Who Qualifies For A Student Loan Without A Cosigner

Federal student loans are determined based on financial need and other factors, so even if you have little or no credit history, you can be approved without a Cosigner. However, private student loans often require a Cosigner if you dont meet the qualifications to be approved on your own.

Its best to exhaust your Federal student loan options before turning to private student loans to complete the funding needed for your education.

Up to 96% of private student loans are cosigned, because the qualifications are difficult for most college students to achieve.

Students will need at least two years of credit history, and make at least $24,000 per year, and have a low debt-to-income ratio to be eligible for a non-cosigned credit-based loan with some lenders. Students with no credit score, or eligible students that meet a minimum credit score, but dont have two years of credit history can apply for certain non-cosigned loans as well.

$24,000 is the minimum salary requirement to qualify for a non-cosigned loan many lenders require incomes of $30,000 and up.

Federal Student Loans Without A Cosigner

If you dont want to take out a cosigned loan, its important to review the options you have with federal student loans through your financial aid package.

Weve been covering private student loans without a cosigner, but always check out federal student loans first as they dont require a minimum credit score, and interest rates are fixed. When you sign up for automatic payments, you can score an automatic payment discount.

While comparing federal student loans and private student loans, look at:

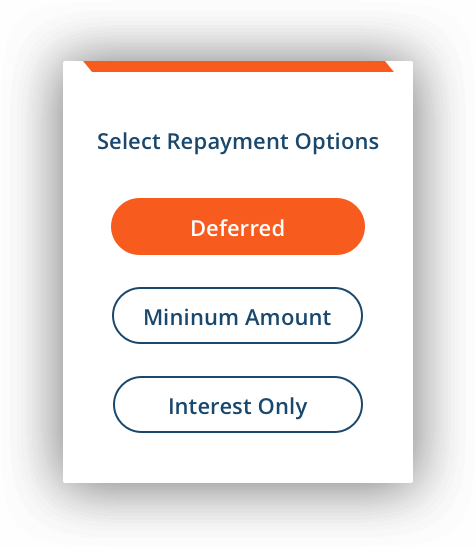

- Repayment options. How many different repayment plans are offered?

- Repayment terms. How many years do you have to pay back the loans?

- Interest rates. A lower interest rate is better.

- Loan amounts. How much can you borrow each year and aggregate limits during your entire education?

- Automatic payment discount. Private lenders might offer an automatic payment discount, but this varies.

The biggest difference between federal student loans and private student loans is that federal loans dont require a credit check. Rather, federal borrowers simply fill out FAFSA. Since private student loans are credit-based, they do require a check.

Also, federal student loans have fixed interest rates, and private student loans can have fixed or variable interest rates. You also have more repayment options with federal student loans, and in most cases, these loans dont require a cosigner.

Tips For Comparing Student Loans For Bad Credit Or No Credit

Having bad credit or no credit doesnt mean you cant get a student loan: Federal student loans for undergraduates dont consider credit in the application process. They do have borrowing limits, though, so you may find you need more money for school than you can get in subsidized and unsubsidized loans.

Heres the ideal order in which to borrow: If you dont have access to a co-signer and you can qualify, start with federal subsidized student loans, then borrow up to the maximum in federal unsubsidized student loans. If youre a graduate student who needs more money for school than what unsubsidized loans provide, you might turn to graduate PLUS loans. These do require a credit check, but there are specific negative marks the government is looking for.

If you learn you have an adverse credit history after you apply for a PLUS loan, you can explain the circumstances that led to it. The government could then determine that youre eligible for a PLUS loan after receiving loan counseling. Otherwise, an additional option is to get an endorser, similar to a co-signer, that can help you qualify. This process is slightly less rigorous than what youll experience if you were to undergo a credit check through a private lender.

Recommended Reading: How To Find The Best Car Loan Rate

Funding U Undergraduate Student Loan

Pros & Cons

- Apply through your computer or mobile device

- Customer service available via email

- 10-year repayment term

- Loan minimum of $3,001, maximum up to $15,000

- Residents of AL, AK, DE, ID, KY, LA, MA, MN, MS, MO, NV, NH, ND, OK, RI, SD, UT, WA, and WY ineligible for loans

- No cosigner allowed

- Loans made through Funding University

Funding U doesn’t make lending decisions solely based on creditworthiness. It will also consider factors like your academic performance and future potential career success when choosing to offer you a loan.

Watch out for: No variable-rate loan options. If you want to take out a loan with Funding U, it will have to be a fixed-rate loan. While this means you’ll likely start out with a higher rate than some variable options with other lenders, your rate won’t fluctuate over the life of your loan.

Read more about Funding U.

Best For International Graduate Students: Prodigy

- Must be a U.S. citizen, permanent resident, or DACA recipient over the age of 18

- Must be enrolled full-time

- Must be an undergraduate student in a bachelors degree program at an eligible four-year, not-for-profit college

- Meet the minimum GPA and graduation rate thresholds for borrowers and institutions depending on your class year

Read Also: Student Loan Forbearance End Date

How To Qualify For A Private Student Loan With No Cosigner

Private student loans operate much like auto loans or mortgages. Borrowers are approved based on their credit worthiness .

Most lenders are going to want to see a good credit history, with a score of 700 or higher. The best rates will likely only be offered to scores above 750. This can be difficult for young borrowers who simply don’t have the credit history built yet.

For example, Ascent Student Loans offers two private loans with no cosigner. Their non-cosigned outcomes based loan considers more than just a credit score to help eligible juniors and seniors qualify for a loan if they have little to no credit history. But, their non-cosigned loan based on credit requires a 680 credit score, and income requirements.

Second, most lenders are going to want to see proof of income. Once again, this can be challenging for borrowers who are in school. Most banks, on average, want to see at least $25,000 per year of income. While some students may earn this, many do not.

Finally, you must be a U.S. Citizen. This is important because most lenders will only lend with the safety net of U.S. law.

So, where can you find a lender? We recommend Credible as they will compare your options. Most of their lender will require a cosigner, but if you meet the requirements above, you might be able to get a loan cosigner free. Check out Credible here and see if you can get a loan.

You can also check out our guide to the best places to get a private student loan.

International Student Loan No Cosigner

Many private student loan companies offer student loans without a cosigner to U.S. students. But if you are aninternational student, they might only offer loans to you with a U.S.-based cosigner a citizen or permanentresident of the United States who joins your application.

Although a cosigner is typically required by most lenders, international students attending certain colleges anduniversities in the U.S. and Canada are able to apply without one. If youre not able to find a cosigner then thistype of loan could be a good option for you.

With no-cosigner loans, instead of looking at credit history, the lender will look at your academic success andcareer path. A few factors they will take into consideration include your home country, graduation date and whatschool you attend.

Here are the common requirements to qualify:

- Attend a school that is approved by the lender

- Come from a country on the lender’s approved list

- Be enrolled a minimum of half-time on a degree-level program

- Be less than 2 years from completing your degree or program

- Live in the U.S. during your studies

- Hold the appropriate visa status to allow you to study in the US

- Be able to prove your identity to the lender

You will also need to meet the lender’s checks into your creditworthiness.

Meeting all of the requirements to qualify for a loan still doesn’t mean that you are guaranteed to be offered one.

Your acceptance or approval for a loan may depend on specific factors such as:

You May Like: Usda Loan Income Limits 2022

Mpower Financing Undergraduate Student Loan

Pros & Cons

Highlights

- 5% origination fee and undisclosed late fee

- Customer service available by filling out a form or phone

- $2,001 loan minimum, up to $100,000 lifetime loan limit

- 1.5% reduction in your interest rate with automatic payments, six on-time payments, and proof of graduation and employment

- Lends to students for 350 schools

- Loans are made by Bank of Lake Mills or MPOWER Financing

MPower lends to international students and doesn’t require a cosigner, one of the only lenders to do both of these things.

You can get up to a 1.5% reduction on your interest rate by signing up for automatic payments, making six on-time payments, and reporting proof of graduation and employment. Each of these three requirements will qualify you for 0.5% off, or up to 1.5% total.

Watch out for: Fees. You’ll pay a 5% origination fee on your student loan, which will be deducted from your loan proceeds. Additionally, if you’re late on your payments, you’ll pay an undisclosed fee.

Read more about MPower.

Stride Funding: Best Income Share Agreement For Career Resources

Overview: Stride Funding’s income share agreements have transparent eligibility requirements and a plethora of online resources. Plus, borrowers only need to make up to 60 payments unless they reach the defined payment cap.

Why Stride is the best income share agreement for career resources: In addition to the basic perks of an income share agreement, Stride goes a step further by providing career resources and perks to its members, even after graduation. These include networking events, skill workshops and exclusive discounts.

Pros:

- Maximum repayment period of 10 years.

Cons:

- Does not disclose income share percentage.

- Relatively short grace period of three months after graduation.

- Funding limited to $25,000 per year.

Eligibility & More:

Also Check: Paying Off Personal Loan Early

Lenders Offering The Best Student Loans Without A Cosigner

Private loan lenders are private financial institutions that rely on credit to determine your eligibility. When youre young and have limited or poor credit, or no credit history at all, it can be tough to get approved. But there are some private student loans without a cosigner requirement. Lets review the best student loans without a cosigner.

Understanding The Risks Of Getting A Cosigner For Private Student Loans

Having a cosigner isn’t a bad thing – there are just risks involved. When you get a cosigner with good credit, typically you’ll see better rates and terms than not having a cosigner. But there are risks to being a student loan cosigner.

For the cosigner, it’s important to remember that you are just a liable for paying back the student loan as the borrower. Furthermore, you could face a lower credit score due to having more debt . Also, you could be 100% on the hook for the loan should the borrower become disabled or even die.

While some loans do offer cosigner release, it can be challenging to get the lender to release the loan. Furthermore, even cosigner release provisions have waiting periods – such as 2 to 3 years before you can even apply.

If possible, it’s always a smart bet to attempt to get a private student loan with no cosigner first.

If you need a cosigner, make sure that the borrower gets life insurance to cover the balance of the loan. That way, the loan can be eliminated if the borrower dies. It’s sad to think about, but it happens. And life insurance on a college student is cheap! Check out Haven Life for quotes to get started.

Also Check: How To Lower Auto Loan Payments

Accept Loans From The Federal Government

Once youre sure you need to borrow loans, you can move forward with accepting whats been offered to you in your financial aid package. You dont need to make a separate applicationfilling out the FAFSA form is all you need to do.

Once your university sends you information about your individual financial aid package, you can choose to either accept or decline the loans offered to you. If you accept, youll have to partake in an entrance counseling program and sign the paperwork.

Why Do International Students Often Need Cosigners

After reading about the difficulty of finding a cosigner above, you may be wondering whether or not you need one? Can you get a loan without a cosigner?

There are many criteria for obtaining a student loan, whether it is a federal loan or a private loan, many of which are more difficult for international students to meet.

Don’t Miss: What Is The Lowest Home Loan You Can Get

How Can I Get A Loan With Bad Credit And No Cosigner

Weve made the point several times that secured loans are easier to get, even when you have bad credit and dont use a cosigner. In this article, weve limited our discussion of secured loan offers to automobile dealership networks, but you can also arrange secured loans in several other ways, including:

- Home equity loans and home equity lines of credit, in which you can cash out some of the equity youve accumulated in your home. Equity is the amount that an assets value exceeds the current amount of debt owed in this case, your mortgage balance. FHA loan programs can help mortgage lenders provide excellent loan terms its hard for mortgage lenders to beat an FHA loan.

- Collateralized bank and , in which you post cash, securities, or personal property to secure a loan.

- Pawnshop loans are a type of secured loan collateralized by your personal property, but they are expensive, and you can easily lose the property if you dont redeem it by a set date.

- You may be able to get a cash advance from a credit card, but this type of loan begins accruing interest right away and doesnt provide the normal .

Because these are secured loans, you wont need a cosigner to receive approval.

In terms of unsecured loans, the lender networks weve reviewed here all serve bad credit consumers, and none mandate the use of a cosigner. But lets be clear it doesnt hurt to apply with a cosigner.

Unwise An Underclassman Whos New To Student Loans

Youre probably already familiar with financial aid that doesnt need to be repaid, like scholarships. But if youre relatively new to the college experience, some financing tools might still seem foreign.

A loan could help you bridge the gap between your cost of attendance and the amount youve been able to raise through gift aid and help from your family.

Taking out a private student loan without cosigner requirements would likely be unwise in your case. This is because federal loans, which almost always dont require a cosigner, come with added protections. You can pause your loan repayment, switch repayment plans and potentially qualify for student loan forgiveness, to name a few examples.

So if you havent borrowed money for your education yet but need to shortly, its likely wiser to go the federal route first. There are different maximum borrowing amounts depending on your dependency status and your year in school. A dependent freshman, for example, would be eligible to receive $5,500 in direct loans.

Recommended Reading: Where Can I Apply For Student Loan Without Cosigner

Ways To Get Government Student Education Loans Versus A Cosigner

In theory, federal college loans are present mostly due to the fact a hack to help you even out economic inequality. Thinking is the fact students whoever moms and dads build $50,100000 annually need an equal attempt within a college knowledge compared to students whoever mothers generate $step one,000,one hundred thousand a year.

While the people in low income mounts generally have straight down borrowing from the bank scores, the us government cannot check your borrowing from the bank in terms of extremely federal student education loans. They also wont wanted an excellent cosigner that have a good credit score to support their student loan says. However, while making an application for Head Including Financing or your mother and father are curious about Mother Together with Financing, your credit score will come to your play. For those who have a woeful credit records or you cant find a great cosigner, you will want to stick to direct paid otherwise unsubsidized funds.

Choose A Less Expensive Car

While the brand new Mercedes SUV may be your top pick, its not a good choice if you have credit issues and are struggling to secure financing as youll need a larger loan. Instead, you should look for a reliable yet affordable vehicle that will cost you less and require a smaller loan.

It may make sense to explore used cars as these are generally cheaper and dont depreciate as quickly as new cars. Plus used car loans are often thousands of dollars less than new car loans. You can always finance your dream car in the future when your credit and finances improve.

You May Like: Do I Have To Pay Back My Student Loan

What Happens To Unused Student Loans

You can return an unused loan to your lender and reduce the amount of loan you took. For private lenders, the amount you return gets back in your account and help you to reduce the money you owe your bank.

You need to understand that, even when you return unused money to your bank, your interest remains. So instead of returning the money, you better do something like starting a business.

Dont Miss: How To Get Approved For Parent Plus Loan