Do I Need No Credit Check Loans Online

So, if you have a bad credit score or no credit history, you might think that applying for online loans guaranteed approval is not even worth considering. And you will not be wrong in your reasoning: most financial institutions would not consider such individuals. What is worse, however, is that when lenders check your credit score to determine your ability to repay, they signal the credit bureau. These, in turn, use these inquiries to further lower your rating.

But, since no credit check loans do not require a hard credit check, that might be a suitable option if you need money and have bad credit. Another option may be using your credit cards or borrowing from friends or family. However, if you decide to opt for a no credit check loan, make sure you understand the offered interest charges and terms.

The Best Payday Loans Nio Credit Check: The Verdict

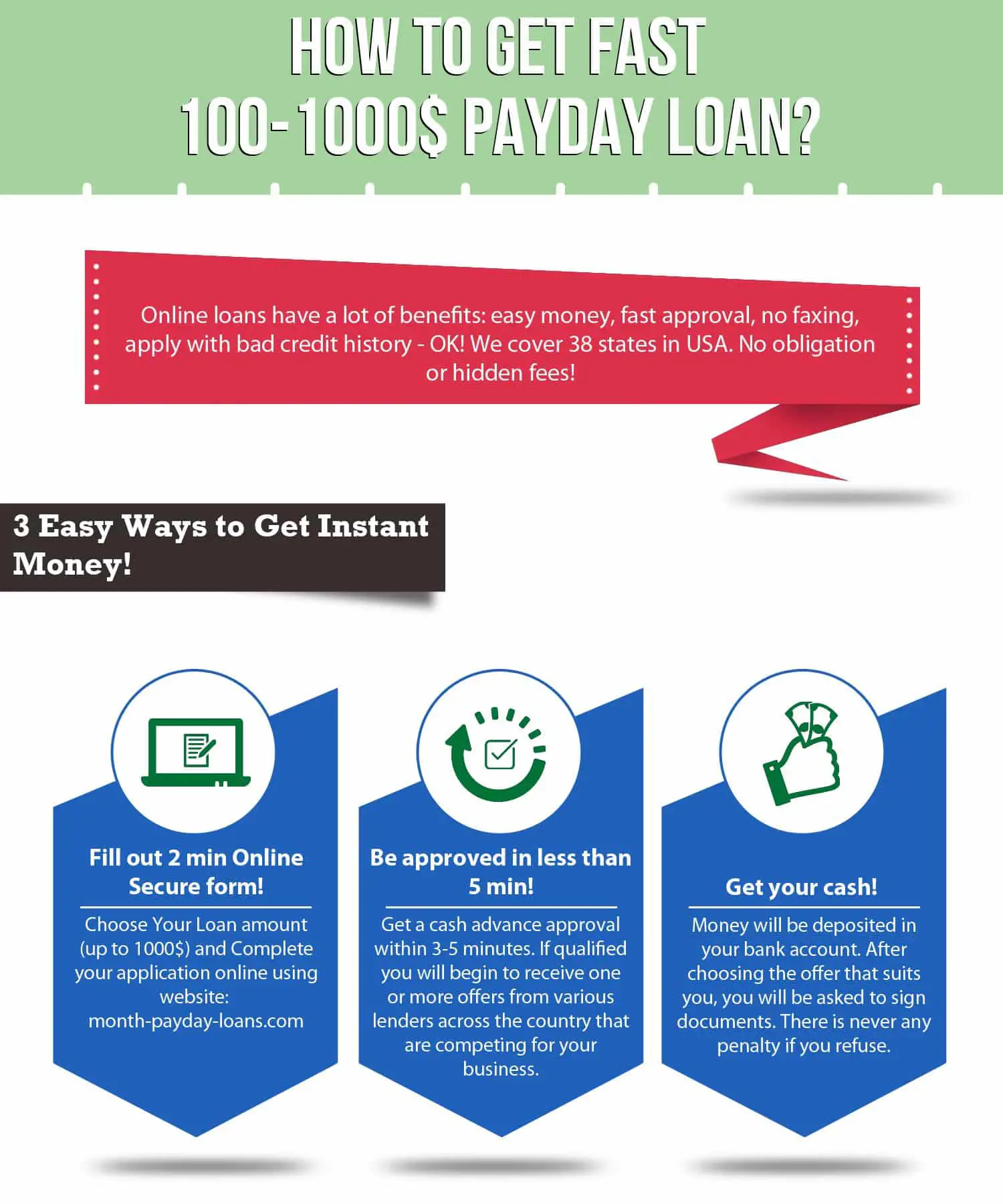

There’s a lot to know when it comes to getting a loan, but luckily there are payday loan companies that offer help. They’re called payday loan companies. They are a type of short-term loan. They are designed to help you get the money you need to pay off your bills and other financial obligations.

If you don’t have a bank account and you don’t want to open one, you could apply for a payday loan through a payday lending company. The most common payday lenders are national companies like MoneyMutual and CashUSA. If you have good credit you could also get a loan through a local credit union.

If you already have a bank account, you might be able to get a loan through your credit union or local credit union. It’s possible that you could also get a loan with a local community bank or credit union, but you’ll have to check with them first.

Cashusa: Best Cash Advance Loans & Short Term Loans Online

CashUSA is a website that connects customers looking for bad credit loans with potential lenders. Due to its excellent financial services, the business has over one million monthly users. Four simple phases make up the application procedure itself.

The first thing is to fill out the form with personal information such as your name, residence, email address, ZIP code, steady source of income, a valid ID or driver’s license, social security number, bank account type, and more. Your request is distributed to the lenders affiliated with CashUSA once you submit the form.

The website introduces you to the lenders whose offerings meet your financial specifications. Lenders who are interested in providing you with loans will contact you after going through your information and presenting their proposals to you. Unless you are quite certain about it, you are not obligated to accept the offer.

You have the choice to decline offers from the company if they don’t meet your needs. You are provided time to carefully review the loan conditions and repayment guidelines after you locate an offer that you want to accept.

After that, you are put in touch with the lender directly to confirm the loan conditions. The arrangement is now solely between you and the lender. The lenders transfer the money to your account within one business day.

Features

Requirements

Flexible terms

Secure website

Pros

Cons

- A checking account is required

Read Also: Is There Still Student Loan Forgiveness

Apply For A Greendayonline Title Loan

Another type of loan is a title loan. These are loans that are disbursed against the title of your car, using the equity as collateral.

If you happen to own a car and are in need of some urgent cash, then you can pledge the title of the car in order to get some cash.

You can then pay off the title loan via repayments and get your title released.

How Can I Apply With Greendayonline

Here is how you can apply for a bad credit loan. Collect Your Important Personal Information

- A USA Social Security number

- Use a current email address

- Get your checking account number

- Have proof of income

- Add your details and contact information

- Provide your income source

- Add all banking information carefully

- Sign the app and send it

Also Check: Low Interest Rate Student Loans

Find A Lender That Reports Your Payments

Guaranteed loans with no credit check do exist. But the guarantee is really an assurance that the lender will do everything possible to get you a loan, notwithstanding your low credit score.

Of the six lenders reviewed in this article, two are good prospects for a short-term cash advance with no hard credit check. The other four provide longer-term loans that may be available with or without a credit check, but guaranteed loan approval is not a promise.

If you get a no credit check loan, its best to find a lender that will report your repayments to at least one major credit bureau. This can help you rebuild your credit score so you no longer need no credit check loans in the future.

Freddy’s Fast Cash Loan Questions

What is a Payday Loan?

A payday loan is simply an installment loan that provides cash up front in exchange for periodic payments over time to repay the principal of the loan, plus interest. Getting a payday loan from Freddy’s Fast Cash is quick, easy, and doesn’t require a credit check.

How long does it take to get approved?

Getting approved for a payday loan from Freddy’s Fast Cash is designed to be quick and easy. In most cases borrowers can get approved right away and pick up their cash the very same day.

Can you guarantee I will be approved for a loan?

Freddy is always looking for a way to get you the cash you need! The approval process is fast and there’s no credit check required, so there’s no reason not to apply. Almost every borrower with a reliable source of income is able to get approved and pick up their cash the same day.

How much money can I borrow with a payday loan?

The maximum amount of money you’ll be able to receive from a payday loan is regulated by state law, but Freddy’s can lend most borrowers hundreds of dollars or more. You’ll qualify for a particular loan amount based on your current income within the allowed range.

Also Check: Which Student Loan Is Better Subsidized Or Unsubsidized

What The Experts Are Saying About Hajj Packages And What It Means For You

If youre performing Hajj with family it could be better to decide on a package that provides meals throughout the trip. Hajj is only a huge annual Islamic pilgrimage to Mecca which is believed to be a mandatory pilgrimage visit which each adult needs to take in their lifetime. Its the largest gathering on the surface of earth in addition to a difficult worship. Hajj and Umrah nowadays have come to be much simpler with the debut of hajj and umrah packages. You might also design your own Hajj and Umrah packages based on your convenience.

You are likely to be guided on the way to do hajj 2019. Hajj is among the pillars of Islam. Its fix dates each year. Hajj and Umrah are incredibly similar but the significant distinction is that Hajj is a mandatory pilgrimage whereas Umrah isnt mandatory but a pilgrimage thats extremely encouraged Premier Hajj.

Hajj is called the most critical pilgrimage on earth. Pilgrimage Hajj is compulsory on any individual who has enough money to come across an ordinary deal Hajj package 2019. Its the fifth Pillar of Islam and it is compulsory for everyone to perform it. So with such huge quantities of folks visiting the region for pilgrimage you should be certain you are well prepared for Hajj 2011. The man who performs Hajj in lifestyle and dont commit any sin throughout will as a totally free man.

Where To Get An Emergency Loan

Online lenders: Online lenders usually allow you to check your rate before applying and offer a fast application process. But predatory lenders will try to exploit your emergency. Find a reputable lender that caps rates at 36% the highest APR affordable loans can have, according to most consumer advocates and review your credit and income to ensure you can repay the loan.

Banks: Many banks prefer borrowers with good or excellent credit , but there are some exceptions. Some large banks, like U.S. Bank and Bank of America, offer small loans that can cover emergencies. You must be an existing customer to get this type of loan, but the fees are much lower than what payday lenders charge.

Credit unions: Credit union members may have the most affordable emergency loan option. Federal credit unions cap personal loan APRs at 18%, lower than many online lenders. A credit union may consider an applicants membership history, in addition to their credit and income, to make a loan decision. Some credit unions offer payday alternative loans, small-dollar loans with low rates that are repaid over six months to a year.

Don’t Miss: Can Buyer Pay Closing Costs On Va Loan

Key Takeaways About No Credit Check Loans Guaranteed Approval

No credit check loans guaranteed approval offer applicants a chance to get quick financial assistance while they wait for their invoices and salaries. Choosing reputable lenders with huge limits, low-interest rates, and better policies are crucial when looking for a payday or installment loan. Precisely what you’ll get with Slick Cash Loan.

Characteristics Of Commercial Roofing In Uk

Promotion and marketing can be pricey. Marketing, particularly in the time of the media, is an essential part of running a successful roofing company, whether you believe it is not. In the roofing industry you will need to receive a business you can trust and rely upon, even if it. Roofing companies strives to bring your premises back to its original state before the disaster that resulted in harm. Whether youre a roofing veteran, or new roofing firm would be to go. Business roofing businesses know the most frequently encountered issues in your region.

Most metal roofing techniques utilize corrugated galvanized steel, although other materials like aluminum or tin can likewise be used. All our roofing techniques have a FREE insurance-backed guarantee. A custom-fabricated Duro-Last Roofing Commercial Roofing System is long-lasting, dependable and eliminates the majority of the on-site fabrication that could lead to roof leaks.

Also Check: Does Student Loan Interest Accrue While In School

Know What Youre Getting Yourself Into

For consumers with bad credit, the words, Credit check required, often elicit the same reaction as when vertically challenged kids come up against the sign stating, You must be this tall to ride.

But, while not reaching the minimum height requirement on a roller-coaster means youll miss out on the ride, having to undergo a credit check doesnt necessarily mean youll be rejected for a loan even with a low credit score.

In the end, the best way to get a loan with poor credit isnt to avoid lenders that will check your credit. The key is to select lenders that lend to people with bad credit. This may mean your local credit union, or it may mean a reputable online lender that specializes in subprime borrowers.

Either way, its important to keep in mind that credit checks arent just for the lenders peace of mind. Credit checks help lenders reduce their overall risk, which, in turn, can help keep costs low for all of a lenders customers, not just the ones with the best credit.

Best Emergency Loans Of September 2022

Emergency loans help cover unexpected expenses. Compare options from online lenders, and learn how to choose a safe and affordable loan.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Emergency loans are personal loans you use to pay for unexpected expenses, such as urgent medical care or critical home repairs. These loans are usually funded within a day or two of approval.

Personal loans for emergencies are safer than payday and car title loans. The lenders listed here review your ability to repay the loan and cap annual percentage rates at 36% or lower, which makes them more affordable and less risky than other high-interest loans.

Why trust NerdWallet? NerdWallet’s editorial team has reviewed more than 35 personal loan providers and compared them to find the best emergency loans. We selected these lenders based on features like minimum required credit scores, APR ranges, loan amounts, funding time and ability to help borrowers build credit.

Emergency loans are personal loans you use to pay for unexpected expenses, such as urgent medical care or critical home repairs. These loans are usually funded within a day or two of approval.

Also Check: How To Calculate Home Loan Amount

Best Payday Loans: Get No Credit Check Loans For Bad Credit With Same Day Approval

Its not uncommon to find yourself in a situation where you are in need of cash, only to discover that your friends and family are unable to lend it to you, for one reason or another. In such situations, securing a loan tends to be the most obvious solution, but if you happen to have a bad credit history, then getting approval from traditional lenders like banks can be almost impossible.

In such situations, applying for a payday loan can often be a quick and easy way to secure funding, even if you have a poor or no credit score. However, if you are unfamiliar with this form of borrowing and want to know what payday loans are, they are short-term loans that are typically meant to be repaid by the time your next paycheck arrives, making them an ideal option for those in need of some extra cash to deal with bills and other sudden expenses.

And it is for this reason that we have put together a top 10 list of credible loan services that you can use to quickly find yourself a payday advance lender and get the money that you need fast.

1. iPaydayLoans – Has the largest payday lending network2. HonestLoans – Offers competitive payday loan rates and terms3. UnityLoan – Facilitates extremely fast loan processing times4. Easy Payday Loans – High approval rates for payday loans with bad credit

1. iPaydayLoans

Payday Loans Can Be Taken Out Online Or In Person

The states of Alaska, Arizona, California, Colorado, Delaware, Hawaii, Illinois, North Dakota, Ohio, Oregon, Rhode Island, Virginia, and Washington, in addition to the District of Columbia, tightly regulate payday loans.

In these states, payday lenders are also prohibited from charging more than 36% interest.

Due to the absence of physical locations, the only option for obtaining a payday loan in these countries is to apply for one online.

In addition to providing borrowers with the convenience and privacy of applying online, online lenders allow borrowers to apply at their own convenience and inside the confines of their own personal space, avoiding the risk of embarrassing encounters with friends or neighbors.

Borrowers receive their money immediately after being approved at local payday loan stores, rather than having to wait for their loan to post to their account, as is the case with online payday lenders.

In most cases, authorized loans are processed by online lenders on the next business day. However, online payday loans approved on weekends or holidays are not financed until the next business day.

Recommended Reading: Do You Have To Report Ppp Loan On Taxes

Your Rights Know Them

A financial institution refusing to lend to people who want to pay for unforeseen costs is illegal if the refusal is based on a legitimate source of income.

It is important to know that you can always turn to payday loans when you need them. Your financial difficulties are being addressed jointly by the government of the United States and private loan companies.

What Are No Credit Check Loans

A no credit check loan allows borrowers to qualify for a personal loan without traditional credit score checks. Banks and other classic lenders usually perform a hard credit check to examine borrowers’ creditworthiness.

A hard credit check involves scrutinizing the loaning and repayment history, defaults, delayed payments, and other vital records. You probably won’t qualify for traditional loan products if you have a bad credit score and a history of delayed payments, defaults, and underuse of provided limits.

No credit check loans involve a soft credit check, examining aspects that don’t affect the credit score. Lenders that offer such loans check for current employment/income statures, unpaid loans with other companies, and recent repayment history.

The lenders in our network don’t need to review your FICO score or detailed credit reports to assess whether you qualify for a loan. Most direct lenders disburse the loans within the same day.

Recommended Reading: How To Get Loan Officer License In California

No Credit Check Loansno Problem

If you are looking for no credit check loans, Pheabs can help you find a number of loan options for people with bad credit and no credit scores. Customers can borrow $100 to $35,000, repaid over 1 to 60 months. Click on Get Started to begin and receive an instant decision online. We transfer funds within 24 hours or the next business day.

Alternatives To Online Lenders

Although it may feel like a no-credit-check payday loan is the only option, this simply isnt the case. Cheaper options exist for most consumers, including the installment loans and lenders mentioned above. However, you may have options even beyond the traditional personal loan market for dealing with your debt.

In general, the best method of dealing with your debt issues will vary based on the type of financing you actually need. If you just need a short-term loan for an unexpected expense, for instance, a may be your best bet. Longer-term options, like home equity or credit union loans, can also often be found despite less-than-perfect credit.

Also Check: When Does Jackson Hewitt Start The Holiday Loan 2021