Home Loan Eligibility Based On Salary

One of the eligibility criteria that determine how much loan you can avail is your net salary . Your salary is crucial as it helps in forecasting your repayment capabilities.

Your income will determine the loan amount you are eligible for. Lenders will consider your take-home salary, minus certain common deductions such as gratuity, PF, ESI, etc. The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow.

For instance, if your take-home salary is Rs. 25,000, you can avail as much as Rs.18.64 lakh as a loan to purchase a home worth Rs. 40 lakh But if your take home is Rs. 50,000, you can avail a loan amount of Rs. 37.28 Lakh for the same property. Subsequently, if your take-home is Rs. 75,000 you can increase your eligibility up to a loan amount of Rs. 55.93 Lakh.

|

Net monthly income |

|

|

55.93 lakh |

What Is Home Loan Repayment

A home loan repayment refers to a housing loan in which the monthly repayments covers a portion of the capital amount loaned as well as the accrued interest. This means that your home loan balance will gradually decrease each month, and with faithful repayments, the loan would be fully paid by the end of its term.

But what is home loan exactly?

One of the most common forms of debts, housing loans are offered by a mortgage company, bank or other financial institutions for the purpose of acquiring a property.

Under a home loan, the title of the property is transferred by the owner to the lender as collateral . It would be transferred back to the owner once the housing loan is fully paid and all other terms are met.

This gives more people the chance to own a home as the entire payment of the house does not need to be provided up front. With a tenure of 10 to 30 years, home loans have two main types fixed rate and adjustable rate. In a fixed rate home loan, a borrower pays the same interest rate throughout the duration of the loan. In an adjustable rate home loan, the interest rate charged by the lender varies.

Generally, adjustable rate home loan has lower interest rates than fixed rate home loans as the borrower bears the risk of a hike in interest rates.

A person wanting to secure a home loan must submit an application and the information on his/her financial history to the lender to prove that he or she is capable of repaying the loan.

How Does Loan Repayment Work

The commonest way in which repayment works is through EMIs. In this method, the monthly installment is fixed at the start of the loan and comprises principal and interest.

The EMI is paid on a particular date during the month until the end of the loan duration and the borrowed amount is repaid in full.

However, the EMI does not equally comprise principal and interest amounts. During the initial loan duration, a larger component of the EMI is paid towards interest.

As you continue paying the installments, the interest comprised within the EMI reduces and a higher amount is used towards repaying the principal amount.

You May Like: Usaa Auto Pre Approval

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Recommended Reading: Usaa Auto Refinance Rate

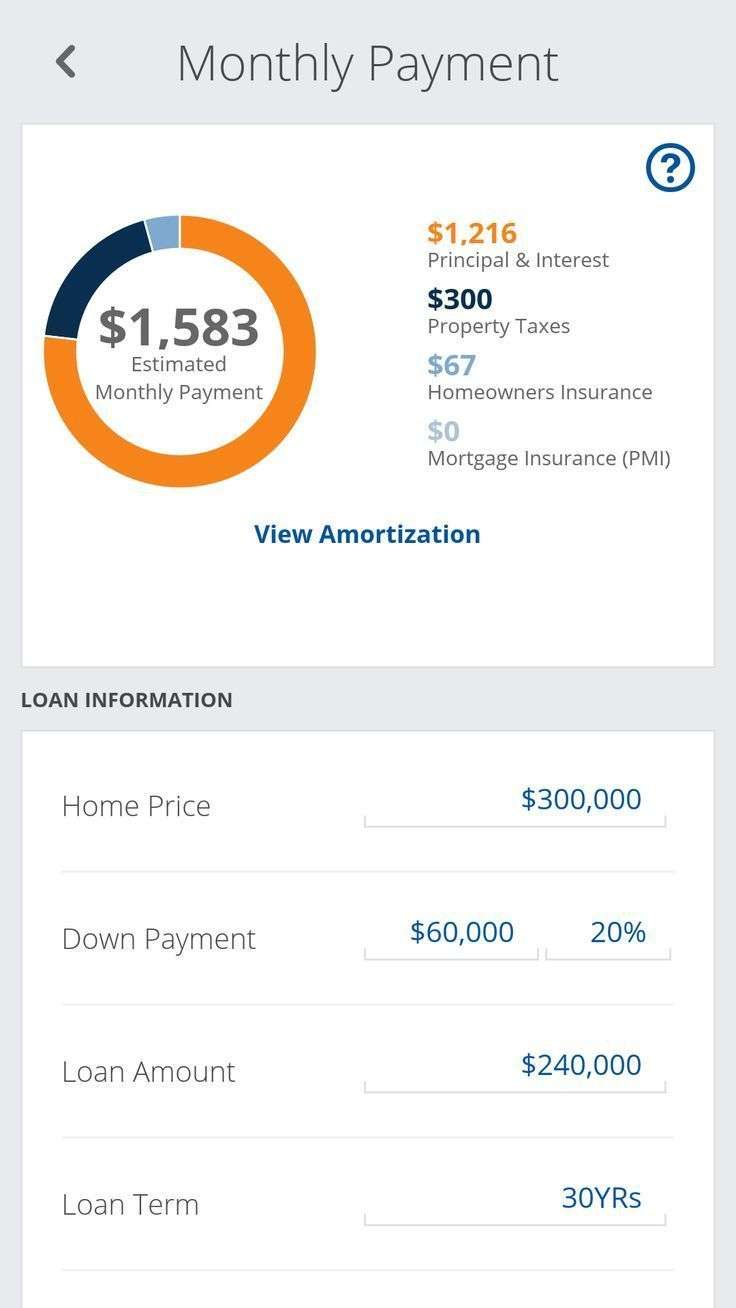

What Is A Home Loan Calculator

Calculating a housing loan is no easy feat what with all the jargons you will have to face as well as the numbers and formulas to determine your monthly home loan repayments.

An accurate calculation of home loan could significantly lighten a borrowers efforts to acquire a home. A wrong calculation could affect your home loan instalments, which could eventually lead to the foreclosure of your house.

Thankfully, we have the a special calculator created to help homebuyers determine how much money they would have to pay monthly and how long it would take to fully pay the loan. With this tool, a homebuyer can easily see if he or she could afford the monthly loan repayments for their dream home.

We have a few other tools you might find useful in your property-seeking journey:

takes into account the principal on the loan and the repayment of interest to arrive at the length of time that a homebuyer would have to pay off the loan. To achieve the most accurate figure, a homebuyer should ask the lender the in which they qualify.

The calculation of housing loan is based on the term of the loan as well as the size of downpayment given by the homebuyer.

Paying a large downpayment can help a homebuyer secure a high credit ceiling with a relatively low home loan amount. This is based on the assumption with a fixed period of time the bigger the downpayment paid by the homebuyer, the smaller the home loan gets.

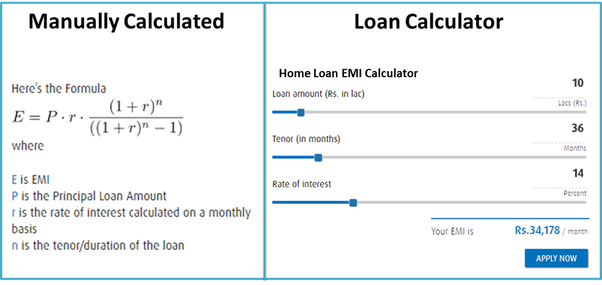

What Is Home Loan Emi Calculator

The home loan EMI calculator, as the name suggests, is a tool you can use to calculate your housing loan EMIs. Based on the values entered for the principal amount, interest rate, and tenor, the calculator displays the EMI you must pay each month.

What is a Home Loan EMI?

EMI, or Equated Monthly Instalment, is the monthly amount you must pay to repay your loan by the end of the tenor. Its amount depends on the applicable home loan interest rate, the principal amount, and the loan tenor. To know your EMI, use the Bajaj Housing Finance EMI calculator.

What Factors Affect your Housing Loan EMI?

Your home loan EMI is dependent on the principal amount, interest rate, and loan tenor. Use our Home Loan Eligibility Calculator to know how much you can borrow based on your monthly income and fixed obligations.

The tenor refers to the number of months over which you will pay your EMIs, and the housing loan interest rate is the rate offered to you by the lender. The rate, in turn, depends on market conditions and your credibility as a borrower.

The below EMI formula exhibits the relationship between the EMI, principal, rate of interest, and tenor..

EMI = /

Where,

P is the principal or loan amount

R is the monthly home loan interest rate

N is the number of EMIs

What is a home loan amortization schedule?

| Year |

How Does Home Loan EMI Repayment Reduce Tax Obligations?

As per the India Income Tax Act, you can claim home loan tax benefits on both principal and interest repayment.

Also Check: Usaa Car Loan Rates

Mortgage Payment Calculator Canada

Looking to take out a mortgage sometime soon? Know what you’ll be signing up for with our mortgage payment calculator. Understanding how much your mortgage payments will be is an important part of getting a mortgage that you can afford to service long term.

The mortgage payment calculator below estimates your monthly payment and amortization schedule for the life of your mortgage. If you’re purchasing a home, our payment calculator allows you to test down payment and amortization scenarios, and compare variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

What Are Hdfc Home Loans Key Features And Benefits

-

Home Loans for purchase of a flat, row house, bungalow from private developers in approved projects

-

Home Loans for purchase of properties from Development Authorities such as DDA, MHADA etc

-

Loans for purchase of properties in an existing Co-operative Housing Society or Apartment Owners’ Association or Development Authorities settlements or privately built up homes

-

Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority

-

Expert legal and technical counselling to help you make the right home buying decision

-

Integrated branch network for availing and servicing the Home Loans anywhere in India

-

Special arrangement with AGIF for Home Loans for those employed in the Indian Army.

Our tailor made home loans caters to customers of all age groups and employment category. We provide longer tenure loans of up to 30 years, telescopic repayment option, under adjustable rate option that specifically caters to younger customers to become home owners at an early stage of their life.

With our experience of providing home finance for over 4 decades, we are able to understand the diverse needs of our customers and fulfill their dream of owning a home .

Don’t Miss: Refinance Usaa Auto Loan

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Read Also: How Do I Find Out My Auto Loan Account Number

What Can A Mortgage Calculator Help Me With

Whichever mortgage calculator you use, its objective should always be to help you feel more informed on how to get a mortgage and your budget for buying a home, or to decide whether to move forward with a refinance. It all depends on your lifestyle and personal goals.

Below are some of the questions a mortgage calculator can answer.

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Read Also: How Long Does An Sba Loan Take

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

What Kind Of Mortgage Is Right For Me +

The answer to this question is totally dependent on your present situation. To determine what kind of mortgage is right for you, you would need to realistically consider your financial situation. Some important questions you would need to answer include whether you are able to make a down payment, the length of time you would spend in the house, the state of things with your annual salary for the period of the mortgage as well as your credit history.

Don’t Miss: Fha Limits In Texas

How To Use Hdfcs Eligibility Calculator

HDFCs Eligibility Calculator facilitates checking eligibility for housing loans online.

- Gross Income in : Input gross monthly income. NRI should input net income.

- Loan Tenure : Input the desired loan term for which you wish to avail the loan. A longer tenure helps in enhancing the eligibility.

- Interest Rate : Input HDFCs prevailing housing loan interest rate. to know the prevailing interest rates

- Other EMIs : Input the EMIs of the other loans you may have

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Also Check: Usaa Refinance Auto Loan Calculator

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Recommended Reading: Mountain America Credit Union Refinance Rates

The Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into, because it might be cheaper than the closing costs on a refinance.