Can I Finance My Closing Costs

With an FHA loan, your closing costs usually cannot be financed into the loan amount. However, they can almost always be paid by the seller or the lender. FedHome Loan Centers can provide a lender rebate up to 2.75% toward your closing costs on a purchase transaction.

Your down payment doesnt have to come from your own funds either. The down payment can come as a gift from a family member, employer or approved down payment assistance group. FHA loans also allow for a non-occupant cosigner to help the borrower qualify for the loan.

Non-traditional credit sources such as insurance, medical and utility payments can be used to help build credit history if traditional credit is unavailable. With an FHA refinance, you can significantly lower your monthly payment with no out of pocket costs and may even be able skip a monthly payment during the process.

Where Can I Apply For An Fha Loan

The FHA doesnt offer loans directly, so youll need to contact a private lender to apply.

The majority of lenders are FHA-approved, so youre free to choose a local lender, big bank, online mortgage lender, or credit union.

To find a good FHA lender, you can get recommendations from friends or family whove used an FHA loan. You can also check with the Better Business Bureau to review a bank or mortgage lenders rating and read online reviews.

Keep in mind that credit requirements for FHA loans vary from lender to lender. While many lenders allow a credit score as low as 580, some might set their minimum at 600 or even higher. So if your score is on the lower end of qualifying for an FHA loan you might need to shop around a little more.

Regardless of credit score, you should find at least three lenders you like the look of and apply with them.

FHA mortgage rates can vary a lot between lenders, and you wont know which one can offer you the best deal until youve seen personalized quotes.

What Are Some Fha Loan Alternatives

If youre not sure if an FHA loan is right for you, there are a few other options to consider.

- Conventional loan A conventional loan means your mortgage isnt part of a government program. There are two main types of conventional loans: conforming and non-conforming. A conforming loan follows guidelines set by Fannie Mae and Freddie Mac such as maximum loan amounts. A non-conforming loan can have more variability on eligibility and other factors.

- USDA loan A USDA loan, also called a rural development loan, may be an option for people with low-to-moderate incomes who live in rural areas. They can be attractive because they offer zero down payments, but youll have to pay an upfront fee and mortgage insurance premiums.

- VA loanVA loans are made to eligible borrowers by private lenders but insured by the Department of Veteran Affairs. You may be able to make a low down payment . Youll probably have to pay an upfront fee at closing, but monthly mortgage insurance premiums arent required.

Also Check: How To Find Student Loan Number

The Program Is Restricted To Those Who Try Not To Presently:

- Be eligible for a old-fashioned funding

- Currently very very own real estate

- Have actually owned estate that is real the final 36 months

Nonetheless, Schwertner cautions, purchasing a homely household through Habitat is a procedure.

You attend a wide range of classes, including credit guidance, before they will certainly enable you to continue to choose a whole lot. You need to work hours within their workplace, resale shop as well as on real construction web sites for homes as sweat equity, Schwertner explains.

How Do I Apply For An Fha Loan

An FHA mortgage is a great way to buy a house without needing a big down payment or perfect credit score.

While theyre backed by the federal government, FHA mortgages are available from just about any private lender. So its easy to apply and shop around for low rates.

You can start your application online and even close online in some cases. Or you can work one-on-one with a loan officer for extra guidance. You get to choose your lender and how you want to apply.

Recommended Reading: How To Get An Aer Loan

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

Taking Out An Fha Loan Makes The Dream Of Home Ownership A Reality For People Who Might Not Be Able To Afford It Otherwise

Many of us dream of owning our home, but it’s getting harder to achieve. Thanks to the federal housing administration’s home loan program, you could qualify for a mortgage even if you have poor credit. However, the market is finally rising once again. Who is an fha home loan right for? Learn more about what an fha mortgage is and who can qualify for this type of loan. Purchasing a home may well be the biggest financial outlay that you’ll ever make. Buying a house gives you the freedom to do what you want and build a lif. The persian, indian and other asian cultures have developed a heritage of making fine carpets that have been prized for their beauty. Buying a home is probably the biggest purchase you’ll make in your lifetime, and you don’t want to leave any room for error. Getting it right means understanding the mortgage process, from start to finish. Owning a home is a dream come true for many americans, and a federal housing administration loan can be a great tool for buying one. If you’re on the market for a mortgage loan, you may want to consider an fha loan as one option. If you are looking for a fl.

Do you have dreams of buying your first home? If you are looking for a fl. Purchasing a home may well be the biggest financial outlay that you’ll ever make. Owning a home is a dream come true for many americans, and a federal housing administration loan can be a great tool for buying one. However, the market is finally rising once again.

You May Like: What Happens If You Default On Sba Loan

Fha Loan Limits In 2021

Each year, the FHA updates its loan limits based on home price movement. For 2021, the floor limit for single-family FHA loans in most of the country is $356,362, up from $331,760 in 2020. For high-cost areas, the ceiling is $822,375, up from $765,600 a year ago. These limits are referred to as ceilings and floors that FHA will insure.

FHA is required by law to adjust its amounts based on the loan limits set by the Federal Housing Finance Agency, or FHFA, for conventional mortgages guaranteed or owned by Fannie Mae and Freddie Mac. Ceiling and floor limits vary according to the cost of living in a certain area, and can be different from one county to the next. Areas with a higher cost of living will have higher limits, and vice versa. Special exceptions are made for housing in Alaska, Hawaii, Guam and the Virgin Islands, where home construction is generally more expensive.

Home prices have reached record highs in 2021, so its safe to assume that the FHA loan limits for 2022 will increase in most areas of the country.

Qualifying For An Fha Loan

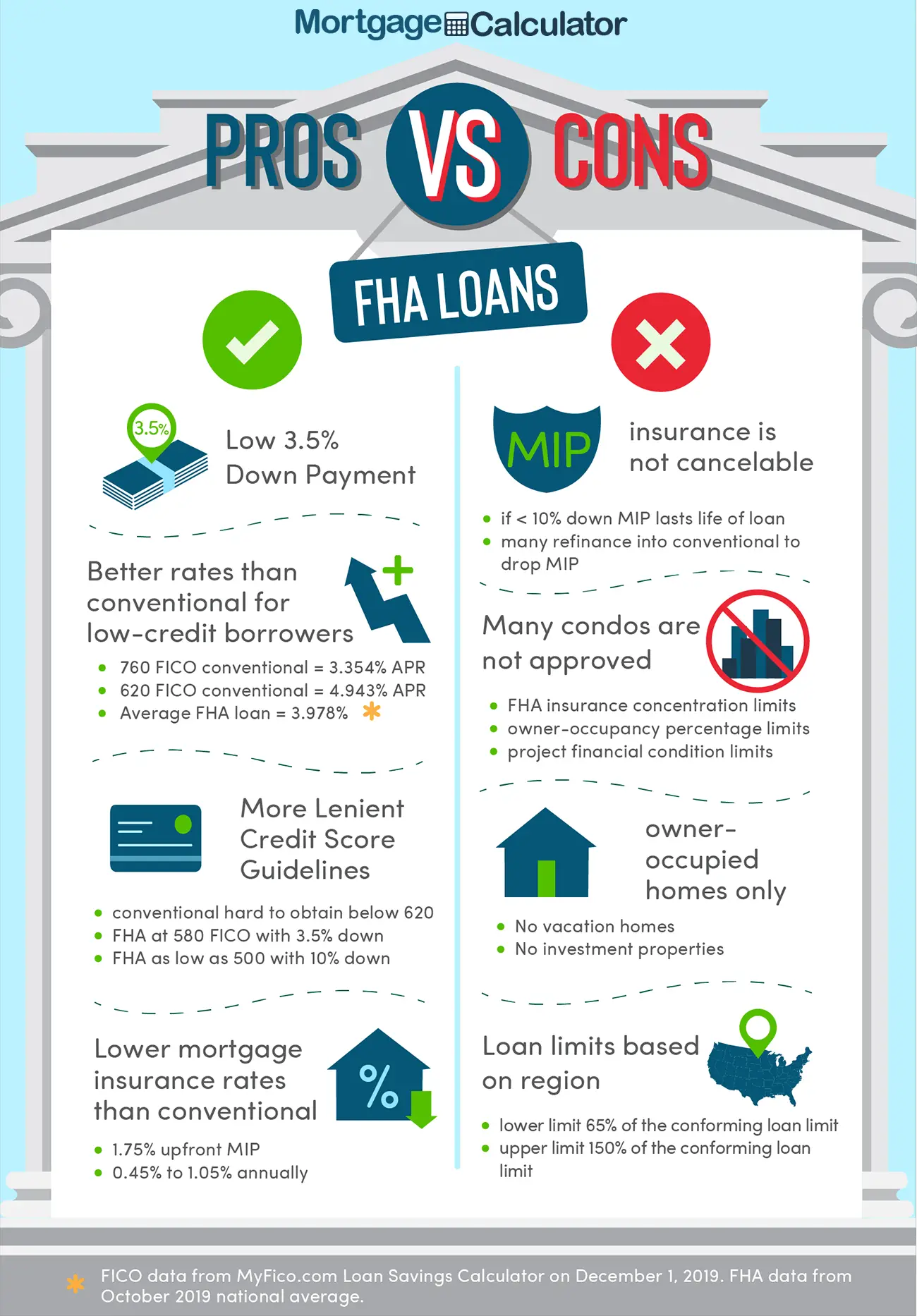

To qualify for an FHA loan, you’ll need a of at least 500 with a 10% down payment. To determine if youre eligible for the lowest FHA down payment just 3.5% underwriters will look for a score of 580 or higher. Youll also need to have a debt-to-income ratio of 50% or less.

In addition to money for your down payment, you’ll also need funds to cover FHA closing costs and an upfront mortgage insurance premium, which for FHA borrowers is 1.75% of the loan amount. Both the upfront insurance premium and the closing costs can be rolled into the total amount of the mortgage.

Bear in mind that these are the FHA’s qualification guidelines individual lenders may impose additional rules. That’s just one reason it’s worth comparing several lenders.

» MORE:Debt-to-income ratio calculator

Recommended Reading: What Is The Commitment Fee On Mortgage Loan

Fha Loan Document Checklist

Youll need documentation of your income and assets to apply for an FHA loan. The lender will pull your credit report as proof of debts and accounts, and to obtain your credit score.

Specifically, it helps to have the following documents ready shortly after you apply:

- W-2 forms

- Your pay stubs for the last month

- Bank statements

- Investment account statements

- Employers for the past two years

- If self-employed, a profit and loss statement for the current year and tax returns for the previous two years

- Proof of other income, such as alimony and child support if you choose to disclose that income

The types of documents you need will depend on the type of work you do and how you earn your income. Full-time employees can use their pay stubs, for instance, while self-employed borrowers or those who receive commission or bonus may need to show tax returns.

A loan officer with your preferred lender will explain everything theyll need to process your application.

Are Fha Loans Only For First

No, you do not need to be a first-time home buyer to use an FHA loan. Lower credit score minimums and down payments certainly make FHA loans attractive to first-time home buyers, but current homeowners are eligible, too. In fiscal year 2020, about 83% of FHA purchase loans were made to first-time home buyers which means 17% went to borrowers who were already homeowners.

» MORE:How to qualify for first-time home buyer benefits

Read Also: Bayview Loan Servicing Class Action Lawsuit

Qualifying For An Fha Home Loan

The requirements for an FHA home loan are more flexible than those for a conventional loan, but borrowers do have to demonstrate a certain level of fiscal responsibility and meet certain standards. According to the FHA, you must meet the following requirements to qualify for an FHA loan:

- You must be of a legal age to sign a mortgage, possess a valid Social Security number, and be a lawful resident of the U.S.

- You need a steady work history and proof of employment.

- You must intend for the property to be your primary residence.

- You must have a down payment of at least 3.5 percent if your credit score is 580 or more.

- You must have a down payment of at least 10 percent if your credit score is between 500 and 579.

- You should have a debt-to-income ratio of less than 43 percent.

- You must have the property appraised by an FHA-approved appraiser, and it must meet certain minimum standards.

How Can You Make An Application For An Fha Finance

An FHA financial is a good method to get a residence without needing an enormous down-payment or perfect consumer credit score.

While theyre backed by the government, FHA mortgage loans come from just about any exclusive lender. So that it very easy to employ and research rates for reduced charges.

Youll be ready the job on the web and even close on the web periodically. You can also manage one-on-one with loans specialist for additional recommendations. You reach decide the lender and the way you would like to employ.

In this artic

Also Check: How Much To Loan Officers Make

Can I Refinance An Fha Loan

Yes. You can refinance an FHA loan to reduce or eliminate mortgage insurance, increase the size of your loan, or reduce or change your interest rate. Learn more at:

Still have questions? Read more about everything you need to know about FHA loans.

What Do You Need To Apply For An Fha Loan

The good news is that you dont need anything on hand to apply.

Whether you prefer to apply for an FHA loan online or speaking to a professional, you will likely field questions you know how to answer off the top of your head. No need to compile all your paperwork for that initial call or click.

Applications take as little as 15 minutes to complete.

Once youve applied, youll submit documentation to support what youve verbally told the lender. What paperwork do you need? Read on.

Also Check: How To Get An Aer Loan

Trusted Fha Loan Officers

Assurance Financial has FHA-approved loan officers, but we also have much more. We pride ourselves on being The People People. We dont just focus on numbers our experts get to know you and help you find the right home loan for your situation. We always answer your questions and stay responsive.

Assurance Financial also uses the most current application technology to allow you to apply online or with a real persona quickly and easily. Abby, your virtual assistant, can walk you through the application process online so you can get your free quote. You dont even have to fax over your paperwork since Abby can guide you to log into your bank account and payroll information to confirm your financial details.

Where Can I Get An Fha Loan

Many lenders offering government-secured loans offer FHA loans. Assurance Financial offers a range of home loan products and is one place you can go if you have been wondering where to get an FHA loan. The FHA does not offer mortgages you still need to work with an approved lender to get this type of financing.

Also Check: How To Transfer Car Loan To Another Person

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

You Can Compare Your Options

A preapproval also allows you to determine whether an FHA loan is actually the best option for you. Despite their many benefits, FHA loans do have some drawbacks.

You must pay an upfront mortgage insurance premium of 1.75% of the loan amount for FHA. There is no upfront mortgage insurance requirement with a conventional loan, even if you only put down 3-5%..

And, a conventional loan may be the better option if you have excellent credit. Youll pay private mortgage insurance until you reach 20% equity, but after that, it falls off.

Getting preapproved tells you all the potential loan programs that may be right for you, allowing you to make the most informed choice.

Don’t Miss: How Long For Sba Loan Approval

What Are Fha Loan Requirements In Nc And Sc

FHA loans in Charlotte, NC or other areas in the Carolinas are available to buyers as long as they meet FHA loan requirements. North and South Carolina FHA loan requirements include:

- A credit score of at least 580. However, if your score is between 500 and 579, you may still be eligible for an FHA loan if you make a down payment of at least 10% of the homes purchase price.

- Borrowing no more than 96.5% of the homes value through the loan, meaning you need to have at least 3.5 percent of the sale price of the home as a down payment.

- Choosing a home loan with a 15-year or 30-year term.

- Purchasing mortgage insurance, paying 1.75% upfront and 0.45% to 1.05% annually in premiums. This can be rolled into the loan rather than paying out of pocket.

- A debt-to-income ratio less than 57% in some circumstances.

- A housing ratio of 31% or less.

FHA lenders in NC and SC will provide you with all the information you need and can help determine if you qualify for an FHA loan.

Income Requirements for FHA Loans

Theres a common misconception that FHA loan requirements include income restrictions. While FHA income guidelines can be confusing, FHA loans are available to those who have any type of income. There are no minimum or maximum income requirements.