How Likely Is It That My Employment Qualifies For Loan Forgiveness

To be eligible for forgiveness, you must be a full-time employee of an eligible public interest employerthat is, at a 501 not-for-profit school, university or hospital in government or approved governmental entities or at a few other public interest organizations. The University of Colorado is considered a public service employer for the purpose of this program.

Have The Correct Type Of Loans Or Consolidate

Only loans that are part of the federal direct loan program are eligible for PSLF. Private student loans arent eligible.

You can consolidate other types of federal student loans Federal Family Education Loan loans or Perkins loans to make them PSLF-eligible.

If you qualify for Perkins loan cancellation, which offers forgiveness after five years of public service, pursue that option and dont consolidate your Perkins loans. You can still participate in PSLF with your other federal student loans.

What To Expect When Enrolling In Pslf Using Savi

The Savi tool is free to use for CU employees. It supports you in completing the PSLF accurately and maximizing your forgiveness benefits. However, managing all the required steps has historically been challenging for borrowers.

Thats why Savi’s Essential Service helps you enroll and remain compliant with all the program rules for a $60 annual fee*, which covers:

- Generating all forms electronically and checking them prior to submission

- Tracking applications and forms with loan servicers and employers

- Providing payment and application filing reminders to ensure important deadlines are met

- Tracking the accrual of PSLF credits throughout the process to prevent surprises at the end of the repayment period

Savi has more than a 98% success rate when submitting paperwork on behalf of Savi users for the Public Service Loan Forgiveness program. Their experts keep you on track and help you through the entire process.

Heres a snapshot of what will happen when you enroll in Savi Essential Service.

If you havent yet, take a minute and find out how much you could lower your monthly payment. Visit TIAAs CU debt relief page today to calculate your savings.

Recommended Reading: How Can I Apply For Student Loan Forgiveness

Psid 211 Mid 219 Fmi 12

However, the only way to be positive that you qualify for Public Service Loan Forgiveness now or in the future is to complete and submit the Employment Certification form as soon as possible. How to Apply PSLF. After 120 qualifying payments , borrowers can apply for PSLF. The payments dont need to be consecutive to. To qualify for PSLF, I must make 120 qualifying payments on my Direct Loan while employed full-time by a qualifying employer or employers. Neither the 120 qualifying payments nor the employment have to be consecutive. 2. To qualify for PSLF, I must be employed full-time by a qualifying employer when I apply for and receive PSLF. 3..

rev a shelf lazy susan manual

- Make all of your mistakes early in life. The more tough lessons early on, the fewer errors you make later.

- Always make your living doing something you enjoy.

- Be intellectually competitive. The key to research is to assimilate as much data as possible in order to be to the first to sense a major change.

- Make good decisions even with incomplete information. You will never have all the information you need. What matters is what you do with the information you have.

- Always trust your intuition, which resembles a hidden supercomputer in the mind. It can help you do the right thing at the right time if you give it a chance.

- Don’t make small investments. If you’re going to put money at risk, make sure the reward is high enough to justify the time and effort you put into the investment decision.

What Do I Need To Get Started With Savi

Go to TIAA.org/cu/student and follow the path to explore your federal forgiveness options. Youll need three things to use Savi effectively:

Don’t Miss: Closing Costs For Va Loan

Its Practice For Applying For Public Service Loan Forgiveness

If you take a look at the Public Service Loan Forgiveness Application, it looks very similar to the employment certification form. Filling out the certification form annually will help you become more familiar with the type of information Fedloan Servicing is looking for and will make the application process much easier.

You Will Help Make Pslf Possible For Other People

If youve been keeping up on current events, PSLF is a hot topic in Washington, with several lawmakers working to end the program. One way to let the government know that PSLF is important is to continue to send in your employment certification form. The federal government tracks how many forms are submitted annually so the more they receive, the more it shows how valuable the program truly is to American citizens.

Also Check: How To Pay Back Student Loans

Who’s Gotten Pslf So Far

Public Service Loan Forgiveness began in 2007, meaning the first batch of borrowers became eligible for relief in 2017. A total of $10 billion has been erased for 175,000 borrowers so far.

The approval rate is low, but improving. Among all 1,299,286 combined applications for PSLF and TEPSLF submitted from November 9, 2020 onward, only 130,728 have been deemed eligible for forgiveness, according to April 2022 data from the Department of Education. That means only 10.1% of all applications have been approved. However, this is still an improvement: From November 2020 through October 2021, only 2.4% of combined applications had been approved.

Borrowers get nearly six figure debt erased, on average. The average balance of borrowers whose loans were discharged under PSLF was $67,592.

IDR forgiveness fixes are here. Millions of borrowers are will benefit from one-time fixes that count past payments toward the 240 or 300 needed to qualify for income driven repayment forgiveness, the Department of Education announced on April 19. The fixes are also expected to cancel debt for at least 40,000 borrowers through Public Service Loan Forgiveness. So far more than 128,000 borrowers have had their debt discharged by the waiver and collectively had $8 billion in debt erased.

Apply For Pslf Using Savi’s Student Loan Forgiveness Tool

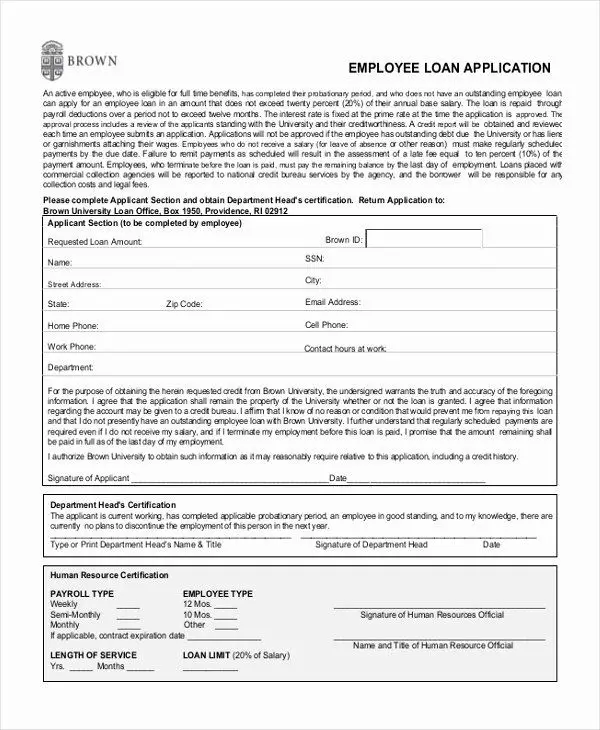

TIAA has joined forces with Savi, a social impact technology company, to help University of Colorado faculty, staff and their immediate families benefit from forgiveness programs like PSLF. The service helps eligible borrowers to understand their choices, lower their monthly payments, and enroll in a forgiveness program. Think of Savi as an advocate someone who cares as much as you do about finding a good outcome.

Savi provides two service tiers to CU faculty, staff and their immediate families:

Based on Savis internal measurements, Savi users saw average projected annual savings of $1,880 in 2021. Money saved is money in your pocket to use for other financial goals, whether its building up an emergency fund, saving more for retirement or paying off other debts.

Try the free calculator today to see if you qualify.

Also Check: How Does An Equity Loan Work

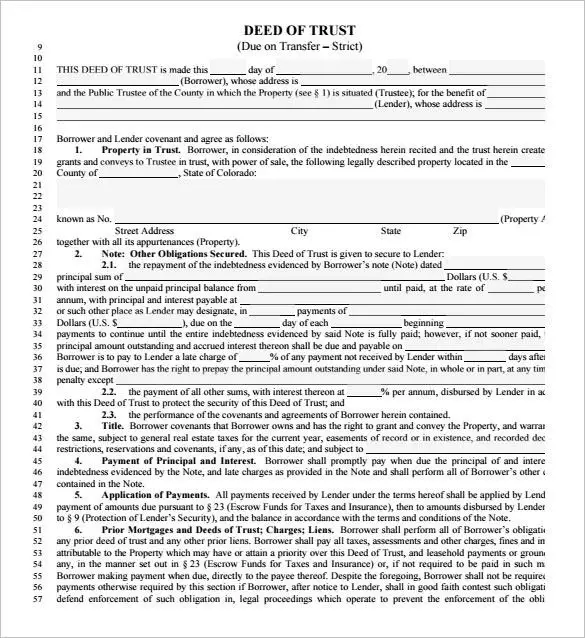

Give The Form To Your Employer To Fill Out Sections 3 And 4

Section 3 of the PSLF Employment Certification Form can be filled out by you or your qualifying employer. Since your employer will have all the necessary information and will need to certify the form, you can also have them fill out this section.

Once youve filled out the first two sections, bring the form to your employer and ask them to fill out the third and fourth parts of the form. Your employer will provide basic information about your start date, employment status, hours and the type of organization they are. Your work must be considered full-time not part-time for your monthly payments to count toward PSLF and get your remaining balance forgiven.

Once they complete Section 3, an authorized official from your organization must sign, date and certify your employment in Section 4.

How Can Savi Help Me Is There A Fee To Use Savi

As of Dec. 31, 2021, based on Savis internal measurements, Savi users saw average projected savings of $1,880 per year.

There are two service tiers available to borrowers.

You May Like: Scholarships To Pay Off Student Loans After Graduation

Important Limited Pslf Waiver

On October 6, 2021, the U.S. Department of Educations office of Federal Student Aid announced a temporary period during which borrowers may receive credit for payments that previously did not qualify for PSLF or TEPSLF. This change will apply to student loan borrowers with Direct Loans, those who have already consolidated into the Direct Loan Program, and those who consolidate into the Direct Loan Program by October 31, 2022.

Learn more about how this limited PSLF waiver may impact your loans. Act soon the waiver ends October 31, 2022. You can also contact us with questions.

*Any loan received under the William D. Ford Federal Direct Loan Program qualifies for PSLF.

Loans from these federal student loan programs don’t qualify for PSLF: the Federal Family Education Loan Program and the Federal Perkins Loan Program. However, they may become eligible if you consolidate them into a Direct Consolidation Loan.

Student loans from private lenders do not qualify for PSLF.

Under normal PSLF Program rules, if you consolidate your loans, only qualifying payments that you make on the new Direct Consolidation Loan can be counted toward the 120 payments required for PSLF. Any payments you made on the loans before you consolidated them dont count. However, if you consolidate these loans into a Direct Consolidation Loan on or before October 31, 2022, you may be able to receive qualifying credit for payments made on those loans through the limited PSLF waiver.Learn more.

Should I Pay Loans During Forbearance

Borrowers might want to continue making payments on federal loans if they want to pay down their debt faster. … If you do continue making payments, you won’t pay any new interest on your loans during the forbearance. This 0% interest rate will save you money overall, even though your payment won’t be lower.

Read Also: Best Home Loan Interest Rates

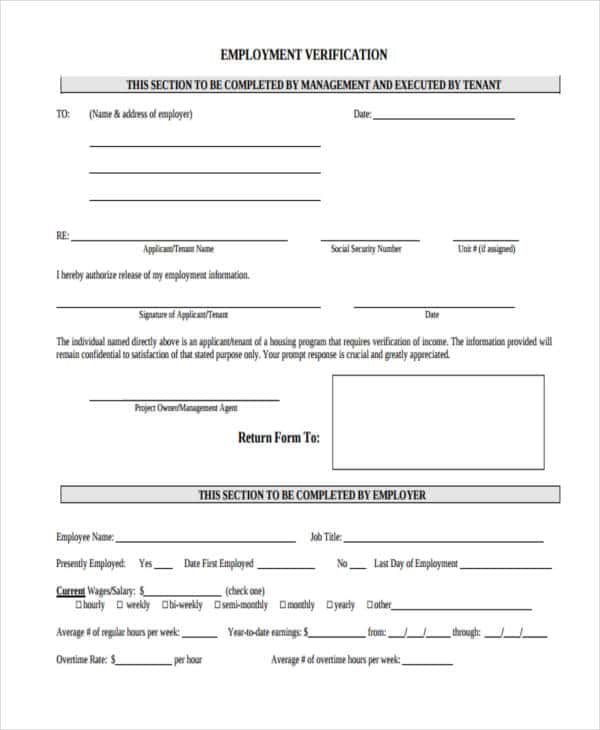

Declare Your Reason For Submitting The Form

The next section is where youâll specify that youâre submitting the PSLF form to verify your employer. Select the first box that reads: âI just want to find out how many qualifying payments I have made or if my employer is a qualified employer.â

Then, read the legal acknowledgment. Certify that the information youâve provided is accurate by including your signature and the date in this section.

Tip: At the top of the next page thereâs a line to write your full name and Social Security number again. Remember to add this information to avoid processing delays.

Important Changes To The Pslf Program

The Department of Education has announced a set of actions to help more people take advantage of the PSLF program, including a time-limited waiver so that student borrowers can count payments from all federal loan programs or repayment plans toward forgiveness. This includes loan types and payment plans that were not previously eligible. The Department of Education will pursue opportunities to automate PSLF eligibility, give borrowers a way to get errors corrected and make it easier for members of the military to get credit toward forgiveness while they serve.

The waiver will run through October 31, 2022. That means borrowers who need to consolidate will have to submit a consolidation application by that date. Similarly, borrowers will need to submit a PSLF formthe single application used for a review of employment certification, payment counts, and processing of forgivenesson or before October 31, 2022, to have previously ineligible payments counted.

The Department recommends borrowers take this action through the online PSLF Help Tool .

You May Like: Chase Auto Loan Phone Number

Where Do I Submit My Completed Pslf Employment Certification Form

To turn in your completed employment certification form, you can mail it or fax it to Fedloan Servicing.

Mailing Address:

Harrisburg, PA 17106-9184

Fax Number: 720-1628

If your student loans are already being serviced by Fedloan Servicing, you can upload your form through their website.

Once youve submitted an employment certification form it will be processed by Fedloan Servicing. After your loans are transferred over to them, they will determine how many qualifying payments youve made. You will receive a letter letting you know how many payments have qualified.

If they need more information or to verify any details, they will reach out during this processing period.

One thing you will want to do is to keep copies of every employment certification form you submit. That way you have them for your records and can refer to them if there are any issues during the process.

If you want to see how many total qualifying payments youve made, you can view that information by logging into your student loan account online.

What Is An Income

Any PSLF plan includes an income-driven repayment plan. These are repayment plans that take into account your income, student debt and personal situation, and may result in lower monthly payments. The plans that qualify you for PSLF include IBR, ICR, PAYE, and REPAYE.

The Standard repayment plan technically qualifies as well, but since this plan spans only 10 years, you wouldnt have any balance left to forgive after 120 qualifying monthly payments.

Recommended Reading: Is Fha Mortgage Insurance For The Life Of The Loan

Key Points: Pslf Summary Of Changes

- For a limited time, until Oct. 31, 2022, you may receive credit for past periods of repayment on loans that would otherwise not qualify for PSLF.

- If you have FFEL, Perkins or other federal student loans, you’ll need to consolidate your loans into a Direct Consolidation Loan to qualify for PSLF, both in general and under the waiver. Before consolidating, make sure to check to see if you work for a qualifying employer. Begin with the direct consolidation loan application.

- Past periods of repayment will now count regardless of whether you made a payment, made that payment on time, for the full amount due, on a qualifying repayment plan.

- Periods of deferment or forbearance, as well as periods of default, continue to not qualify.

What Is Public Service Loan Forgiveness

The federal government has a program specifically for people who work for nonprofit, government or public sector employers. If you work for one of these employers, have direct loans, and make 120 monthly on-time payments while with a public service employer, you may be eligible to have your remaining federal student loan debt forgiven tax-free.

Entering into PSLF or another forgiveness program requires a commitment to see it through to the end. Switching to an income-driven repayment plan may actually cause your student debt to increase over time, which can be problematic unless you get forgiveness at the end. If you know you will not be working full-time for a qualifying nonprofit or public sector entity for at least 120 months, then the PSLF may not be the right path for you. Individuals may want to consult their personal tax or legal adviser before making any decisions regarding the status of their student loans.

Recommended Reading: What Is Prime Loan Rate

About The Public Service Loan Forgiveness Program

The Public Service Loan Forgiveness Program is a federal program created for those in public service jobs, offering the opportunity to have their federal loan balances forgiven after 120 qualifying monthly payments.

The University of California is a qualified employer for the PSLF program. Generally, many full-time UC employees who otherwise qualify may be eligible to apply their months of employment towards PSLF.

To ensure as many eligible UC faculty and staff as possible can take advantage of this program as possible, this page will be updated regularly with news and resources.

How To Fill Out And Sign Pslf Form Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The times of terrifying complicated tax and legal forms are over. With US Legal Forms completing official documents is anxiety-free. A powerhouse editor is right close at hand providing you with a range of advantageous tools for submitting a Public Service Loan Forgiveness : Employment Certification Form – Studentaid Ed. These tips, along with the editor will help you with the whole process.

We make completing any Public Service Loan Forgiveness : Employment Certification Form – Studentaid Ed faster. Start now!

Recommended Reading: How To Calculate Personal Loan Interest Rate