Are There Any Va Funding Fee Exemptions

Not every borrower has to pay the VA funding fee. Be sure to find out if youre eligible for an exemption, as changes have been made to VA funding fee exemption rules in 2020 to allow certain Purple Heart recipients to receive an exemption. The following are circumstances under which someone would be eligible for a funding fee exemption:

- Individuals who receive compensation for a service-related disability.

- Individuals who are eligible for a service-related disability pay but receive retirement pay or active service pay.

- Surviving spouses who meet the eligibility requirements for the VA home loan program.

- Active-duty service members who have been awarded the Purple Heart.

To find out if youre eligible for an exemption to the VA funding fee, check out your VA loan Certificate of Eligibility. It will state whether youre exempt or nonexempt. If you dont yet have a COE, you can learn how to apply on the VA website.

What Can I Expect From Va Loans What Am I Responsible For

In a VA loan, the entitlement is the amount of money guaranteed to the borrower. The basic entitlement of a VA loan is $36,000 on a house. As real estate prices escalate, however, vast numbers of prospective homeowners are forced to contend with prices that exceed $144,000 or the maximum loan for a basic entitlement. For prices in excess of this limit, the bonus entitlement applies.

During 2018, the median sales price of new homes ranged from $310,500 to $335,400, making it necessary for VA loan holders to opt for the bonus entitlement. The bonus entitlement amount is set by the VA using limits established by the Federal Housing Finance Agency , which set 2019 loan limits at $484,350 for most locations.

The higher limit of $726,525 â 150 percent of the basic limit â has been established for properties in some of the nationâs pricier communities where a basic loan would not suffice. As a qualified borrower, you would be awarded 25 percent on the mortgage for a home that meets the 484k limit. Therefore, you would get $121,087 down on a $484,350 home. The basic entitlement of $36,000 would then be subtracted from that $121,087, giving you a bonus of $85,087 in entitlement loans.

VA lenders will often loan borrowers an amount that quadruples the entitlement, turning that $85,087 amount into $340,350. When you add your basic VA entitlement of $144,000 to that $340,350 amount, you get a new limit of $484,350 in accordance with the FHFAâs 2019 loan limit.

Va Funding Fee For Va Cash

The VAcash-out refinanceprovides veterans the opportunity torefinancetheir mortgage at a lower rate and take cash out from the equity in their home. The funding fee for the VA cash-out refinance loan is similar to the purchase loan with less than a 5% down payment. In other words, the funding fee for the first use of a VA guarantee is 2.3% of the loan value, while it is 3.6% of the loan value for subsequent uses. Thus in cash-out refinance loans, the funding fee is independent of the down payment amount.

Don’t Miss: Usaa Graduate Student Loans

What Can You Do With A Va Loan

Unlike FHA and other conventional loan options, VA loans can be used in a variety of ways.

VA loans allow you to:

- Buy a single-family home, VA-approved condo, or manufactured home.

- Buy VA-approved condo home, a condominium unit in a VA-approved project.

- Borrow money to build a home.

- Finance the purchase AND remodel of a home.

- Make energy-efficient improvements.

- Refinance an existing VA-guaranteed or direct loan for a lower interest rate.

What Is The Va Guaranty

Although the VA loan is a federal program, the government generally does not make direct loans to Veterans. Instead, private lenders including Veterans United Home Loans finance the loan while the Department of Veterans Affairs offers a guaranty.

This guaranty protects the lender against total loss should the buyer default, which provides an incentive for private lenders to offer the VA loan with better terms than other mortgage options.

You May Like: Usaa Rv Rates

Can You Get A Va Funding Fee Refunded

If you dont fall under one of the exempt eligibilities, you may be required to pay for the fee and wont be eligible to receive a refund. If you subsequently fall under an exemption but it did not process until after you closed and paid the fee, you may apply for a refund.

The VA funding fee is a standard closing cost if you are borrowing under this program. If you think you are exempt or eligible for a refund, check with the official VA website and your lender today.

How Do I Apply For A Va Loan

If you fit the profile of a VA loan applicant, the only thing you will need to furnish in order to qualify is a certificate of eligibility . The COE is a document that verifies the dates when you began and completed your service in a branch of the U.S. military. There are three ways to apply for the COE:

- Request the certificate from your mortgage lender, who should be able to access the database and quickly furnish your COE.

- Submit an application for the COE yourself on the VA website at VA.gov. You will need to set up an account if you have not done so already and fill out your application from there.

- To print out a paper application, fill out the pages and send the application off in the mail. You can obtain the document for printing purposes at the VA website.

As soon as you obtain your certificate of VA loan eligibility, you can submit an application for a VA loan. The steps involved in the application are relatively simple and easy to understand, though not all mortgage lenders offer VA loans.

Read Also: Usaa Auto Loan Interest Rates

Can I Get A Va Loan After Foreclosure

VA loans are generally lenient regarding the past financial difficulties of applicants. As such, you can qualify for a VA loan even if you recently have filed for bankruptcy or had a home foreclosed on:

- If you have filed for Chapter 7 bankruptcy, you could be eligible for a VA loan after 24 months.

- If you have filed for Chapter 13 bankruptcy, you could be eligible again for a VA loan after 12 months. If your last home was subject to foreclosure, you could apply for a VA loan after 24 months.

The VA provides one of the easiest opportunities to own a home again after you have lost one due to financial hard times. In the two years you spend recovering from a foreclosure, you could save and stabilize with a new source of income while renting or staying with relatives. Once the two years have passed, the VA could offer you more generous terms than any prior loan you might have taken from a lending bank.

How To Complete A Va Funding Fee Exemption Form

To determine your eligibility for the VA funding fee exemption, your lender completes Form 26-8937 to confirm any disability payments you receive. You may need to provide your VA claim folder number or your service number . Youll then certify that youre receiving those benefits, and the form is sent to the VA for verification.

In many cases, your funding fee status will be reflected at the top of your certificate of eligibility . Your lender will automatically remove the funding fee from your VA loan costs upon receiving a COE with a funding fee exempt status.

Read Also: Bayview Home Loans

A Va Loan Is More Forgiving With Credit Scores

Since the VA backing reduces lenders risk, they can be more flexible with their terms, such as credit score minimums and ranges. The minimum will vary vary from lender to lender, but most are looking for a of 620 or above. However, Atlantic Bay can potentially qualify down to a 580 credit score, with additional requirements.Credit ranges are much more broad as well, and interest rates are not based heavily on credit scores. For example, if you have an average credit score, you may get the same interest rate as someone with an excellent score.In addition, the VA program is more lenient with things like previous bankruptcy, short sales, and foreclosures than a conventional loan program.

Va Loan Eligibility Requirements

VA loans are only for qualified veterans, active-duty service members, and, in many cases, their surviving spouses. To qualify, youll need to meet specific service requirements.

These service requirements vary slightly based on when you served, but generally speaking, you will need to have at least one of the following:

- 90 consecutive days of active service during wartime

- 181 days of active service during peacetime

- 6 years of service in the National Guard or Reserves

- A veteran/service member spouse who died in the line of duty or due to a service-related disability or injury

To prove you have the above service record, youll need to submit a Certificate of Eligibility to your lender. This is a document that details your service record, the nature of your release from the military, and your VA loan entitlement.

You can get your COE through the VA eBenefits portal online. Or, when you apply for a VA loan, the lender can request a COE on your behalf. This usually takes only a few minutes.

Recommended Reading: Usaa Car Loans Reviews

The Va Funding Fee Is Unique To This Type Of Loan

VA borrowers do not have to pay PMI, but they do have to pay a funding fee. However, the VA funding fee tends to be much less expensive than PMI because you only pay it once, not year after year as with a conventional loan.

Why charge service members a funding fee to get a mortgage? The Department of Veterans Affairs, which guarantees VA loans to make them easier for service members to obtain, is part of the federal government, which means that the VA loan guarantee is funded, in part, by taxpayers.

Through the VA funding fee, borrowers also contribute to the VAs loan guarantees. Youre paying into a program that benefits you and your fellow servicemembers because it helps keep the federal governments VA loan guarantee financially viable. You can pay the fee in cash at closing, or you can finance it as part of your mortgage.

With few exceptions, all borrowers must pay the VA funding fee. The VA will waive the fee in limited cases, most notably for veterans with service-connected disabilities or active duty service members who have earned a Purple Heart.

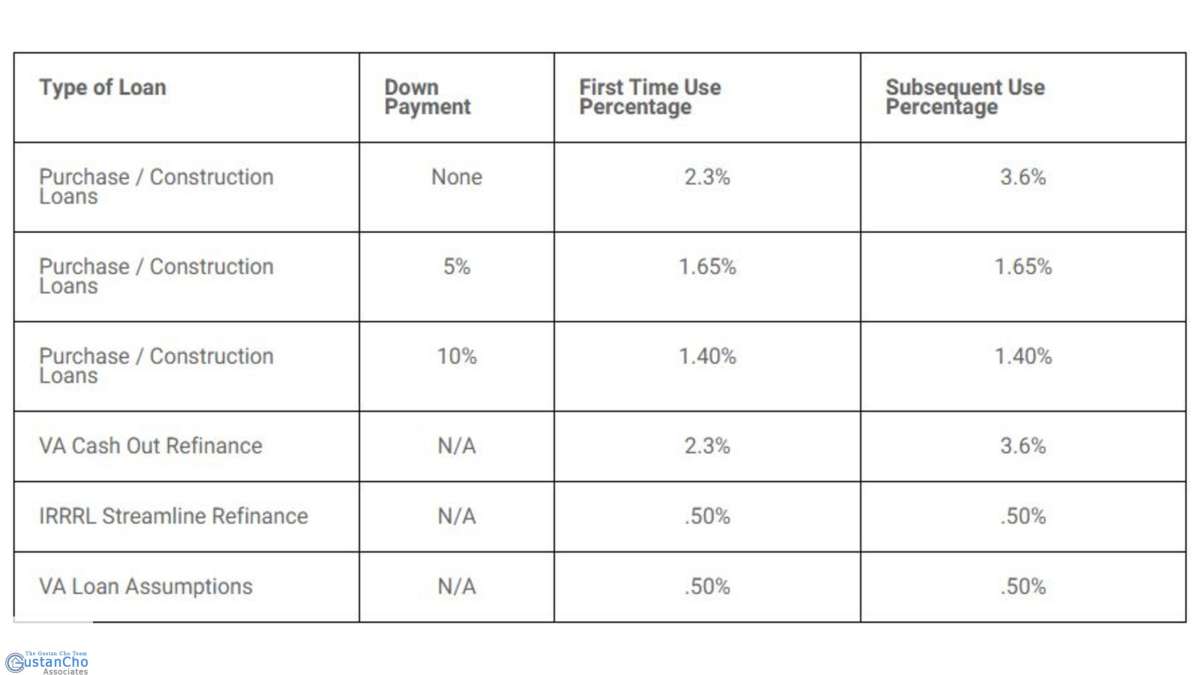

For other VA borrowers, the funding fee depends on your down payment. The table below shows the funding fees you can expect to pay in 2020 for a purchase or construction loan as a veteran, active-duty service member or National Guard or Reserve member, and how they compare with paying PMI on a conventional loan.

Other Va Loan Lenders We Considered

When we looked at the VA lending industry, we found that many of the biggest or most talked-about lenders didnt necessarily offer the best products, though they might excel in other areas. Here is the list of the other VA lenders that we considered:

- No online resources for application or loan tracking

- High origination fee of $995 on all home loans except VA mortgages

- Branch network limited to 11 offices in Missouri

- No renovation mortgages or home equity products

Recommended Reading: Usaa Auto Loans

How Much Is The Va Funding Fee For A Refinance

You can also use the VA loan program to refinance your existing mortgage. If youre doing a VA Interest Rate Reduction Refinance Loan , otherwise known as a streamline refinance, the funding fee is a nominal 0.5 percent.

If youre hoping to do a VA cash-out refinance, the fee is higher: 2.3 percent of the amount borrowed for your first use and 3.6 percent for subsequent use of the program.

There are some exceptions to having to pay a higher funding fee for further use of the program, the main one being the higher subsequent use fee doesnt apply if you used your previous entitlement for a manufactured home.

How Does The Va Funding Fee Work

- You are only required to pay the VA funding fee once per VA loan.

- The fee amount can fall anywhere between 1.4% and 3.6% of the purchase price.

- These funding fees are applied to every VA mortgage with few exceptions.

- The purpose of the fee is to sustain the VA loan program for future military homeowners.

You May Like: Usaa Approved Dealerships

Qualifying For A Va Loan

Beyond service eligibility requirements, the VA doesnt set specific financial standards for these mortgages. The individual private lenders that issue VA loans, however, often do. While these vary from one lender to the next, you can typically expect to need a 620 credit score and a 41% debt-to-income ratio or lower.

The good news is, theres no down payment required for a VA loan. So eligible borrowers can qualify for a VA home loan with very little cash upfront.

How Much Will I Pay

This depends on the amount of your loan and other factors.

For all loans, well base your VA funding fee on:

- The type of loan you get, and

- The total amount of your loan. Well calculate your funding fee as a percentage of your total loan amount.

Depending on your loan type, we may also base your fee on:

- Whether its your first time, or a subsequent time, using a VA-backed or VA direct home loan, and

- Your down payment amount

Note: Your lender will also charge interest on the loan in addition to closing fees. Please be sure to talk to your lender about any loan costs that may be added to your loan amount.

You May Like: Fha Loan Limits Texas 2016

Fees And The Va Loan Program

The VA loan guaranty program gives qualifying veterans access to affordable home loans with attractive mortgage rates and terms.

Funding fees paid by VA borrowers help keep this entitlement financially healthy and available to all veterans.

Understanding how these fees are calculated and who has to pay them can help veteran homebuyers make informed decisions about funding the purchase of a home.

Do I Qualify For A Va Loan

A Certificate of Eligibility doesnt guarantee youll get a VA loan.

Youll still have to qualify with a VA lender based on your credit score, credit report, debt-to-income ratio, and income.

The VA itself doesnt set a minimum credit score to borrow, but many VA lenders require a FICO score of 620 or higher.

Some lenders may extend credit to borrowers with lower credit scores, but VA lenders dont accept subprime credit.

The VA no longer sets maximum loan limits, but your VA lender may. So if youre shopping for a higher-priced home, be sure to ask your lender about this upfront.

Recommended Reading: Rv Loan Rates Usaa

Benefits Of A Va Loan

VA loans come with a number of significant benefits to home buyers, particularly when compared with other types of mortgage programs.

Just a few VA loan advantages include:

- No down payment required: Most other loan programs require at least 3% down .

- Competitively low interest rates: Rates on VA loans are some of the lowest youll find. This saves you both monthly and in the long run.

- Closing costs are limited: You cant be charged an origination fee of more than 1%, and sellers can contribute a large portion of your closing costs.

- No prepayment penalty: This means you can pay off the loan or refinance quickly without an added fee.

- No private mortgage insurance is required: The majority of other loan products require mortgage insurance, which adds upfront and monthly fees.

VA loans are also assumable, which means if you eventually sell the house, the buyer can take over your loan, too a huge perk, given the low rates and other benefits VA loans come with.

Who Is Excluded From Paying A Va Funding Fee

All veterans who are using a VA mortgage to finance a home must pay the VA funding fee, with a few specific exceptions. For example, if the veteran is receiving VA disability benefits for a service–connected disability, this veteran will not be charged a VA funding fee. Sometimes, veterans who qualify for VA disability benefits after they receive their loan can have their funding fee refunded.

The VA also provides some exceptions for surviving spouses. For example, if the homebuyer is the surviving spouse of a veteran who died either during their time of service or from a service-connected disability, the surviving spouse may be exempt from paying the VA funding fee. The same is true of the surviving spouse of a veteran who was totally disabled as long as the surviving spouse also receives Dependency and Indemnity Compensation.

In addition, some active duty military members can avoid the VA funding fee. The homebuyer is exempt from the funding fee if they are an active duty military member with a disability rating for a pre-discharge claim. Active duty service members who have received the Purple Heart are also exempt from paying a funding fee.

The VA reserves the right to consider individual fee waiver requests on a case by case basis, and may at times offer exemptions that are outside of their guidelines.

Certificate of Eligibility

Also Check: Credit Score Needed For Usaa Auto Loan

Va Funding Fee Definition

The VA funding fee is an upfront expense paid when applying for a VA mortgage. Rather than go to your lender, this cost goes directly to the Department of Veterans Affairs to help fund the program and keep it running.

Keep in mind that VA mortgages are backed by the U.S. government, meaning the programs expenses are carried by taxpayers. As a means of supplemental funding and to ease the tax burden on U.S. citizens, VA funding fees are assessed to applicable VA home loans.

Also, if youre not sure youll be able to cover the cost of your VA loan fees all at once, dont worry you have options. You can pay your funding fee upfront as part of your closing costs, or you can bundle the expense into your loan amount and finance it over the term of the loan.