Requirements For An Easy Finance Lending Golf Cart Loan

In order to apply for income tax loans through EasyFinanceLending.com you have to meet the minimum requirements.

- You must be at least 18 years

- United States citizen or legal resident.

- Verifiable source of monthly income

- Working email address

- Verifiable home and work telephone numbers.

Your state residence will determine the minimum age and if you are able to apply for a golf cart loan.

Receive Your Refund Early With A Tax Refund Loan

If you are looking for a cash advance on your taxes, there are a variety of lenders who specialise in this service. The process of applying for a tax refund loan varies between each lender, although the most common first step will involve an appointment with a tax professional. Most tax return loans are offered by companies which specialise in tax preparation services, they partner with lenders who then loan you the funds.

Once the professional has assessed the taxes you have paid you will be advised whether a tax return advance is available. The loan application will then be passed to the underwriters to evaluate whether your application meets their criteria. In many situations the cash advance tax refund loan can be paid within 24 hours, with many tax specialists offering same day payments.

The time it takes to process the loan will depend on your individual circumstances, as the company will need to review your tax payments. When the tax refund is received by the tax specialist, they will then repay the tax return advance and issue any remaining refund to you.

How Much Can I Borrow

To be eligible for a tax refund advance, you must have minimum refund amount typically around $1000. The loan amount itself comes in smaller fixed increments starting around $200 to $500 up to the full amount. But some companies, like TurboTax, will only let you access a portion of your refund. For example, if youre getting a $1,284 refund, you can only borrow $250.

You May Like: How To Fill Out Fsa Loan Application

How Does Canceled Personal Loan Debt Affect Your Taxes

If a creditor cancels, discharges, or forgives part of your debt, the portion of the loan that you didnt repay may be considered taxable income. Often, this occurs if you fall behind on payments and agree to a settlement with the creditor.

The creditor will send you a Form 1099-C, Cancellation of Debt, which shows how much debt was canceled. You may need to include the canceled debt in your income and pay taxes on the amount. However, there are exceptions, and you may be able to exclude the amount from your income if youre insolvent .

Can I Compare Tax Loans

We specialise in comparing a variety of business loans and products, so our team can provide expert advice to help you with your tax loan comparison. We can help with advising upon the ideal tax preparation service to suit your individual requirements, while also explaining the fees and costs involved with any tax anticipation loans you are considering.

If you decide that a tax refund loan is not the right solution for you, our useful business loan comparison tool can provide you with instant access to a variety of lenders. Our panel of lenders can provide loans in as little as 24 hours with highly competitive interest rates. To find out more about income tax loans or discuss the options available to you, please use our tax finder tool.

Recommended Reading: Rates For Refinancing Student Loans

How A Loan Against Your Tax Refund Works

A loan against your tax refund, also known as a refund-advance loan or a refund-anticipation loan, is a type of secured loan. This means that collateral is used to guarantee the loan . Refund anticipation loans may have fees and interest, or they may be marketed as no-fee although they usually have other costs associated with them. Refund-anticipation checks, another kind of refund-advance product, is a loan for the tax-preparation fee from your refund.

Tax-refund loans are short-term loans and must be repaid when you receive your tax refund. Banks typically partner with tax-preparation services to offer these loans to their customers.

Youll usually receive your refund-advance loan as a deposit into a bank account, or on a prepaid debit card. When the IRS issues your refund, it will be deposited into that bank account or onto the prepaid debit card, and the loan amount and any interest or fees will typically be deducted from the account.

Tax-refund loans marketed as no-fee are usually for smaller advance amounts than loans that charge interest, but products vary. The amount you can borrow depends on factors such as the lender, the tax preparer, and your financial and credit health.

Do I Have To Report A Personal Loan On My Taxes

In most instances, you dont need to report a personal loan on your taxes since its not considered income. If any part of your loan gets canceled, youll need to report the amount that got canceled as income because its the amount you were given and it didnt get paid back.

If you used any of your loan for business expenses, however, you can note that in your itemized deductions on your tax return.

Recommended Reading: Does The Military Pay Off Student Loans For Officers

Tax Refund Loans: Get An Advance In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you need cash while waiting for your income tax refund, some tax preparation services including Jackson Hewitt, H& R Block and TurboTax offer 0% interest tax refund loans.

Instead of having an interest rate and repayment terms, the tax preparation service lends you money and reclaims it through your return.

Tax refund loans, also called “refund advances,” are a way to access your refund early. However, note that tax preparers may charge fees for filing some tax returns. In paying a tax preparer just to get the advance, youre paying to access your own money.

» MORE:Fastest way to get your tax refund

Topic No 453 Bad Debt Deduction

If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses and Publication 535, Business Expenses. Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you’re a cash method taxpayer , you generally can’t take a bad debt deduction for unpaid salaries, wages, rents, fees, interests, dividends, and similar items. For a bad debt, you must show that at the time of the transaction you intended to make a loan and not a gift. If you lend money to a relative or friend with the understanding the relative or friend may not repay it, you must consider it as a gift and not as a loan, and you may not deduct it as a bad debt.

Don’t Miss: What Are Rv Loan Rates

Loans For Purchase Of A Home / Home Renovation

Personal loan tax exemption for salaried is not available even if you use the funds towards purchasing a new home or renovating your existing home. However, the home loan you may have taken to purchase a home is certainly exempted from taxes. If it is a house that you own and live in, you are eligible for deductions up to 2 lakh. If it is a rented house, the total interest paid on the loan can be deducted from your taxable income. Make sure that you keep all the relevant documents that prove how the loan amount was used before claiming the tax benefit.

What Is A Loan Against Tax Refund

Simply put, this is a loan that uses your anticipated federal income tax refund as collateral.

Refund anticipation loans are usually provided by tax preparation companies in collaboration with third parties, such as banks. Depending on the lender, the requirements, costs, and loan amounts can vary.

These loans can have a 0% interest rate, but they can also have different fees as well, so always make sure to thoroughly read and fully understand the terms and conditions of your specific loan.

Loans against income tax refund are short-term loans that you must repay when you get your tax refund from the IRS.Here is how it works:

The loan may be deposited into your account or on a prepaid card shortly after the approval. After the IRS issues your refund from federal income taxes, the amount borrowed together with fees and interests is deducted from your account.

Loan amounts vary depending on the lender, the amount of tax refund youre expecting, the tax preparation company, and your overall credit and financial health.

Don’t Miss: Can You Have More Than 1 Loan With Onemain Financial

Get Income Tax Loans Now

Income Tax Loans Now is the best way to get your tax refund back faster than waiting on the government. When it comes to income tax loans the government never gets in a hurry and if you need cash fast can be a problem.

That is why income tax loans now can get you cash as soon as the next business day or sooner once you are approved and agree to the rate and terms. By applying online there is no obligation and by applying for a income tax loan offer does not affect your credit.

Tax Advance Instant Tax Loan

Fast, safe, and secure refund anticipation loan via direct deposit to a checking, savings, or prepaid account. A tax advance loan is based on your actual refund so there is no credit check and no upfront fees to pay. All tax advances are $1,200 less tax preparation fees and $0 finance fee even if your actual IRS refund is delayed. A Tax Advance Instant Tax Loan is not your actual refund. Tax Preparation fees apply and are non-refundable.

Taxadvance.com reserves the right to reject a tax loan application except for on the basis of race, color, religion, national origin, sex, marital status, or age to the fact that all or part of the applicants income derives from a public assistance program or to the fact that the applicant has in good faith exercised any right under the Consumer Credit Protection Act. Please be responsible and consider all refund options prior to applying for a refund anticipation loan.

RAC , AR , and ERD are tax-related products that allow tax preparation fees deducted from YOUR refund upon completion of services and the balance of the refund disbursed to you by check, direct deposit or a prepaid card. Dont be misled by fancy marketing names because none of these tax-related products speed up your tax refund deposit time. According to the IRS your actual tax refund will be processed within 8-21 days.

Also Check: Who Can Use The Va Loan

Where Can I Get A Tax Refund Loan

Many tax preparation companiesincluding H& R Block, Jackson Hewitt and Liberty Taxlet their customers borrow against an upcoming U.S. tax refund. While these companies have many brick-and-mortar locations, they also have an online presence, so you can apply for a loan in person or online.

If you prepare your own taxes, you don’t have to go to a tax preparer to get a tax refund loan. Online tax filing services, including TurboTax and TaxAct, also offer refund loan options.

Lending Requirements For Income Tax Loans

Now is the time to apply for the income tax loan you need to take care of unexpected expenses and put extra cash in your bank account.

Must Be 18 Years or Older

Steady Monthly Income From Job or Benefits

Valid Government ID

Bank or Savings That Accept Direct Deposits

Working Email Address & Phone Number

Tax Refund Cash Advance Loan Lenders

Fast Reliable Payday Loans with No Hard Credit Checks

Income Tax Loans

Read Also: Loans You Don’t Pay Back

Risks Of Tax Refund Loans

The main concern with a tax refund loan is the cost. Make sure that you understand all of the costs associated with the loan. For example, you may need to pay penalties if your IRS refund doesnt arrive within a certain amount of time. The last thing you want is for the loan to go delinquent. This will lead to interest and an even higher cost for you.

Another concern is that you receive a lower refund than you anticipate. In that case, you will have borrowed more than you got from the IRS and you will need to come up with the money to pay off the loan. That doesnt include any extra fees and interest. You can estimate your refund with SmartAssets free tax refund calculator.

Sometimes the IRS will also take longer than usual to process your refund. That could be due to an error in your return or because the IRS simply has a lot of returns to process .

Cons Of Taking Out A Personal Loan To Pay Off Taxes

Hidden costs

Be sure to carefully read the terms and conditions of any loan you are considering. Origination fees are standard because they are what fund most online platforms, however, be wary of any unadvertised fees or costs, such as loan repayment fees. Do not be afraid to ask the loan provider any additional questions you may have because it is your money, after all.

Too-high Interest rates

It is important to make sure the interest rate you are getting on a personal loan is favorable. Depending on the lender, some interest loans may not be as competitive as others which is why its important to shop around and weigh your options.

Also Check: Who Can Qualify For An Fha Loan

What Are The Qualifications For Receiving A Tax Advance Refund

The only qualification is you need to be eligible to receive a tax advance refund from the IRS.

Theres a reason why most loan providers demand you file your taxes with them first. Theyll know exactly what youll receive from the IRS this year, so theyll base your maximum loan amount on this figure.

There are usually minimum loan amounts in place, which range from $500 to $1,000.

Are Personal Loans Taxable

Since personal loans are loans and not income, they arenât considered taxable income, and therefore you donât need to report them on your income taxes. However, there are some instances where you could face tax implications from a personal loan.

Your personal loan is considered a debt. As long as you are on track for paying it back, you shouldnât worry. However, if part of your loan gets canceled, you may find yourself in a very different situation, one that may prove costly.

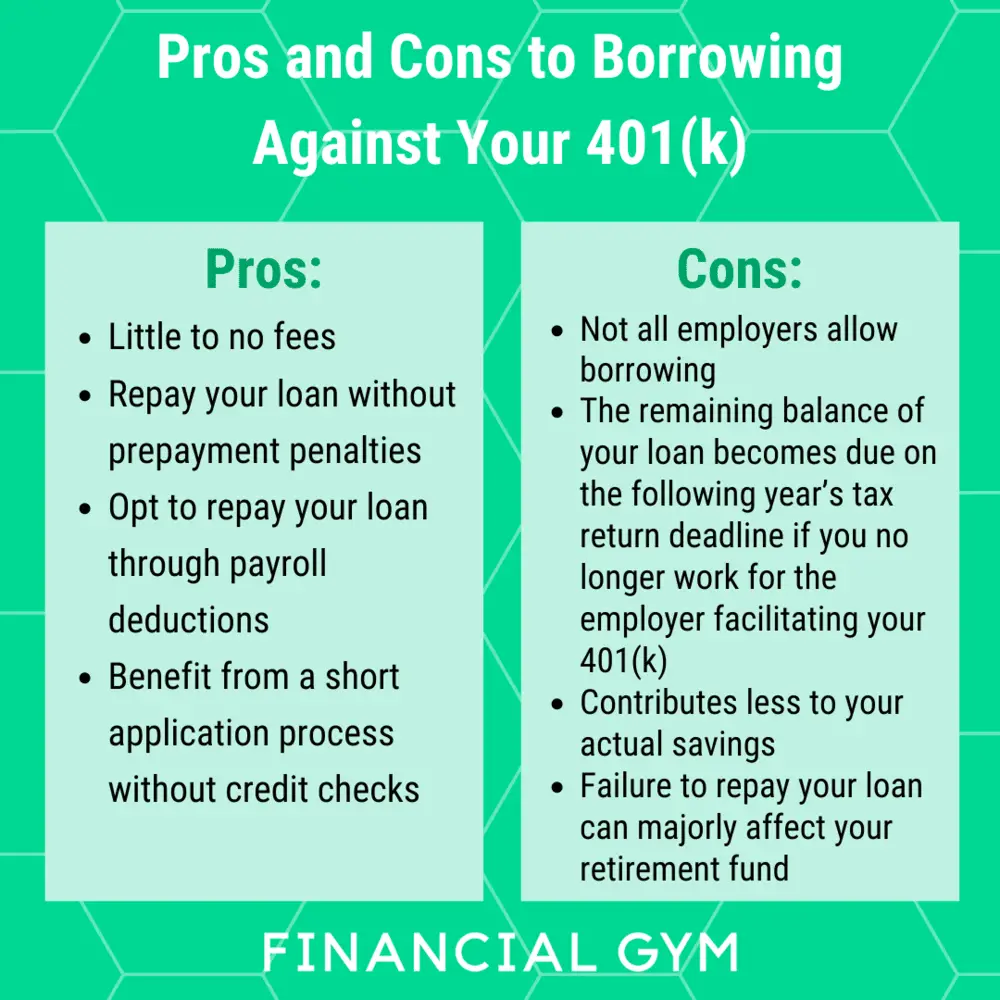

Also Check: 401k Loan Interest Rate 2021

Alternatives To A Tax Refund Loan

Tax refund loans are not usually worth the high cost, so here are a few alternatives that may be better for you:

Do Personal Loans Count As Income

A personal loan is a loan you can use for almost anything, like covering the cost of an emergency, wedding or home repair. Theyâre generally unsecured, or loans that donât require an asset to borrow money. Secured loans, like auto loans and mortgages, use collateral to secure your loan.

Because income is classified as money that you earn, whether through a job or investments, loans are not considered income. You donât make money from your loan you borrow money with the intent of paying it back.

Recommended Reading: What Is The Lowest Auto Loan Interest Rate

Tax Filing Season Not A Holiday Season

The most wonderful time of the year almost never refers to tax season. But this advice might make it a little less painful.

This blog post was updated February 5, 2020 by Andrew Tavin and Kelly F. Zimmerman. It was originally published January 18, 2018.

Jacob Dayan is CEO and Co-Founder of Community Tax, LLCand Finance Pal, LLC. He began his career on Wall Street in New York City, working in the financial analytics and structured transactions group at Bear Stearns. He continued to work on Wall Street until early 2009. when he returned to Chicago to be with his family and pursue his lifelong dream of self-employment. There, he co-founded Community Tax, LLC, followed by Finance Pal in late 2018. Follow him @communitytaxllc.

Andrew Tavin is a writer, comedian, and a full-time content manager for OppLoans. He graduated with a BFA in TV Writing from Tisch School of the Arts in New York City, worked as a writer for BrainPOP, and created a branded comedy video series for the National Retail Federation called Interview Day. He performs around the country and his writing has also appeared on Collegehumor, Funny or Die, and Sparklife. Read more of his OppLoans’ work here.