Apply And Wait For A Decision

How long it takes: One to two days to apply up to 60 days for the decision

Youll also be officially applying for the mortgage loan and waiting for a decision. Getting everything together and applying can take one or two days, since these are complicated applications. The decision can take a while, including up to 60 days, depending on other factors.

How Long Does Mortgage Underwriting Take

Each situation is different, but underwriting can take anywhere from a few days to several weeks. Missing signatures or documents, and issues with the appraisal or title insurance are some of the things that can hold up the process. Be very responsive to requests for information, and if you need more time to gather requested documents, continue to communicate status with your mortgage loan officer.

Wait For The Appraisal And Title Search

If your offer is accepted, the lender will order an appraisal of the property. The appraisal helps determine the fair market value of a home and ensures the mortgage amount does not exceed the home’s value. It’s designed primarily to protect the lender, but it can also protect you from overspending on a house.

If the appraisal comes in for less than the asking price, you may need to search for an alternative property. Typically, the lender will not approve a home loan that exceeds the appraisal value. If the home has an asking price of $300,000, for instance, and appraises for $270,000, you would be responsible for making up the $30,000 difference. Sometimes, if a home appraisal comes in low, the seller will lower the asking price. Just be aware that you may have to walk away from a home that doesn’t appraise as expected.

If the appraisal is in line with your offer and the loan amount, the lender will authorize a title search. The title company researches the property’s history and ensures no claims exist on the property, such as a current mortgage or lien, pending legal action, restrictions or unpaid taxes. After the search, the title company issues a title insurance policy guaranteeing the search accuracy. Two title policies may be issued: one to protect the lender and sometimes, a separate policy to protect the buyer.

You May Like: How Long Does Sba Loan Approval Take

What Is The Underwriting Process Of A Mortgage

Mortgage underwriting is the process during your mortgage application where the underwriters check what level of financial risk your lender would be taking by agreeing to give you a mortgage.

Professional underwriters use a series of checks to decide how likely it is that you will default on the mortgage loan youve applied for. If they think theres a big risk you might not repay the mortgage in accordance with the agreement, then your mortgage application could be declined.

An experienced mortgage advisor, like those we work with, can answer all your mortgage-related questions, including the underwriting stage and help with your application to ensure you apply for the right loan and can give all the required details for it.

Its important to always give the correct information as the mortgage underwriting process compares all the answers on your application to your financial history and any discrepancies could mean they wont approve your mortgage.

The Underwriter Will Make An Informed Decision

The underwriter has the option to either approve, deny or pend your mortgage loan application.

- Approved: You may get a clear to close right away. If so, it means theres nothing more you need to provide. You and the lender can schedule your closing. However, if your approval comes with conditions, youll need to provide something more, such as a signature, tax forms or prior pay stubs. The process may take a little longer, but nothing to worry about if youre prompt in responding to any requests.

- Denied: If an underwriter denies your mortgage application, youll need to understand why before deciding on next steps. There are many reasons for the denial of an application. Having too much debt, a low or not being eligible for a particular loan type are some examples. Once you know the reason for the decision you can take steps to address the issue.

- If you dont provide enough information for the underwriter to do a thorough evaluation, they may suspend your application. For example, if they can’t verify your employment or income. It doesnt mean you cant get the loan, but youll need to provide further documentation for them to decide.

Read Also: How Far Back Do Underwriters Look At Bank Statements

Submit For Clear To Close

Your Processor will submit the file back underwriting for the final loan approval once all conditions have been procured. The Underwriter typically reviews conditions within 24 to 48 hours.

Assuming the submitted paperwork satisfies all the conditions the Underwriter will issue the Clear to Clear or CTC.

Please note: there is a small chance that more paperwork may be required from you if the submitted conditions raise additional questions.

What Happens When A Uk Mortgage Goes To The Underwriting Stage

When your mortgage application goes into the underwriting stage in the UK, the underwriters use a variety of sources of information to assess your attitude to credit, repayments and lifestyle.

Underwriters will assess your creditworthiness and the degree of potential risk involved in the agreement based on information from, bank statements, your financial history and your mortgage application form.

Recommended Reading: Does A Loan Processor Have To Be Licensed In California

A Clear Understanding Of The Mortgage Application And Approval Process Can Help You Move Forward And Make Decisions With Confidence

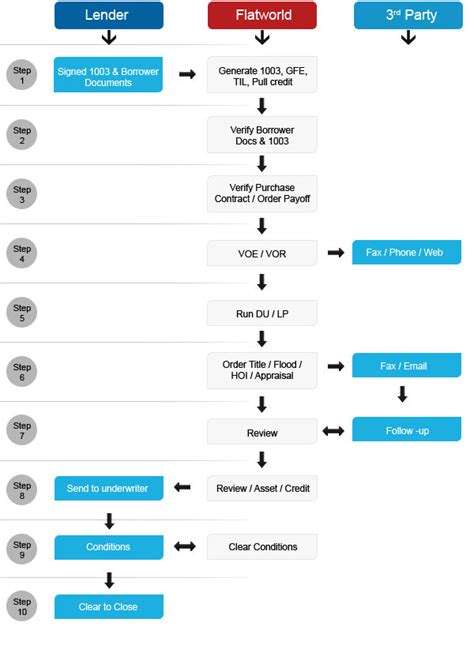

The process of successfully obtaining mortgage financing can be broken down into 7 steps which we divide into 3 distinct stages. The first stage is to have an initial assessment discussion with a trusted mortgage broker to diagnose your situation and determine the best course of action. The second stage is the pre-approval in which a formal application with supporting documents is submitted and reviewed. Finally, in the approval stage, financing is formally requested and the details of the mortgage contract are finalized.

Each step is explained individually below.

Our mortgage application and approval process is an organized and sequential procedure that helps you progress towards your goals with confidence and clarity. A plan helps you define the scope of your objective and anticipate commonly encountered pitfalls. How long the mortgage approval process takes depends on how busy lenders are and how quickly you can provide the requested documents. We use checklists and diligent communication to keep things moving along. The approximate number of business days to complete each step are shown in brackets.

How Strict Is Mortgage Underwriting

In 2020, 9.3 percent of applications for a home purchase loan were denied, according to Home Mortgage Disclosure Act data.

For the most part, mortgage lenders follow specific standards for the loans they originate.

For conventional loans, lenders adhere to Fannie Mae and Freddie Mac standards, because if a loan meets those requirements, the lender can sell it on the secondary market and use that capital to create more mortgages for more borrowers. For an FHA, VA or USDA loan, lenders follow the guidelines of the Federal Housing Administration, Department of Veterans Affairs and Department of Agriculture, which guarantee or insure those types of loans if the borrower defaults.

Lenders also have to account for the business of making mortgages they cant take on more risk than what their operation supports. So, in addition to baseline loan standards, lenders can impose additional requirements, known as overlays.

Sometimes, lenders implement stricter protocols in response to economic volatility. Throughout the pandemic, for example, many lenders began requiring higher credit scores and larger down payments.

That said, some lenders can be flexible, such as allowing a borrower to qualify based on assets instead of income.

Also Check: Usaa Used Car Loan

Loan Is Submitted To Underwriting

The Underwriter begins the loan underwriting process, reviewing all documentation to determine whether you qualify for a mortgage.

While the Loan Officer and Mortgage Consultant will do their best to submit a complete file during loan underwriting, an Underwriter may still have questions and/or require additional documentation to satisfy any conditions for a final approval.

In addition to the loan file submitted by processing, the Underwriter examines:

- The completed appraisal

- Other ancillary documentation pertinent to the loan

If the loan is approved, the borrower receives a list of conditions required to be met before receiving final approval and notification of Clear to Close.

Next step: The Loan Coordinator provides you with underwriting’s preliminary decision on the loan.

Mortgage Guide: What’s The Average Time To Close On A House

See Mortgage Rate Quotes for Your Home

The average amount of time it takes for homebuyers in the United States to close on their home purchases is 47 days across all loan types, according to leading mortgage software company Ellie Mae. In general, purchase loans take longer to close than refinance loans by an average of 12 days. Learn more about the purchase process, time spent at each stage and tips for keeping your closing on track below.

Don’t Miss: Does Advance Auto Rent Tools

The Mortgage Approval Process

Your Employment Status Recently Changed

Lenders like to see financial stability. When youre getting a steady paycheck, youre more apt to make your monthly payment. If you lost your job recently, a lender may question whether you can afford a mortgage right now.

And a new job can come with a lot of uncertainty you might hate it and quit, or you could get fired. Maybe you accept a job with a lower salary, which can also affect your loan approval.

If youre switching from a job in the same field and with equal or greater pay, this typically wont be an issue. If thats not the case, you can prevent this from being an issue by staying at your current job until after you close or by waiting to apply for a mortgage until youve been at your new job for at least a few months. If you cant do either and want to get a mortgage with a new job, just make sure youre transparent with your lender and in communication with them on this change. You may also provide additional documentation to help, including your offer letter and Verification of Employment from your employer.

Read Also: Stilt Loan

Completing The Loan Application

Anytime you apply for a mortgage, you must complete a Uniform Loan Application. On this application, youll complete your personal identifying information as well as your financial information. This includes your income, assets, and debts. Youll also disclose your employment information. The lender then inputs this information into the computer program.

If you have a low credit score, high debt ratio, or unstable income, chances are the computer program will spit back a denial. Lenders often take the time to look at the issue at hand, though. They determine whether you would benefit from a manual underwrite or if you really arent eligible for a loan.

Choose A Digitized Mortgage Process

Choosing a mortgage lender who offers an online or digital mortgage process can also help speed up the process by leveraging technology to prepare documents and disclosures.

Digitized mortgage lenders can complete electronic signatures and even underwrite loan applications according to Fannie Mae or Freddie Mac guidelines. While theres no guarantee that other parts of the loan process will move as quickly, a commitment to boosting efficiency via technology can be a good indicator of a companys ability to close your loan quickly.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Also Check: Arvest Construction Loan

How Long Does Manual Underwriting For Home Loans Take

If your loan application and qualifying factors dont quite fit the mold of the standard loan applicant, you may find yourself dealing with manual underwriting. The good news is that you werent turned down for the loan. You were just told that the automated system cant approve your loan. With manual underwriting, an actual human being will go over every detail of your loan to see if you qualify for it.

So how long does this process take? As you probably guessed, it can vary by lender. Each underwriter works at a different pace and has a different size workload. It also depends on the complexity of your application. Do you have a lot of paperwork that needs sorting through? Or is your case pretty open and shut but the computer just couldnt recognize the validity of it? These factors will determine exactly how long it takes to go through manual underwriting.

In order to give you an idea of what to expect, we walk you through the process below.

What Does A Mortgage Underwriter Do

A mortgage underwriters job is to assess delinquency risk, meaning the overall risk that you will not be able to repay the mortgage. To do so, the underwriter evaluates factors that help the lender understand your financial situation, including:

- Your credit report

- The property you intend to buy

The underwriter then documents their assessments and weighs various elements of your loan application as a whole to decide whether the risk level is acceptable.

Heres an example from Fannie Maes underwriting guidelines. For a single-family home thats to serve as a primary residence, assume the lender typically requires the following:

- Maximum debt-to-income ratio of 36 percent

If a borrower falls short in one area, the loan might still be approved based on the strength of the other two factors, and/or factors such as:

- Whether you will occupy the property

- Amortization schedule

- Type of property and how many units it has

- Financial reserves or assets

So, if you had a higher DTI say 40 percent you might get approved for a mortgage as long as you have a better credit score. If your LTV ratio was lower than 97 percent, you might be able to get mortgage approval even with a lower credit score, like 620.

You May Like: One Main Financial Approval Odds

How Long Does Underwriting Take On Average

Overall, the average time to close on a mortgage the amount of time from when the lender receives your application to the time the loan is disbursed was 52 days in March 2021, according to Ellie Mae.

Conventional loans had the shortest turnaround times at 51 days, followed by FHA loans at 55 days and VA loans at 57 days.

This is how long the overall process takes, but what does this tell us about underwriting?

The bulk of the closing process is made up of the various steps your lender will take to ensure that youre creditworthy and that they arent taking on an unreasonable amount of risk with your loan. Much of this work happens during underwriting. If the underwriter encounters issues, this can delay your closing.

How long does this process typically take? Underwriting can take a few days to a few weeks before youll be cleared to close.

How long it will take for you depends on a lot of different factors, including the amount of applications your lender is currently processing, the lenders policies and procedures for underwriting and the complexity of your own financial situation. For those with more complicated financial histories, such as self-employed borrowers, the process may take a little more time than someone with a relatively clear-cut application.

What To Expect From The Underwriting Process

If youre applying for a home purchase or refinance loan, youve probably heard the term underwriting.

Mortgage underwriting is the process through which your lender verifies your eligibility for a home loan. The underwriter also ensures your property meets the loans standards.

Underwriters are the final decisionmakers as to whether or not your loan is approved. They follow a fairly strict protocol with little wiggle room. But delays can still happen at different stages in the process.

Heres what to expect during mortgage underwriting, and what to do if your loan approval is taking longer than expected.

You May Like: What Is The Average Interest Rate On A Commercial Loan

Problems With The Property

If youre looking to buy a fixer-upper, keep in mind that some lenders require property to meet certain standards in order to secure financing. Some loans, such as Federal Housing Administration loans, come with a set of specific property standards for safety, security and soundness that must be met to qualify. So if the inspection report for the home you have your eye on comes back with roofing or electrical issues, for instance, you may be denied a mortgage.

Getting Started With Underwriting

When you begin the underwriting process, youll probably be quizzed right off the bat about any large deposits in your checking or savings accounts or how much of your 401 plan is vested, especially if you’re planning on making a down payment of less than 20%. This is standard, so it’s nothing to be concerned about. Be quick with your answers and any additional information. It will get the process moving.

You May Like: Apply For Capital One Auto Loan