Consider Variable Interest Rate

Lenders will offer you the option of fixed or variable interest rates on your refinanced student loan. In most cases, variable interest rates are lower than the fixed rates. The rates may fluctuate depending on prevailing market conditions and yes, there is a risk that the rates may increase. But you can benefit from the lower rate if you are planning on paying off your loans quickly. Make sure you can afford the higher monthly payments if you choose this option. .

Student Debt Continues To Rise

Student debt continues to be an epidemic in our society. Since the 20072008 Great Recession, federal funding for public universities has decreased by 22%, while tuition costs have risen 27%. This has led to student loan debt that has surpassed $1.6 trillion. The debt may get worse if the education system is forced to undergo more budget cuts and more unemployed Americans take advantage of low interest rates to go back to school.

There is an origination fee of 1.057% for federal direct subsidized loans and direct unsubsidized loans, in addition to 4.228% for parent PLUS loans. This fee isnt added to your repayment rather, its deducted from your initial loan disbursement.

Private lenders set a range for interest rates. Your actual rate will be based on the of you and your cosigner. According to Bankrate, private student loan annual percentage rates are currently:

| Loan Type |

|---|

| 1.74% to 7.75% |

Use A Student Loan Calculator To Estimate Long

Unfortunately, some borrowers take out loans without having any idea what repayment will look like. Make sure you know exactly what to expect before signing any paperwork.

The math of compound interest is complicated, but fortunately you dont have to know how to calculate student loan interest with a pencil and paper. Use a student loan repayment calculator to compare long-term costs.

With a student loan repayment calculator, you can see an estimate on how much you pay each month to pay off your loan in a certain number of years.

With a $30,000 loan at 5.70% interest, for example, youd need to pay $329 per month to pay it off in 10 years. Want to see what it would take to pay off the loan even faster?

Enter a seven-year term instead of 10, and the calculator reveals your monthly payment would be $434. Plus, it shows youd pay $2,975 less in interest.

Play around with these online tools to gain a clear sense of the overall costs of your student loan.

Read Also: How To Ask For Student Loan Forgiveness

Will I Need A Co

If you have no income and either no credit or bad credit, youll need a co-signer to get a private student loan. Without bills in your name, such as a credit card, car loan or utility, you have no way to demonstrate that you can pay bills on time. Your co-signer will need to have a steady income as well as good to excellent credit scores, typically at least in the high 600s. Signing with a co-signer means theyre on the hook for your loan bill if you cant pay.

Some lenders offer loans exclusively for student borrowers that don’t take credit into consideration. Instead, these lenders look at the school youre attending as well as your income and career potential to determine the amount you can borrow and at what rate.

» MORE: How to get a student loan without co-signer

Get An Instant Rate Quote From Multiple Lenders

If youre a fan of online shopping, you know how to search different stores for the best deal. The same principle applies to finding private student loans with low interest rates.

All you have to do is prequalify for a rate from a lender. Youll fill out basic personal information, such as your name, school and the amount you wish to borrow. Some lenders might also ask how much you pay in rent or make each month, along with your Social Security number.

After you provide this information, the lender will give you an instant rate quote. It will say if you prequalify for approval, plus it will offer some fixed and variable interest rates.

Keep in mind that these interest rates represent preliminary offers. They wont be final until you submit an application and the lender runs a full credit check. But they offer a useful starting point for comparing your offers. You can see what rate you might get with each lender.

Note that this process applies to private student loans, not federal ones. To access federal student loans, all you have to do is submit the FAFSA.

But comparing all the rates will help you find private student loans with your lowest interest rates.

Also Check: Can I Use Personal Loan For Education

Current Student Loan Interest Rates

Depending on the kind of student loan you have or are looking to get, interest rates vary. About 90 percent of student loan debt is comprised of federal loans, with interest rates ranging from 4.99 percent to 7.54 percent. Average private student loan interest rates, on the other hand, can range from 3.22 percent to 13.95 percent fixed and 0.94 percent to 12.99 percent variable. While federal student loan rates are the same for every borrower, private student loan rates vary widely based on the lender, the type of interest rate and the borrower’s credit score.

Pick The Shortest Term You Can

Lenders typically offer a few options for the loans term, or the length of the repayment period. Generally, youll get the lowest interest rate by choosing the shortest loan term. Youll also save on interest because youll be paying interest for a shorter period of time. On the flip side, a shorter loan term means your monthly payments will be higher, so choose the shortest term you can comfortably manage.

About the author:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

You May Like: How Much Car Loan Can I Afford Based On Income

How To Find The Best Personal Loan With Low Interest

There are several steps you can take to get the best low interest personal loan for your needs.

Make yourself look like an ideal borrower

If you have a good credit score, a solid credit history of making on-time payments, a good job, and youve had a steady employment and housing situation for several years, these will all signal to the lender that youre a stable and reliable person who is less likely to default on payments.

Increase your credit score

You may want to improve your credit score first, especially if you have missed some recent payments, before applying for a personal loan if youre keen to score a low interest rate.

Pay down your debts

If you can, pay down your other debts before you apply for low interest loans to bring down your debt-to-income ratio. Lenders will want to take a look at how much monthly income you have and how much monthly debt payments you have.

Get a copy of your credit report and fix any errors

You may have errors on your credit report that are bringing down your credit score. You can correct these errors by ordering a free copy of your report from Equifax or TransUnion and filing a dispute. The process will take several weeks, but it can improve your credit score.

Consider a secured loan

Getting a secured loan offsets the risk for the lender and can help you qualify for a lower rate. But make sure you can manage the repayments.

Ask about collateral

Look into relationship discounts

Research personal loan interest rates

Fees

Other perks

How Do I Get Low

To get a low-interest student loan without the help of a co-signer, youll have to qualify on your own. Youll need a high credit score and a consistent income that comfortably covers your other debt obligations to be eligible for the lowest rates on private loans.

If you cant qualify for desirable rates on private loans, federal student loans may still offer you a relatively low interest rate. The rates on federal loans are standardized, and most are not based on your credit or incomethat means you could get competitive rates even if you dont have much of a credit history.

Don’t Miss: Where To See Student Loan Balance

Lender Rate Reduction Programs

Lenders seldom advertise or publicize interest rate reduction programs, but they do exist. Private lenders created these programs to help borrowers who had fallen behind on their debt. It is typically available only to those with an income insufficient to keep up with payments. A rate reduction program is rarely a term of the loan contract. As a result, lenders can change the requirements whenever they want.

The nice thing about rate reduction programs is that they can help. Lenders usually give most borrowers who cannot make a monthly payment the option of forbearance or deferment. Delaying payments is typically good for the lender and bad for the borrower, however. The balance on the account will grow due to unpaid interest. Once the deferment or forbearance ends, the borrower has a bigger student loan problem. Continuing to make payments with a lower interest rate allows a borrower to put a dent in the principal balance.

How Is Student Loan Interest Calculated

Federal student loans and most private student loans use a simple interest formula to calculate student loan interest. This formula consists of multiplying your outstanding principal balance by the interest rate factor and multiplying that result by the number of days since you made your last payment.

- Interest Amount= × Number of Days Since Last Payment

The interest rate factor is used to calculate the amount of interest that accrues on your loan. It is determined by dividing your loans interest rate by the number of days in the year.

You May Like: Do Pawn Shops Loan Money

Apply With A Creditworthy Cosigner

If your credit score and debt-to-income ratio dont qualify you for lower rates, applying with a can help. A creditworthy cosigner is someone with great credit who meets all the lenders refinancing requirements. When you apply with a cosigner, lenders will calculate your rate based on their credentials. The cosigner in turn shares responsibility of the loan with you.

Keep in mind that asking someone to cosign your loan is a big ask. If you delay or default on your payments, the lender will hold them responsible for making the payment. Any delays or defaults on payments will damage your credit score as well as your cosigners credit score.

Which Type Of Loan Is The Best For Students

This primarily depends on why you want to get the loan. Federal loans are preferable to private loans because they are more considerate in some terms.

Meanwhile, students must be very careful before they apply for any loan. First, it is advisable to check the interest rate of the loan and also get to know their terms and conditions before applying.

Below are the possible, best student loans from private and governmental lenders. We dont give direct links to any of them because we advise you to do personal research on each of them before applying.

Read More:

Don’t Miss: How Much House Can I Afford With Fha Loan

Comparing Student Loan Interest Rates To The Lowest One For Your Situation

Because student loan interest is always accruing, it can make it tough to pay off debt. But the way to save yourself this financial headache is to learn how to get the lowest student loan interest rates. Shop around for your best terms, especially if youre looking for low-rate private student loans.

And dont forget about other considerations, such as student loan repayment plans and forgiveness programs. By weighing all the short- and long-term costs, you can find the right loan to finance your education.

Get Creative To Make The Decision Easy

A borrower with an interest rate in the 4-6% range may be torn. Retirement contributions might do better than the current student loan interest rate, but there is also a very real chance that they dont.

Those who are stuck in this position may want to consider refinancing their student loans with a new lender. At present, many refinance rates start right around 2%. Approval for a refinance will depend upon the borrowers income and credit score, but for many borrowers, securing a low interest rate can open up many new opportunities. Refinancing usually only takes a few minutes, but it is a good idea to know the different lender options and some of the pros and cons of refinancing.

Don’t Miss: What’s Better Home Equity Loan Or Line Of Credit

The Cost Of 0% Interest

While 0% interest could give students some financial relief, Coleman notes that someone would have to pick up the tab for the governmentâs lost revenue. âIf it was just zero then I think it would fall on the backs of taxpayers because the program is not paying for itself.â

Delisle agrees. âTaxes would have to go up or the government would have to cut spending on something else,â he says. And to take it a step further, he notes that student interest rates are pretty low already. At 3.73% currently, the rate is comparable to a mortgage, though student loans are far easier to acquire. âThere is no credit check, there is no collateral requirement, there is no down payment. So in that regard itâs rather remarkable itâs about the same rate as a mortgage,â he says.

Meanwhile, borrowing money for free is practically unprecedented. âEverybody would take out loans because itâd be the best deal around. Itâd be the only place you could get a 0% interest loan,â Delisle says. There would likely be an explosion in borrowing, but not necessarily because more people would go to college. Instead people would take advantage of a rare opportunity.

âThatâs what a financial advisor would tell them to do,â Delisle claims. âTheyâd say, âLook, just keep your savings in a savings account and letâs take out the 0% interest loan.ââ Even if someone had enough money in the bank to pay for college, theyâd be incentivized to take the loan instead.

Lowering Student Loan Debt

Since 2004, student loan debt has nearly tripled, with Federal Student Loan debt surpassing $1 trillion nationwide for the first time ever. According to the NY Federal Reserve, while most forms of consumer debt have fallen since 2008, student loan debt has grown, eclipsing both auto loan and credit card debt. Outside of mortgages, student loan debt is currently the largest form of consumer debt.

New York graduates alone face student debt levels of, on average, more than $27,000 per graduate. Nationally, two-thirds of those earning a four-year bachelors degree graduate with more than $25,000 in student loan debt 10% owe more than $54,000.

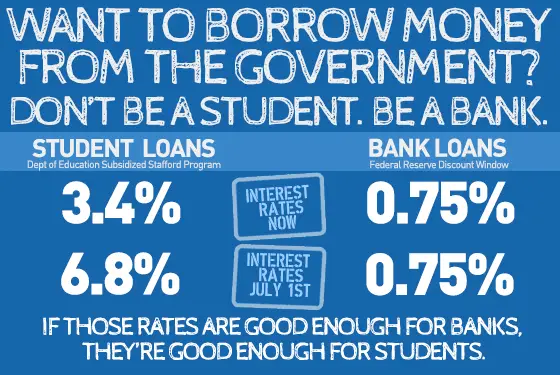

U.S. Senator Kirsten Gillibrand feels strongly that higher education is the pathway to the American Dream, and because of the rising cost of higher education, more and more Americans are finding it out of reach. She is committed to working to ease the burden on the millions of Americans struggling with crushing student loan debt.

To accomplish this, Senator Gillibrand has introduced the Federal Student Loan Refinancing Act, which would allow student borrowers to refinance their student debt at a lower interest rate, just as business-owners and homeowners are able to do. Interest rates on government debt remain lowcurrently below 2 percentyet interest rates on unsubsidized federal student loans remain up at 6.8 percent and expected to rise.

Don’t Miss: Should I Refinance My Car Loan Calculator

Ask The Lender About Other Rate Discounts

Some lenders may offer additional incentives if you meet certain criteria. Some may offer a rate discount if you make consecutive on-time payments for a specific period. Every little discount matters and will add to your savings over the life of the loan. Ask the lender about other rate discounts.

We hoped you enjoyed this article! Remember, you cancompare your personalized rates with our lending partnerscompare your personalized rates with our lending partnerscompare your personalized rates with our lending partnersand potentially lower your monthly student loan payments and save money.

Federal Student Loan Interest Rates

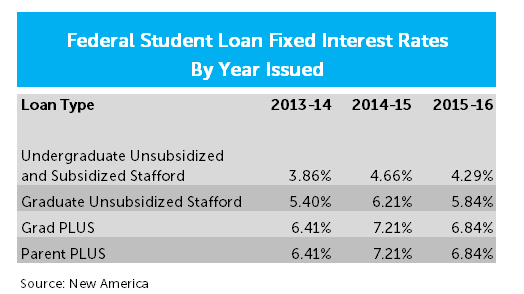

Each spring, student loan interest rates are set by Congress based on the high yield of the last 10-year Treasury note auction in May. New rates apply to student loans disbursed from July 1 to June 30 of the following year. Federal loans are fixed, meaning that the rate will not fluctuate for the life of the loan. The interest rate you receive on a federal student loan is not determined by your credit score or financial history.

Interest charges differ between subsidized and unsubsidized loans. For federal subsidized loans, the government pays your interest charges for you while youre in school at least half time, during your grace period and while youre in deferment. The amount youll owe once your loan is in repayment will include only your original principal balance, loan fees and interest accrued moving forward.

With federal unsubsidized loans, interest charges start accruing immediately after funds are disbursed. If you choose to hold off on making loan payments until later, the accumulated student loan interest gets added to your principal balance when the loan enters repayment.

With that said, interest rates on federal student loans are temporarily set to zero through Aug. 31, 2022, due to impacts of the coronavirus pandemic.

Recommended Reading: What Is The Max Va Home Loan