How Are Student Loans Disbursed

When your lender disburses your student loan funds, theyll send the money directly to your school. This is true for both federal and private student loans.

The school will apply the funds toward your direct costs, such as tuition and fees, and room and board if you live on campus. If money is left over after paying those costs, the school may send the balance to you as a student loan refund.

But unlike a tax refund, youre not free to spend your student loan refund money on anything you want. As explained earlier, you must put the money toward school-related expenses. Misusing the funds could lead to significant consequences.

How Do I Get Financial Aid For Living Expenses

To get financial aid for living expenses, youll need to complete the FAFSA. How much youll receive in financial aid will depend on several factors, including your schools cost of attendance, your year in school, and whether youre an independent or dependent student.

If youre a dependent student, it will also be affected by your Expected Family Contribution which is how much your family is expected to contribute toward your education.

Learn More: How Long Does It Take to Get a Student Loan?

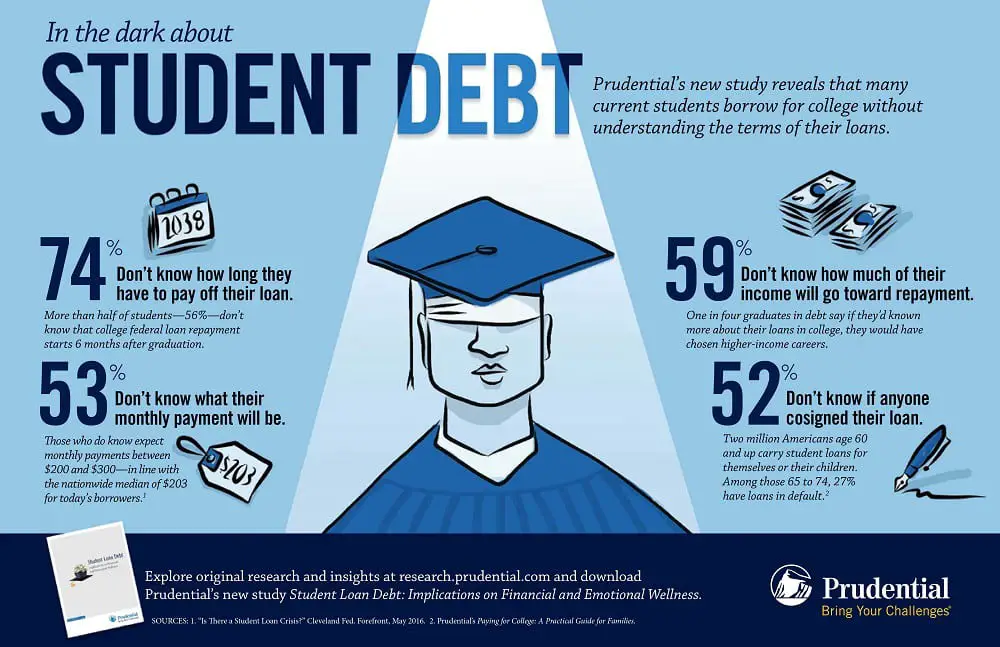

An Explosion Of Student Debt

Even used appropriately, student debt has exploded over the past decade, leaving an entire generation mired in debt that threatens their future. Its clear that every student needs to work to borrow less for school, not more, and that means keeping student loans focused on their intended purpose.

To quickly see how student loan debt has grown over the past decade, check out this shocking graph from the Federal Reserve Bank of St. Louis:

Every dime spent on something other than education expenses adds to that large mountain of debt, and the borrower will be dealing with those financial repercussions for many years after those purchases are forgotten.

Read Also: How To Ask For Student Loan Forgiveness

How To Use Student Loans For Living Expenses

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Keep your guard up: How to spot a student loan scam

Student loans are intended to pay for college, but education costs include more than tuition. You can also use student loans for living expenses.

Youre limited to borrowing the schools cost of attendance thats tuition and fees, books and supplies, room and board, transportation, and personal expenses minus any aid you receive.

» MORE: College survival guide for your money

Each college determines the cost of attendance, which covers expenses for one academic year and is adjusted yearly. Schools calculate numbers for on-campus, off-campus and commuter students, as well as for in-state and out-of-state tuition.

Both federal and private loans are disbursed directly to your school, which takes out tuition, fees and room and board if you live on campus. Any remaining funds from the loan will be distributed to you, according to your schools policy. You may then return any funds you dont need or use the money for living expenses, transportation, and books and supplies.

A Beginner’s Guide To Getting The Loans You Need To Graduate

Unless their parents have somehow saved enough moneyor earn massive salariesmost students need to borrow to pay for college today. Working your way through college is also largely a thing of the past. Few students can make enough to pay for college while they’re also taking classes. For that reason, student loans have become increasingly common. Here’s what you need to know about applying.

Recommended Reading: How To Calculate Income Based Student Loan Repayment

Living Off Student Loans: Dos And Donts

Student loans may seem like free money, but the debt you take on can follow you for years to come. If you run out of student aid too soon, you could find yourself forced to rely on credit cards or personal loans to pay the bills which could put you even further in debt.

Since most college and graduate students have little or no time to work and earn money while in school, its even more important to be responsible with your spending to make sure your loan money doesnt run out and force you into this bad financial situation.

The key to keeping your borrowing costs at a minimum is to know what you should and shouldnt spend your student loan money on. Here are some things its good to pay for with student loans:

- Tuition costs and fees

- School activities that enhance your resume or deepen your learning

- Study abroad programs that give you exposure to different cultures and the chance to learn new things while living in a foreign country

- Books and other supplies you need for classes

- Essential living expenses, including reasonable rent, food, toiletries, and personal items

- Tutoring or training you need to excel in your college career

- Professional testing, certificates, or licensing

- A computer you need to perform schoolwork

Some of the things you shouldnt use your loan funds to cover are:

- Spring break trips

- Restaurants or takeout

- Treating your friends

- Buying a car you dont absolutely need to get to class

Unacceptable Expenses For Student Loans

Dont take out more money in loans than you need. Always avoid creating more debt by forgoing certain conveniences or finding a source of income. Consider these options before using more loan funds than you need.

There are major consequences for using your student loans for unauthorized purchases. Some lenders require immediate repayment of the full loan balance, including any portion you have already spent. Inability to pay can negatively impact your credit report. It may also have an impact on your other loans and future loan opportunities.

You May Like: How To Apply For Sba Veterans Advantage Loan

What You Shouldnt Spend Your Private Student Loans On

When you take out a private student loan, youll typically sign a loan agreement that includes language about what you can and cant spend your private loans on. Pay attention to this information, because you could face serious consequences if the lender finds out that you misused loan funds. For instance, the lender might terminate your current loan, ask you to repay the loan balance immediately and block you from borrowing in the future.

Even if you get away with using the loan for unauthorized purchases, its not a good idea, because youll eventually have to repay that money with interest. Those fancy dinners, extravagant trips and brand-new cellphones will ultimately cost more when you repay the loan, thanks to compounding interest.

Generally, you shouldnt spend your loan money on:

When Student Loans Can Be Used

There are no hard and fast limits when it comes to spending your extra student loan funds. The best rule of thumb? If its something you need for school, your student loans can be used to pay for it.

Heres a general list of private and federal student loan uses:

Keep in mind that education-related expenses will vary by student. A journalism student may need subscriptions to major newspapers for their reporting or editing class, while someone in culinary school may need an apron, knives, pots, pans, or other supplies. Your course of study and class choices will play a big role in determining what qualifies as an educational expense.

Read Also: What Is An Upstart Loan

Eligible Expenses For Federal Student Loans

The Office of Federal Student Aid states that college students must use federal student loans only for approved expenses. In fact, when you sign the Free Application for Federal Student Aid , you certify that you’ll only use the money for educational purposes.

According to the agency, the following are approved:

- Tuition and fees

- Costs related to studying abroad

- Transportation to and from school

- Child care expenses

- Disability expenses

What Happens If You Misuse Your Student Loans

While examples of financial aid fraud prosecution have surfaced in recent years, the reality is that schools do not actively look for misuse. After depositing the approved student loan amount in students’ accounts, colleges remain largely uninvolved.

That said, if a school discovers a student has committed fraud, the institution may notify its legal department for advice or report the student to the Office of Inspector General.

Accruing additional debt by misusing loans can spell trouble for students long after they graduate. In general, learners should try to keep their student loan debt as low as possible. When repaying these loans, borrowers must cover both the original loan and all accrued interest.

Recommended Reading: Which Is Better Home Equity Loan Or Line Of Credit

What Expenses Can You Use Student Loans For

The Office of Federal Student Aid mandates that student loans must be used to pay for education expenses. But there’s some flexibility in how you can use federal student loans, beyond tuition and fees.

The list of expenses you can apply federal student loans to includes:

- Housing and housing supplies. Loan funds can be used to pay for living expenses, whether you’re staying in the dorms or renting an apartment or home. That includes rent and utilities. If you need to buy linens, rugs or other basic housewares to outfit your dorm room or apartment, those supplies can be purchased with student loan money.

- Books, supplies and equipment. Textbooks can easily cost several hundred dollars per semester and you may also have other costs related to your major, such as special lab safety equipment or a new laptop. All of those things are covered as educational expenses for student loan purposes.

- Transportation to and from school. If you don’t live in the dorms and travel to campus every day using public transportation or your own vehicle, those costs can be paid for with student loans.

- Child care. Student loans can also be used to pay for child care expenses if you pay someone to watch your children while attending classes.

- Study abroad costs. Spending a semester or two abroad can be an eye-opening experience and as long as you’re attending an eligible school, you can use federal student loans to pay for your expenses.

What Private & Federal Student Loans Can Be Used For

So, can you use student loans for anything? Well, the answer is no. Even if you receive extra money, the idea is that you should still be using student loans to cover living expenses and other necessities related to attending school.

Here are some of the things that student loans can be used for:

Make sure, though, that you document your student loan expenses. While its rare that youre required to prove how you use the money, its usually best if you can show that youre spending your student loan money on approved costs.

Also Check: How Much Auto Loan Can I Qualify For

How To Apply For Biden’s Student Loan Forgiveness Plan

If you check the above boxes, then you are likely eligible for student loan forgiveness under this new plan. Just note that your relief will be capped at the amount outstanding .

Now that you know you meet the qualifications, you’ll want to set a reminder to actually apply for the forgiveness. You can from the Department of Education when the application opens. The application will likely open around early October, White House officials said.

Qualifying borrowers are being advised to apply prior to November 15, 2022 “in order to receive relief before the payment pause expires on December 31, 2022.” But, you’ll have time. The deadline to apply is December 31, 2023.

You will submit an application through the Department of Education, which will outline the exact steps you need to take. You will likely need to demonstrate that you meet the above income threshold and have federal student loan debt, so make sure to gather the appropriate documents to have ready when the application becomes available.

“The application will be available no later than when the pause on federal student loan repayments terminates at the end of the year,” the White House said in a statement, adding that 8 million borrowers may be able to automatically get relief because their financial records and income data is already available to the Department of Education.

What Are The Alternatives To Student Loans For Living Expenses In College

Do you need money for your living expenses and other college-related costs but you dont want to go through the trouble and stress that come with a student loan? Here are some alternatives:

- Grants and Scholarships If you can get a grant or scholarship, youll benefit from money that you will not have to pay back, which is great.

- Use Your Savings Saving money during your school years can help you more than you think. When you finally need money for your tuition and other expenses, the savings will be at your disposal and you will not owe anything to any institution since the money is yours.

- Consider a Part-Time Job What better way to get money than getting a job? Your time will be limited because of the classes youll have to attend, but you can always work part-time. The income you get can be used to pay for your studies.

Also Check: Can I Change My Student Loan Repayment Plan

What Are Federal Student Loans

If you need to borrow money to pay for higher education, its best to start with federal student loans. They usually have lower interest rates and more repayment options than private loans. To qualify for federal aid, you need to fill out the Free Application for Federal Student Aid . Its what the government, states, and universities use to decide if you should receive scholarships, grants, and federal student loans.

You can complete the FAFSA online. Youll need the following information:

- Your Federal Student Aid ID

- Social Security number

- Drivers License number, if you have one

- Parents tax returns

- Parents bank statements and records of investments or other assets

- A list of schools youre interested in attending

The financial aid offices of the schools you list will all get a copy of your FAFSA, and will use that information when creating your financial aid package for their school. Of course, some federal loans have caps on how much you can borrow each year and have an aggregate limit so they may not cover your total cost of attendance.

Will My Student Loan Refund Accrure Interest Over Time

Yes, your student loan refund check will eventually accrue interest over time. Your refund check is part of your total student loan amount, whether you use a private student loan lender or federal student aid.

Federal loans will start accruing interest after graduation, but private lenders will start accruing interest on your loan throughout your college career.

Also Check: How Much Do Loan Officers Make

Alternatives To Using Student Loans For Living Expenses

You can borrow to pay for living expenses, but that doesnt mean you always should. Some alternatives to using student loans for living expenses include:

- Getting a part-time job while in college, whether on your own or as part of the work-study program, if you qualify. While you dont want to take too much time away from your studies, working during college could help you earn money and avoid borrowing too much in student loans.

- Relying on your savings. If youve socked away money while working during high school or school breaks, you could draw on your savings account to cover living expenses. At the same time, its a good idea to keep some money in your account in case an emergency comes up.

- Applying to scholarships and grants. Look for opportunities to win scholarship money that you dont have to pay back.

If youre concerned that your college will put you deeply into student loan debt, you might also consider choosing a less expensive school.

Can I Get In Trouble For Misusing Student Loan Funds

Your student loans are supposed to be used for educational expenditures and essential living expenses. If your student loan lender finds out youre misusing funds, such as by paying for spring break trips or bar-hopping, its possible your loan could be terminated and you could be forced to pay back the full amount borrowed.

However, its very unlikely lenders will look into what youre using the funds for or take any action if they find out youre having some fun with your student aid money. Their main concern is your ability to repay the loan.

Also Check: How Much Down Payment For Home Loan

Acceptable Expenses For Student Loans

Any expense that is considered part of the Cost of Attendance is allowable. You schools financial aid office determines its own COA, which determines your individual loan disbursement.

Though your school receives your student loans directly from the lender, any funds left over are disbursed to you. You then have the choice to return those funds or use those funds for other allowable expenses.

The Office of Federal Student Aid strongly recommends that students borrow only what they need to avoid racking up unnecessary debt. Use loans only after you have explored all education funding options, such as scholarships. Qualify for more and better scholarships when you improve your SAT score with an SAT prep course.

How The Cost Of Attendance Is Determined

The COA is determined by the individual school, not the federal government. The COA will vary based on the college you attend and its location. For example, a college in New York, which has a very high cost of living, will have a higher COA than a school in Mississippithe state with the lowest cost of living in the country.

Schools have their own formulas for calculating the COA, but many use an average of what students spend to determine the typical cost.

The school-determined COA is generally the maximum you can receive in financial aid, including grants, scholarships and student loans. Both the federal government and private student loan lenders use the COA to determine your maximum aid amount.

Read Also: Companies That Pay Student Loans