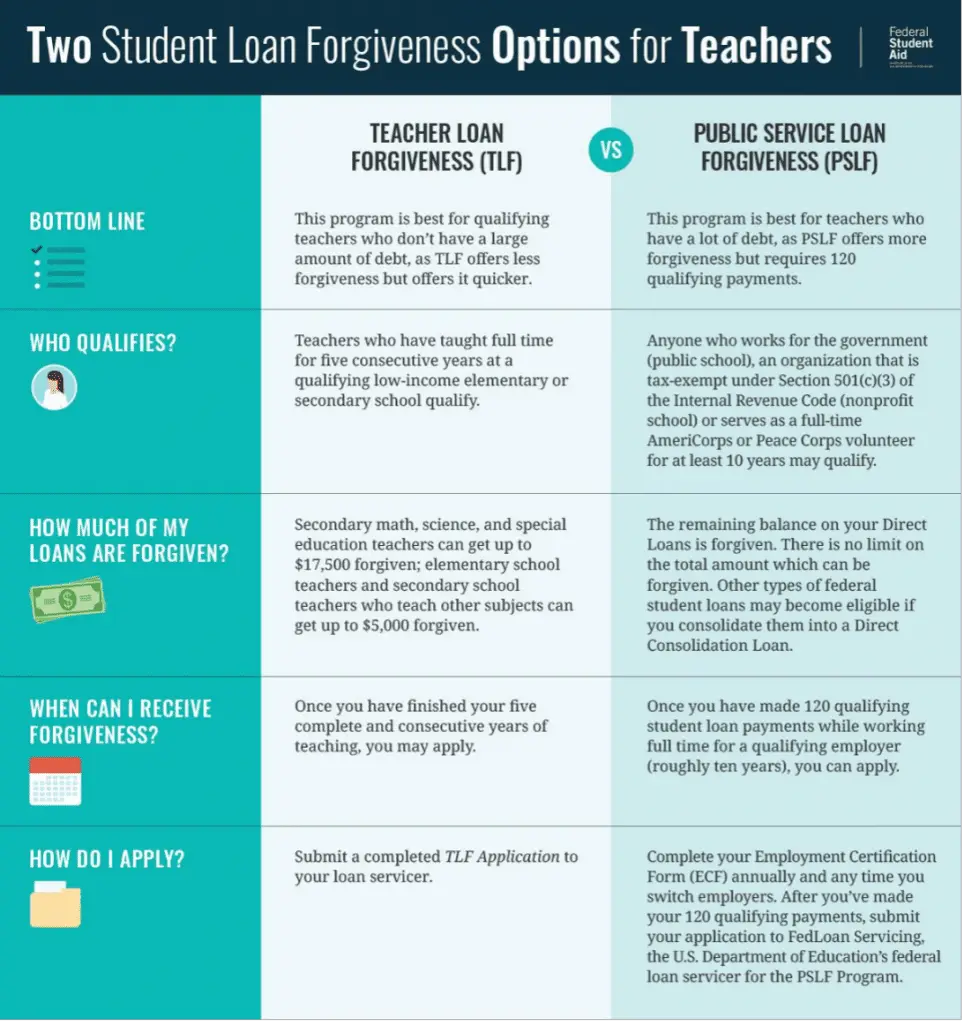

There are many ways to apply for student loan forgiveness during the Biden administration. The Public Service Loan Forgiveness program was created by Congress and signed into law in 2007 by President George W. Bush. Hailed as an opportunity to provide meaningful student loan relief, the program rejected 99% of applicants at one point due to confusion of the programs requirements. Student loan borrowers must meet several requirements, including working full-time for a qualified public service or non-profit employer, make 120 monthly payments and enroll in a qualified income-driven repayment plan. If you meet the requirements, you can get total student loan forgiveness for your federal student loans.

Student Loans: Next Steps

If youre excited about Biden extending the limited waiver for student loan forgiveness, then you have reason to celebrate. This relaxation of the rules for student loan forgiveness will help you get student loan forgiveness faster. If you want to shape the future of student loan forgiveness, the Education Department is giving the public 30 days to comment on the proposed rules. After the public comment period, the Biden administration will finalize the rules by November 1, 2022 and implement the final rules on student loan forgiveness by July 1, 2023. Importantly, these rules are separate from any potential wide-scale student loan cancellation and the end of the student loan payment pause on August 31, 2022. Make sure youre prepared for the restart of student loan payments beginning September 1. Here are some smart ways to pay off student loan debt faster:

Limited Waiver For Student Loan Forgiveness Could Become Permanent

Bidens major changes to student loan forgiveness will incorporate several features of the limited waiver and make them permanent. For example:

- make it easier for student loan borrowers to qualify for student loan forgiveness

- count partial, lump-sum, and late student loan payments toward student loan forgiveness and

- allow certain types of student loan deferments and student loan forbearances to count toward public service loan forgiveness.

However, the U.S. Department of Education notes that some of the limited waiver provisions will not become permanent due to statutory restrictions. For example, suppose you have FFELP student loans. In that case, you should apply for public service loan forgiveness before October 31, 2022 to ensure you can count previous student loan payments under the limited waiver for student loan forgiveness.

Don’t Miss: How Much Will My Home Loan Be

Which Is Better: Tepslf Or The Limited Waiver

Both programs attempt to resolve the same issue. However, there are some key differences that make one program far more useful than the other.

The Limited Waiver will help far more borrowers due to several important factors:

- The Limited Waiver helps borrowers who signed up for the wrong repayment plan and it helps some borrowers with ineligible loans. TEPSLF only helps people with repayment plan selection issues.

- The Limited Waiver awards partial credit. Under the limited waiver, the Department of Education reviews previous applications and updates PSLF payment counts accordingly. Some people qualify for forgiveness right away, while others are moved slightly closer to the required 120 certified payments.

- TEPSLF is all or nothing. Either your entire loan balance is forgiven under TEPSLF, or you dont benefit from the program at all.

- There isnt a cap on the total amount of forgiveness available under the limited waiver.

The latest Department of Education statistics support this assessment. As of April 2022, over 112,000 borrowers have had more than $7 billion worth of federal loans forgiven under the limited waiver. TEPSLF helped just over 6,000 borrowers get $283 million forgiven so far.

However, there is one remaining advantage to TEPSLF. Based upon the amount of funding set aside, TEPSLF will be available to borrowers long after the limited waiver has expired.

Will Biden Extend The Pslf Waiver

Last month, President Joe Biden extended the pause on federal student loan payments and interest accrual for the seventh time. He noted that this is the final extension, and borrowers should plan to resume their payments in January. Many are wondering if hell provide a similar extension to the PSLF waiver.

Its possible, though not likely. The administration used the powers granted to the Secretary of Education during periods of a national emergency to change the rules around PSLF , according to Tricia Kollath, a financial planner and Certified Student Loan Professional.

With the COVID-19 national emergency being extended through February 2023, it appears the administration does have the authority to make an extension of the waiver. Kollath says. However, since borrowers were given an entire year to make the necessary changes to qualify, I would not count on receiving an extension.

She noted that several state Attorneys General sent the administration a formal letter requesting additional changes to the program, including an extension of the waiver. Despite that, and borrower advocates warning about the fast-approaching deadline, administration officials havent announced an extension and instead have focused on stressing the need to apply before the existing cutoff date.

You May Like: Is Closing Cost Included In Va Loan

Pslf Limited Waiver Fact Sheet

Student loan borrowers working towards Public Service Loan Forgiveness have struggled to navigate the programs frustratingly complex rules and requirements. A limited waiver of specific PSLF program requirements was announced by the U.S. Department of Education on Oct. 6, 2021.

To earn PSLF, a borrower must make 120 qualifying payments while employed full-time for a qualifying public service employer. Through October 31, 2022, the Department of Education will count additional payments as qualifying that had previously been ineligible. Borrowers may certify previous public service employment and many public service professionals may now qualify for the PSLF program, to include individuals submitting first time applications for benefits as well as applicants that were previously denied forgiveness.

Heres what you need to know:

Under the new, temporary rules, any prior period of repayment will count as a qualifying payment, regardless of loan program, repayment plan, or whether a payment was made in full or on time. Periods of deferment or forbearance, and periods of default still do not qualify.

And heres what you need to do:

Can My And My Spouses Joint Consolidation Loan From The Federal Family Education Loan Program Be Consolidated Into A Direct Consolidation Loan So That One Or Both Of Us Can Qualify For Pslf

- No. The 120 payments do not have to be consecutive payments. For example, if you have a period of employment with a non-qualifying employer, you wont lose credit for prior qualifying payments you made. However, a payment can only be counted if you are employed full-time by a qualifying employer at the time you make the payment.

You May Like: How To Apply Loan For New Business

You Have Options If You Were Denied Pslf

If your application for PSLF was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

If You Still Have Ffel Loans

You’ll need to consolidate FFEL Loans into a Direct Consolidation Loan. The Education Department will allow you to consolidate even if you only have an FFEL Consolidation Loan.

You can consolidate for free on the FSA website, studentaid.gov. You can choose any new student loan servicer when you submit your application. But since MOHELA is taking over PSLF, it makes sense to choose them to handle your loan consolidation.

After you consolidate, you’ll need to submit a PSLF Employment Certification Form for each qualifying employer you’ve worked for since October 1, 2007.

Note: Student loan Borrowers with FFEL Joint Spousal Consolidation Loans are kicked out of this relief. They cannot consolidate to take advantage of the waiver.

Learn More:How to Consolidate Student Loans for PSLF?

Also Check: How To Apply For Sba 7a Loan

Eligibility For The Pslf Limited Waiver

Although the PSLF Limited Waiver removes many barriers to forgiveness under the PSLF program, there are still many requirements that you’ll have to meet if you want to qualify:

- You still must work for a qualifying employer during the repayment period

- All of your employers you have worked for during the repayment period must certify your employment

- You must have a federal Direct Loan

- You must have credit for 120 qualifying monthly payments

If you don’t have a federal Direct Loan, you’ll need to make sure you consolidate your loans by October 31st, 2022. Some examples of loans that applicants will need to consolidate are Perkins loans or Family Federal Education Loan loans. If you’re not sure what kind of loans you have, contact your loan servicer.

How Many Payments Can I Get If I Consolidate Loans With Different Numbers Of Qualifying Payments

- Assuming your repayment history overlaps for each loan, the consolidation loan will be credited with the largest number of payments of the loans that were consolidated. For example, if you had 50 qualifying payments on one Subsidized Stafford Loan and 100 qualifying payments on another Subsidized Stafford Loan and you consolidate those loans, you will receive 100 qualifying payments on the new Direct Consolidation Loan.

- If your repayment history does not overlap for each loan, the consolidation loan may be credited with more total payments than the loan with the largest number of payments.

Don’t Miss: How To Find My Mortgage Loan Servicer

Public Service Loan Forgiveness: What It Is How It Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Public Service Loan Forgiveness is a federal program designed to encourage students to enter relatively low-paying careers like firefighting, teaching, government, nursing, public interest law, the military and religious work.

You must make 10 years worth of payments, for a total of 120 payments, while working for the government or a nonprofit before qualifying for tax-free forgiveness.

You can use the PSLF Help Tool on the federal student aid website to find out your eligibility based on the types of loans you have and your employer.

Public Service Loan Forgiveness has undergone temporary changes in the face of the COVID-19 pandemic.

-

First, all federal student loans were put into forbearance with no payments due through Dec. 31, 2022.

-

Second, the Education Department has issued a limited waiver through October 2022 of sometimes-onerous provisions for PSLF qualification.

The waivers for PSLF qualification mean that a broader range of past payments on federal loans will count toward forgiveness, as long as you were working for a qualified employer at the time.

Youll find details on both those programs below.

What Is Limited Student Loan Forgiveness

While the Biden administration made major changes to public service loan forgiveness, these changes are not automatic. Thats a surprise to many student loan borrowers who may be expecting student loan forgiveness. On the contrary, you must apply for limited student loan forgiveness by completing this waiver. . This will enable you to get credit for any past student loan payments that were previously ineligible. This is the key to getting student loan forgiveness faster. If you need additional payments to qualify, make sure to complete this form.

Recommended Reading: Who Has The Best Home Loan Rates

Who Qualifies For The Pslf Limited Waiver

For a limited time, the PSLF waiver benefits nearly all federal student loan borrowers who worked full-time for the government or a nonprofit anytime after Sept. 2007. One exception is public servants who borrowed parent loans for their children: Parent PLUS Loans aren’t eligible for the waiver.

You don’t need to have worked in public service all those years. You qualify for the waiver opportunity even if you changed employers or left for the private sector. You’ll get credit for the payments you made while working for a qualifying employer.

Public Student Loan Forgiveness Limited Waiver

To qualify for Public Service Loan Forgiveness , a borrower generally must make 120 qualifying monthly payments under a qualifying repayment plan, while working full-time for a qualifying employer. On October 6, 2021, the U.S. Department of Education announced substantial changes to these requirements due to the COVID-19 pandemic.1 The Department implemented a Limited PSLF Waiver to count all prior payments made by student borrowers toward PSLF. The limited waiver helps address the effects of the pandemic on student loan borrowers by making it easier for borrowers to repay their federal student loan debt.

Recommended Reading: Can You Refinance An Upstart Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Pslf Waiver Results So Far

Department of Education has released forgiveness totals for each month under the PSLF waiver. Heres what the results look like. A yellow color indicates official numbers. A green color indicates our projections if the rate of growth in approved borrowers and debt forgiven remains at 10%.

Notice that the rate of growth in approvals is slowing.

Also Check: How Much Interest Will I Pay On My Car Loan

Submit An Employment Certification Form

This can be completed by using the PSLF Help Tool within your studentaid.gov account, then sending a form to your employer to sign. Youll need to complete a separate form for each qualifying employer you have worked for since 2007, even if you were not working full-time or making payments.

We dont know what changes to the program will be made in the future, so it is best to go ahead and get the work history certified now so it will already be on file, Kollath says.

Also, be sure you have the correct information for all employers, such as the Employer Identification Number and your hire and termination dates, to avoid your form being rejected. If you are consolidating, submit these forms after the consolidation is complete . If the consolidation is still in process near the end of October, Kollath says you should go ahead and submit the ECFs.

Some Rules That Havent Changed

To qualify for PSLF, borrowers are still required to make 120 payments be employed by a government, 501 non-profit or other non-profit organization that provides a qualifying service work full-time and have direct loans or consolidate into a direct consolidation plan. Remember, private loans are never eligible for PSLF. All in all, the PSLF program has not changed in the long term if you expect to get PSLF after October 31, 2022, borrowers will still need to be enrolled in an income-driven repayment plans and make payments on Direct loans. For further information, please read our article on Public Service Loan Forgiveness.

Also Check: How To Apply For Fha Loan

Public Service Loan Forgiveness

Public employees who hold federal student loans may be eligible for the Public Service Loan Forgiveness program. To be eligible to have a student loan balance forgiven, an individual must have made 120 payments while employed by an eligible employer .

Visit the PSLF webpage to learn more, determine if you are eligible, and apply to the program. This site provides a tool that can assist you in determining if you are eligible.

Act now to take advantage of the limited PSLF waiver, ending October 31, 2022. Under this option, borrowers may receive credit for past periods of repayment that would otherwise not qualify for PSLF.

For more information and FAQs visit Public Service Loan Forgiveness.

- Categorized

How Many Direct Loans Will Be Forgiven From This Pslf Order

The typical public servant borrower with Direct Loans who benefits from this PSLF order will probably just get a couple of years of extra credit toward their 120 months of qualifying payments.

Many borrowers started out on the wrong repayment plan or made a loan consolidation mistake. But they figured out what to do shortly after that.

Borrowers who didnt certify credit toward forgiveness during times they were on plans besides an IDR plan will have the most to gain.

Also, FAR more borrowers qualify for PSLF with Direct Loans than have currently submitted an approved employer certification PSLF form. The final benefit amount of the PSLF Waiver may ultimately depend on reaching a huge number of individuals in the next year.

Don’t Miss: Federal Student Loan Interest Rate 2020-21