Should I Start Paying Off Student Loans Before Graduation

Federal student loans do not require students who are enrolled at least half-time to make payments on their student loans while they are in school. Private lenders may or may not require payments while the borrower is still in school.

Making payments on your student loan before you graduate could help you accelerate the loan repayment, which could ultimately help you save money over the life of the loan.

How To Use This Calculator

Youll get the most accurate results if you enter your loan amounts separately with their precise interest rates, but you can also estimate or use the sample loan amounts and interest rate provided.

You may have a mix of federal and private loans. If you dont know how much you owe, search for your federal loans in the National Student Loan Data System or contact your private student loan lender.

This calculator assumes youll be paying monthly for 10 years once repayment begins, which is the standard term for federal loans and many private loans.

Enter the total amount you borrowed for each loan. You can enter up to three loans for each year youre in school, up to four years. Its possible to include 12 loans total.

Enter the interest rate for each loan amount. Your interest rates will vary depending on whether your loans are federal or private, the year you borrowed and, in some cases, your credit score. Check with your federal loan servicer or your private lender to find out your interest rate.

Interest will accrue daily on unsubsidized federal and private loans while youre in college. The total amount accrued will capitalize and be added to your total loan amount when repayment begins. During repayment, interest will continue to accrue and will be included as part of your monthly bill amount.

Select Yes if you have a subsidized federal loan or No if you have an unsubsidized federal loan or a private loan.

How Do I Repay My Student Loan

- If youre employed, repayments are taken out of your salary at the same time as tax and National Insurance. Check your payslips to see how much is being deducted and make sure your employer has you on the right plan.

- If youre self-employed, repayments are calculated from your tax return and payments are made at the same time as you pay tax . You’ll need to register with HMRC, file a tax return and pay. untied helps with all this. .

- If youre an employee and also do a tax return, you need to include how much of your loan youve paid off during the year, on your self-assessment tax return. untied helps you include any student loan payments in the right place on your self-assessment tax return. .

Dont forget, you can also make extra payments or pay off some/all of your loan early without penalty.

Also Check: Will Paying Off My Auto Loan Increase My Credit Score

Use Your Results To Save Money

If you have unsubsidized or private student loans, you can lower your total to repay by making monthly interest payments while youre going to school. Or, you may opt to make a lump sum payment of the total interest that accrues before repayment begins. Either method will prevent the interest that accrues from being capitalized. The result: a lower monthly bill amount.

You can submit more than your monthly minimum to pay off your loan faster. The quicker you finish paying your loans, the more youll save in interest. Learn how to pay off your student loans fast.

If youre having trouble making payments on your federal loans, you can extend the term to 20 or 25 years with an income-driven repayment plan. Income-driven plans lower your monthly loan payments, but increase the total interest youll pay throughout the life of your loan.

Private lenders may allow you to lower monthly payment temporarily. To permanently lower monthly payments youll need to refinance student loans. By doing so, you replace your current loan or loans with a new, private loan at a lower interest rate. To qualify youll need a credit score in the high 600s and steady income, or a co-signer who does.

Student Loan Repayment Options

It is not uncommon for new graduates to struggle to repay their student loans. Unfortunate circumstances such as flaccid job markets or recessions can exacerbate situations. For federal student loans, there are some alternative solutions that can aid in dwindling down student loan payments. Income-based repayment plans can potentially cap the amount that students repay each month based on available income if they find that their student loans become increasingly harder to pay off. These plans prolong the life of the loans, but they relieve the burden of large monthly payments. There are also graduate repayment plans that slowly ramp up monthly payments over time, presumably in conjunction with projected salaries as people progress through their careers. Extended graduated repayment plans allow borrowers to extend their loans for up to 25 years. For some income-linked plans, in the end, the remaining balance may be forgiven, especially for those in public services.

The major repayment plans for federal student loans are listed below.

| Plans | |

| Low-income borrowers with Federal Family Education Loans | No |

* Loan forgives tax-free after 120 qualifying loan payments for these in public services. It is not income tax-free and only forgives at the end of the loan term for others.

Read Also: How Do You Calculate Loan To Value

Estimate Your Student Loan Payment

Estimate your student loan payments under a standard repayment plan using the calculator below.

- This is only an estimate! Your actual payment amount is determined by your loan holder based on the amount that you borrowed. However, most student loan programs require at least a $50 payment each month, no matter how small your loan amount.

- Your interest rate depends on your loan type and when you received the loan. for a chart with Direct Loan interest rates.

- The calculator is preset to 120 months and an interest rate of 6.8 percent. You may adjust these.

- It is recommended that your student loan payment be less than 8 percent of your gross income. The minimum salary field is based on this recommendation.

- If you have not made payments while in school or during your grace period, you may have capitalized interest Accrued interest that is added to the principal of your loan that will be added to the principal amount of your loan. This amount should be included in the principal amount in the calculator below in order to give a more accurate estimate of the loan repayment information.

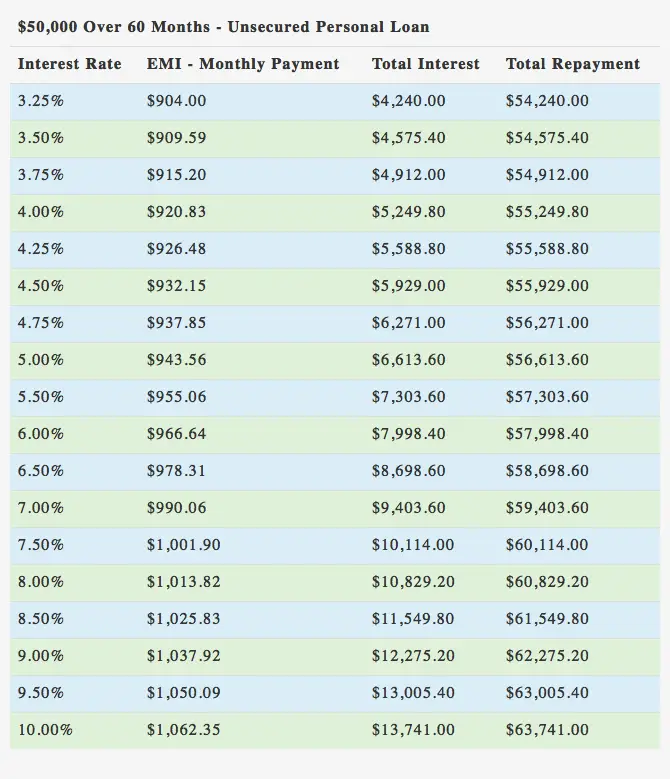

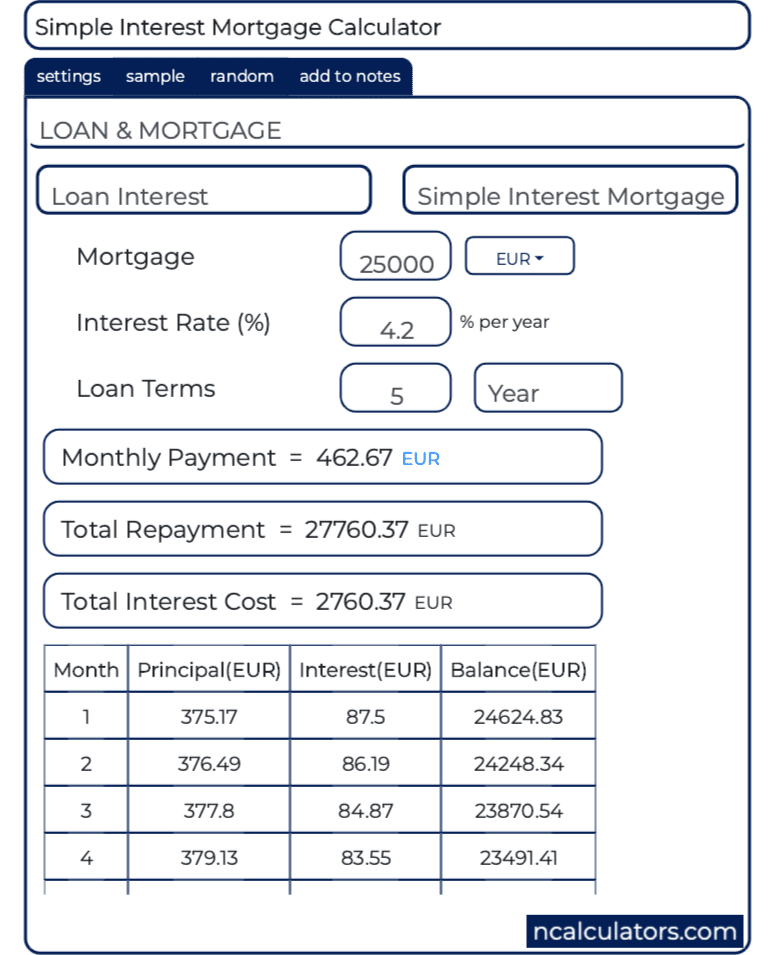

Enter your Principal Amount of Loan, Simple Interest Rate, and Number of Monthly Payments.

What Are The Different Types Of Student Loans

There are two main types of student loans federal loans and private loans. Federal loans are offered by the U.S. Department of Education, while private loans are offered by private lenders, which include banks and credit unions.

You might want to begin by applying for federal loans since they come with fixed interest rates and typically include more borrower protections. When you apply for federal loans, you may qualify for either subsidized or unsubsidized loans.

Direct subsidized loans are designed to help borrowers facing financial need. Your college determines the loan amount, which cant exceed your financial need. The main benefit of subsidized loans is that the government will pay for the interest while youre in school.

In comparison, direct unsubsidized loans are available to undergraduate and graduate students whether they have a financial need or not. The amount you can borrow is based on your colleges total cost of attendance and other financial aid you receive. Youre responsible for paying any interest that accumulates while youre still in school.

If your federal loans dont cover the full cost of your education, you may decide to supplement them with private loans. Private loans are distributed by private lenders like banks or credit unions.

Read Also: How Much Home Loan Can I Get 40000 Salary

Whats Next: Apply For A Private Student Loan

If federal student loans arent enough to cover your college costs, private student loans can be an option to consider. Generally, private lenders will allow students to borrow up to the cost of attendance, less any other financial aid theyve received.

If you are interested in a private student loan, consider SoFi. Private student loans with SoFi have no fees, offer competitive interest rates to qualifying borrowers, and becoming a SoFi member qualifies you for other member-perks like career-coaching.

Benefits Of Using A Student Loan Calculator

Using a student loan calculator can help provide a reliable estimate of how much a loan will cost you in the long-term, in addition to a good estimate of how much youll owe each month. If you plan on making over-payments to accelerate your loan pay-off, this information wont be included in the calculations.

Don’t Miss: Will Refinancing My Auto Loan Help My Credit

Other Student Loan Calculators

Student loan refinance calculator: Compare your current loan payment or multiple payments with a refinanced student loan.

Student loan consolidation calculator: Compare your payments under federal loan consolidation plans with your current bills.

Parent PLUS loans calculator: Estimate your monthly payments on federal direct PLUS loans.

Daily student loan interest calculator: Estimate the amount of interest that your loan accrues daily and between payment periods.

How Does Interest Accrue On My Student Loan

Interest on federal student loans accrues on a daily basis. At the end of a period of non-payment, such as the grace period, the accrued interest will be capitalized on the loan amount. This means the accrued interest will be added to the principal value of the loan. This new total will be considered the new principal value of the loan and interest will continue to accrue based on this new total.

Generally interest on private student loans also accrues on a daily basis. Confirm with your lender or by reviewing your loans terms and conditions.

You May Like: What Are The Requirements For An Fha Loan In Texas

Summary Of Our Student Loan Payment Calculator

Use this calculator to estimate what your payment could be, how much you would pay in total on the loan, and how much forgiveness you might receive. Understand that this calculator makes some assumptions and in the end the final determination for all of the above is made by the department of education and your student loan servicer.

Provide us with your loan info

Things To Consider Before Taking Out A Student Loan

Student loans may seem like the best way to go to college, but there are more opportunities for free money than most people realize. Before taking out any loan, consider other options like grants and scholarships. A quick Google search and a chat with your schools financial aid office should help point you in the right direction.

If you still need to take out student loans, consider the following:

Read Also: Is Interest From Home Equity Loan Tax Deductible

Student Loan Planner Disclosures

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Who Can Use It

You have full access to MLOC if you are an enrolled medical school student, a medical school graduate, or a medical school administrator at an AAMC-member medical school. All eligible users have free premium access, which includes the ability to upload your federal loans, run repayment scenarios, and save your loan repayment options. To sign in to your MLOC account, see below under getting started.

Non-premium users have limited functionality and are not able to upload their federal student aid loan file or save their repayment information. A visitor can upgrade to premium access for $9.99. Upgrading your account provides premium access for four years.

Please note: If you are a dental student or graduate see the Dental Loan Organizer and Calculator .

Read Also: Ppp Loan Round 3 Deadline

Student Loan Forgiveness Calculation

In all of the income-driven repayment plans, the balance on your student loans is forgiven after either 20 or 25 years. If making income-driven repayments for 20-25 years, any balance on the loan is then forgiven at that time. To get your student loan forgiveness amount, we calculate how much you would normally pay on your student loan in total, and subtract it by what you would pay in any of the income-driven plans after 25 years.

Does The Student Loan Repayment Threshold Change

In general, the repayment threshold increases each year, but there are rumours that the government will lower the repayment thresholds.Lowering the threshold will affect the cash in your pocket in two ways. First, more people will be paying back loans. And second, people already making repayments will be paying back more.Loan repayments can hit hard and mean that you end up getting a lot less in your pay than you expect – for many, it’s effectively adding another 9% tax to your income. Proportionately, a reduction in the repayment threshold will most affect those who earn less.

Use our student loan repayment calculator above to see what impact a reduction in the repayment threshold might have in your pocket.

Read Also: Can You Refinance An Upside Down Car Loan

What Information Do I Need To Apply For A Student Loan

To apply for a federal student loan youll need to fill out the FAFSA, which will require personal and financial information.

To apply for a private student loan, youll fill out an application directly with the lender of your choice. The exact requirements may vary, but youll likely need to know how much you want to borrow, and provide personal information like your address, income, employer, and more. Private lenders will also generally conduct a credit check.

What Types Of Student Loans Are There

The two types of student loans available are federal loans, provided by the federal government, and private student loans, made by financial institutions like banks and credit unions. Federal student loans typically come with lower interest rates and more consumer protections than private loans. So its best to borrow those up to the maximum allowed, if necessary, before considering private loans.

Read Also: Will Student Loan Refinance Rates Go Down

Do I Have Federal Student Loans

If you have federal student loans, refinancing will result in you losing all federal loan benefits, .

Do you see your income changing in the future? More importantly, do you think your income could drop and/or leave you unable to make payments? If youre willing to lose the federal loan benefits in exchange for saving money on interest, refinancing could be a good option.

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Don’t Miss: How To Pay Back Student Loans

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

The Difference Between Private And Federal Student Loans

Private student loans are offered by private banks, each with its own programs and requirements. Most banks charge an origination fee and require both immediate principal and interest payments. Some private student loans also require in-school payments.

There are several federal student loan options . While each loan has differing qualifying factors and terms, most utilize deferred payments for students who are in school at least part-time. This means you wont have to make payments on student loans until you graduate or stop attending school.

Recommended Reading: How To Get Pmi Off Fha Loan