Interest Rates And Apy

Be sure to use the interest rate in your calculationsnot the annual percentage yield.

The APY accounts for compounding, which is the interest you earn as your account grows due to interest payments. APY will be higher than your actual rate unless the interest is compounded annually, so APY can provide an inaccurate result. That said, APY makes it easy to quickly find out how much youll earn annually on a savings account with no additions or withdrawals.

What Is The Average Interest Rate On A Personal Loan

Interest rates vary by state, lender, and a variety of other factors, including your:

- Debt-to-income ratio

- Loan term

So, what’s the average interest rate for a personal loan? That’s not easy to pin down because there are so many factors involved. Broadly speaking, however, we can break down the average interest rate by loan term and credit score.

The average interest rate for a 24-month personal loan was 9.34% as of August 2020, according to the most recent data from the Federal Reserve. Meanwhile, the national average interest rate for a 36-month personal loan was 9.21% at credit unions and 10.28% at banks as of June 2020 , according to the National Credit Union Administration.

Interest rates for personal loans vary considerably depending on your credit score. In general, the higher your credit score, the lower your interest rate will be. Here are the average upper limit interest rates you might expect, based on different credit scores:

| Poor | 32.0% |

If you have an excellent credit score, you may qualify for a 0% balance transfer credit card, which could be a cheaper option than a personal loan.

Benefits And Features Of A Personal Loan Emi Calculator

Here are the features of Clix Capitals personal loan EMI calculator.:

- Easy access online 24/7

- Address Proof

- Income Proof

What is the tenure, EMI, rate of interest and down payment for a personal loan with Clix Capital?

At Clix Capital, you can choose from customized repayment and down payment options. However, the interest rate of your personal loan depends on various factors, such as the specifics of your application . Well share the final applicable interest rate once we go through your application form and all supporting documents.

Do I need to pay anything to use a personal loan EMI calculator?

No. You dont need to pay anything to use our personal loan EMI calculator. It is an online tool that you can use absolutely for free for any number of times.

Is the EMI amount I get with EMI calculator is exact?

No. EMI calculator gives you an estimate of the EMIs you will be paying every month. The exact amount may vary a little once your loan plan is booked.

How much time does the calculator take to estimate my EMI amount?

Using a personal loan EMI calculator is a matter of seconds. Just enter your loan amount and your EMI estimate and loan plan will be displayed on your screen automatically.

What is the maximum time I can get to repay my personal loan?

Recommended Reading: Bayview Loan Servicing Class Action Lawsuit

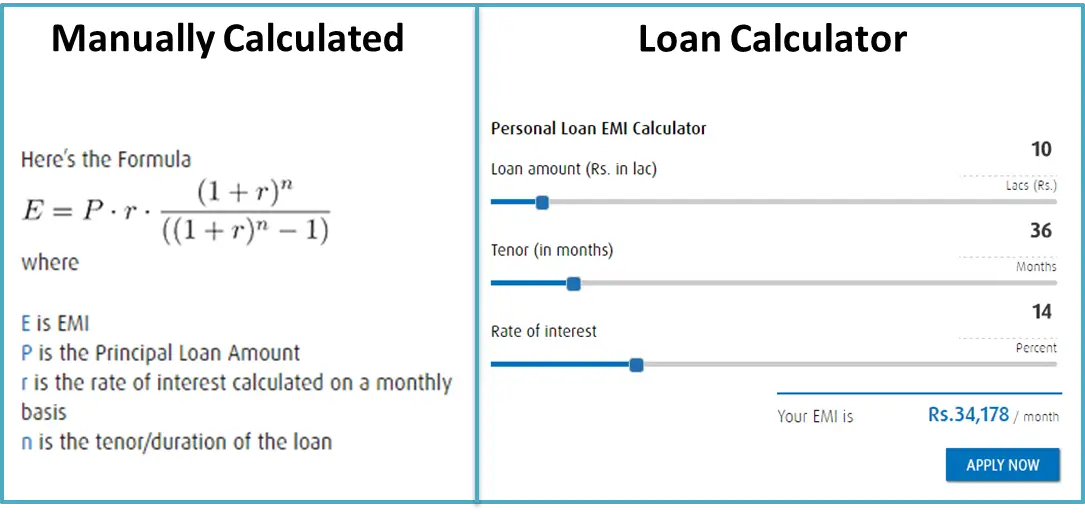

How To Calculate Interest On A Loan

Banks and financial institutes that offer loans consider various approaches when it comes to fixing interest rates. You can also calculate the interest levied on your loan amount. However, sometimes it might seem challenging to do the math as it usually involves the use of formulas.

To make things somewhat smoother for you, we have explained the two common ways that lenders and borrowers usually follow to calculate the interest cost. You can apply the same processes and do the math by yourself to know the interest charged on your loan amount.

How It Helps To Repay Personal Loan

The calculator will help you reckon the amount and period, within which you intend to repay the debt. This is necessary because you can calculate your budget, and in bad cases, you will not be left with open debts.

The results that the calculator provides are based on simple mathematical calculations. They are estimates and depend solely on the information that you provide to them. Your banker may have an additional establishment fee or other charges that this calculator will not include. Pay attention to the information you provide. Inaccurate data will lead to erroneous results.

Therefore, while such calculators are a good way to get estimates of your payments, you need to check with your banker about the exact amount you will pay.

Also Check: How Long Does It Take Sba To Approve Loan

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Received A Mailer From Us

If you got a letter stating that youre pre-selected for a SoFi loan, youre in the right place. Get started by entering your confirmation number below.

You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website.

Don’t Miss: Defaulting On Sba Loan

Personal Loans And Creditworthiness

The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan. Good or excellent credit scores are important, especially when seeking personal loans at good rates. People with lower credit scores will find few options when seeking a loan, and loans they may secure usually come with unfavorable rates. Like credit cards or any other loan signed with a lender, defaulting on personal loans can damage a person’s credit score. Lenders that look beyond credit scores do exist they use other factors such as debt-to-income ratios, stable employment history, etc.

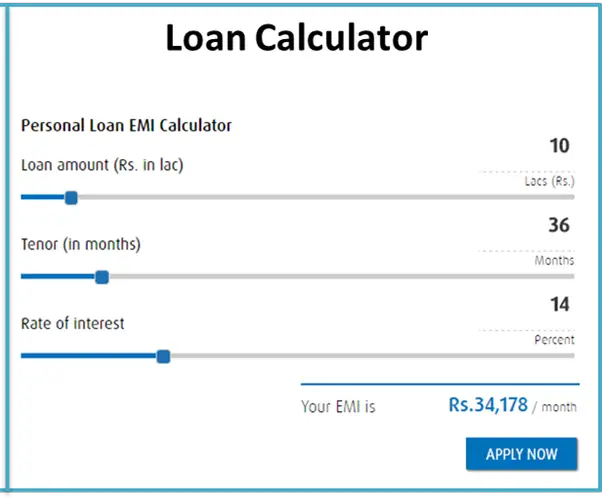

How To Use This Calculator

The personal loan calculator estimates your monthly payment once you input the loan amount, estimated interest rate and repayment term. By changing one or more of the numbers, you can see how different loan offers will impact your monthly payment and how much interest youll pay overall.

Generally, a loan with a longer term will have a lower monthly payment, as youre taking more time to repay what you owe. But youll also wind up paying more interest because it will accrue over a longer period. Some lenders may also charge a higher interest rate if you choose a longer term.

As you compare lenders and loan offers, also find out whether the loans youre considering charge an origination feea common fee on personal loans thats generally a percentage of the loan amount.

Lenders may deduct this fee from your loan disbursementfor example, sending you $9,500 if you accept a $10,000 loan that has a 5% origination fee. In these cases, use the full loan amount , as thats the amount youll need to repay. But if a lender adds the origination fee to your loan rather than subtracting it from your disbursement, use the total of the loan plus the fee as your loan amount in the calculator. In both situations youll be paying interest on the full outstanding amount, which may include the fee.

Based on the numbers you enter, our calculators results will show you how many months it will take to pay off the loan, when it will be paid off and how much youll pay in interest.

Don’t Miss: How To Apply For A Second Loan With Upstart

Which Is Better: A Personal Loan Credit Card Line Of Credit Or Home Equity Loan

While taking out a personal loan could be a good option in some circumstances, it isnt the right move for everyone. Heres how a few other options compare to personal loans so you can decide which is best for your situation:

If you decide to get a personal loan, remember to consider as many lenders as you can to find the right loan for you. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

Keep Reading: How Debt Consolidation Loans Can Help Your Credit Score

Taylor Medine is a Credible authority on personal finance. Her work has been featured on Bankrate, Experian, The Balance, Business Insider, Credit Karma, and more. Shes also the author of The 60-Minute Money Plan, a self-published intro to budgeting guide for people who hate budgeting.

Personal Loan Calculator Results Explained

To use the personal loan calculator, enter a few details about the loan, including the:

- Loan amount: How much money you want to borrow.

- Loan term: How much time you’ll have to pay back the loan.

- Interest rate: How much money the lender will charge you to borrow the money, expressed as a percentage of the loan. If you don’t know the interest rate, enter your range to see an interest rate estimate.

Once you enter your loan details, the personal loan calculator displays three numbers, which you can use to evaluate and compare various loans. Here’s what the numbers mean:

- Total interest paid: The total interest you pay over the life of the loan. Borrowers with higher credit scores typically pay less interest overall than those with poor credit.

- Total paid: The total amount you pay to the lender, including the original amount you borrowedknown as the “principal”plus the interest. This amount doesn’t include any additional fees your lender may charge .

- Monthly payment: How much you can expect to pay each month for the duration of the loan term. Part of each payment is applied to interest, and part goes toward the principal, according to an amortization schedule.

If you choose a longer loan term, your monthly payment will be lower, and your total interest will be higher. With a shorter loan term, your monthly payment will be higher, but your total interest will be lower.

Aim for the shortest possible loan term that has payments you can still afford.

| Loan Term |

|---|

| $12,748.23 |

Don’t Miss: Usaa Auto Loan Interest Rates

Interest Rates And Credit Scores

The interest rate that you receive will depend on several different factors:

The type of loan and lender youre using

The state of the economy

Inflation

The borrowers credit score/history

Most of these things are outside of your control as a borrower. But the one thing that you can control is your credit score. Having a good credit score will help you receive better interest rates, no matter which kind of loan youre applying for.

Although there are loans for those with less than perfect credit, a lender would typically prefer to offer a loan to a borrower with a demonstrated history of sound financial practices. For example, if you consistently pay your bills on time, dont have a lot of debt, and manage your credit cards well, you probably have a good .

Having a good credit score makes you much more likely to get a reasonable interest rate on your loan.

However, keep in mind that a good credit history isnt the only thing that affects your interest rate. For example, if interest rates are high due to the economy or inflation, your will only do so much. But its still essential to maintain your credit score to get the best interest rate and lowest interest payments possible.

What To Do If Your Credit Score Isa Work In Progress

Researching your credit score can be a terrifying process. Pulling up your scores can provide a similar feeling to pulling up your final grades for the semester. If your score is not what you want, don’t panic. The first step you should take is to verify that all the information is correct. While the statistics are in dispute, as many as 79 percent of all credit scores contain at least one error.

A major mistake on your score such as falling victim to identity theft could lower your score dramatically, which you now realize can cost a lot of money due to higher interest rates. Work with the credit agencies to correct any glaring mistakes. If you have an unfortunate track record with payments thus far, understand that your credit history only goes back seven years. From this point forward, determine to pay all of your bills on time, and you will be rewarded with much better credit scores in the future.

Also Check: How Long Does It Take Sba To Approve Ppp

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

Personal Loan Payment: Your Loan Term

The next factor that drives your monthly payment is your loan term. Loan term is the number of years you take to repay the loan. Most personal loans are installment loans with fixed interest rates. This means you make equal monthly payments and repay the loan by the end of its term. Most personal loans allow you to prepay your loan, zeroing out your balance sooner and saving on interest charges.

The chart below shows how one, five, seven, 10 and 15 year terms impact the payment of a $10,000 loan at an 8% interest rate.

Notice that even though longer loan terms result in lower monthly payments, your total interest paid is higher sometimes much higher. Personal finance specialists generally recommend using long-term loans only for long-term purposes. For instance, a ten-year loan for college tuition or a sizable home renovation can be a sensible choice. But you probably dont want to still be paying off your wedding loan on your tenth anniversary.

The loan term, like the loan amount, affects what lenders charge. Longer terms are riskier to lenders, and they normally charge higher rates to compensate for that extra risk. Here are typical interest rates for highly-qualified applicants at different terms from the same lender:

- 2 years: 4.44% to 13.29%

- 5 years: 4.94% to 14.49%

- 7 years: 5.39% to 14.99%

- 12 years: 6.89% to 14.99%

Be sure to check rates for the term you want when using the MoneyRates calculator.

Don’t Miss: Bayview Loan Servicing Lawsuit

Floating Rate Emi Calculation

We suggest that you calculate floating / variable rate EMI by taking into consideration two opposite scenarios, i.e., optimistic and pessimistic scenario. Loan amount and loan tenure, two components required to calculate the EMI are under your control i.e., you are going to decide how much loan you have to borrow and how long your loan tenure should be. But interest rate is decided by the banks & HFCs based on rates and policies set by RBI. As a borrower, you should consider the two extreme possibilities of increase and decrease in the rate of interest and calculate your EMI under these two conditions. Such calculation will help you decide how much EMI is affordable, how long your loan tenure should be and how much you should borrow.

Optimistic scenario: Assume that the rate of interest comes down by 1% – 3% from the present rate. Consider this situation and calculate your EMI. In this situation, your EMI will come down or you may opt to shorten the loan tenure. Ex: If you avail home loan to purchase a house as an investment, then optimistic scenario enables you to compare this with other investment opportunities.

Pessimistic scenario: In the same way, assume that the rate of interest is hiked by 1% – 3%. Is it possible for you to continue to pay the EMI without much struggle? Even a 2% increase in rate of interest can result in significant rise in your monthly payment for the entire loan tenure.