Can I Get A Bank Business Loan With No Credit Check

Simply put, no. Traditional lenders have a stringent and time-consuming process. They require massive amounts of documentation to prove your creditworthiness. In order to apply, you could need to give them:

- Two years of business tax returns

- Three to six months of bank statements

- Copies of all leases

- Articles of incorporation

It can take several months to pull together all of the required documentation and another few months to be approved or rejected. During the loan application process, usually near the beginning so no one wastes their time, the lender will pull your credit score.

Many traditional lenders will not lend to a borrower whose credit score is below 620. Even then, it might have to be a FHA-backed mortgage or other type of secured loan. You might have to pledge collateral to secure a loan which risks losing that collateral if you default.

Traditional lenders and banks typically, but not always, offer the lowest interest rates and best terms. If you have a great credit score but do not want to spend your time applying with a traditional lender, alternative lenders might offer you a competitive rate without the hassle of a banks application process.

But there are no traditional financing options available without a credit check. If you want to avoid one, youll have to go to an alternative lender.

Can I Get A Small Loan From A Credit Union

Yes. A credit union is a great way to get a small loan. Youll normally have to be a member of a credit union to get a loan from one, but its worth joining if you can.

Some federal credit unions offer payday alternative loans, or PALs, which are loans for small amounts of money at a lower cost than traditional payday loans and that can be repaid over a longer period.

PALs are regulated by the National Credit Union Administration. Loans can be for $200 to $2,000 and have a maximum APR of 28% and an application fee up to $20. Loans are repaid within 12 months through installment payments. Loans cant be rolled over.

A good credit score isnt required to qualify for these loans. PAL repayments are usually reported to the major credit bureaus, which can improve a borrowers credit scores.

If youre a business owner looking for emergency money to keep your business going, dont expect the installment loan providers weve reviewed to help. They cannot help you with a small business loan.

Instead, you may qualify for a loan from the Small Business Administration, or an SBA loan. The loans come with competitive terms, lower down payments, and no required collateral. Loans as small as $500 are available.

A business credit card is another option for short-term cash, though a small business loan is probably best if you plan to take months or even years to pay it off.

Best No Credit Check Loans: Top 10 Loan Companies For Payday Loans & Bad Credit Loans With Guaranteed Approval

The best way to solve your monetary urgency is to get a loan from a direct lender. See this top 10 no credit check or bad credit loan service platforms to find the right one.

When youre in pressing need of money and cant get it anywhere due to your poor credit score, the world might feel bleak. Unfortunately, traditional loan providers will rarely accept those applicants who dont have a top-notch credit history. Then, how could you solve your cash-strapped situation?

Here come the no credit check loans from brokers with an extensive network of online lenders. So, while considering no credit check loans guaranteed approval, you must ponder a loan that is easy, fastest and straightforward to apply for.

To ease your search, we have incorporated the top 10 loan service agencies which can offer loans with no credit check:

You May Like: How Does Equity Loan Work

What Is A Small Business Loan

A small business loan is a type of business funding that enables smaller sized businesses to borrow moneyto fund their business operations. Business loans can be used as working capital for easing cash flow problems,financing a small business purchase, to pay off debt or as a business expansion loan.

What Credit Score Do I Need For A Small Loan

These loans are a type of signature loan, meaning you only sign a legal document that youll repay the loan and therefore dont have to put up collateral. Without collateral, lenders may use an applicants credit score to weigh the risk of whether theyll repay the loan on time.

FICO is one of the credit score providers often used by lenders. A FICO score below 580 is considered very poor or simply bad. FICO scores can be as low as 300, which some lenders may still allow for borrowers seeking a small loan.

Lenders must receive your permission to access your credit report. This is and can cause your credit score to drop a little.

As weve mentioned earlier, a low credit score shouldnt prevent you from being approved for a loan. Other criteria lenders may look at include:

- Stable employment history.

- Existing debt of no more than 30% of income.

You May Like: How Can I Get Out Of My Car Loan

How Bad Credit Affects Lending: Get A Business Loan With Bad Credit

HomeBlogSmall business tipsHow bad credit affects lending: Get a business loan with bad credit

Sufficient cash reserves are crucial for operational expenses such as wages and reinvesting in initiatives that drive growth.

For many companies, these initial cash reserves come in the form of loans from financial institutions. But what if you have bad credit? You may be wondering, Can I still get a business loan?

You can still get a business loan, but its not as straightforward if you have bad credit.

In this article, well explore how bad credit impacts your ability to access funds and how to obtain a business loan if you do have bad credit.

Have You Explored All Other Options For Managing Your Business

When you go for a business loan, it is because you need capital to fund a critical task. However, a business loan is not the only way to fund your working capital needs, asset acquisition or new business unit. You can also get the necessary investment by adopting cost reduction mechanisms, increasing production and sales to a limited extent, or by using the money in your contingency fund.

So, consider all your financial options carefully before applying for a business loan. Sometimes it may turn out that you did not need a business loan at all and have ended up with a commercial debt for no reason.

Recommended Reading: Ppp Loan Bank Of America

What Is A Bad Credit Score

Lenders typically look at a business owners personal credit score and business score when evaluating a business loan application. However, for startups and other businesses without a credit history, the applicants personal score is even more important.

A business owner should have a personal FICO Score of at least 500 to qualify for a bad credit business loan. That said, even a FICO Score under 670 is considered fair or poor, and likely wont qualify a business owner for the most competitive interest rates available.

Best Options For Small Loans With No Credit Check

The best options for small loans weve found that dont require a credit check are from lending networks. These networks connect borrowers with an online lender that will provide short-term loans from $100 to $35,000.

The lending networks make it easy to prequalify for an unsecured loan online without a credit check. Once a borrower is approved for a personal loan, the lender may ask to access their credit report, which is a hard inquiry that could drop their credit score. However, since theyve already been preapproved by the lending network, and because the lenders have easier lending requirements, chances are theyll be given the small loan they need.

Here are the lending networks we recommend. Each can provide multiple loan offers within minutes. If approved for a loan, the money can often be sent to you as soon as one business day.

| 3 to 72 Months |

See representative example |

CashUSA.com is another favorite, in part, because its one of three companies we recommend that help consumers find large loans. CashUSA.com finds loans from $500 to $10,000. While the top amount isnt exactly a small loan, it can be enough money for a major hospital bill if youve been in an accident or a loved one has to go to the emergency room.

| Varies |

See representative example |

| 3 to 72 Months |

See representative example |

| Varies |

See representative example |

Recommended Reading: What Does Usda Loan Mean

Work To Bolster Your Credit Score

Its true that merchant cash advances, ACH loans, and business lines of credit can provide financing even when your credit is unimpressive. But thats no reason to accept the status quo. You should put effort into improving your credit, which will open more doors to you in the future. Not only will you qualify for more loan products, but you can also receive more favorable interest rates and repayment terms.

You may hear a lot of theories about tricks to quickly fix your credit, but there are 2 things you should focus on above anything else: Always pay on time, and keep your rotating account balances low, explains a from Business Insider. If you can do those 2 things and resist the urge to tinker with your credit report, much of the rest of your credit will take care of itself.

In order to maintain stellar payment history, sign up for automatic payments whenever possible. This practice may sound obvious, but a surprising number of small business owners still neglect it. Making manual payments might seem fine, but the chaos of entrepreneurship usually intervenes and you ultimately miss one or more obligations.

To avoid this fate, always automate your payments. If you cant sign up through the payee, just add them to your banking system. At the very least, make a regular calendar reminder so you wont be forced to rely solely on your memory.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Read Also: How Do I Find My Student Loan Account Number

How To Calculate Business Loan Emi

The Business Loan EMI calculation is done on the basis of a simple formula i.e.E = P x r x n/n-1Here,P represents the loan amountr stands for the interest rate offered on a monthly basisn is the duration of the loan

A business loan EMI calculator is a digital version of this formula, that allows you to calculate EMI amount through a web interface. The business loan EMI calculator can help you understand the breakdown of interest and principal loan amount, thus, allowing you to decide the layout of your cash resource planning.

Bank Credit Has Grown By Twice The Amount In March

CareEdge reported that the Bank Credit Growth has nearly doubled in March 2022, propelled by Retail and Financial Year Closing. It has risen by 9.6% year on year and grown by 402 bps compared to the 5.6% last year. There are some of the factors that played a role in this were retail loans, a rise in working capital loans, increased inflation, and boosted capital by corporates from banks. This has been quite a growth after outshining Deposit Growth after 2.5 years. Credit offtake of 9.6% y-o-y for the fortnight concluded on Mach 25 this year is better than 5.3 to 6.7 in the first H1FY22. With the gradual relaxation of COVID restrictions, the development of bank credit has resumed. The Union Budget 2022-23 is said to aim to expand CAPEX and infrastructure, and thus, credit offtake will also increase.

News Updated Date: 27-05-2022

Don’t Miss: Can You Keep Your Car Loan In Chapter 7

Business Grants: No Credit Score Time In Business Or Revenue Requirements

A business grant is like a loan that you do not have to pay back. Even better, business grants usually do not have any credit score, time in business, or revenue requirements. Though competition for these funds can be pretty stiff, its definitely worth looking into to see if there are any grants you may be eligible for.

Business grants may be offered by government agencies, private companies, business associations, and other organizations. The best place to start looking is usually within your local business community since most small business grants are regional. Read this article to get started: Small Business Grants: Get Free Money Through These 8 Grant Resources.

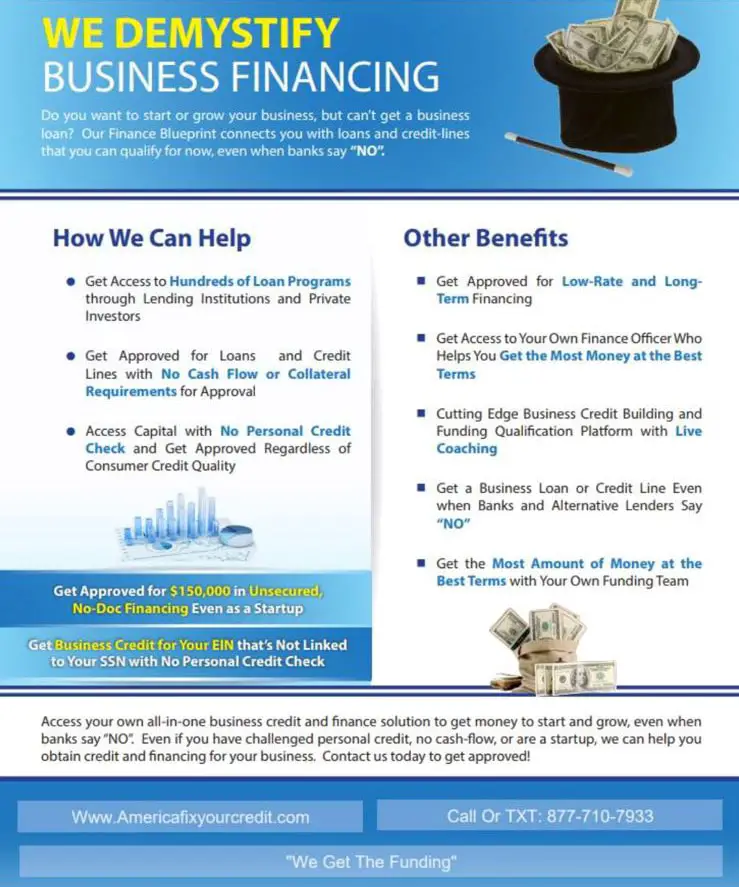

Types Of Business Loans That Dont Require A Credit Check:

- Invoice Factoring: using your unpaid invoices to obtain financing is a great way for business owners with bad credit to obtain quick financing without having to have their credit pulled. Invoice factoring companies will lend money to a small business by using the unpaid 30 to 90 day invoice as collateral. Since the invoice is being used as the basis for financing, and since the invoice comes from another company than your own, theres no need to pull your small businesss credit. Once the invoice is supplied to the lender, they will then forward your small business a large percentage of the invoices amount and then charge a small fee for the transaction. After the invoice has been fully-paid, the factoring company will then forward the remaining amount to the small business.

- MCA Credit Card Split: Unlike a true lending product, a credit card cash advance is a way to obtain quick business financing without having to rely on credit for approval. As opposed to being credit-driven, a MCA split uses your daily merchant credit card processing accounts transactions as the basis for financing. A cash advance lender will look at how much the small business processes each month in , lend the small business an amount of money the lender feels comfortable with, and then collects repayment by splitting each days credit card sales with the merchant.

You May Like: How To Get Approved For Hud Home Loan

How A Merchant Cash Advance Works

A merchant cash advance is an ideal type of no credit check loan. Instead of relying on your credit score, we assess your business recent debit and credit card transactions to determine affordability and produce a funding offer tailored for your business.

Get in touch with our team today to receive a tailored quote. The application process is quick and easy, and we can give you a funding decision within 24 hours.

There is no need for you to provide collateral or business plans, and we only conduct a soft credit check that does not affect your credit score. From this, were able to make a funding decision without running a hard check that will show on your credit report.

Unlike a traditional bank loan, there are no interest rates or fixed monthly payments to worry about. Instead, repayments are taken from a small percentage of your future debit and credit card payments.

We dont require any APR as there is no fixed fee, just one all-inclusive cost thats agreed on at the start, which never changes.

Is This A Payday Loan

No. Unless you decide to work with CashAdvance, all the other lending networks we recommend work with lenders that have interest rates as high as 36% and can allow years to repay.

CashAdvance works with lenders that provide payday loans that must be repaid in 15 to 30 days, and at interest rates that start at 400% and go as high as 2,290%.

These loans use your next paycheck as collateral if you dont pay. Almost half of these loans end up in default, some studies show. That means your next paycheck will be swallowed up whole by the payday lender, and your debt will increase.

These should be your last loan option for small emergency loans. Theyre high-interest loans due quickly, and since half of such borrowers default on the loans, its a clear sign that theyre difficult to afford.

Though the other lending networks we recommend dont offer such loans, the small loans that they connect borrowers with should still be paid on time and not skipped entirely.

Only paying part of the loan, having a late payment, or not paying the loan back at all can cost you additional fees and you could face collections from your lender. If you think you may miss a payment, you should immediately contact your lender and discuss your options. Most lenders are often willing to work with you if you need help.

Also Check: How Do I Refinance My Sallie Mae Student Loan