New Process For Students Who Have Previously Received Part

Effective June 10, 2019, there is a new online process for receiving your part-time funding. Once you have been assessed and approved for part-time funding you will now be required to complete an electronic part-time Master Student Financial Assistance Agreement on the National Student Loans Service Centre website. The part-time MSFAA is a legal agreement between you and the Canada Student Financial Assistance Program that outlines your responsibilities and the terms and conditions of accepting your Canada Student Loans and/or Grants and your responsibilities for repayment. PEI Student Financial Services will give you a 10-digit part-time MSFAA number. It is important for you to keep this number to complete your online registration.

Even if you have previously completed a full-time MSFAA, you will still need to complete a part-time MSFAA as it is a separate agreement. If you already have an account, you can sign-in to the NSLSC website and complete the part-time MSFAA. If you dont have an account, you will need to register for an online account and complete the part-time MSFAA using the URL in the Welcome Email sent by the NSLSC.

The new electronic part-time MSFAA process replaces having to sign and mail a paper loan agreement process. Since it is a multi-year agreement, it is more efficient and easier to use. For instance, you will not need to complete a new part-time MSFAA the next time you apply for part-time student funding .

Find Out What’s Available And Determine What You Can Pay Back

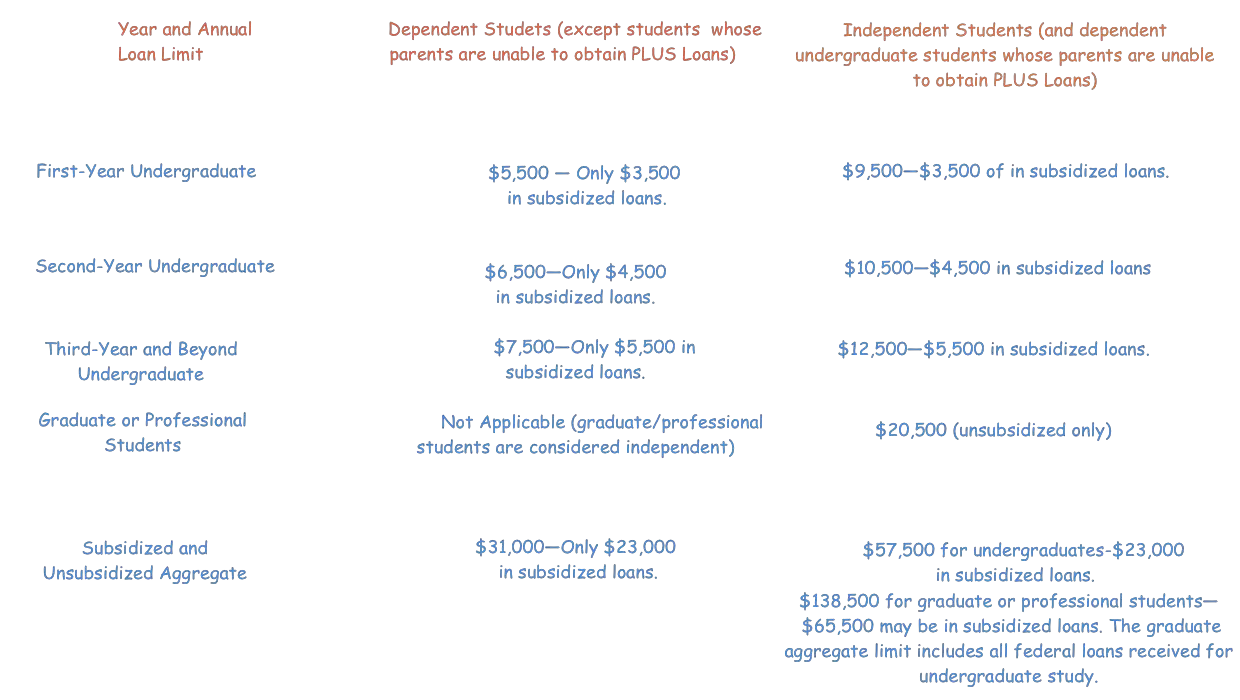

There are limits to almost everything in life, including how much you can borrow on student loans. Student loan limits are based on a variety of factors, including the type of loan , your year in school, and how much it costs to attend your school of choice.

Maintenance Loans In England 2021/22

| Household Income | Away from home | Away from home |

|---|---|---|

| £4,422 | £6,166 |

The household incomes in bold represent the upper earnings thresholds for the parents of students in each living situation. As the table shows, students with parents earning above the following thresholds will receive the minimum Maintenance Loan for someone with their living arrangements:

- £3,516 if you live at home and your household income is above £58,220

- £4,422 if you live away from home and outside London, and your household income is above £62,286

- £6,166 if you live away from home and in London, and your household income is above £70,004.

Bear in mind that the household incomes we’ve given in the table above are just examples the Maintenance Loan you receive will be calculated using your exact household income rather than a band .

What are the minimum and maximum Maintenance Loans in England?

The minimum Maintenance Loan on offer for students from England is £3,516, which is paid to students with a household income of £58,222 or more and who’ll be living at home during their time at uni.

The maximum Maintenance Loan is £12,382 and is paid to students who will be living away from home and in London, and whose annual household income is £25,000 or less.

And for more info on Student Loans in England, check out this guide.

For that reason, weve included Maintenance Grants amounts in these tables, starting with the amount on offer if youll be living with your parents:

| Household income |

|---|

| Household income |

|---|

Read Also: Auto Loan Payment Calculator Usaa

How Much Does Student Accommodation Cost

The average cost for weekly rent in the UK in purpose-built student accommodation from 20182019 was £147. Private sector accommodation averaged £148 a week for an ensuite room and £193 for a studio. In London, the average was £178 per week for university accommodation and £233 for the private sector.

Student Loans From The Government

See the latest finance advice in relation to COVID-19 for students in higher education.

Student Loans can help you with the costs of higher education. They are issued by Student Finance NI, a service managed by the Student Loans Company in partnership with Student Finance Northern Ireland and the government.

The interest on Student Loans is linked to the rate of inflation, so in real terms what you repay will be broadly the same as what you borrowed. There are two types of loan available – you can take out either or both:

- a student loan to cover your tuition fees – called the Student Loan for Tuition Fees

- a student loan to help with your accommodation and other living costs – called the Student Loan for Maintenance

Read Also: How Long Does Sba Loan Take

Federal Borrowing Limits For Graduate Students

| $138,500 | $65,500 |

Your federal borrowing limits are higher if youre working on a masters or doctorate program, including an M.A., MBA, M.D., J.D., or Ph.D.

The annual borrowing limit for grad students is $20,500 a year, and you can borrow up to $138,500 in total, including the loans you took out as an undergraduate. Since July 1, 2012, grad students arent eligible to take out subsidized loans anymore. But its possible for grad students who took them out before then to have up to $65,500 in subsidized loans.

Medical school students can take out up to $224,000 in federal loans before turning to grad PLUS or private student loans. For most medical school students, the annual borrowing limit on the more affordable federal student loans is $40,500.

Learn More: Graduate Student Loan Limits: How Much Can You Get?

Can I Get Other Financial Assistance With A Student Loan

You may be eligible for a non-repayable grant or bursary, depending on your student category, family size, and income level and the length and location of your study program.

-

Eligible students enrolled in a program of at least 60 weeks duration may receive up to a maximum of $750 per month, based on their income and family size.

The exact amount awarded is determined according to a single progressive threshold under which the size of the grant gradually decreases as income increases, with the rate of reduction varying by family size.

The grant is a fixed amount that shall not be further reduced based on student need and may exceed a borrowers assessed need. The grant amount gradually reduces to zero as income increases however, to ensure a minimum grant amount is provided to all eligible students, and grant awards of less than $100 per period of study should be rounded up to $100 accordingly.

- Low-income students may receive $400 per month for each dependent child who is under age 12 at the beginning of the school year

Students with permanent disabilities will receive up to:

- $4,000 per year towards the cost of tuition, books, and accommodation. Appropriate medical documentation is required. Visit our Canada Student Grant for Students with Permanent Disabilities page for more information and required forms.

- $8,000 per year for special services and equipment such as tutors, note-takers, interpreters, Braille, or technical aids.

Recommended Reading: Prosper Credit Requirements

What Is Manitoba Student Aid Do I Qualify

We break it down for you: Who we are, what we do, what we can do for you and what it takes to be eligible for our program.

Our program provides loans, grants and bursaries to Manitobans who need help paying for school.

Student loans are calculated based on your financial need and are meant to supplement, not replace, your own resources. Just because you apply for a student loan does not mean you’ll get one, and just because you get one does not mean you will get the maximum amount.

If you do get a student loan, you don’t have to make payments or pay interest on it while you are a full-time student.

One Application Two Loans

When you apply to Manitoba Student Aid, you become eligible for loans and grants, not only from Manitoba Student Aid, but also from the Canada Student Loans Program.

When you receive and repay your student loans, you deal with both lenders separately.

Studying In The Republic Of Ireland

If you normally live in Northern Ireland and are currently studying or starting a higher education course in the Republic of Ireland in the 2020-2021 academic year, you may be eligible for a loan to cover the full cost of the student contribution charge, which is 3,000.

If you started your course in RoI before September 2013, you will continue to be eligible for a non-means tested non-repayable grant to cover the student contribution charge.

Don’t Miss: Transfer Loan To Another Person

Student Loan For Maintenance

The Student Loan for Maintenance is there to help towards your accommodation and other living costs while youre studying.

All eligible full-time students can get a Student Loan for Maintenance, but the exact amount you can borrow will depend on several factors, including your household income, where you live while youre studying and whether youre in the final year of your course. Its also affected by any help you get through the Maintenance Grant .

The basic student loan for Northern Ireland students is:

- £3,750 if you’re living and attending college in Northern Ireland

- £6,780 if the course is in London

- £5,770 if youre overseas

- £4,840 if you live elsewhere

You can take out around 75 per cent of the maximum Student Loan for Maintenance regardless of your household income – this is called the ‘non income assessed’ part of the loan. Whether you get the remaining 25 per cent – the ‘income assessed’ part of the loan – depends on your household income.

To qualify for a Student Loan for Maintenance, you must also be aged under 60 when you start your course.

Your Education Authority will assess your application and decide which rate you are eligible to receive.

Student Finance NI will usually pay the money into your bank account in three instalments – one at the start of each term.

Compare Your Financial Aid Offers

The financial aid offices at the colleges you apply to will use the information from your FAFSA to determine how much aid to make available to you. They compute your need by subtracting your EFC from their cost of attendance . Cost of attendance includes tuition, mandatory fees, room and board, and some other expenses. It can be found on most colleges’ websites.

In order to bridge the gap between your EFC and their COA, colleges will put together an aid package that may include federal Pell Grants and paid work-study, as well as loans. Grants, unlike loans, do not need to be paid back, except in rare instances. They are intended for students with what the government considers “exceptional financial need.”

Award letters can differ from college to college, so it’s important to compare them side by side. In terms of loans, you’ll want to look at how much money each school offers and whether the loans are subsidized or unsubsidized.

Direct subsidized loans, like grants, are meant for students with exceptional financial need. The advantage of subsidized student loans is that the U.S. Department of Education will cover the interest while you’re still at least a half-time student and for the first six months after you graduate.

Direct unsubsidized loans are available to families regardless of need, and the interest will start accruing immediately.

Payments and interest on these loans was suspended in 2020 during the economic crisis, with both resuming in early 2022.

Recommended Reading: Refinance Conventional Loan

When Youre Eligible For Full Support

You can apply for full support if all the following apply:

- youre a UK national or Irish citizen or have settled status

- you normally live in England

- youve been living legally in the UK, the Channel Islands or the Isle of Man for 3 continuous years before the first day of your course, apart from temporary absences such as going on holiday

You may be eligible for full support if youre a UK national who both:

- was living in the EU, Switzerland, Norway, Iceland or Liechtenstein on 31 December 2021, or returned to the UK by 31 December 2020 after living in the EU, Switzerland, Norway, Iceland or Liechtenstein

- has been living in the UK, the EU, Gibraltar, Switzerland, Norway, Iceland or Liechtenstein for the past 3 years

You may also be eligible if your residency status is one of the following:

You could also be eligible if youre not a UK national and are either:

- under 18 and have lived in the UK for at least 7 years

- 18 or over and have lived in the UK for at least 20 years

You must have been living in the UK, the Channel Islands or the Isle of Man for 3 continuous years before the first day of your course.

What Is Pslf And How Is Tepslf Different

Public Service Loan Forgiveness is a federal program that began in 2007. The program encourages graduates to pursue a career in public service. If a borrower with federal loans works for a qualifying employer and makes 10 years of student loan payments120 totalthey will have their remaining loan balance forgiven.

PSLF has many technical requirements regarding loan type, repayment plan, and employment. TEPSLF expands those requirements by allowing payments from all federal loan programs or repayment plans to count toward the 120 payments needed for forgiveness. As long as the borrower worked full-time for a qualifying employer, they will receive credit for all federal student loan payments they made.

Also see: Should I use my 401 to pay off student loans?

Read Also: 18009460332

Maximum Lifetime Limit For Student Aid

There are lifetime limits on the number of weeks you can receive student aid. This includes interest-free periods while you are in school. Once a lifetime limit has been reached, interest starts to accumulate. You will also have to start paying back the loan 6 months after you graduate or finish your studies.

Full-time students can receive student aid for no more than 340 weeks, except:

- students enrolled in doctoral studies can receive student aid for up to 400 weeks

- students with permanent disability can receive student aid for up to 520 weeks

Household Income Assessment Students Eligible For Benefits

Students with household incomes of £25,000 or less qualify for the maximum Maintenance Loan at whichever rate applies to your situation .

The income assessment for students with household incomes of more than £25,000, is calculated as follows:

Students studying in London and living away from home:

- If your household income is below £25,000, you will be eligible for the maximum amount of Maintenance Loan £13,504.

- If your household income is above £25,000, 54.3% of the Maintenance Loan is income assessed on a sliding scale. There will be a £1 reduction in loan for every complete £4.979 increase in income above £25,000 up to £42,875 and a £1 reduction in loan for every complete £7.24 increase in income above £42,875.

- However, this income assessment does not continue indefinitely all eligible students will get at a Maintenance Loan of at least £6,166 .

- If your household income is £70,011 or above you will receive £6,166.

Students living at home:

Final Year Rates:

The income assessment for final-year rates of loans for students eligible for benefits is calculated as follows:

Home Rate: £1 reduction in loan for every complete £4.615 increase in income above £25,000 up to £42,875. £1 reduction in loan for every complete £7.43 increase in income above £42,875.

London Rate: £1 reduction in loan for every complete £4.894 increase in income above £25,000 up to £42,875. £1 reduction in loan for every complete £7.24 increase in income above £42,875.

Recommended Reading: How Long Does The Sba Loan Process Take

How Much Can You Get

The amount you can receive depends on several factors, including:

- your province or territory of residence

- your family income

- your tuition fees and living expenses

- if you have a disability

The amount you can receive in grants and loans is calculated when you apply with your province or territory.

To find out if you can receive Canada Student Grants or Loans, use the federal student aid estimator. Note that this estimator doesn’t take into account the provincial and territorial student grants and loans.

Apply For Bursaries Scholarships And Grants

Weve briefly covered Maintenance Grants above, but there are loads more grants on offer that arent funded by the government.

Most universities offer a wide range of grants, bursaries and scholarships none of which need to be repaid!

While this is basically free money, theres a bit of a catch: often there are qualifying criteria to make sure the money goes to those who need it the most or, in some cases, those who excel in a particular field or discipline .

Use our list of bursaries, scholarships and grants to find out more about some of the biggest and most common types of funding in this area, or if none apply to you, check out our guide to funding sources and discover how to find some for yourself.

And if you think theres no way youll be eligible for anything, think again. As these weird bursaries, scholarships and grants go to show, theres funding out there for just about anyone and everything!

Don’t Miss: Fha Loan Limits Harris County

Sbi Home Loan Eligibility Based On Salary

State Bank of Indias home loan eligibility depends on a number of factors such as the age of the applicant, credit score, and income or salary.

The SBI home loan eligibility calculator given below shows you the loan amount that you are eligible for based on different ranges of monthly income considering an interest rate of 6.95% p.a., which is the starting interest rate, and a maximum repayment tenure of 30 years, and assuming there are no other financial commitments towards the Equated Monthly Instalments towards other loans.

| Monthly Income |

You May Like: Usaa Car Loans Review