Get Personal Loan Rates

However, it still may not be the best option for you, especially if you don’t have a cosigner. To find the best personal loan lender for your situation, do some comparison shopping before deciding to take out a personal loan.

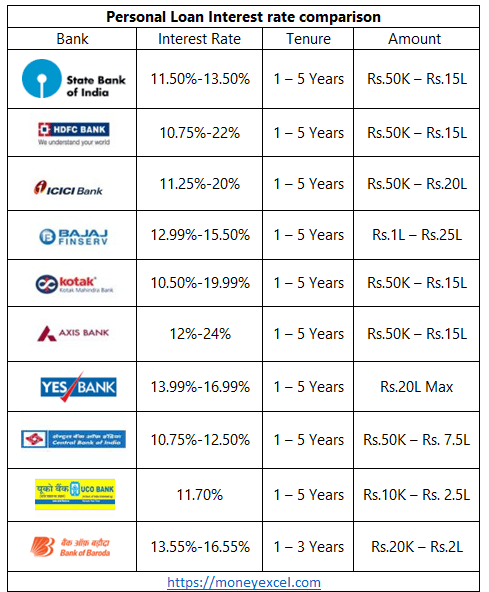

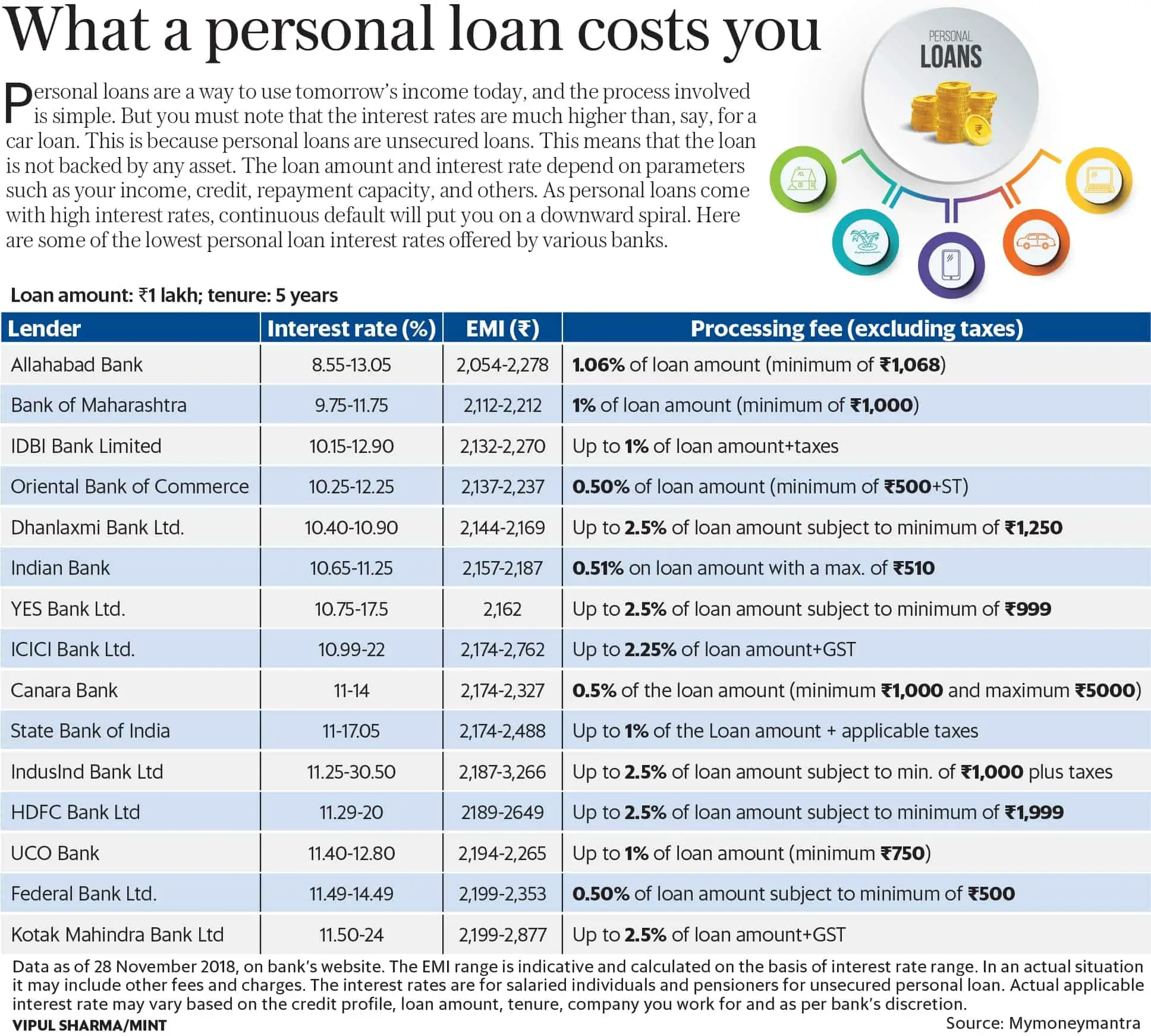

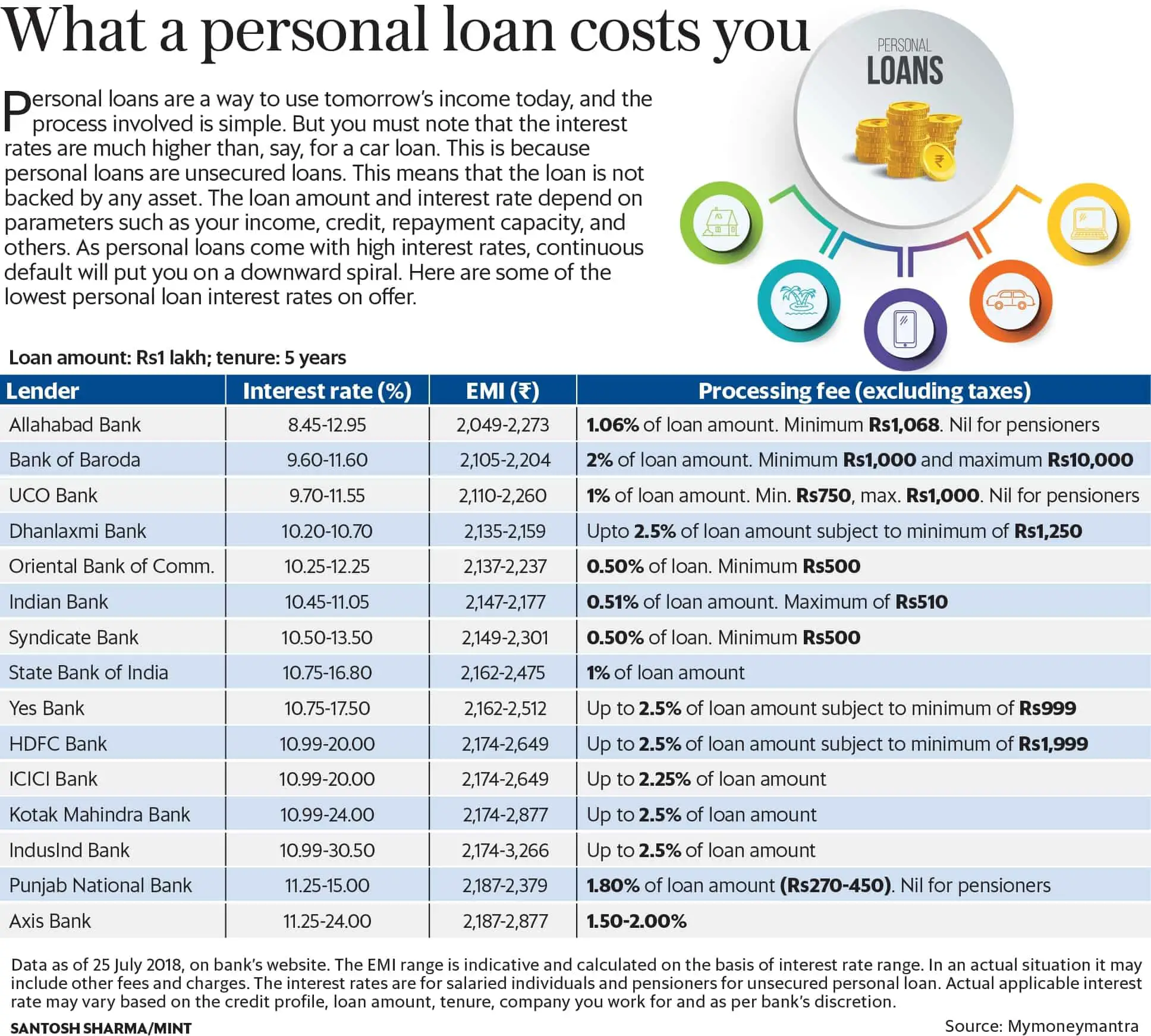

Your personal loan interest rates will depend on your credit score and other financial history. Each lender is different with various types of loan offerings and ways to evaluate a potential borrower.

Whats The Maximum Loan Amount I Can Get

Minimum and maximum loan amounts vary by lender. With Credibles partner lenders, you can take out a $600 personal loan up to a$100,000 personal loan.

Keep in mind that your credit will also likely affect how much you can borrow. Youll typically need good to excellent credit to qualify for the highest loan amounts. If you have poor credit, you might need a cosigner to get approved for a larger loan.

Read More:$15,000 Personal Loans: Everything You Need to Know

Bad Credit Vs Good Credit: How Does It Impact My Score

Your credit score has a direct influence on your personal loan interest rates in Canada.

- Higher scores. Scores of 660 or more usually mean youll get lower personal loan rates.

- Lower scores. Scores below 660 usually mean higher personal loan rates.

Sample interest rates by credit score:

Consult the table below to get an idea of how your rates might fluctuate with your credit score. Keep in mind that these rates are for illustrative purposes only, and your personal loan rate will depend on other factors besides your credit score.

| 5.45% to 11% |

You May Like: How To Get Sba 7a Loan

Understanding Personal Loan Interest Rates

In order to make loans, banks have to first borrow the money themselves, either from other banks or from their customers’ deposits. The interest rate on a personal loan reflects how much it costs a bank to borrow money, as well as the inherent risk of lending money when there is no guarantee that it will be repaid.

There are three important factors that determine the interest rate on a personal loan:

- The borrower’s : Borrowers with a high credit rating tend to get better deals because they have a lower risk of default. Lenders may also consider the borrower’s employment status and income since these affect the likelihood of repayment. Borrowers with low income or a history of missed payments tend to get the worst interest rates because there is no certainty that they will be able to make full payments.

- The length of the loan: Lenders make more money from long-term loans than short-term ones because the debt has more time to accrue interest. As a result, they offer lower rates for longer-term loans. Some lenders may charge a prepayment penalty for borrowers who pay off their loans too quickly.

- The cost of borrowing: Banks borrow money from one another, at an interest rate that is based on the federal funds rate. This cost is then passed on to the consumer: if the cost of borrowing money is high, the interest rates for personal loans will be even higher.

A fourth factor is whether the borrower can secure the loan with collateral assets. This is discussed further below.

Personal Loan Rates At Credit Unions

The average rate charged by credit unions in June 2022 for a fixed-rate, three-year loan was 8.84%, according to the National Credit Union Administration. Federal credit unions cap the APR on personal loans at 18%.

You have to become a member of a credit union to apply for a loan, which may mean paying fees or meeting certain eligibility requirements.

» MORE:

Recommended Reading: Unsecured Loan Vs Secured Loan

Factors Affecting Personal Loan Interest Rates

Lenders fix interest rates primarily on the basis of their cost of funds and the credit risk evaluation of their loan applicants. Here are some of the key factors that can influence your personal loan interest rates:

- Many lenders have started factoring in the credit scores of their loan applicants while setting their interest rates. Those having higher credit scores are offered personal loans at lower interest rates than others. Hence, try to maintain credit scores of 750 and above. Good financial habits like repaying your credit card bills and EMIs by their due dates, avoiding multiple loans or credit card applications within a short period would help you maintain higher credit scores.

Note that errors in your credit report can also pull down your credit score. Therefore, applicants should check their credit reports at regular intervals to identify such errors in time and take necessary steps to avoid adverse effect on their credit score. To check your credit scores for free either avail free credit report once a year from each of the credit bureau or visit Paisabazaar.com to view your credit scores from multiple bureaus along with their monthly updates. Those having no or low credit scores can improve their credit scores by availing lifetime free Paisabazaar Step UP Credit Card.

Check:How much personal loan can you avail based on your salary?

Check: Personal Loans for Salaried Employees

Check Free Credit Report before you apply for personal loans Check Now

Which Bank Has The Lowest Interest Rate For A Personal Loan

The lowest interest rate we found was at First Midwest Bank, with rates as low as 5.23% APR as of April 2022. However, that doesn’t necessarily mean that you’ll qualify, as they will likely consider other factors such as the borrower’s credit score. There may be other lenders offering even lower rates.

Don’t Miss: What Kind Of Loan For Rental Property

Key Features And Benefits

- Existing personal loan customers are eligible for the loan top-up provided that they have paid their EMIs regularly and have no pending payments.

- Quick or instant disbursal of the top-up loan amount.

- Minimum documentation required.

- Zero processing fee offered by a number of lenders.

- No collateral required.

How Does My Credit Score Affect My Offer

Lenders prefer credit scores in the good-to-excellent range. A high credit score tells a lender that the borrower can be trusted to handle credit and debt responsibly, so higher credit scores tend to merit a higher chance of loan approval and lower interest rates. A fair or poor credit score wont disqualify you from getting a personal loan , but it may be more difficult to get a low interest rate thats competitive with credit card interest rates.

Read Also: Where Do You Apply For Parent Plus Loan

Example Of Simple Vs Compound Vs Add

The table below, shows the differences among simple, compound, and add-on interest when applied to a $10,000 loan at 10% APR over five years with and without missed payments. The amounts shown do not include late-payment fees or other charges, which vary by lender.

- Column 1 shows the interest method used.

- Column 2 lists the monthly payment.

- Column 3 indicates total principal paid with on-time payments.

- Column 4 shows total interest.

- Column 5 lists the total amount paid.

- Column 6 shows total principal paid over 57 payments .

- Column 7 indicates total interest with three missed payments.

- Column 8 shows accumulated unpaid interest and principal.

- Column 9 lists the total amount paid with three missed payments.

Comparison of the three methods clearly shows why you should avoid add-on interest at all costs. It also shows that when payments are late or missed, compound interest adds up. In conclusion, simple interest is the most favorable to the borrower.

| METHOD | |

|---|---|

| $750 | $15,000 |

* With a total of three missed payments, one each at the end of years one, two, and three1 Total principal and interest when paid on time2 Total principal and interest with three missed payments

How To Get Lowest Interest Rate On Personal Loan

If you are looking to apply for a personal loan, here are a few tips that will help you avail a cheapest rate of interest:

Among the various points that are mentioned above, the credit score of an applicant is one of the primary factors that is taken into account by banks and financial institutions to decide the interest rate. Make sure to check your credit score at the earliest to ensure that you are offered a favorable interest rate.

| CIBIL Ratings |

| Loan with a low interest rate, faster approval, larger loan amount |

Recommended Reading: How Long To Get Approved For Student Loan

What Are The Benefits Of Personal Loans

Personal loans offer several benefits, including:

Fixed interest rates:

Can be used to consolidate debt:

You can take out a personal loan to consolidate multiple kinds of debt, such as credit cards or other loans. Depending on your credit, you might get a lower interest rate than youve been currently paying, which could potentially help you pay off your debt faster.

Cover large expenses:

If you need to pay for a large expense such as home improvements, medical bills, or a wedding a personal loan could be an option to get the cash you need.

Generally unsecured:

Most personal loans are unsecured, which means you dont have to worry about collateral. However, because unsecured loans present more of a risk to the lender, an unsecured personal loan could be harder to qualify for compared to a secured loan.

How Does Loan Term Affect Personal Loan Rates

Your loan term can also influence how much interest you pay over time.

- Longer terms. Youll typically pay more interest for longer term loans since youre paying an annual interest rate over a larger number of years. Learn more about long term loans.

- Shorter terms. Youll pay a lower amount of interest over the duration of your loan with shorter terms .

Representative example: Jimmy compares a short and long term loan

Jimmy has a credit score of 710 and wants to get a $10,000 personal loan to refinish his basement. He compares the personal loan interest rates for 2 loans with different terms and interest rates to determine which one is a better fit.

| Feature |

|---|

| $ |

Also Check: How Do I Apply For Home Equity Loan

Investing Along The Way

While I could have paid my student loans off even faster, I decided to begin investing heavily in 2018 once my interest rate was around the 4% mark. At that rate, I knew I had a high likelihood of making more money by investing over the long term compared to the amount of my monthly interest payments.

I started putting more money into my 401, Roth IRA and Health Savings Account and doing this has definitely paid off. Notably, when the initial stock market plummet happened in March and April of 2020, I began throwing as much money as I could into my investment accounts as a way to buy the dip. At that point, my student loans were down to a 2.25% interest rate, so it made much more sense to invest.

If you have your student loans under control and a low interest rate, it may be beneficial to put them on the back burner for a bit and prioritize investing for the future. These brokers and offer IRAs and taxable investment accounts:

-

Betterment RetireGuide helps users plan for retirement

Terms apply.

Work On Improving Your Credit Score

When you apply for a personal loan, a lender reviews your credit score to determine how risky of a borrower you might be. In general, the higher your credit score is, the better your chances of receiving the lowest rate possible.

The most important step to improving your credit score is to pay all of your bills early or on time payment history accounts for 35 percent of your FICO score. You can also pay down debt to lower your , which accounts for 30 percent of your FICO score.

In addition, removing inaccurate information from your Experian, Equifax or TransUnion credit reports could improve your score. To monitor all three reports for errors, visit AnnualCreditReport.com. If you catch any mistakes, dispute them with the respective credit bureaus.

Read Also: What Happens If My Parent Plus Loan Is Denied

Compare Rates From Different Lenders

Before applying for a personal loan, its a good idea to shop around and compare offers from several different lenders to get the lowest rates. Online lenders typically offer the most competitive rates and can be quicker to disburse your loan than a brick-and-mortar establishment.

But dont worry, comparing rates and terms doesnt have to be a time-consuming process.

Credible makes it easy. Just enter how much you want to borrow and youll be able to compare multiple lenders to choose the one that makes the most sense for you.

How To Get A Good Interest Rate

There are a few ways to secure a good interest rate. You might start by improving your credit, if necessary. A small increase in your credit score could seem insignificant, but it can make a big difference in the interest rate a lender offers.

Also, you should comparison shop and weigh all your options. Look for trusted lenders with reasonable rates and loan terms that fit your budget. Many will show you which rates you qualify for with a soft credit check, which wont affect your credit score. Make sure you gather quotes from various types of lenders, too, including national banks, credit unions, online lenders and small community banks, to find the right rate for you.

Don’t Miss: How To Calculate Personal Loan Interest Rate

Personal Loan Comparison Rates

The comparison rate is a tool that may help you compare the true cost of a loan.

While the interest rate is a major component, its not the only cost. There are other fees and charges that affect the true cost of the loan. The comparison rate includes in its calculation the interest rate and some of the fees and charges that may be payable with a loan reduced to a single rate.

You should be aware that different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

Fees and charges are not the only factors to consider when deciding on the best loan for you. The features that each personal loan offers may also be important when making your decision.

Shop Around And Compare Lenders

Getting a good personal loan rate also involves shopping around. Different lenders offer different rates to applicants based on their unique underwriting guidelines. This means that applying for a personal loan with a lender that offers the lowest rate wont ensure you get the lowest rate available.

To increase your odds of finding the lowest rate, prequalify with as many lenders as possible. Prequalifying allows you to get an estimate of the interest rate you could receive when you submit a formal application, and it often has no impact on your credit score.

You May Like: What Credit Score For Va Home Loan

Factors That Affect Personal Loan Interest Rates

- Income: Loan providers take the applicantâs income into account when deciding the interest rate. Individuals who have a high income pose a lower risk to the bank and, thus, might be offered a lower interest rate. On the other hand, those with lower annual incomes may have to pay a higher interest rate.

- Employer Details: If you work for a reputed organisation, the bank/financial institution is more likely to offer you a lower rate of interest.

- Nature of the Employment: Loan providers may offer different interest rates to applicants based on whether they are self-employed or salaried.

- Age: The age of the applicant can also have an impact on the interest rate quoted by the loan provider. Individuals who are nearing the retirement age may be charged a higher interest rate.

- Relationship with the Loan Provider: Existing customers of the bank/financial institution may be offered a lower rate of interest at the time of applying for a personal loan, provided they have a good relationship with the loan provider. This is, however, at the discretion of the bank and not all existing customers will be offered a preferential interest rate.

How Do I Find The Best Personal Loan Rates In Canada

You can find the best rates for personal loans in Canada by ensuring your finances are in great shape before you apply and comparing offers from multiple lenders. To qualify for low interest loans, youll need a good to excellent credit score, a solid history of on-time payments and your monthly debt payments should be less than 20% of your monthly income.

To compare offers, get personal loan pre-approval from your top choices. Banks, credit unions and select online lenders tend to offer the best personal loan rates in Canada.

Recommended Reading: How Much Can I Get Approved For Va Home Loan

What Is A Good Interest Rate On A Personal Loan

A good interest rate on a personal loan is one that is lower than the national average. So, a rate below 10.42% for three-year loans and 12.62% for five-year loansthe average as of February 2022is considered a good personal loan rate. However, borrowers with excellent credit scores may qualify for even lower rates.

Whats The Hike So Far

The RBI had cut interest rates from 5.15 per cent in February 2020, when Covid-19 hit, to as low as 4 per cent by May 2020. Interest rates on home loans had fallen to as much as 6.50 per cent from around 10 per cent, prompting buyers to go for loans. Since May this year, interest rates are back on an upward climb, with Repo rates rising by 190 basis points to 5.90 per cent as the RBI fights to bring down inflation. The hike in Repo rates means the cost of funds of banks and housing finance companies is also rising, leading to the transmission of the hike to customers.

Sales of residential units have increased by more than two times during the first half of 2022 vis-à-vis the same period last year, and the growth trajectory was maintained during the July-September quarter. With the last weeks repo rate hike, home loan EMIs would increase by an average of 8-9 per cent from six months ago. Ditto is the case with vehicle loans and other personal loans.

The continuous rise in home loan EMI is hence, expected to act as a sentiment disruptor. We believe that home loan interest rates inching towards 9 per cent and above may result in moderation of housing sales growth in the medium term, especially post the current festive season, said Samantak Das, Chief Economist and Head of research and REIS, JLL India.

Read Also: What Type Of Student Loan Do I Have