What Do I Need To Qualify For Student Loan Refinancing

The requirements to qualify for refinancing can vary by lender. However, there are a few common eligibility criteria youll likely come across, including:

-

Good credit: Youll typically need good to excellent credit to qualify for refinancing a good credit score is usually considered to be 700 or higher. While some lenders offer refinancing for bad credit, these loans generally come with higher interest rates compared to good credit loans.

-

Verifiable income: Some lenders have a minimum required income while others dont but in either case, youll likely need to provide documentation showing proof of income.

-

Low debt-to-income ratio: Your debt-to-income ratio is the amount you owe in debt payments each month compared to your income. Lenders typically like to see a DTI ratio of 50% or below though keep in mind that some lenders might require lower ratios than this.

-

Loan information: The lender will need information regarding each of the student loans you want to refinance, such as loan balances, your current lenders, and what schools you attended.

If youre struggling to get approved for refinancing on your own, consider applying with a cosigner to improve your chances. A cosigner simply needs to be someone with good credit such as a parent, other relative, or trusted friend whos willing to share responsibility for the loan.

Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

Best For Student Who Didn’t Graduate: Citizens Bank

- Interest Rate: 2.24%+

Citizens Bank lets borrowers refinance their student loans even if they didnt obtain a degree.

-

May qualify to remove co signer

-

Loyalty discount

-

Cant be in school to qualify

-

Loans must be in repayment

If you didn’t graduate from school, you’d struggle to find a lender willing to work with you on refinancing your loan. Citizens Bank is one of the few national lenders that allows borrowers to refinance without a degree.

Citizens Bank offers borrowers some other useful perks:

- Loyalty Discount: If you have another account with Citizens Bank, such as a checking or savings account, you can qualify for a 0.25% reduction on your interest rate.

- Automatic Payment Discount: Sign up for automatic payments and get another 0.25% off your interest rate.

- Cosigner Release: After making 36 consecutive, on-time payments, you may qualify to have your cosigner removed from your loan.

You must refinance a minimum of $10,000, and repayment terms include 5, 7, 10, 15, and 20 years. There are no application or origination fees. Citizens Bank offers the following interest rates :

- Variable: 2.24% to 9.24%

- Fixed: 4.29% to 9.74%

To qualify for refinancing a student loan with Citizens Bank, you must not be currently in school, and your loans must be in repayment. If you didn’t graduate, you need to have made 12 on-time, consecutive payments on your loans before you apply for refinancing.

Read the full review: Citizens Bank Student Loans

Student Loan News Updates

The student loan landscape has been changing in recent months, driven by the coronavirus pandemic and forgiveness policies implemented by the Biden administration. Some current student loans trends to be aware of include:

- Federal student loans are in administrative forbearance: President Biden extended the forbearance period for federal loans through Aug. 31, 2022. Federal student loan payments are not required, and interest charges and collections activities are paused.

- Borrowers with defaulted FFEL student loans are in forbearance: While FFEL student loans were originally not included in administrative forbearance, borrowers with defaulted FFEL student loans can now benefit from coronavirus relief.

- Federal student loan interest rates will be higher in 2022-23: Federal student loans for the upcoming school year are 1.26 percentage points higher than they were for 2021-22. Borrowers who take out loans after June 30, 2022, will be subject to these higher rates.

- Public Service Loan Forgiveness is undergoing an overhaul: An revision to what constitutes a “qualifying payment” toward PSLF has resulted in thousands of borrowers gaining progress toward loan forgiveness. Borrowers who apply for PSLF through Oct. 31, 2022, can benefit from this temporary waiver.

- Student loan forgiveness is now tax-free: The $1.9 trillion stimulus package passed in March 2021 also known as the American Rescue Plan made student loan forgiveness tax-free through 2025.

Also Check: How To Reduce Car Loan Payments

How To Prepare For Refinancing Student Loans In 2022

If you havent yet considered refinancing your student loans, youre losing out on a major opportunity to save money. Interest rates hit rock bottom in mid-2021. Theyve gone up since then but only marginally. Right now, interest rates are at near-record lows, making it the perfect time to prepare for refinancing your student loans.

Youre Looking For An Opportunity To Pay Off Your Loan Faster Or Lower Your Monthly Payment

A new loan with a lower interest rate can decrease your monthly payment and/or allow you to pay off the loan faster. If you’re looking for more money in your budget today, you can refinance your student loans for a longer period of time spreading out your payments can help you reduce your monthly bill.

Don’t Miss: How To Get Approved For Investment Property Loan

How To Request A Refund For Student Loan Payments

To request a refund of student loan payments that you made during the pandemic, you must contact your loan servicer. If you arent sure who your loan servicer isand it may have changed in the last two yearsyou can sign into your account dashboard on the Federal Student Aid site to find out. Or, you can call the Federal Student Aid Information Center at 1-800-433-3243.

Once you know who your loan servicer is, call the company directly. Below are the phone numbers for each of the federal loan servicers:

- FedLoan Servicing: 1-800-699-2908

- Great Lakes Educational Loan Services: 1-800-236-4300

- Edfinancial: 1-855-337-6884

- ECSI: 1-866-313-3797

- Default Resolution Group: 1-800-621-3115

Be prepared to give the customer service representative your account number and a list of what payments you want refunded. If possible, include transaction numbers for each one and dates when the payments were made.

Expect long wait times, as many borrowers are calling their servicers to find out about the new loan forgiveness programs and to ask for a refund of their payments.

Note that after your payments are refunded, most borrowers will still have to submit a separate application to receive loan forgiveness.

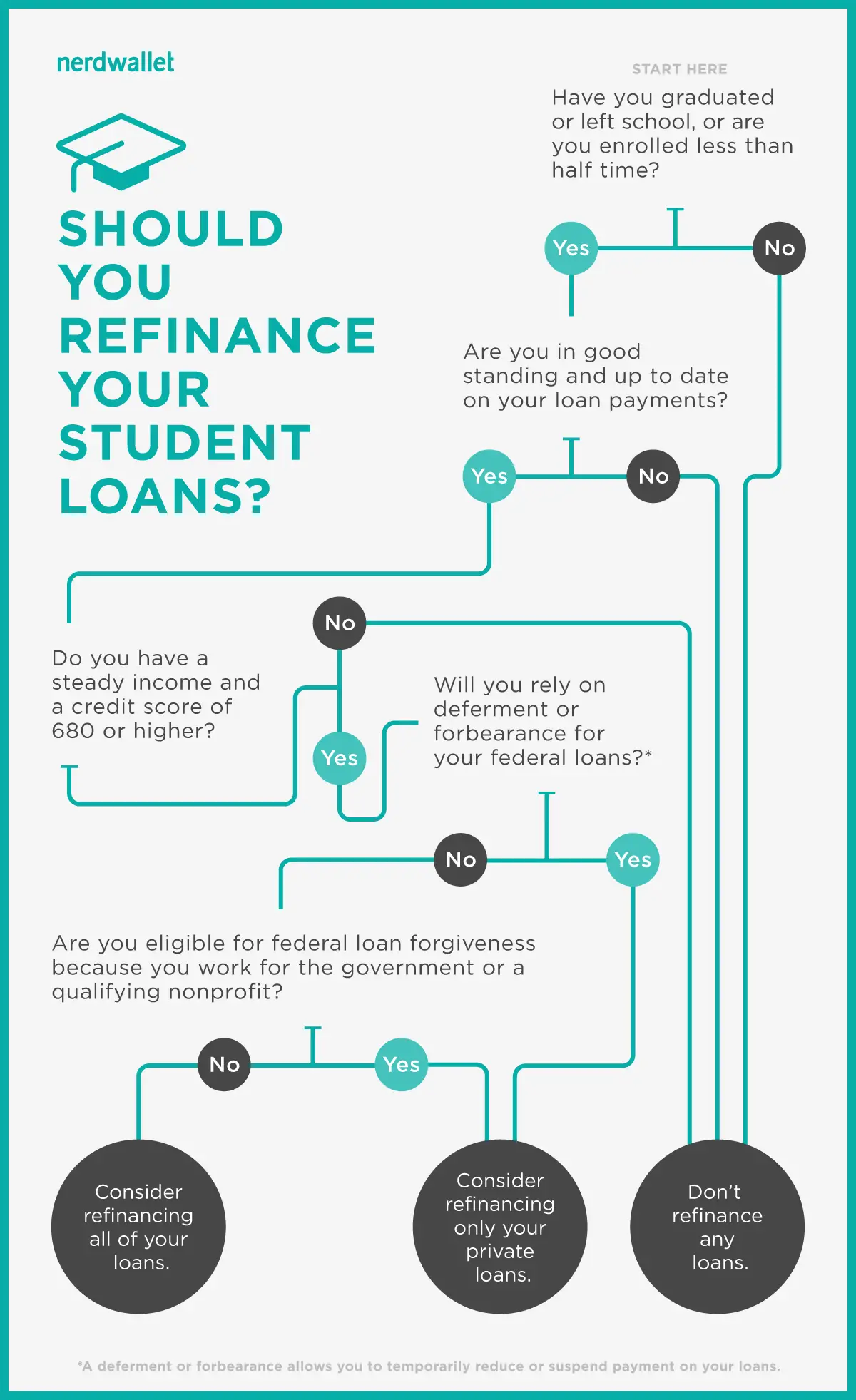

When Should You Refinance Student Loans

Lenders generally require you to complete your degree before refinancing. Though its possible to find a lender without this requirement, in most cases, youll want to wait to refinance until after youve graduated.

Keep in mind that youll need a good or excellent credit score to get the lowest interest rates.

Using a co-signer is one option for those who dont have strong enough credit or income to qualify for a refinance loan. Alternatively, you could wait until your credit and income are stronger. If you decide to use a co-signer, make sure theyre aware that theyll be responsible for payments if youre not able to for some reason. The loan will also appear on their credit report.

Its important to make sure youll save enough money when refinancing. While many borrowers with solid credit scores could benefit from refinancing at todays interest rates, those with poorer credit wont receive the lowest rates available.

Do the math to see if refinancing will benefit your situation. Shop around for rates and then calculate what you could save.

Read Also: What Is An Agency Loan

Does Refinancing Student Loans Save Money

Our student loan refinancing calculator allows you to see what you could save by refinancing your student loans with ELFI. Input your current student loan debt, monthly payment, and your interest rate or term length, and our calculator will automatically generate estimates based on the information you entered. You can see estimates for both fixed and variable rate loans, as well as term lengths of 5, 7, 10, 15, or 20 years.*

*The calculated monthly payments and savings are estimated based on the loan information you entered and the loan term you selected. Your actual payments will depend on the exact amount of your loan balance, and specific rates are subject to approval. ELFI variable rate loans are based on either the three-month LIBOR or the Prime Rate of Interest and may change monthly. Changes in the LIBOR or Prime Rate of Interest may cause your monthly payment to increase. Although the interest rate will vary after you are approved, the interest rate will never exceed 9.95% APR.

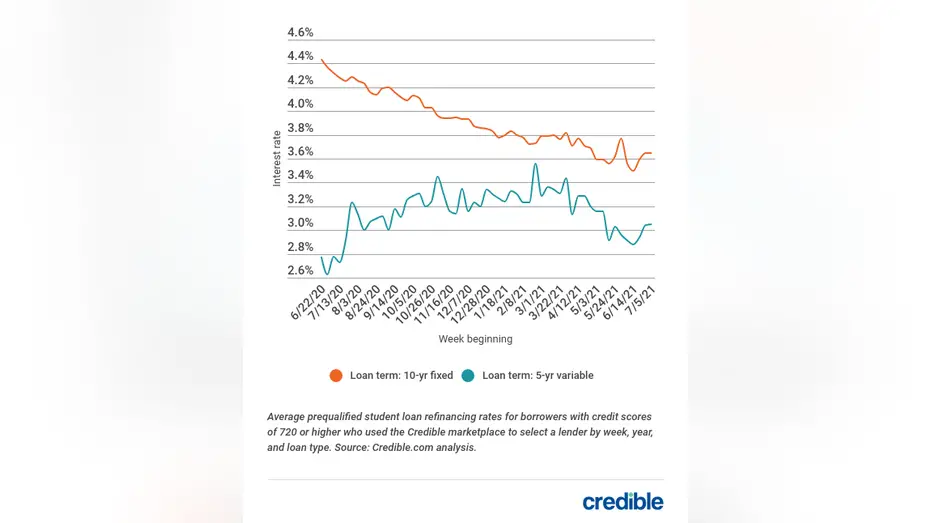

The Latest Rates For Those Looking To Refinance Their Student Loans

- Email icon

The latest student loan refi rates

To refinance your student loan to a 10-year fixed-rate loan, average rates are 5.68%, down from 5.80% a week prior. Meanwhile 5-year variable-rate loans rates ticked up a bit to hit 3.73%, according to data from personal finance company Credible for those who prequalified on their student loan marketplace for the week ending August 28. For those with credit scores of 720 and above, rates were 5.43% for 10-year fixed loans and 3.63% for 5-year variable loans.

Even though theres a repayment pause on federal loans in effect until January 2023 and certain borrowers are eligible for up to $20,000 in debt cancellation, todays low rates on student loans have many borrowers interested in refinancing. For those with private student loans, that could make sense, but for those with federal loans, it likely makes less sense. Heres why.

If, however, you have private student loans, the decision to refinance assuming you can get better rates and terms is an easier one. If youre planning to refinance a private student loan because your credit score has improved or your finances have changed and youre able to get a more attractive interest rate or shorten your loan term, youre likely to benefit from a refinance.

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.

You May Like: Auto Loan Calculator With Credit Score

How Much Could I Save By Refinancing My Student Loan

The answer to this question will depend on a few factors including the interest rate and loan term that youre offered, as well as your current interest rate and term. As an example, lets take a look at how much Kendall, a recent graduate from university, could stand to save by refinancing her $40,000 student loan with a lower interest rate and a shorter loan term.

Current loan

Remaining loan term: 15 years

New loan

New loan term: 10 years

| Original loan | |

|---|---|

| 10 years | 5 years |

How Do You Refinance Student Loans

To refinance your student loans, apply for a loan from a private lender for the amount of your existing debt. Once approved, you can use the loan to pay off your old loans. You can refinance both federal and private student loans, consolidating them together. After that, you’ll have just one loan to manage, with only one monthly payment to remember.

Read Also: Should You Refinance Car Loan

Adjusting Your Loan Terms

When you refinance your student loans, you can choose a different repayment term that matches your goals. You could choose a loan term of 5, 7, 10, 15, or even 20 years. Choosing a longer repayment term may reduce your monthly payments, while a shorter repayment term may help you pay off your debt faster and save you money in interest over your loan term. For instance, if a borrower has already paid five years of a ten-year repayment term, he or she may be able to refinance the outstanding amount to ten or fifteen more years, thereby lowering their monthly payment amount.

Refinancing your student loans and paying a lower monthly payment could decrease your debt-to-income ratio which may make it easier to qualify for a mortgage or other large purchase. Borrowers should, however, avoid the temptation to extend the term too much, as longer terms generally increase the overall cost of the loan.

See how much you could save by refinancing with ELFI with our student loan refinancing calculator. Keep in mind that shorter repayment terms are typically associated with lower interest rates and longer repayment terms are typically associated with higher interest rates. Learn how you can weigh your options by choosing the right student loan repayment terms.

Should I Refinance Or Consolidate My Loans

You should consider refinancing if your finances are stable and youre able to qualify . Refinancing is best for borrowers who are looking to lower their interest rate, restructure their debt or combine multiple loans into one. Since refinancing is typically done through a private institution, you should only refinance federal loans if you dont need federal repayment plans or programs.

If youre looking to combine several federal student loans into one loan, consider direct loan consolidation. This federal option helps you simplify repayment, and apply for a new repayment plan, but it wont result in a lower interest rate. Also check out direct loan consolidation if you want to combine your federal loans while maintaining access to federal repayment plans.

Read Also: Bad Credit Online Loans Guaranteed Approval

Sofi Student Loan Refinance Review For 2022

SoFi Review: Saving thousands of dollars on your student loan debt seems ideal, and that’s just what SoFi promises. Is it legit, though?

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. You help support Smarts by using our links.

|

|

|

|

- 0.25% APR discount with autopay

- No hard credit pull required

Pros:Pros:

- 0.25% rate discount with AutoPay

- Graduate, Parent PLUS, private loans

Saving thousands of dollars on your student loan debt seems ideal, and thats just what SoFi promises. Is it legit, though?

SoFi is a modern finance company. They partner with members to offer great service and low rates for student loan refinancing, mortgages and personal loans.

But if it the right student loan refinancing company for you?

Lets find out, together in our SoFi review.

Should I Consider Student Loan Consolidation

Managing one student loan payment instead of managing multiple is often an enticing option for people – and thats essentially what youre getting when you consolidate.

Youre taking your total loan amount and consolidating it into a single loan. You can create a direct consolidation plan pretty easily with all of your federal loans.

For private student loans, this is usually a consideration when refinancing with a private lender – and many lenders will offer consolidation as an option when you apply to refinance your student loans.

Consolidating your loans results in savings because it can lower the aggregate interest rate of your student loans when combining them all into one.

Don’t Miss: How Long It Takes For Home Loan Approval

What Is Student Loan Refinancing

Refinancing student loans allow you to do a few things. If you have multiple loans, you can combine them into one brand new loan making it more convenient to stay on top of personal finances. Youll also sometimes have the opportunity to release cosigners on your existing loans eliminating them from any liability for your loans. But probably most exciting is the opportunity to save money. With a student loan refinance, you are replacing all of your existing student loans with a new loan with new terms. By qualifying for a lower interest rate or reducing the payback period of the new loan, you could save thousands in interest over the life of the loan.

What Is The Credit Score Needed To Refinance Student Loans

The minimum credit score needed to refinance student loans varies by lender, but as a general rule of thumb, youll likely need a score of about 650 to qualify. However, to get the best interest rates available, a credit score of roughly 720 or higher is a common benchmark.

If your credit is lower, consider waiting to refinance until you can increase your credit score.

Recommended Reading: How To Check If Loan Is Fannie Or Freddie

Can I Refinance My Student Loan With Bad Credit

It is possible to refinance your loan if you have bad credit, though the process will be more difficult. Most lenders require a credit score in the mid-600s, and even if you do qualify, you’ll likely see higher interest rates. If this is the case, refinancing ultimately may not be worth it. Before applying for a student loan refinance, check your credit score to know where you stand and compare that against lenders’ listed credit requirements.

Am I Eligible For Student Loan Refinancing

You can refinance one or more federal and/or private student loans, but you must meet a lenders requirements for credit and income. Most lenders look for a of 650 or higher, along with a steady source of income or an offer of employment. If you cant meet these criteria on your own, you could qualify by applying with a creditworthy cosigner, such as a parent.

Along with your credit score and annual income, some lenders also look at your savings and debt-to-income ratio. Finally, some lenders require proof of graduation, as theyll only approve borrowers who have obtained their degree. If you left school before graduating, there are relatively few student loan refinance providers that will work with you.

Also Check: What Does Loan Discount Points Mean