Refinancing: Heloc Vs Mortgage Loan Pros And Cons

Mortgage Development Manager at National Bank

With higher property values, one of the biggest perks of owning a home is the ability to tap into your homes equity for a variety of other financial needs.

Whether it is for debt repayment, the purchase of other assets, home renovations, a wedding, or some other large, unexpected expense, a Mortgage Loan or Home Equity Line of Credit can help you secure funds against the equity value of your home. Besides the immediate cash flow, you enjoy lower interest rates than what you may pay for most other types of personal loans.

Both, HELOCs and Mortgage Loans unlock the equity value of your home. Understanding the ins and outs of both products will help you choose the one that best meets your financial requirements and goals.

Also Check: What Size Mortgage Loan Can I Qualify For

Employment And Income Verification

Your lender will want to verify your employment and income by reviewing your last two W-2 forms as well as your most recent paycheck stubs.

If youre self-employed, youll have to provide your federal income tax returns for the last two years. If you receive retirement income, the lender will want to see a retirement award letter or 401 distribution letter.

Amount Of Equity You Can Cash Out

The amount of money you can withdraw from your home depends on your current loan balance and the value of your home.

When you get a cashout refinance, you typically have to leave at least 20 percent of your homes value untouched. That means your new loan can only be up to 80 percent of your homes value .

The loan also has to pay off your existing mortgage. So your maximum cashback is equal to 80 percent of your homes value minus your current loan balance.

For example:

- Your homes market value is $400,000

- Your current mortgage balance is $200,000

- The max. cashout loan amount is $320,000

- Your max. cash-back is $120,000

Only VA loans let you do a cashout refinance whereby you take out 100% of your equity.

The calculation is similar for home equity loans.

You arent using the new loan to pay off your existing one. But the first mortgage and second mortgage combined usually cant be above 80 percent of the homes value. So the math works out the same.

However, some home equity loan lenders are more flexible and will allow you to borrow up to 85 percent of your homes value.

Recommended Reading: Can You Refinance An Fha Loan

Home Equity Line Of Credit

A home equity line of credit, also known as a HELOC, is one of the best ways to access equity in your home without selling it.

Instead of taking out a loan at a fixed amount, a HELOC opens a pool of money that you can utilize, but you don’t have to take it all at once or use it all. For instance, instead of having a $100,000 loan, you could have access to a $100,000 HELOC that you could draw on only when you needed it for something like an emergency repair or renovation.

“You have a pool of money you can draw on, and it doesn’t cost anything unless you use it,” said Thomas Blackburn, a CFP with Mason & Associates in Newport News, Virginia, adding that he recommends them for a lot of people.

“It’s almost like insurance,” said Nolte, adding that like life insurance policy it makes sense to have a HELOC in place before you need to draw on it.

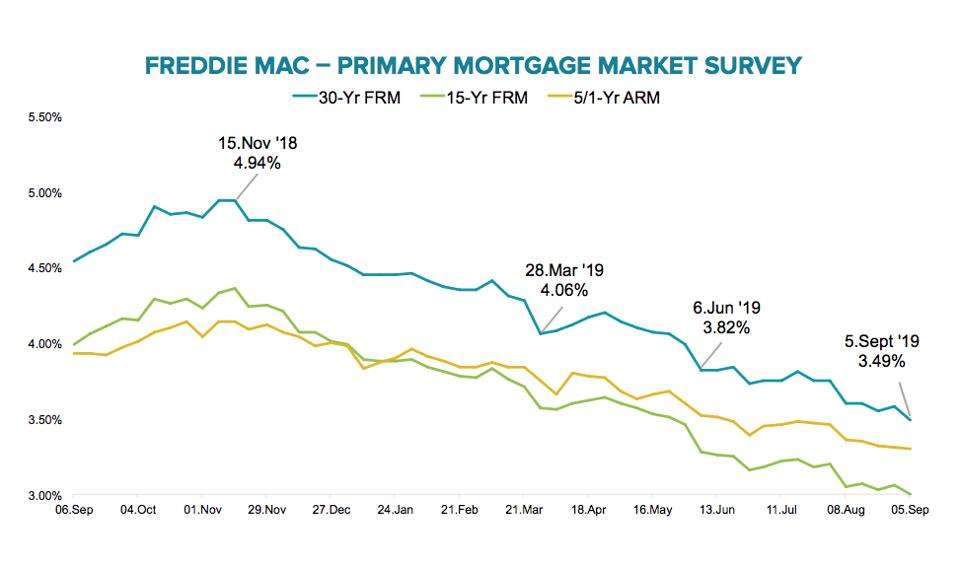

Currently, interest rates are low on HELOCs. People with good or excellent credit generally a FICO score of 670 or more can get HELOCs with rates from 3% to 5% according to Bankrate. Those with fair scores or lower may see rates in the 9% to 10% range.

“Now might be a good time to lock in those lower interest rates as we’ve seen they’re gone a little higher and will continue to,” said Brittney Castro, CFP at Mint.

How You Can Use The Funds

Neither cashout refinances nor home equity loans dictate how you can use the funds. Its totally up to you.

However, you typically want to use the money for something with a good return on investment. Thats because youre paying interest on the cash and its secured by your home.

Popular uses for home equity include home renovations and debt consolidation .

Don’t Miss: Fha Mortgages Refinance

Home Equity Loan Vs Mortgage: The Bottom Line

Chances are, this debate closed down for many readers when they learned that a cashout refinance would almost certainly be less costly in the short term. Many of us, especially if were younger, have no choice but to focus on minimizing our current outgoings and letting the future take care of itself.

But those who can afford to take a strategic view of their finances may well find that a home equity loan saves them money in the long run. And, for them, that really is the bottom line.

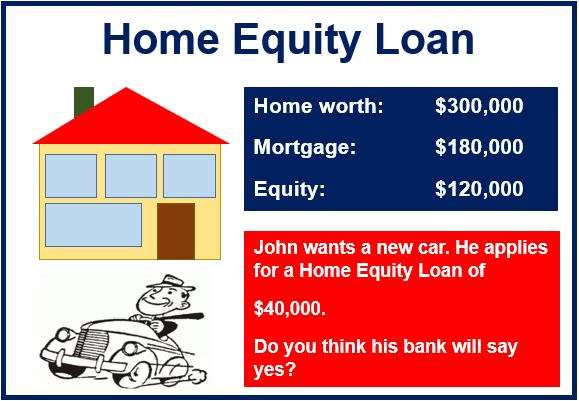

How Borrowing On Home Equity Works

You may be able to borrow money secured against your home equity. Typically, interest rates on loans secured against home equity can be much lower than other types of loans.

Not all financial institutions offer home equity financing options. Ask your financial institution which financing options they offer.

You must go through an approval process before you can borrow against your home equity. If youre approved, your lender may deposit the full amount you borrow in your bank account at once.

You can borrow up to 80% of the appraised value of your home.

From that amount, you must deduct the following:

- the balance on your mortgage

- your total HELOC amount, if you have one

- any other loans secured against your home

Your lender may agree to refinance your home with the following options:

- a second mortgage

- a loan or line of credit secured with your home

You May Like: Usaa Auto Refinance Phone Number

Home Equity Loan Definition

A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 85% of the homes value. You take out a new mortgage that pays off the old and then gives you a payout of the difference.

Using the example above:

Bear in mind that you typically must pay closing costs if you take out a home equity loan. Closing costs generally range from about 2 to 5 percent of the loan amount. The interest rate on the equity loan depends on your credit score. This means you should have a good credit score to apply for a home equity loan effectively.

Home equity loans are often commonly referred to as second mortgages because you effectively have 2 loans taken out on one home.

Why Dave Ramsey May Be Wrong About Home Equity Loans

Although Dave Ramsey has a large following of fervent fans, most financial experts question a considerable amount of the advice he gives. Uniformly advising people against taking out a home equity loan is not responsible financial guidance.

Each borrower needs to consider how the home equity loan payments add to their overall debt burden, what they plan to do with the money from the loan or line of credit, and what other alternatives they may have.

Most home equity loans and HELOCs do not have the high interest rates and unusual balloon payments that Dave Ramsey might lead people to believe are the norm. The interest rates of around 6% to 7% are much lower than credit card interest rates, so using home equity may help borrowers quickly pay off credit card debt.

- HELOCs with no in-person appraisal needed

- Apply completely online in minutes

- Fast access to your equity

- Home equity loans with low fixed rates

- Borrow up to 90% of your homes value

- Loans up to $500,000

Don’t Miss: Usaa Auto Loans Rates

Understanding How Much You Can Borrow

Lenders will usually allow you to borrow up to 80% of your equity with a cash-out refinance and between 80 to 90% of your equity with a HEL or HELOC.

So, using the same numbers from earlier, if your home is worth $250,000 and you have an outstanding mortgage balance of $150,000, then you could end up with around $62,500 if you took the maximum loan amount :

This is a basic example for illustration purposes. Your final amount may be less due to closing costs or any other expenses associated with each loan.

Theres A Limit To How Much You Can Borrow

Theres also a limit to the amount you can borrow on a HELOC or home equity loan. To determine how much money youre eligible for, lenders will calculate your loan-to-value ratio, or LTV. Even if you have $300,000 in equity, the majority of lenders will not let you borrow that much money.

Lenders generally allow homeowners to borrow up to 80 percent to 85 percent of the value of their homes, minus existing mortgage balances. That number can be different from person to person, though, and depends heavily on your credit score, financial history and current income.

You May Like: Fha Title 1 Loan Rates

Heloc: Flexibility & Options

A HELOC, or home equity line of credit, also borrows against the equity you have in your home. Heres how it works: First, you are approved for a HELOC amount, which is like your credit limit on a credit card. You may withdraw some or all of your HELOC funds as you need them during your draw period .

Example: Lets imagine that you are approved for a $35,000 HELOC. You withdraw $5,000 from your HELOC to pay some urgent bills. Five months later, you withdraw $10,000 to pay for a bathroom remodel. At this point, you have used a total of $15,000 of your HELOC funds, leaving $20,000 still available.

So, if you take out money several times during your draw period, your monthly payment is based on the outstanding balance on your HELOC. HELOCs typically have variable rates, which means your interest rate will fluctuate up and down with the market.

Lenders such as Desert Financial offer a fixed-rate HELOC option which allows you to cement your interest rate when you withdraw funds. So, your $5,000 withdrawal at 3.50% will always have that interest rate. However, as you withdraw additional amounts like the $10,000 to pay for your new bathroom those amounts will have their own fixed interest rate.

To sum up, benefits of a HELOC include:

- Flexible and easy-to-use

Home Equity Lines Of Credit

Home equity lines of credit work differently than home equity loans. Rather than offering a fixed sum of money upfront that immediately acrues interest, lines of credit act more like a credit card which you can draw on as needed & pay back over time. This means that the bank will approve to borrow up to a certain amount of your home, but your equity in the home stands as collateral for the loan. The interest rates are lower than they would be with a credit card. Often home equity loans have a variable interest rate that will change according to market conditions.

Unlike traditional mortgage loans, this does not have a set monthly payment with a term attached to it. It is more like a credit card than a traditional mortgage because it is revolving debt where you will need to make a minimum monthly payment. You can also pay down the loan and then draw out the money again to pay bills or to work on another project. Your home is at risk if you default on the loan. Many people prefer this loan because of the flexibility. You only have to take out as much as you need, which can save you money in interest.

Read Also: Usaa Auto Loan Approval

Pros And Cons Of A Cash

The primary advantage of a cash-out refinance is that the borrower can realize some of their property’s value in cash.

With a standard refinance, the borrower would never see any cash in hand, just a decrease to their monthly payments. A cash-out refinance can possibly go as high as an approximately 125% loan-to-value ratio. This means the refinance pays off what they owe, and then the borrower may be eligible for up to 125% of their homes value. The amount above and beyond the mortgage payoff is issued in cash just like a personal loan.

On the other hand, cash-out refinances have some drawbacks. Compared to rate-and-term refinancing, cash-out loans usually come with higher interest rates and other costs, such as points. Cash-out loans are more complex than a rate-and-term and usually have higher underwriting standards. A high credit score and lower relative loan-to-value ratio can mitigate some concerns and help you get a more favorable deal.

Alternatives To A Home Equity Loan

A home equity loan is not the right choice for every borrower. Depending on what you need the money for, one of these options may be a better fit:

- Home equity line of credit : Like a home equity loan, a HELOC lets you borrow from your home’s equity. However, you’ll borrow from a credit line. Additionally, HELOCs have variable rates.

- Cash-out refinance: If you can qualify for a lower interest rate than what you’re currently paying on your mortgage, you may want to refinance your mortgage. If you refinance for an amount that’s more than your current mortgage balance, you can pocket the difference in cash.

- Reverse mortgage: With a reverse mortgage, you receive an advance on your home equity that you don’t have to repay until you leave the home. However, these often come with many fees, and variable interest accrues continuously on the money you receive.

- Personal loan:Personal loans may have higher interest rates than home equity loans, but they don’t use your home as collateral. Like home equity loans, they have fixed interest rates and disburse money in a lump sum.

Recommended Reading: Can You Use A Va Loan For Land

Common Uses For Home Equity Lines Of Credit

There are no restrictions on how you can use your HELOC. You can spend it all on vacation if you want, but we recommend using it in a way you wont regret later on. Your home is too valuable to put on the line without first having a clear plan of action for your funds.

If youre not sure what you could use a HELOC for, check out some of these recommendations:

- Home improvements: Replacing the garage door or remodeling the kitchen or bathroom could increase your homes value. Or you could use a HELOC to repair damage to your home, especially damage not covered by insurance.

- Education: You can use a HELOC to pay for school or pay off student loans, which may come with higher interest rates.

- Debt consolidation: Using a HELOC to consolidate your debts could simplify your life by reducing your monthly payments and lowering the amount you lose on interest.

- Start a business:Dont let a lack of capital be the reason you never got your business off the ground. If you have a solid idea for a business, you can use a HELOC to get things rolling.

- Medical expenses: You can use a HELOC to pay for an expensive medical procedure or to pay off medical debt that could be cramping your credit score.

Inflation Pushes Consumers Toward Alternative Forms Of Credit

Inflation remained near its 40-year high in April, with the Consumer Price Index hitting an 8.3% annual increase, according to the latest data from the Bureau of Labor Statistics .

“Compared to a year ago, the price of everything from filling a gas tank to buying a carton of eggs has increased due to inflation,” Michele Raneri, TransUnion vice president of research and consulting, said. “Since wages of many consumers have not kept up with inflation, people are spending more to get less.

“However there are several positives to note, including low unemployment, lenders increasing access to credit, and strong consumer performance,” Raneri said. “These are all indications that consumers are well-positioned as the economy continues to find its footing from the financial volatility of the pandemic.”

Total new mortgage loans decreased 28% annually as mortgage rates rise, but HELOCs have risen significantly over the past year because they allow homeowners to pull cash from their homes without changing the interest rate on their entire mortgage loan. While a borrower’s interest rate on the HELOC could be higher than the rate on the entire mortgage, it is likely to still be lower than the interest rate on a personal loan, TransUnion said.

Also Check: Usaa Credit Score Requirements

How Will A Heloc Impact My Credit Score

HELOCs are classified as a revolving type of credit on most credit reports, the same designation as credit cards. However, they dont impact credit scores in the same way.

The issue boils down to the credit utilization ratio, which accounts for 30% of a credit score. Credit bureaus recommend you keep your revolving balance under 30% of your credit limit. That presented a major problem when HELOCs became popular in the 1990s.

HELOC borrowers tend to use up most of the balance right away for things like putting a down payment on a second home or renovating a kitchen. That would put a major dent in your credit score if it were treated as a regular revolving line of credit. For this reason, HELOCs over $35k probably are not factored into credit utilization.

However, different credit bureaus have different rules, and none of them have released an official cutoff. Evidence suggests it is a safe bet that a HELOC over $35k wont affect credit utilization, but anything under that number might count. Thus, for smaller HELOCs, keep your utilization under 30% of your credit limit, and you should have nothing to worry about.