What Is A Single Close Construction Loan

With a single close construction loan, you can finance both the construction of your new home and the long-term mortgage that will be needed to afford your home once its built.

This streamlines the process, allowing you to close on your home loan once, rather than having to secure two or more separate loans for the property, construction, and home financing.

You qualify once and have a single appraisal, loan originator, and closing process. This reduces the time it takes to build and move into your new home, protects you from unforeseen circumstances down the road, and saves you from paying double the closing costs.

With other loan options, financing new home construction has been notoriously difficult. Buyers had to find a way to finance the land, construction project, and home. In many cases, this required getting two or three loans.

Home construction is complicated and requires many moving parts. Single close construction loans are made to help simplify the process.

Qualifying for a one-time close construction loan is no more complicated than qualifying for a conventional home loan, depending on your overall financial health and risk level.

Single Close Construction Loan Program Options

We offer specialized loan programs to meet various borrower needs. Each loan program is government-backed, meaning we follow standard rules for fees, interest rates, and how funds are used.

Government backing allows borrowers to secure financing with low or no down payments and even low credit scores, as long as you meet standard eligibility requirements.

All of our available loan programs can be used to finance new home construction. We also work with homebuyers to finance land if you dont already have a lot to build on.

Learn more about each of our single close construction loans available.

U.S. Department of Agriculture Single Close Construction Loans

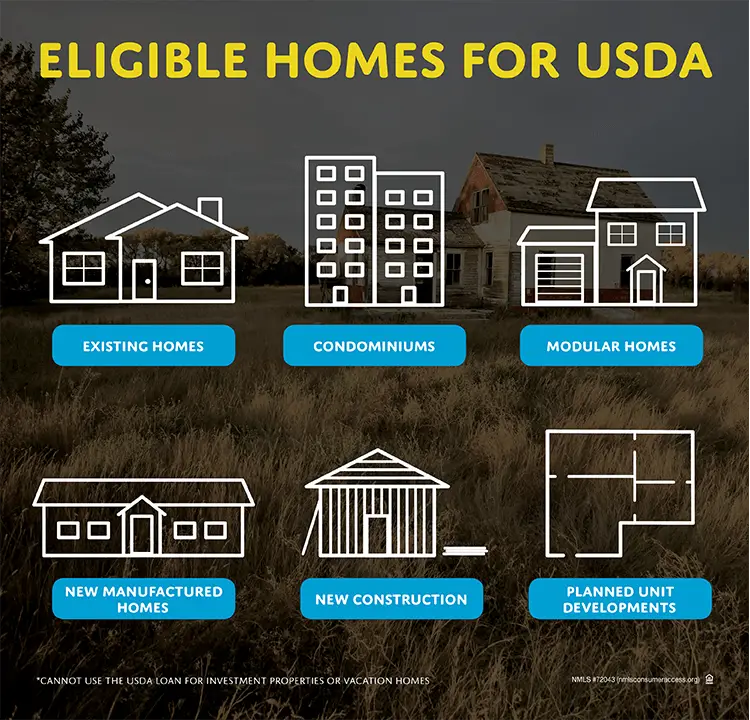

A USDA single close construction loan, also known as a rural development loan, is available in certain rural and suburban areas. These 30-year fixed-rate mortgage loans dont require a down payment. Buyers can even finance their closing costs, minimizing additional expenses beyond the homes upfront cost.

Veterans Administration Single Close Construction Loans

Available to qualified veterans, active military, and their eligible surviving spouses, a VA single close construction loan equips you to build, buy, repair, retain, or adapt a home. No down payment is required, closing costs are limited, and you arent charged a penalty for paying the loan in advance.

Federal Housing Administration Single Close Construction Loans

Fannie Mae Single Close Construction Loans

The Lowdown Onusda Otc

With a USDA One-Time Close Construction Loan, your lender is responsible for managing the disbursement of the loan proceeds to the homebuilder or contractor for costs associated with the home.

Loan costs that are covered by the USDA One-Time Close Construction Loan include:

- Costs detailed in the contract between the homebuilder and borrower

- Costs paid to subcontractors for work on the home, including items such as septic, driveways, utilities and landscaping

- Cost to acquire the land or pay off the balance of the land

Additional costs that may be paid for with your USDA One-Time Close Construction Loan also include items such as surveys, permits, appraisals, inspections, architectural design plans, plan reviews and lender construction administration fees.

You May Like: Can You Get Va Loan With General Discharge

Quick Review Of Our One

-

620 Minimum credit score required for all One-Time Close Construction Loans

-

Options available in all 50 states

-

Up to 100% under our VA Program for Veterans and USDA Eligible Rural Areas

-

Up to 96.5% under our FHA Program, max FHA County loan limit, or FHA & USDA high-cost areas

-

Up to $150,000 land value allowed included in your max loan amount

-

NO payments due from the borrower during construction

-

1 Loan vs. 3 saves closing costs, appraisals, title fees, & down-payments when factoring land loan, construction loan, and final take-out loan of traditional construction financing

-

NO re-qualification once construction is complete

-

NO Re-Appraisal, one appraisal only, completed as if the home was built, so less worry of property values dropping during the build

-

Land can be used as a down payment if owned or purchased at the same time

-

The land you already own with a loan balance will be paid off and rolled into the loan

-

Our construction loan is 100% in place before breaking ground

-

Full inspectors working to ensure your build is going as planned before payments are made to the builder

-

Builder is never paid for work that is not yet completed, designed to protect you, the customer

-

15 and 30-year fixed rates are available

-

No Self-Help, Family Builders, and Buyer can not act as a contractor or complete any work on the home

-

Builder / Retailer can offer seller concessions, roll in closing costs, VA loans may be possible to have zero out-of-closing

Alternative Home Construction And Renovation Loans

Here are a few other construction loan options to consider if youre having trouble finding USDA loans, or simply want to widen your search:

- A VA one-time close construction loan These loans, backed by the Department of Veterans Affairs, are available to qualified veterans and active-duty military members. Like USDA loans, they can provide up to 100 percent financing

- An FHA one-time close construction loan Backed by the Federal Housing Administration, these loans require as little as 3.5% down and have lenient credit guidelines

- A conventional one-time close construction loan Conventional loans, backed by Fannie Mae and Freddie Mac, typically require a credit score of 620 or higher and at least 5% down

- AnFHA 203k loan Can be used to finance the purchase price and cost of renovations on an existing fixer-upper home. Requires only 3.5% down and a 580 credit score

- A traditional USDA home loan that can be obtained after getting a separate lot loan and/or construction loan

The right type of construction loan depends on your location, home building budget, credit score, and down payment, among other factors.

You should make sure youve explored all your options and found the best loan for you before signing on.

Also Check: How To Calculate Dti For Conventional Loan

Usda No Money Down Construction Loan Financing Now Available

Financing a new home construction has just gotten easier and more affordable. With a USDA One-Time Close Construction-to-Permanent Loan option you can arrange financing for the construction, lot purchase , and permanent loan, all wrapped up in one loan. Instead of the two phases typical of most construction mortgage programs where a first closing takes place at the start of building to finance the land and the construction costs, followed by a second closing when the home is complete to put the permanent financing in place, there is just one closing with a USDA One-Time Close Loan.

Benefits of the USDA One-Time Close Loan:

Process and Planning

- Preliminary Approval. Determine how much you can qualify for under the USDA Loan Program. This will require that you make a preliminary loan application and provide income and assets documents. Note, the minimum credit score is 640 for all borrowers on the loan. No exceptions

- Find lot to build your house and a builder and plans for you new home

- Builder/Retailer Approval. Loan Calculation Information on the plans, builder, and cost of construction are submitted to determine total cost of construction

- Lender Credit Underwriting. A full credit application is submitted for underwriting

- Construction Underwriting. A detailed construction application is submitted including plans, land cost, cost of each phase of building, and more

Apply For A Construction

You dont want a loan you want a home. Assurance Financial understands that. Its why we pride ourselves on being The People People with technology. We treat you like a person, not a number, and we explain your options in plain English. We are not just about numbers, but rather about your homeownership goals.

Our goal is to help more Americans reach the dream of homeownership. Its why we focus on mortgages and offer a range of loan products to help you accomplish your goals. Whether youre building new construction, renovating or buying an existing home, Assurance Financial has loans for you.

You can apply for a construction-to-permanent loan in 15 minutes with Abby, your virtual assistant. The application is simple, with no need to know complicated terms or enter strings of numbers. Abby lets you sign in to your payroll and banks to instantly verify assets and income, which can help streamline your application without sending in any statements.

If you prefer to speak to a person, we have mortgage experts licensed in 28 states. Our friendly and experienced professionals can listen to your goals and concerns and address them with customized advice.

Even if you apply with Abby, a real person will handle your application, so you dont have to worry about being treated like a number or getting lost in a computer system.

Read Also: Can I Pay Off Personal Loan With Credit Card

About Construction Loans And Uses For Construction Loans

No matter how excited you are to begin the construction process on your dream home, you may still be feeling a bit overwhelmed about all the unknowns of construction loans. Thats why we want to help you understand the basics so you can feel comfortable moving forward with the construction process.

Who Is Eligible For Usda One

Loan qualification is the biggest hurdle for most home buyers but its not as intimidating as it looks. Qualifying for a Conventional One-Time Close Construction Loan is no more complicated than qualifying for a conventional home loan. If youve ever bought a property, youre familiar with the steps.

Naturally, not everyone will qualify for a Conventional One-Time Close Construction Loan. Your loan amount will depend on your overall financial health and risk level.

Read Also: How To Be Approved For Home Loan

The Benefits Of Construction

Lets go over the basics a construction-to-permanent loan will let you borrow upward of $2 million, locking in interest rates when you apply and enabling you to finance a lot or build on a lot for your primary residence or vacation home. Now, lets cover the specific benefits of a construction-to-permanent loan for your home construction.

What Are Usda Construction To Permanent Loan Builder Approval Requirements

How does a builder get approved for a USDA new construction loan? What are USDA construction to permanent loan builder approval requirements in Florida, Texas, Tennessee, or Alabama?

As you can imagine, these are common questions for homebuyers looking to take advantage of the USDA construction to permanent loan program, a.k.a. USDA Single-Close Loan.

In todays short video, we will break down the USDA builder requirements and further explain this part of the USDA new construction loan process.

However, before we get started, dont forget to download our USDA Blueprint for Success with the link below. This free guide is designed to walk you through the USDA loan process and is a great resource for homebuyers and Realtors alike.

What are USDA construction to permanent loan builder approval requirements?

As a starting point, USDA guidelines include the following description for contractor-builder approval requirements:

A key to the success of the loan feature will be the financial stability and reputation of the builder constructing the home.

The approved lender and their agent, if any, will be responsible for approving participating builders.

Owner-builders are ineligible for this loan feature. Lenders are required to document their determination for eligibility of the builder to participate in the Rural Development mortgage transaction as further described in Handbook Chapter 15.

806-9836 X 280

Recommended Reading: Is The Loan Forgiveness Program Worth It

Usda Construction To Permanent Loan

USDA Construction Loan To Build A Home The USDA construction-to-permanent loan not only allows home buyers to build a home with no down payment , but it also offers an all-in-one financing option for construction, buying land and the funding of a “permanent” mortgage with one closing.

Blog > New USDA pilot program enhances Construction To Permanent Loans Shannon Faries In a recent announcement, the acting administrator of the USDA rural housing service notified state directors of a new pilot program proposed to enhance certain features of the existing single family construction-to-permanent financing option.

USDA. perm” financing also called “single close” financing will provide funds when construction begins. This will encourage homebuilders, lenders and borrowers to build more new homes. Here is.

Construction Loans Are Typically A construction loan is any value added loan where the proceeds are used to finance construction of some kind. In the United States Financial Services industry, however, a construction loan is a more specific type of loan, designed for construction and containing features such as interest.

Direct Benefits of Construction to Permanent Loans After you start the process of building your house, well provide you with the best expertise to make the whole project easy. The construction to permanent loans provided by us does not require you to sell off your existing home at the time of construction.

Usda Alternative One Time Close Construction Loans Are Available For Fha & Va Eligible Borrowers On The Following Property Types:

-

YES, One-Time Close – True Prefabricated Modular Homes: Viewed the same as a stick build traditional homes by lenders around the country, this property style could allow you to save money, decrease build time, and get a great home at a cheaper rate than Manufactured Homes., Eligible on our FHA & VA Construction Loan Program. Prefab Modular Homes are usually built in more than 4-10 sections, do not come attached to an axle and tongue, and are not issued a VIN number like that of a Manufactured Single, Double, or Triplewide. Youre able to choose builders from across the country, order your home and have it delivered, installed, set up all under this program.

-

YES, One-Time Close for Stick, Stone, or Brick-Built Homes: Get Up To 100% For Veterans & Up To 96.5% FHA Purchase. These consist of wood, frame, brick, more traditional construction styles that are acceptable under our version of this program. Build a ranch slab, starter home, ranch walkout, ½ story, or two-story home with or without a walkout, but stay on the more traditional side of this property. Find a great piece of land and start building your dream home for you and your family.

YES, JUST ADDED: Jumbo Home Financing, Steel/Metal Homes, Barndominiums, Log Cabins, Concrete Block Homes, SIP Panel Homes, ICF Insulated Concrete Foam Homes, Log Cabin Style Homes, Multi-Family, 2nd Homes, Investment Homes, ADU Accessory Dwelling Units.

Read Also: How To Get Rid Of Pmi Insurance On Fha Loan

Property Requirements For A Usda Construction Loan

As a nonconforming loan, a house built with a USDA construction loan isnt subject to the traditional home purchasing standards of government-sponsored enterprises mortgage companies like Fannie Mae and Freddie Mac. However, there are still several property requirements for homes built with a USDA construction loan:

- The property must be in a USDA-approved area.

- The property must be the primary residence.

- You must use a USDA-approved contractor.

- You must have a new construction warranty from the builder.

Get your free credit report and score.

Create a Rocket Account to see where your credit stands.

Borrower Requirements For A Usda Construction Loan

There’s a long list of requirements borrowers must meet to qualify for this type of loan. Here are the USDA construction loan requirements for borrowers:

- You usually need a minimum of 640.

- Your debt-to-income ratio must be no more than 41%. As part of this, the amount you spend on housing each month cant represent more than 29% of your pretax monthly income.

- Your total income cannot exceed the state’s USDA income limit.

- If you’ve experienced bankruptcy, you may have to wait 1 3 years for depending on the type of bankruptcy and lender policies, among other factors.

Don’t Miss: What Is California Jumbo Loan Amount

Build The Home Of Your Dreams On Your Terms

The space you’ve dreamed of is possible. With a new construction-to-permanent loan, you can cover the costs of your project, then convert your loan to a traditional mortgage when your dream home is finished.

One closing

Close once and cover your financing for construction and beyond.

Financing that fits

Make interest-only payments while construction is underway.

Peace of mind

We pay your builder as construction progresses, giving you one less thing to worry about.

Boosting Rural Americas Housing Supply With Usdas Construction

Boosting the housing supply is crucial to bringing homeownership within reach for millions of Americans. USDA Rural Development and its lending partners have affordable financing options for homebuyers who are considering building their dream home.

Through USDA Rural Developments Combination Construction-to-Permanent Loan Program , USDA-approved lenders with experience in construction loans can help borrowers who want to build a home. This program streamlines the lending process and saves money for homebuyers because they pay closing costs on one loan instead of on a construction loan and a permanent loan.

This program can help support housing construction in rural areas throughout the country.

For example, USDA recently partnered with 1st Signature Lending, based in Indiana, to help people build homes financed through the Combination Construction-to-Permanent Loan Program. Chief Operating Officer Joe Willing highlights many of the programs benefits.

Of course, one of the biggest benefits that attracts us to the program is the fact that these loans are guaranteed at closing, even before construction begins, Willing said. This gives us confidence to market this loan program to our customers knowing that USDA is standing behind the guarantee. USDA has also structured their loan for secondary market acceptance. The securitized feature allows a lender to free up capital by transferring these loans to secondary during construction.

Read Also: No Credit Check Installment Loans Online

Rules And Restrictions On Va Construction Loans

There are many rules youll need to navigate if you pursue a VA construction loan. Here are some of the most important ones to be aware of:

- You must use a VA-approved builder . You are free to choose any builder you want as long as they are willing to go through the VA approval process.

- You cant buy undeveloped or vacant land. Unless you begin construction on a house right away, you arent allowed to buy a parcel of land with no housing on it. If youre not ready to build yet, consider a VA land loan, which can be paid off later with a VA construction loan.

- You need to build a home that will be your primary residence. VA loans cant be used for building investment or rental properties.

- Your house must be connected to utilities and paved roads. If youre interested in extremely rural or off-grid living, a VA loan probably isnt right for you.

- You cant buy or build a house outside the United States. If you want the expat experience, your best bet is to build or buy in U.S. territories or possessions. This includes Puerto Rico, Guam, the Virgin Islands, American Samoa and the Northern Mariana Islands.

- You may be approved if you have a debt-to-income ratio higher than 41%, which is the listed maximum for qualification, as long as you meet the residual income requirements.

- You can have more than one VA loan at a time. The maximum loan amount may be limited, and a down payment could be required on a subsequent VA loan if you dont pay off the existing one.