What Builders Are Saying

DeAndray B.

St Louis, MO

I plan to buy a new car, and I also want to get a home in a year or two. Cash only gets you so far because you’re limited with what you can do. It feels great now to be building my credit.

Jalysa E.

Lincoln, AL

I signed up with Credit Builder, and in just three months I’m in a position to get approved for a mortgage and reach my goal of a homeowner.

Allison P.

Orlando, FL

Very nervous because all other secured cards that I have inquired about go by credit score… it’s nice to see a card helping people instead of bashing them for a predicament.

Beware Of Greenwashing Banks

Theres a long history of corporations telling individuals to fix climate change with individual choices that the consequences of profiteering from the environment should be shouldered by each of us individually, whether each of us gained in a direct financial way or not. Much of the marketing around financial products may reflect greenwashing or PR-friendly token gestures towards the environment.

When it comes to which banks fund fossil fuels and which banks dont, consumers may find it difficult to suss out the truth. For example, BNP Paribas pledged exit from coal, announced exclusion of investment to specific Arctic and Amazon-area oil and gas drilling and made commitments toward net zero initiatives, yet has since reportedly increased its fossil-fuel development investments. Bank of the West, meanwhile, published what appears to be a PR campaign to promote it and its parent companys progress with statements including: Our low-carbon future depends in part on banks not making the climate crisis worse by underwriting carbon-intensive industries and advertises a 1% for the Planet Mastercard Debit Card with carefully-worded promises about what specific types of fossil-fuel investments cardholder deposits wont be used to fund. Which narrative should you believe?

Grace Enfield Content Writer

@grace_enfield11/30/21 This answer was first published on 11/30/21. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

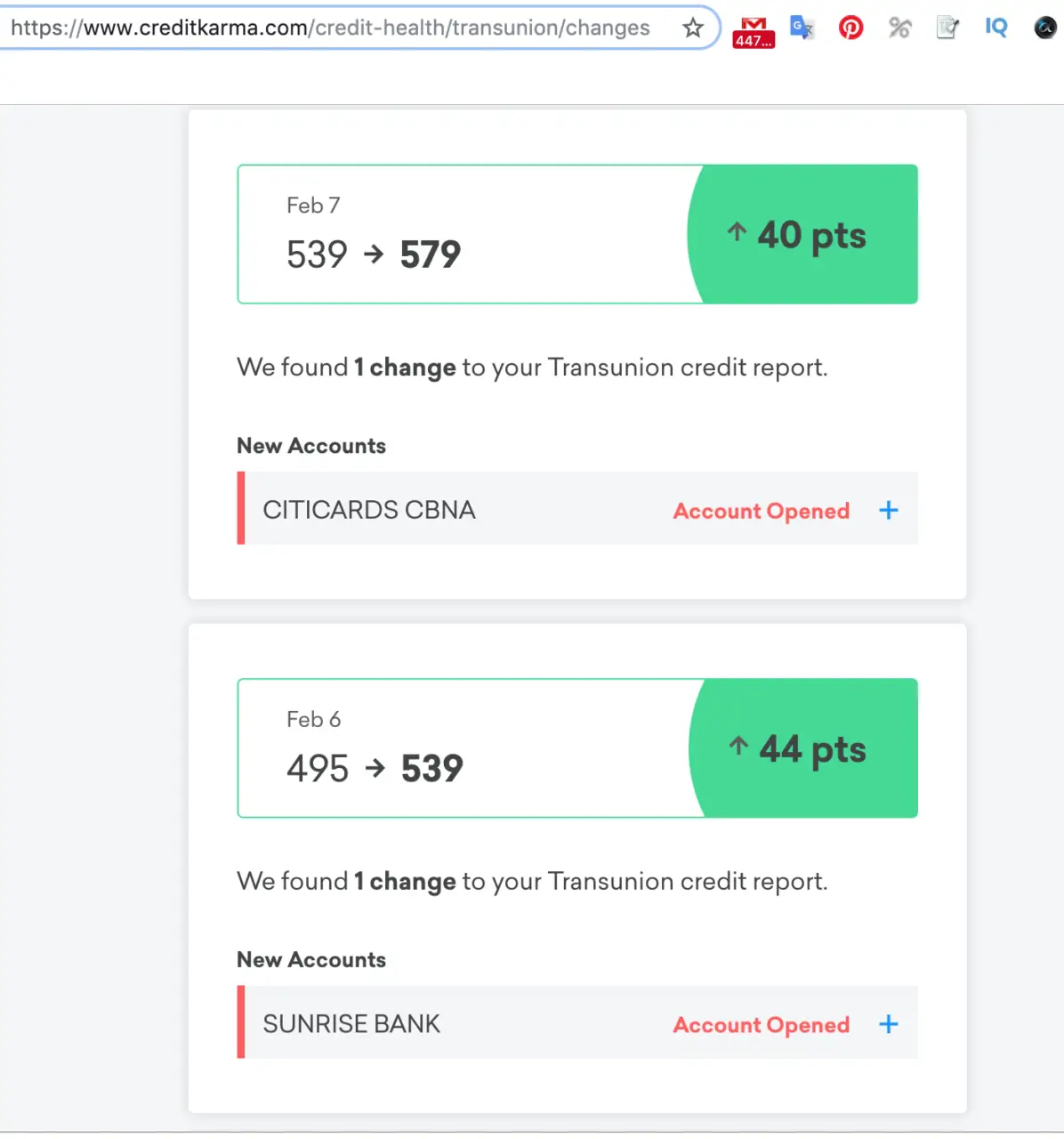

Yes, Sunrise Banks offers credit-builder loans. Sunrise Banks has of $600 – $900 with an APR range of 15% -21% and repayment periods of 12 – 18 months. To apply for a credit-builder loan from Sunrise Banks, you need to be at least 18 years old, have an Social Security number or ITIN and have U.S. Citizenship or Resident Alien status.

With a credit-builder loan, Sunrise Banks puts a sum of money into an interest bearing account for the borrower. That person then pays the lender in monthly installments, plus interest, and receives the money in the savings account at the end of the loan term.

Sunrise Banks also offers other options to improve your credit if you think a credit-builder loan isnt right for you, like credit cards or personal loans.

You May Like: Can Va Loan Buy Foreclosure

Can I Pay Self Off Early

Yes, Self allows customers to pay off their loans early. However, they discourage customers from doing this, as it reduces the number of positive payment reports to their credit reports. The purpose of the loan is to provide a consistent payment history, which could result in a positive effect on a borrower’s credit. Reducing the number of payments reported lessens the impact.

Best For Immediate Access To Money: Moneylion

Why MoneyLion stands out: MoneyLion gives you access to a portion of your loan funds right away. However, youll have to pay a $19.99 monthly membership fee on top of your monthly loan payments. MoneyLion offers credit-builder loans up to $1,000.

If you need a way to build your credit but also need to access to some of the cash quickly, MoneyLion could be a good option for you. And if you apply for a loan, MoneyLion wont perform a hard check on your credit.

MoneyLion also offers credit monitoring to help you track your credit scores along the way.

Read our full review of MoneyLion to learn more.

Also Check: Why Are Home Equity Loan Rates Higher Than Mortgage Rates

What Factors Determine Your Credit Score

Credit scores are calculated by a formula that takes into account five main factors:

- Payment history: Payment history refers to how often you make payments on time, or if you are likely to miss payments. Payment history accounts for 35% of your score.

- Credit utilization is how much you owe on loans and credit cards compared to your credit limit. For example, if your credit card has a limit of $1,000 and you have a $100 balance on the card, your credit utilization ratio is 10%. Lower ratios are more favorable. Credit utilization is worth 30% of your credit score.

- Your credit history length, or how long youve had established credit, represents 15% of your credit score. Your credit history length factors in the age of your oldest credit account, your newest credit account, and the average age of all your accounts.

- Credit mix refers to the types of accounts you have, such as different loans and credit cards. Lenders like to see a mix of different types of accounts that you have paid off. Credit mix makes up 10% of your score.

- New accounts: When you open a new account or apply for credit, lenders make a hard inquiry, which means they pull your credit report to assess your risk as a borrower. The number of new credit accounts you open and the number of hard inquiries into your credit report represent 10% of your credit score.

The Risks Of Credit Builder Loans

- You could hurt your credit if you dont pay on time: The point of a credit builder loan is to improve your credit score, but this will backfire if you fail to make on-time payments or if you miss your payment due date altogether. You should not take out a credit builder loan unless you are confident that youre ready to pay your loan when it is due.

- You could end up paying high fees: Some credit builder loans charge application fees. If you do not pay your bill by the due date, you will likely also need to pay a late fee. These fees could add significant costs.

- You may pay interest on money you dont yet have access to: In most cases, the interest rates on credit builder loans are under 10%. But, thats not always the case. And, paying any interest on money that you cannot access until the loan is repaid can be frustrating because you may feel as though it is a waste of money.

You can mitigate these risks by making a budget that factors in your monthly payments before borrowing, and by shopping around for a lender that offers the most affordable loans possible. Some lenders will even refund the interest you pay as long as you pay back the loan on time.

You May Like: Maximum Conventional Loan Amount 2022

Can You Refinance A Usaa Personal Loan

Yes, you can refinance a USAA personal loan using either a new personal loan or a balance transfer credit card from a different lender. By paying off your remaining USAA balance with a new, lower-interest loan or credit card, you will shift what you owe to the new lender and save money on finance charges. read full answer

How to Refinance a Loan from USAA With a New Loan

Final Thoughts

What Are You Doing To Improve The World

The story starts thirty-five years ago when Ahmad Kian and Ehssan Taghizadeh, both young immigrants, were college roommates at the University of Minnesota. Taghizadeh focused on electrical engineering. Kian enrolled in Pre-Med and Engineering. My goal was to serve people. Engineering was a backup, in case I couldnt get into medical school, Kian recalled.

Following graduation, the pair each pursued separate, highly successful corporate careers. Kian in engineering, global procurement and operations management. Taghizadeh in medical device and computer products engineering, then corporate leadership. But they never lost touch with each other.

In 2004, Kian was challenged by his 7-year-old daughter, who asked him what he was doing for her future. She wasnt asking about savings accounts, Kian points out. Rather, she wanted to know what he was doing to improve the world.

That question changed my life, said Kian. From that day, I have been on a quest to eliminate waste and improve efficiency.

The pair reunited in 2013 to launch one of the first companies in the Twin Cities focused on conserving energy through LED lighting upgrades.

Searching for a name for their new business, Taghizadehs son reminded them about the great hall of the ancient Persian culture called Apadana. This hall was viewed as a gateway to the future, Kian explained.

In 2019, again prompted by a conversation with his daughters, their focus on thrivability grew again.

Don’t Miss: Home Loan Pre Approval Online

What Pimento Can Be

Following extensive planning, Beevas has big plans in 2021 for Pimento Relief Services. He said to keep an eye out for the Pimento-backed Twin Cities Can Be campaign the first U.S. incarnation of the global Cities CAN B movement, an effort to make cities more prosperous, sustainable, inclusive and resilient.

Although Pimento has raised more than $150,000 from community members, Beevas is looking for corporations and foundations to pitch in.

This is not simply a nice-to-do. The economy will never realize its full potential until we all are able to participate equitably, he said.

- Minnesota State Representative/Senior Director of Diversity and Foundations at the Minnesota Bar Association

But Were Meeting You Where Youre At

Branchless banking.

Bank anywhere, anytime with FAIR. Our online and mobile banking lets you view your accounts and statements and transfer money from your mobile device or computer. You can deposit funds from approved checks via Mobile Deposit. With your FAIR Debit Mastercard® you can complete surcharge free ATM withdrawals at any of the eight Sunrise Banks ATMs or obtain cash back while making point of sale purchases.

Coaching for your accounts and your goals.

When you enroll, well walk you through each account. Well make sure you understand how they work and how they can support you in reaching your goals. Sign up for alerts3 and tips thatll help keep you on track and making progress.

Did we miss anything?

Check out our FAQ for other answers you might be looking for.

Read Also: Is Car Loan Interest Tax Deductible

Black Tech Talent: Creating A More Diverse Workforce Through Culturally Relevant Offerings

Mike Jackson sits on a throne during Zoom meetings.

The chair has a maroon back and golden stiles, creating a pleasant distraction in the oft-drab world of virtual conversations. But given Jacksons recent success, the seat is also a fitting mirror of his ascent in the start-up realm.

Jacksons new company, Black Tech Talent, has won multiple awards and gained more than 4,000 members since it launched in July 2020. The companys small-but-mighty team has landed contracts with some of the biggest employers in the Twin Cities, including Target and Health Partners.

Were making tech cool in the Black community, says Jackson.

Black Tech Talents main goal is to create more diversity in the technology field. The company offers a job board and culturally specific content catered to Black workers interested in entering tech as well as training and recruiting services. Black workers make up only 3% of the roughly 200,000 people working in the tech sector locally, according to CompTIA. Jackson adds that of around 900,000 unfilled IT positions, just 4-7% go to Black applicants.

Why do these disparities exist? There are multiple reasons, according to Jackson. But mainly, he says, the problem stems from unconscious bias.

As a founder and CEO, Jackson himself is an anomaly: Only 3% of executive positions are held by Black employees at companies with more than 100 workers in the United States. Just 1% of venture-funded startup founders are Black.

How Can The Sunrise Banks Credit Builder Program Help Your Credit Score

Since payment history is the largest factor affecting your credit score, its a good idea to get into the habit of paying off your loans and credit cards promptly. The Sunrise Banks Credit Builder program may help develop that habit, while building your savings and boosting your credit score1.

The Sunrise Banks Credit Builder program starts off with a 12- or 18-month loan2, which is deposited into a Certificate of Deposit account3. You make the monthly principal and interest payments for the duration of the loan , and once the loan is paid off, the funds are routed to your checking or savings account.4

If you make all your payments on time, your credit score may increase. The Credit Builder program is a great option if youve never had credit before, or if youve had a poor payment history in the past. In 2019, we opened 651 new credit-builder loans, with an average loan size of $600.

Similarly, Sunrise Banks partner, Self, offers small Credit Builder Accounts to help establish credit history. Since its inception, Sunrises partnership with Self has helped over 95,000 individuals build their credit.

To learn more about how to build your credit, visit our personal finance knowledge center.

Individual results may vary. Subject to credit approval. Fees may apply. SSN or ITIN required for loan application. Individuals using an ITIN must apply in person, click here to find a location.

If you do not have a Sunrise checking or savings account, we will provide you with a check.

Don’t Miss: How To Determine Home Loan Amount Based On Income

How To Save Thousands On Your Citizens Bank Auto Loan Clutch

Contact Citizens One Auto Finance for complete details. Addresses are listed for reference only. Payoff Phone Numbers. Lienholder Titling Address

First Citizens provides a full range of banking products and services to meet your individual or business financial needs. Learn more about our products and .

Pay your bill over the phone: Call 1-800-708-6680. Pay your bill through the mail: Send a check to Citizens Bank Citizens One Auto Finance

If you do not have such a number and are interested in enrolling in the Services, you must contact Capital One Auto Finance Customer Service at .

Make a payment 24/7 via our Interactive Voice Response system. Simply call 877-333-5363 from your phone and follow the prompts to pay your loan with a debit .

ELT PO BOX 91326 / 6150 OMNI PK DR / MOBILE AL 36691 .

Citizens Bank & Trust Proud To Be Your Bankhttps://www.citizens-bank.comhttps://www.citizens-bank.com

Citizens Community Credit Unionhttps://www.citizenscu.comhttps://www.citizenscu.com

Dont Bite Off More Than You Can Chew

You can choose an account with a 12- or 24-month term, and your payment plan options are as follows:

- $25 or $35 per month for a 24-month account

- $48 or $150 per month for a 12-month account

A larger loan doesnt necessarily mean that youll build or rebuild your credit faster. Make sure you choose the plan youre going to be comfortable with.

Also Check: What Kind Of House Qualifies For Fha Loan

Use Donotpay To Expedite Your Citizens Bank Customer Service Issue

The best option for contacting Citizens Bank customer service is to use DoNotPay. DoNotPay is the fast, easy, successful solution for bypassing long phone queues and getting your questions answered in a timely manner. Heres how to use DoNotPay to contact Citizens Bank:

Frequently Asked Questions :

- Where is CITIZENS ONE AUTO FINANCE?

CITIZENS ONE AUTO FINANCE is located at: 1 Citizens Plz Ste 211, Providence, RI 02903, United States.

- Want to book a hotel in Rhode Island?

We can surely help you find the best one according to your needs. Compare and book now!

- Where are the coordinates of the CITIZENS ONE AUTO FINANCE?

Latitude: 41.8274128

Read Also: Who Offers Owner Builder Construction Loans

The Fight Against Hiv/aids Continues During Covid

The AAATF is located at the corner of Franklin and Pillsbury, south of Downtown Minneapolis in the Minnesota Church Center, and was incorporated in 1994. The organization, like so many others across the state and the country, took an economic hit due to COVID-19.

In August, AAATF Executive Director Gwendolyn Velez got word the organization had received a Paycheck Protection Program loan. The funds have helped the AAATF secure capacity so that it may continue to provide services for its roughly 130 case management clients.

In particular, the money has allowed the AAATF to move to a remote environment while still effectively supporting clients.

We needed to free up money so that we could upgrade all of our IT systems to conform to this new environment that were in, said Velez.

Communities of color are disproportionally affected by AIDS across Minnesota and the country. Black Americans make up just 12% of the national population, yet they account for 44% of the deaths related to HIV. The Human Immunodeficiency Virus, or HIV, can cause AIDS if not treated.

Stats from the Minnesota Department of Health state that 61% of new HIV cases were among communities of color in 2019.

Velez speaks frankly when asked about these disparities.

Generally there is mistrust in the African American community regarding medical systems the care is not the same, its not equitable, said Velez.