Maximum Fha Loan Amount For California

FHA loans are originated by mortgage lenders operating within the private sector. But they are insured by the government, through the Federal Housing Administration. This agency falls under the Department of Housing and Urban Development, or HUD. So it is HUD that determines the maximum FHA loan amount for California and all other states.

As mentioned earlier, maximum FHA loan size in California can change from one year to the next due to rising home prices. They can also vary by county because they are based on median home values.

In 2021, the max FHA loan amount in California ranges from $356,362 to $822,375 for a single-family home. It varies depending on the county where the home is being purchased. Generally speaking, more expensive counties have a higher maximum FHA loan size. The more affordable counties have lower limits.

California is a fairly extensive state, from a home-buying perspective. As result, quite a few counties in the state have the absolute maximum FHA loan size.

The following 10 counties have a single-family FHA limit of $822,375 in 2021:

- Alameda

- Santa Clara

- Santa Cruz

As you can see, most of the San Francisco Bay Area and Southern California have a maximum FHA loan size of $822,375. Again, that is for a single-family home purchased in 2021. Multifamily properties like duplex or triplex units have even higher limits.

In other counties across the state, the max FHA loan amount starts at $356,362 and goes up from there.

Fha Loan Closing Costs Faqs

FHA loan closing costs be included in the loan?

You can include the FHA upfront mortgage insurance fee of 1.75% in your loan if you dont want to pay it at closing. Other costs cannot be financed, such as your prepaid property taxes, homeowners insurance, and daily interest charge.If youre worried about being able to afford your closing costs on an FHA loan, you can use gift funds or closing cost assistance to cover those expenses.

What are the typical FHA closing costs?

Closing costs usually total between 2-5% of the loan, on the higher end of that range for less expensive homes and lower percentages on high-cost homes. On a $200,000 loan, your closing costs might be around $6,000 , and on a $400,000 home, perhaps around $8,000 . Your upfront costs will vary based on your lender and where you live. Lender fees are different company to company. Additionally, local property taxes can significantly affect the amount of money youll need to close. You need to prepay around 6 months of taxes when you buy a home. So if taxes are $150 per month, prepaid taxes are not as big a deal as if the homes property taxes are $700 per month. FHA loans also carry an upfront mortgage insurance fee of 1.75% of the loan, though this can be rolled into your mortgage.

What is the maximum closing costs on an FHA loan?

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE:;Facts about FHA home loans

Read Also: How To Make Personal Loan Agreement

How To Lower Your Fha Closing Costs

FHA loans are often among the most affordable home loan options because of the low down payment requirement and competitive interest rates.

But every dollar counts when youre buying a home, especially if youre a first-time homebuyer.

Here are three ways to reduce your out-of-pocket expenses:

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: Is Homeowners Insurance Included In Fha Loan

Dti Limits For Fha Loans: 31% / 43%

According to official FHA guidelines, borrowers are generally limited to having debt ratios of 31% on the front end, and 43% on the back end.

But the back-end ratio can be as high as 50% for certain borrowers, particularly those with good credit and other “compensating factors.” See the table below for a breakdown of debt-to-income, credit scores, and compensating factors.

Those are the current FHA DTI ratio limits for 2021. We expect these requirements to remain in place throughout the year, since HUD has not announced any changes to them. If they do update their debt ratio guidelines in 2022, we will update this page to reflect those changes.

What Down Payment Is Required For Fha Loan

For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly.

Contents

Read Also: What Is The Cheapest Student Loan Repayment Plan

What Are The Differences Between An Fha Loan And A Conventional Loan

It’s easier to qualify for an FHA loan than for a conventional loan, which is a mortgage that isn’t insured or guaranteed by the federal government.

-

FHA loans allow for lower credit scores than conventional loans and, in some cases, lower monthly mortgage insurance payments.

-

FHA rules are more liberal regarding gifts of down payment money from family, employers or charitable organizations.

-

FHA loans may involve closing costs;that aren’t required by conventional loans.

» MORE:;Details on FHA vs. conventional loans

How To Calculate Your Dti

Now that you know the figures, its time to figure out your DTI.

The front-end debt ratio is simply your housing payment divided by your gross monthly income. Heres an example:

- Mortgage Payment $1,000

- Mortgage insurance $50

Total monthly housing payment equals $1,650

Gross monthly income equals $5000

Front-end DTI equals $1,650/$6,250 = 26%

Taking it one step further, lets look at the monthly debts:

- Auto loan $250

Total monthly expenses with housing equals $2,155

The back-end debt ratio equals $2,155/$6,250 = 34%

These ratios fall within the FHAs guidelines.

Also Check: Can Closing Costs Be Included In Refinance Loan

How To Qualify For An Fha Loan

You’ll need to satisfy a number of requirements to qualify for an FHA loan. It’s important to note that these are the FHA’s minimum requirements and lenders may have additional stipulations. To make sure you get the best FHA mortgage rate and loan terms, shop more than one FHA-approved lender and compare offers.

It’s important to note that lenders may have additional stipulations.

Fhastreamline Refinance Loan Limits

One perk of having an FHA loan is that you can refinance using the FHA Streamline Refinance program.

The FHA Streamline is a low-doc loan that gives homeowners the ability torefinance without having to verify income, credit, or employment.

When you refinance via the FHA Streamline program, your new loanmust be within local FHA loan limits. But this will not be an issue.

Since the FHA Streamline can only be used on an existing FHA loan and no cash-out is allowed you wont be able to increase your loan balanceabove current FHA mortgage limits. ;

Other requirements for the FHA Streamline Refinance include:

- Youmust be making your current mortgage payments on time. The FHA wants to seethat your last 3 mortgage payments have been paid on time, and that youve beenlate on payments no more than one time in the last 12 months

- Yourcurrent FHA mortgage must be at least 6 months old. The FHA will verify thatyouve made at least six payments on your current mortgage before allowing youto use the;FHA Streamline Refinance program

- Theagency will verify that theres a benefit to your refinance. Known as the NetTangible Benefit clause, your combined rate must drop by at least 0.5%. Youcan achieve this portion of FHA eligibility by dropping your interest rate,mortgage insurance rate, or a combination of both

If you meet these guidelines, the FHA Streamline is a great way torefinance into todays ultra-low mortgage rates and lower your monthly payment.

Also Check: What Is The Lowest Car Loan Rate

Fha Loans And Credit Score

Loan applicants can have a credit score as low as 500, but HUD prohibits applicants from being denied based solely on a lack of credit history. So, even with zero credit, people are encouraged to apply.

Keep in mind these are guidelines from the FHA, and individual lenders can require a higher score. Applicants can boost their chances of approval by finding someone who specializes in FHA loans and offers manual underwriting.

S To Getting Approved For An Fha Loan

Step 1: Decide if an FHA loan is the right fit for you. The first step in the FHA process is determining whether this type of loan truly suits your needs. If youre having trouble qualifying for a conventional mortgage, either because of an imperfect credit score, high debt-to-income ratio, or limited down payment savings, an FHA loan might provide a feasible path to homeownership. Review the qualifications above to get a sense of whether you meet the minimum requirements for FHA borrowers, and then take a look at your credit score and savings to see what kinds of specific FHA lending options might be available to you.

Step 2: Choose which lender you want to work with. Keep in mind that there are more conventional loan lenders than approved FHA loan lenders, so you may need to do some research before finding one. Better Mortgage offers both options and our FHA loans are available in all 50 states. As a digital lender, weve eliminated unnecessary processing, origination, and commission fees that can drive up the cost of working with traditional lenders. On top of that, our online tools make it easy to instantly compare loan products and see detailed estimates to understand how different down payment amounts and interest rates impact the overall affordability of any mortgage. Note: if you apply for an FHA loan with Better, youll need a 620 minimum credit score.

Recommended Reading: What Happens To My Parent Plus Loan If I Die

What Are The Types Of Fha Loans

The FHA offers a variety of loan options, from fairly standard purchase loans to products designed to meet highly specific needs. Here’s an overview of FHA loans commonly used to buy a house:

» MORE:;Learn more about FHA 203 loans and Title I loans

|

FHA Loan Type |

|

|---|---|

|

Can be used to make improvements that make the home more energy-efficient. |

The home must be professionally assessed to qualify. Improvements must be deemed cost-effective. |

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

Read Also: What Kind Of Loan Do I Need To Buy Land

Overview Of 2021 Fha Loan Limits

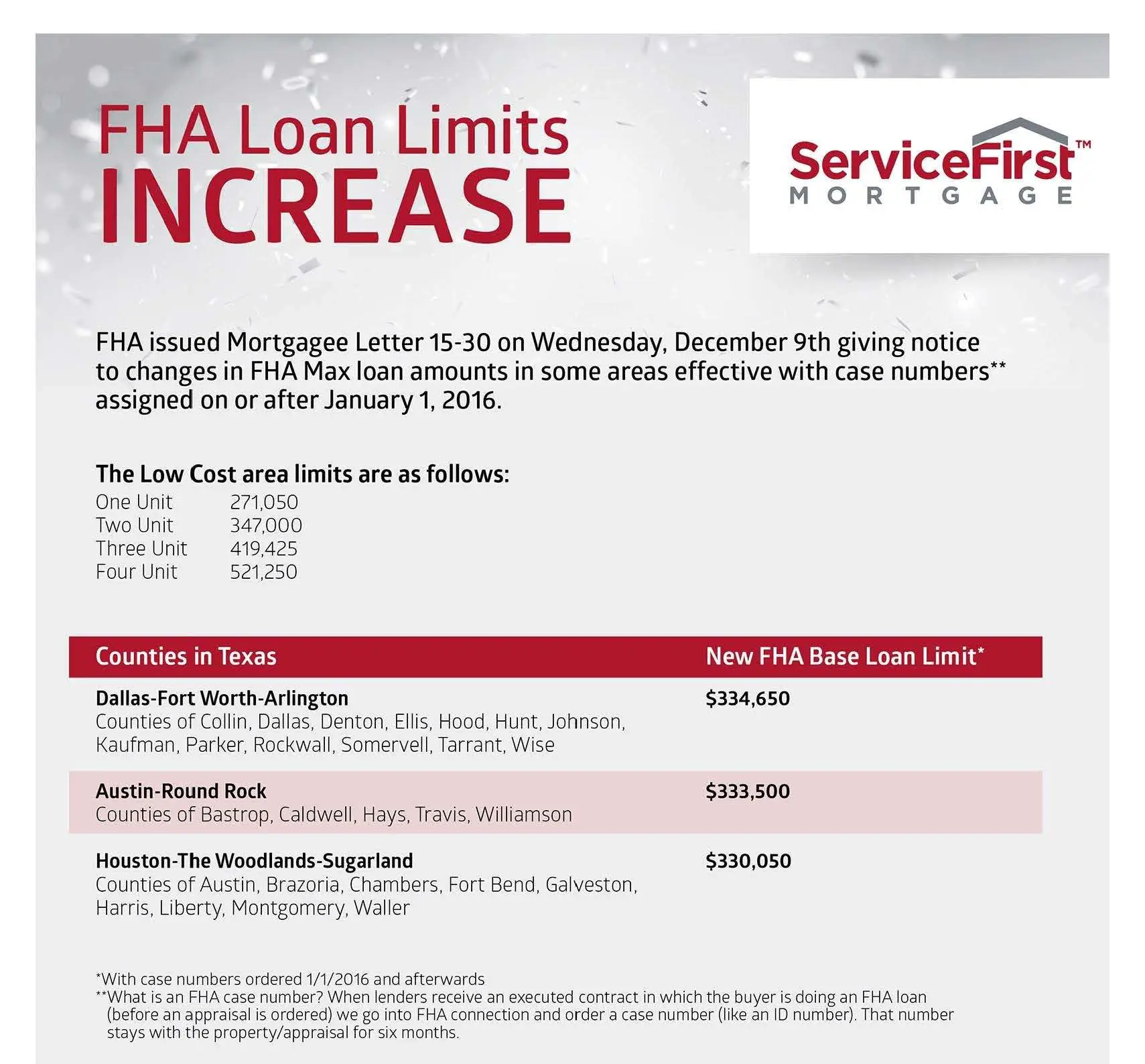

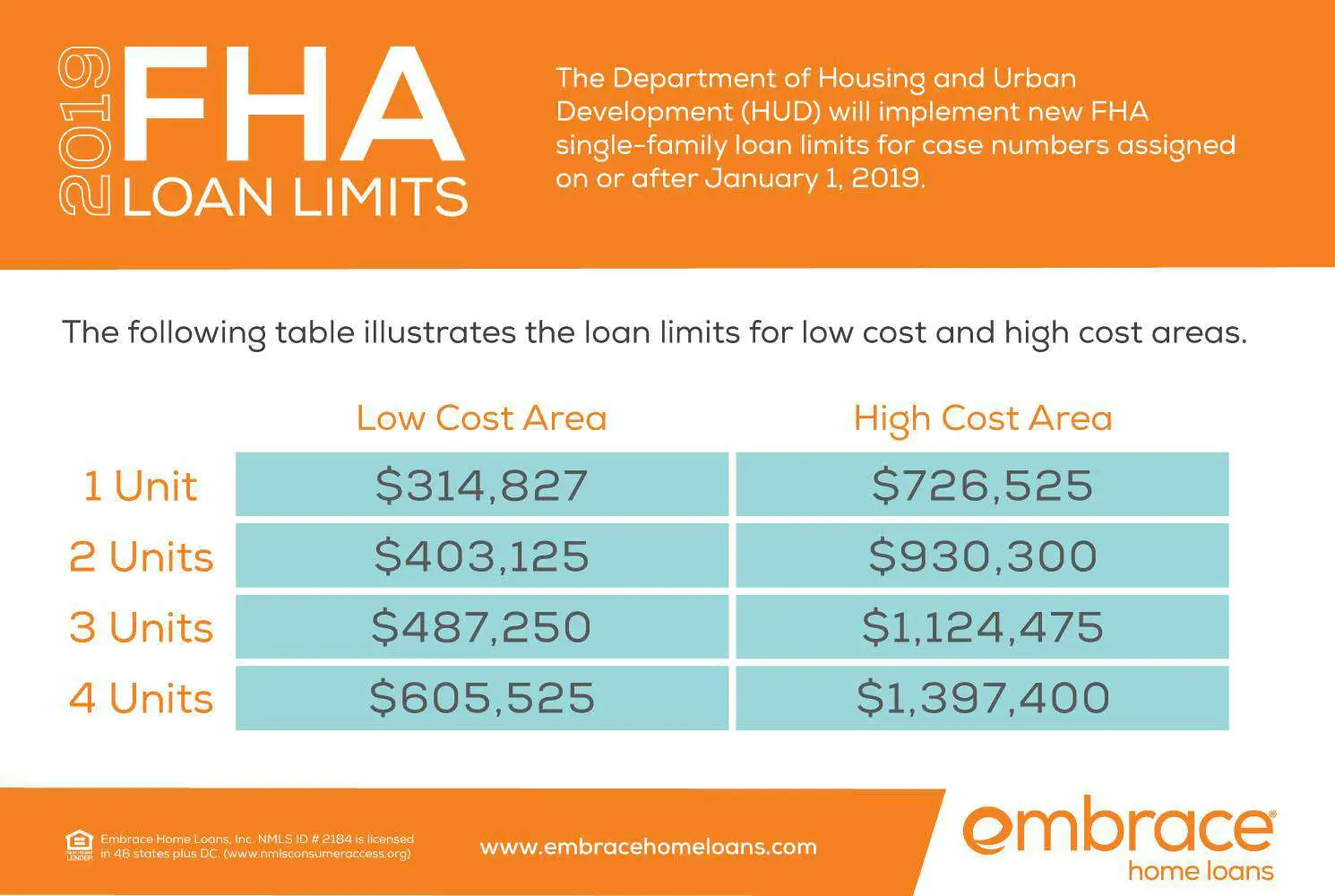

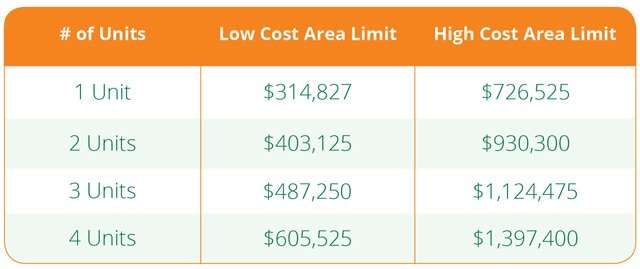

Below you will find the 2021 FHA loan limits for low-cost areas, high-cost areas, and special exceptions for areas like Alaska and Hawaii with expensive construction costs.

Low-Cost AreasThe FHAs national low-cost area mortgage limits for 2021 are set at 65% of the national conforming limit of $510,400 . Here are the specific amounts for this category, by property type:

- One-unit: $356,362

- Four-unit: $2,372,625

Fha Limited 203 Loan Limits

A second form of FHA loan, a limited 203 mortgage, can be used to make repairs, renovations or upgrades to a residence. A 203 loan can even be used to make improvements prior to the sale of a residence.;

Borrowers seeking limited 203 loans cannot ask for more than $35,000, and any upgrades cannot require any type of extensive architectural or engineering work. To obtain a limited 203 loan, a borrower must have a credit score of at least 620 and repairs must typically be completed within six months, although it is possible to ask for a deadline extension.;

A limited 203 loan can be used to pay for the following repairs or updates:;

- Removal of potential health or safety hazards

- Replacement of gutters or roofing

- Removal and installation of new floors

- New landscaping, such as a garden

- Upgrades to the plumbing system

- Updates to the homes appearance, both external and internal

- Upgrades to functional aspects of the home, such as air conditioning

- Alterations to the internal and external structure of the residence

Don’t Miss: Does Home Loan Include Furniture

What Does Fha Stand For

FHA stands for Federal Housing Administration, and the FHA is a government agency that insures mortgages. It was created just after the Great Depression, at a time when homeownership was prohibitively expensive and difficult to achieve because so many Americans lacked the savings and credit history to qualify for a loan. The government stepped in and began backing mortgages with more accessible terms. Approved lenders began funding FHA loans, which offered more reasonable down payment and credit score standards.

Today, government-backed mortgages still offer a safety net to lendersbecause a federal entity is guaranteeing the loans, theres less financial risk if a borrower defaults on their payments. Lenders are then able to loosen their qualifying guidelines, making mortgages available to middle and low income borrowers who might not otherwise be approved under conventional standards.

What Is The Fha Waiting Period For Borrowers With Previous Bankruptcy

Bankruptcy does not automatically disqualify a borrower from obtaining an FHA loan.; Minimum 2 years since discharge of chapter 7 bankruptcy.; Borrower with less than 2 years discharge may qualify for financing so long as they meet the extenuating circumstances as defined by FHA/HUD.; Same rule applies for borrower with chapter 13 bankruptcy.

However, borrower with chapter 13 bankruptcy may still qualify if the bankruptcy has been discharged less than 2 years if the lender is willing to do a manual underwrite with satisfactory payment history under the chapter 13 plan.

Also Check: What Size Mortgage Loan Can I Qualify For

Current Fha Loan Limits

As of 2020, the FHA loan limit is $331,760 in most parts of the U.S., and $765,600 in high-cost areas. High-cost areas include Los Angeles, New York, Hawaii, Alaska, Guam, and San Francisco. These loan limits are based on increases in home prices, and the FHA reviews its loan limits most years, although limits may remain unchanged from year-to-year. FHA loan limits have four tiers, based on property type.

Va Loan Limits: No Maximum Loan Amounts In 2021

If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers, and others with their full entitlements, can borrow as much as lenders are willing to approve.

So the size of your VA loan now depends more on your financial credentials than on the local housing market.

VA loan limits still come into play for homebuyers who currently have VA loans and have partial entitlement available.

If youre a qualifying veteran, active-duty military servicemember, or an eligible surviving military spouse, now may be a great time to buy, with a shot at a 0% down mortgage and no loan limit on the type of home you can buy.

Don’t Miss: How Much Business Loan Can I Get