What Are The Most Common Term Lengths

According to data from Experian, here is the percentage of people opting for different term lengths in Q2 of 2020:

- 4960 months: 15.7%

- 7384 months: 35.1%

- 8596 months: 4.8%

Keep in mind that just because longer-term loans are becoming more common, according to Experian, that doesnt necessarily mean theyre a good idea. There are a lot of things to consider when choosing a long-term auto loan.

Using a car loan calculator is just one step in making a smart financing decision. Once you get a sense of how the loan works, its smart to get preapproved for an auto loan before you go to the car lot. This gives you far more negotiating power than theoretical numbers spit out by a calculator.

Auto Loan Payment Calculator Results Explained

Input a few numbers to see how much a car loan might cost:

- Car price: This is the total amount you intend to finance, including the base cost of the vehicle, any upgrades, warranties, or other packages, plus taxes and fees.

- Down payment: This is the amount of cash youll use to buy the caryoull have to finance the difference between your down payment and the car price. If youre trading in a car, put the value of that vehicle here.

- Loan term: This is how long it takes to pay off the loan. Along with the interest rate, it determines the total cost of the loan.

- Interest rate: The interest rate is used to calculate what you pay the lender to borrow the money. Along with the term, it determines the total loan cost.

- If youre not sure about the interest rate of your loan, you can use your credit score to estimate the rate. The estimates are based on the average interest rates for new car loans by credit score according to Experian data from the second quarter of 2020. Keep in mind that if you are getting a used car loan, your interest rate will be higher.

Based on the inputs above, the calculator determines the following:

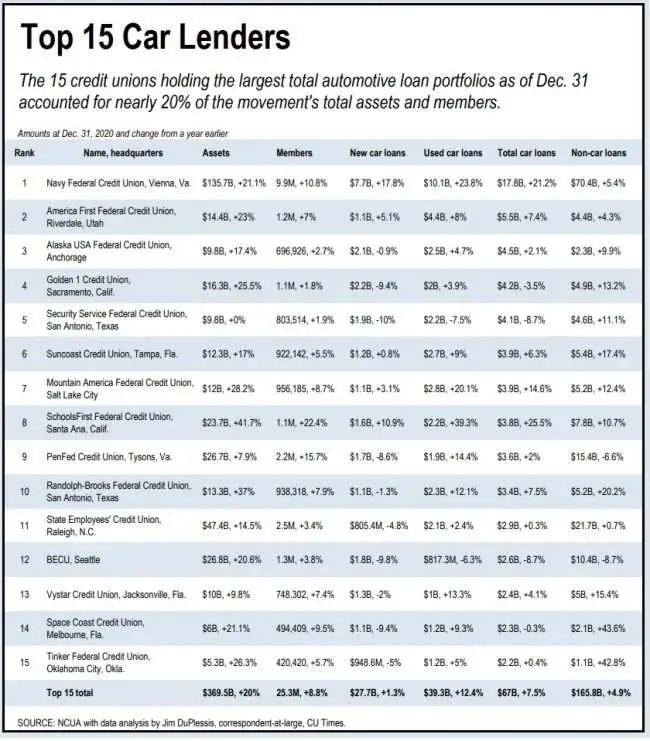

Navy Federal Credit Union New Auto Loans

Whats unique about Navy Federal auto loans for new cars is not that it offers one of the lowest APRs available its unique because of the way it classifies a new car. To NFCU, a new car or truck was manufactured in the last three years, including the current year. So, for the current year, 2017, a new vehicle includes the 2015 and 2016 model years, as long as its mileage is less than 7,499.

Loan terms range from 12 to 96 months. The lowest current APR of 1.99 percent comes with a loan term of up to 36 months. For a 37 to 60 month loan term the lowest APR is 2.39 percent. The APR bumps up a notch to 2.69 percent for a 61 to 72 month term but it jumps considerably to 4.09 percent on a 73 to 84 month term. While some car buyers might appreciate the longer terms of 85 to 96 months, they will pay much higher rates as the low APR for that range is 4.89 percent. The lowest APRs in all loan ranges are reserved for the most creditworthy borrowers with a credit score of at least 700. Buyers with less than stellar credit can expect to be charged APRs of 15 percent to 19 percent depending on the length of the loan term.

Don’t Miss: Can My S Corp Pay My Student Loan

Military Service Awards: We’re Military

We were founded with a vision to provide affordable loans for military members. We continue that legacy today, earning honors for supporting the financial goals for servicemembers and their families.

- Best Military Bank and Credit Union by Military Wallet

- Best Military Bank and Credit Union by US News & World Report

Loan Companies In Douglasville Ga

1. Cash Advance and Payday Loans in Douglasville, GA. Favorite Douglasville, GA, Cash Advance and Payday Loan Companies A 1 CHECK CASHING. 6239 Fairburn Rd Douglasville GA, 30134. 770-942-6400 A-1 Check Cashing. OneMain loan specialists in the Chapel Hill Rd branch in Douglasville, GA are here to help

Recommended Reading: Can I Refinance My Conventional Loan To An Fha Loan

Easiest To Join: Nasa Federal Credit Union

NASA Federal Credit Union

NASA Federal Credit Union may have an intimidating name, but it has easy membership requirements, competitive rates, and some great member perks.

-

No payments for the first 60 days

-

Nationwide coverage

-

Only offers branches in the D.C. area

-

Lower fees only available for high-balance accounts

NASA Federal Credit Union is open to NASA employees, NASA retirees, and their family members. However, you dont have to be a world-class scientist to enjoy membership. It also offers membership to non-employees who join the National Space Society, and the first year is complimentary. After that, your membership will cost $47 a year with automatic renewal. Membership includes their magazine, the latest information on space news, and invitations to conferences and events.

NASA Federal Credit Union offers new and used auto loans and recreational vehicle loans. Auto loan rates start at 2.64% , and although there is no payment due for the first 60 days, interest does accrue. The lowest rates have terms up to 36 months. Longer terms up to 84 months are available, but the rates do increase. You can apply online in a few minutes. You can also reach customer service through email, online chat, and over the phone.

Where Can I Get A Car Loan

There are many places you can get a car loan.

- Buy-here-pay-here dealerships: These dealerships lend the money themselves. These loans come with high rates and are typically marketed toward customers with poorer credit.

- Dealerships: Not to be confused with those above, more reputable dealerships often work with partner lenders who lend the money.

- Most credit unions offer auto loans, although you need to meet membership criteria in order to join.

- Banks: Similarly, banks offer auto loans, and there are usually no membership requirements, although rates tend to be a bit higher than at credit unions.

- Online lenders: Some online lenders also offer auto loans.

Don’t Miss: What Does Lack Of Real Estate Secured Loan Information

Nasa Federal Credit Union

Members of NASA Federal Credit Union include current and retired employees of NASA Headquarters, any NASA Center or Facility or NAS, plus employees or members and their families of one of NFCUs partner companies or associations. They offer flexible terms and low rates for new and used car financing as well as for auto loan refinancing.

Why it stands out: One of its features is the ability for members to apply online and get preapproved quickly. By having financing already in place, members have the advantage at the car dealership because they can focus on negotiating the car price instead of the loan terms.

Pros:

- No payment required for the first 60 days

- Check your rate with no impact to your credit score

Cons:

- Terms only extend to 84 months

What to look for: NASA Federal offers the same rates for both new and used vehicles. Rates start at 2.89% APR for up to 36 months and 2.99% APR for rates up to 63 months. Other rates and terms are available.

Where Navy Federal Falls Short

No option to pre-qualify: Navy Federal does not offer the option to pre-qualify for its loan. Though this is not unusual among credit unions and banks, many online lenders let you check your rates before applying. Pre-qualifying with multiple lenders allows you to compare potential loan offers without affecting your credit score.

No rate discount for autopay: The lender does not offer a rate discount for borrowers who set up automatic payments on their personal loan. According to the lender, it does offer an APR discount of 0.25 percentage points for active duty and retired military who have direct deposit. You must apply at a Navy Federal branch or by phone to qualify for the discount.

No option to change payment due date: Navy Federal does not let borrowers choose their payment date before signing the loan agreement or make changes to the date after signing. It is common for a lender to let you do one or the other, and some even allow both. Payment flexibility is helpful for borrowers if their payday or monthly obligations change over the life of the loan.

» MORE:Best personal loans for fair credit

Read Also: How Much Va Loan Can I Qualify For

What You Need To Know When Buying A Vehicle

If you’ve never purchased an automobile before, or even if you have, you should know that the process is anything but simple. This purchase entails a major expense, and although many consumers assume that a vehicle is an asset, the truth is that you’re paying for a tool, plain and simple, one that transports you from point A to point B. Automobiles don’t gain value . So you need to take great care to select a vehicle that suits both your budget and your purposes. Whether you opt for a modern model or you go for a classic beauty, there are things you need to know going into the process. Here are the key points to consider when you’re planning to purchase a new or used car.

Get pre-approved

You can absolutely finance through a dealer if you so choose, and many consumers opt to go this route when purchasing a car, be it new or old. But the truth is that you have more bargaining power when you show up with a pre-approved loan in your back pocket. And chances are good that your bank, credit union, or other trusted lending institution are going to give you a better deal than what you’ll get from a dealership. Of course, pre-approval also gives you a good idea of your budget going in. So before you even consider signing on the dotted line, talk to lenders about getting pre-approved for a car loan.

Use AAA

Consider a certified pre-owned vehicle

Calculate up-front costs

Consider operating costs

Do your homework

Understand fees and extras

Sleep on it

Inspect the vehicle

Ppp Loan Navy Federal

1. Business Solutions | Navy Federal Credit Union If you received your PPP loan through Navy Federal and you want to apply for loan forgiveness, you must apply through our digital portal. The SBA recently opened a forgiveness application portal. However, if you received your PPP loan through Navy Federal,

Read Also: Who Can Help With Student Loan Debt

Military Choice Loan Rates 10

| Term |

|---|

The Standard Price Lock – Commitment is 60 days from the lock date at no additional cost.

The Float to Lock Option

If you select the Float to Lock Commitment, it means that you want to allow the interest rate and/or discount points to float with the market. You must lock in your interest rate and/or discount points at least seven calendar days prior to settlement/closing.

The Freedom Lock Option

The Freedom Lock Option is available on refinance and purchase loans for a non-refundable 0.250% fee added to the origination. You will have the opportunity to relock one time if rates improve, with no maximum interest rate reduction. The fee must be collected up-front. VA Loans are not eligible for the Freedom Lock Option.

The Special Freedom Lock Promotion

The Special Freedom Lock Promotion is a limited-time offer and subject to change at any time. Offer is available for new loan applications at no additional fee, with a maximum interest rate reduction of up to 0.500%. You will have the opportunity to relock twice if rates improve, and your loan must close within your initial lock commitment period. The Special Freedom Lock option is available for:

- Refinance applications

- Purchase applications

Usaa Car Loan Calculator

USAA Car Loan Calculator is a self-help tool that helps you estimate your monthly expenses if you go on and get an auto loan.

To use the calculator, select the loan type to auto loans, choose the purpose of the loan, select the collateral modal year and enter details like loan term and loan amount.

The calculator will show the estimated monthly payment, total loan amount, finance charges, and total loan cost.

Also Check: What Is An Upside Down Car Loan

Are Credit Unions Better For Car Loans Than Traditional Banks Or Dealerships

If you already belong to a credit union, its often the best place to start shopping for a car loan. The credit union usually offers better rates and terms than traditional banks and dealerships and they usually charge lower fees as well. The credit union may also be more willing to offer you an auto loan if you have less than perfect credit based on the fact that youre a member and have a banking history with them.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

You May Like: What Is Best Loan For Home Improvement

How Can Our Car Loan Calculator Help You Choose The Right Auto Loan

Not all auto loans are created equal, due to different financing terms. Once youve familiarized yourself with your price range, explore your options with Mission Fed to secure an Auto Loan with Mission Fed Bottom Line Rates, which may save you money when compared to auto financing with a car dealer or another lender. Mission Fed offers great rates and loanterms that can help your budget now and in the long run for your monthly payments.

With Mission Fed, you can also enjoy getting a new or pre-owned car without ever setting foot in a dealership. With an Auto Loan from Mission Fed and car buying service from Autoland, you can get the car you want delivered straight to you. Once you have your Mission Fed Auto Loan in hand, you can request a dedicated Autoland representative to find the car that you want from their wide network of partner dealerships. Your representative then negotiates the deal for you and delivers your car to you at your local Mission Fed branch.

Navy Federal Credit Union Vs Usaa

USAA is another credit union that caters to veterans and military members. However, its loan amounts donât stack up well compared to NFCU. For example, USAA only offers personal loan amounts between $2,500 and $20,000, whereas NFCU offers loans between $250 and $50,000.

If your focus is loan terms, however, the right credit union for you depends on your loan purpose. If you plan on using the funds for home improvement projects, NFCU offers terms up to 180 monthsâor 15 years. But if youâre using your funds for personal expenses or debt consolidation, USAA offers terms up to seven years compared to NFCUs five years.

Also Check: Can You Get An Fha Loan With No Down Payment

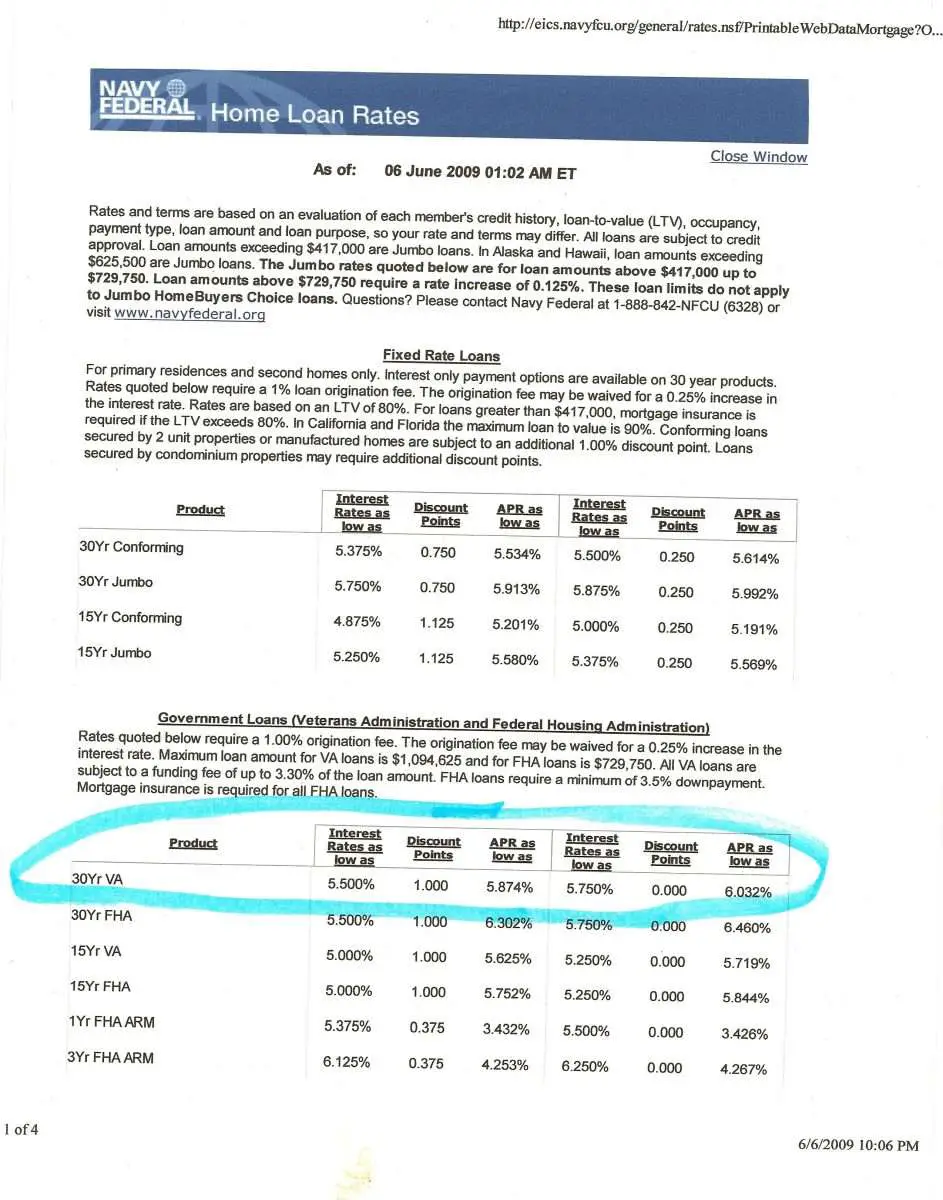

Conventional Fixed Mortgage Rates 6

Special Update for Mortgage Applicants: Due to a high volume of applications, it may take us longer than normal to respond. Were working to process applications to the best of our ability. Thanks for your patience.

| Term |

|---|

Rates as of Jul 22, 2022 ET.

Rates subject to change.

Rates are based on an evaluation of credit history, so your rate may differ. All Conforming and Jumbo HomeBuyers Choice rates quoted above require a 1.00% loan origination fee. The origination fee may be waived for a 0.25% increase in the interest rate. All Conforming and Jumbo HomeBuyers Choice loans are subject to a funding fee of 1.75% of the loan amount. This funding fee can be financed into the loan up to a maximum of 101.75% LTV, or the fee can be waived for a 0.375% increase in the interest rate. Purchase loans require no down payment. LTV restrictions apply to refinance loans.

Purchase loans require no down payment. LTV restrictions apply to refinance loans. Rates displayed are the “as low as” rates for purchase loans and refinances.

Veteran Auto Loan Calculator: How To Estimate Your Monthly Car Loan Payment

While looking for a car, heres what comes to mind.

- What will be the monthly installment?

- What will be the cost of insurance?

- Does the car retain its value?

- What will be the mileage of the vehicle?

And, the most important of all, is the car within my budget?

Using a car loan calculator can help you figure out all these things. Ideally, you should not spend more than 20% of your income on monthly car payments.

You can use a Veteran auto loan calculator to estimate monthly payments, down payments, interest rates, and loan terms. All you need to enter is the interest rate, how much you want to borrow, whether the car is new or used, and the loan term.

Pro Tip You can use the 20-4-10 formula to get the most affordable monthly payment. Pay 20% down payment, choose the loan term to 4 years, and expect the total vehicle expense of 10%.

Need some help? Read our article on how veterans can get auto loan assistance.

Don’t Miss: When Do Student Loan Payments Begin