What Kinds Of Loans Qualify For The Credit

Interest on student loans can only be claimed if you received the loan under:

- the Canada Student Loans Act

- the Canada Student Financial Assistance Act

- the Apprentice Loans Act

- similar provincial or territorial government laws

Loans from other institutions cant be claimed, and you cant claim the interest you paid if you consolidated your student loan with other debts.

Avoid Default At All Costs

Not only can defaulting on a student loan hurt your credit and cost you extra money, it also has other potential consequences. Your wages could be garnished and you could even have your tax refund withheld. While collection activities are on hold through May 1, 2022, for federal student loans, defaulted private student loans could result in a tax refund offset.

If youre at risk of defaulting, take steps to set up a repayment plan or enroll in a forbearance program. Consider calling your loan servicer to create a plan that will help you manage your monthly payments you might be eligible for a hardship program, an income-driven repayment plan or a settlement.

Tax Tips For Students

Heading into tax season and want a few more tax tips to help you through? Read some of our tax tips below.

Tip #1: File even if youre below the income threshold

If you make less than the IRS income filing threshold, which changes each tax year,youre not required to file a tax return. Generally, if you made under the standard deduction for the tax year you are not required to file a tax return. But even if you make less than the specified amount, you might still be owed a tax refund if your employer withheld taxes or if you are eligible for some other tax credits like education credits or arecovery rebate credit. The IRS reports close to a billion dollars in unclaimed refunds every year, some of which belongs to college students who file their taxes.

Tip #2: Get a tax refund for work-study opportunities

Many college students end up in a work-study program to explore their career interests and get experience in their desired field. Any money you earn is considered taxable income. However, the school will withhold income taxes from your paychecks, so you may get a refund when its time to pay taxes.

Tip #3: Pay attention to your location

Recommended Reading: What Happens If You Don T Pay Back Ppp Loan

Claiming The Tax Deduction

One of the best tax benefits for education is the ability to lower your taxable income. The student loan interest deduction is calculated based on your income, tax bracket, and paid interest on student loans.

To claim this deduction, your first question is likely âHow much student loan interest have I paid?â. Lucky for you, this is typically easy to figure out because loan servicers are required to send tax Form 1098-E to any taxpayer who pays more than $600 to that lender in student loan interest during the year.

If you did not pay $600 in interest, you can simply login to your lenderâs online portal and review your payment statements. From those statements, you will be able to calculate the paid interest. Remember to only deduct the interest payments, not the whole principle.

To claim the deduction, you will simply input the amount of interest paid during the tax year on Form 1040, Schedule 1. Youâll find a line called âStudent Loan Interest Deductionâ under the âAdjustments to Incomeâ section.

However, any good tax preparation software will walk you through this deduction to make the process simple. Keeperâs filing software makes it easy to get all the deductions and tax credits you deserve, including student loan interest.

Can A Parent Deduct Student Loan Interest If The Child Isnt A Dependent Any Longer

Parents who are personally liable for repaying student loans can claim the interest deduction. This is true even if you arent claiming your child as a dependent on your taxes. You will want to look into the fine print, though, and make sure that you are the person that is legally liable for the debt repayment.

You May Like: How To Apply For Fha Title 1 Loan

What Qualifies For The Deduction

Interest paid on a loan will typically qualify for the student loan interest deduction if the loan was taken out for the sole purpose of paying the qualified educational expenses for you, your spouse, or a dependent while attending an eligible school. Loans provided by relatives or employers dont qualify for the deduction.

Qualified educational expenses include:

- Room, board, and other living expenses

- Textbooks, supplies, and equipment

- Other necessary expenses like transportation

Colleges, universities, and vocational schools are eligible schools if they are approved to participate in a student aid program administered by the U.S. Department of Education.

Find Out How Much Interest You Paid

To find out how much interest you paid on your student loans during the tax year, look for the Form 1098-E, Student Loan Interest Statement from your loan servicers. Any loan servicer that collected at least $600 in interest from you is required to send you a Form 1098-E by Jan. 31, either electronically or by mail.

If you paid at least $600 in interest during the tax year but made payments to multiple servicers, you can request a Form 1098-E from each servicer even if they collected less than $600 in interest from you. If you paid less than $600 in student loan interest, you can contact each of your servicers for the exact amount of interest paid during the tax year.

You May Like: How To Calculate Home Equity Loan Payment

You Took Out The Loan To Further A Dependents Education

You can also take the student loan interest deduction if you applied for and took out a loan in your own name, but allowed a dependent to access and use the funds. For instance, Parent Plus Loans are federal loans that are made to the parent or legal guardian of an undergraduate student to help cover the cost of their education.

Note that if youre a parent who helps a dependent pay back a student loan, you cannot claim the deduction.

How Much Student Loan Interest Do You Pay

Each student loan statement you receive from your lender should indicate how much of your monthly payment is going toward the principal portion of your loan, and how much is going toward interest on that debt. Furthermore, you should receive an annual student loan interest statement called Form 1098-E, which summarizes your student loan interest for the year.

Typically, your lender will only send out that form if you paid more than $600 in interest over the course of the year. But you can still claim the student loan interest deduction if you paid less than that — you just need to reach out to your loan servicer to get an exact total for the interest you paid.

Although it stinks to lose money to student loan interest, it helps to know that you could snag a tax break from it. Just remember that the criteria for claiming the student loan interest deduction can change from year to year, so consult the latest IRS updates before filing your tax return.

Also Check: What Is The Average Student Loan Debt

Are Student Loans Tax Deductible Here’s Everything You Need To Know

If you have student loans, one of the only positives is knowing you are nowhere near alone. These days, two out of three college graduates leave school with student loan debt. And during tax season, you probably wonder if those monthly payments will benefit you in your tax return. The short answer? Sort of.

“The only portion of a student loan that is tax-deductible is the interest,” Eileen Maki, Tax and Accounting Analyst at FitSmallBusiness.com, explained on her website. “Like any tax deduction, there are certain qualifications that must be met, as well as limitations on the amount that can be deducted.”

How Can You Deduct Student Loan Interest

Taking this deduction should be a pretty straightforward process, and most tax preparation software should prompt you about payments for student loans and interest.

If you paid $600 or more in student loan interest, you should receive a Form 1098-E to report your interest payment on your tax return. Note that, with the pandemic, federal student loan payments and interest accrual were temporarily paused, and the deadline has been extended to at least December 31, 2022. So, you may not have paid enough in interest to receive a 1098-E. However, you can still deduct your student loan interest paid, and you can request that tax reporting documentation from your student loan provider.

Student loan interest deductions are capped at $2,500. For example, if you paid $8,000 towards your student loans and $2,800 towards the interest, you can only take a $2,500 deduction. Alternately, if you paid $3,000 toward your student loans and $1,000 towards the interest, then your deduction will be the total interest payment of $1,000.

You dont have to itemize your deductions to take advantage of the student loan interest deduction. Instead, it works as an adjustment to your income. This is great news, because at this time, the standard deduction limits have been raised to $12,550 for single filers and $25,100 for married filing jointly. This makes the standard deduction a much more logical option for many filers.

Also Check: How Big Is Jumbo Loan

You Took Out The Loan To Further Your Own Education

When you think about paying off student loans, you might picture a graduate doing so once theyre out of school and out on their own. However, there are many students that want to get a head start on the process and start paying while theyre still in school.

Either way, your loan may qualify as long as youve continued to use the funds to pay for your personal education.

Income Tax Calculator: Estimate Your Taxes

The Student Loan Interest Deduction is an above-the-line exclusion from income, so you can claim the deduction even if you dont itemize. An above-the-line exclusion from income reduces the borrowers adjusted gross income , potentially yielding other tax benefits.

The Student Loan Interest Deduction can be claimed for an unlimited number of years.

The income phaseouts in 2021 are $70,000 to $85,000 and $140,000 to $170,000 . Taxpayers who file as married filing separately are not eligible. The income phaseouts are adjusted annually for inflation.

Recommended Reading: How To Roll Over Car Loan

The Basics Behind Deducting Student Loan Interest

Before we dive into the specific steps you need to take to claim this type of tax relief, lets answer one basic question: How are student loan payments tax deductible?

The short answer is that not all payments are, so its important to know how and if you qualify. To assess your financial situation, the IRS will take a look at your modified adjusted gross income, or MAGI. If its less than $70,000, then you could be eligible to receive the full $2,500 deduction.

If its a little higher, youre not completely out of luck. With a MAGI of $70,000 to $85,000, you could still receive a deduction, but it wouldnt be as high as $2,500. The individual taxpayer cap is set at $85,000.

Note that if youre filing jointly, those numbers are a little different. In that case, you could receive the full amount if your combined MAGI was less than $140,000. In addition, you could still receive a portion of the deduction if that amount rises as high as $170,000.

Note that there is no limit on the number of years that a student can deduct student loan interest. As long as your income stays within the above limits, you continue to pay on a qualified student loan, and you meet all other eligibility requirements, you can continue to take this deduction for as long as you need to.

Student Loan Interest Deduction Vs Other Breaks

Students enrolled in higher education programs and their parents may be eligible for other breaks, including tax credits, in addition to the student loan interest deduction. Tax credits are even more valuable than deductions because they are subtracted from the tax you owe on a dollar-for-dollar basis rather than simply reducing your taxable income.

Read Also: How To Apply For Teacher Loan Forgiveness

Can Unpaid Student Loans Affect How Much Social Security Money You Receive

Americans who have defaulted on their federal student loans and are nearing retirement might be in for a painful surprise. The government can garnish up to 15% of their Social Security income, making a huge dent in their nest egg.

Social Security Payment Schedule 2023: What Dates To Watch Out For

And the number of seniors burdened by student loan debt is astounding.

According to the Department of Education data, 2.6 million Americans 62 and older owed $107.3 billion in student loan debt, as of the fourth quarter of 2022.

While Social Security can take retirement and disability benefits to repay student loans in default, the benefits cannot be reduced below $750 a month or $9,000 a year, according to the Legal Aid Society of Cleveland.

The Legal Aid Society adds that borrowers should know that they cannot appeal or challenge this debt to Social Security.

To do this, they must go back to the agency to which the debt is owed. The notices from Social Security will have the name and contact information for the agency that is claiming the debt is owed. To change or challenge the offset, the debtor will have to set up a payment plan, or argue hardship to the agency that is owed the money, according to the Legal Aid Society, which added that one option is Income Based Repayment .

Take Our Poll: Do You Think Student Loan Debt Should Be Forgiven?

More From GOBankingRates

Income Limits For Eligibility

The student loan interest deduction is reduced or eliminated for higher-income taxpayers. For the 2022 tax year, the amount of your student loan interest deduction is gradually reduced or phased out if your modified adjusted gross income is between $70,000 and $85,000 for single taxpayers. It’s between $145,000 and $175,000 in 2022 for those who file married and jointly. You cant claim the deduction if your MAGI is above the maximum amount. For 2023, the phase out for single taxpayers begins at $75,000 and ends at $90,000. If you are married and filing jointly, the phase out for the 2023 tax year begins at $155,000 and end at $185,000. You cant claim the deduction if your MAGI is above the maximum amount.

Income limits for student loan interest deductions are adjusted annually for inflation.

Recommended Reading: What Is The Best Loan App

What Is The Student Loan Tax Deduction

Luckily, taxpayers who make student loan payments on a qualified student loan may be able to get some relief if the loan they took out solely paid for higher education.

In many cases, the interest portion of your student loan payments paid during the tax year is tax-deductible. Your tax deduction is limited to interest up to $2,500 or the amount of interest you actually paid, whichever amount is less. COVID emergency relief and the recent student loan debt relief announced on August 24, 2022, allows suspension of loan federal loan payments an 0% interest, so you will most likely see a lower student loan deduction than usual at tax time, or even none at all.

You can deduct student loan interest if:

- You paid interest on a qualified student loan in the tax year

- You are legally obligated to pay interest on a qualified student loan

- Your filing status is not married filing separately

- You and your spouse, if filing jointly, cannot be claimed as dependents on someone elses return, or

- You are a single filer with income under $70,000. However, your full deduction phases out between $70,000 and $85,000 . If your income falls above those limits, the student loan interest is not tax-deductible. Note: These thresholds are for tax year 2021 .

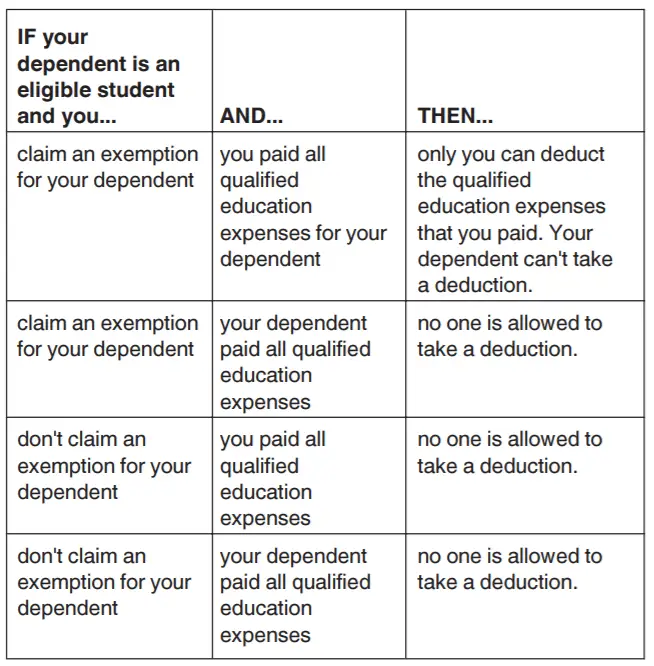

*Note: The income thresholds listed in this image above are for the 2020 tax year .

Student Loans And Tax Credits: What You Ought To Understand Fill Out The Form Below To Send A Copy With This Post To Your Email

Student Loans and Tax Credits: What You Ought To Understand. Fill out the form below to send a copy with this post to your email.

Whenever taxation month try upon all of us, whether youre students or mother or father, if you are paying rates of interest on your own college loans, you will want to take time to understand the different tax credit and education loan tax deductions offered. You are qualified to receive savings might place real money back their pouch.

Understanding education loan tax deductions is somewhat confusing, or even daunting. Luckily there are many online resources that will help you add up of it all. Here are some tips to truly get you going, however if you have questions, its constantly better to check with a tax expert.

Read Also: Should I Refinance My Rv Loan

Claiming The Student Loan Interest Deduction

To claim the student loan deduction, enter the allowable amount on line 20 of the Schedule 1 for your 2019 Form 1040.

The student loan interest deduction is an above the line income adjustment on your tax return. That means you can claim it regardless of whether youre claiming the standard deduction or itemizing deductions.

If youre using tax preparation software like TaxAct, it will do much of the work for you. Heres what you need to know if you need help calculating the allowable amount to enter on line 20.

Tip: