How Do I Obtain A Loan Payoff Statement

Weve compiled a list of the most common public and private student loan servicers, as well as everything we know about the best way to get a loan payoff statement from them. Most require a phone call.

Federal loan servicers

- AESWatch the video below or call 233-0557 to receive your payoff statement.

- CornerstoneCornerstone transferred its loan portfolio to FedLoan Servicing in October 2020. Please contact FedLoan for more information on your loan if it was previously held by Cornerstone.

- Fedloan Servicing Watch the video below or call 699-2908 and they will email you a payoff statement.

- NelnetCall 486-4722 and request your payoff statement. You can also request your payoff amount through your Nelnet.com account. In the Payment Amount section, select Payoff Quote.

- OSLA ServicingPlease login to your account to find contact information. Call this servicer for your payoff amount.

- ECSICall this servicer at 313-3797 to receive your payoff statement.

Private student loan servicers

How Federal Student Loan Servicers Can Make Your Life Easier

The contact information for all Federal Loan Servicers is listed below. And they can offer fast help. After calling four of the nine numbers, I was on the phone with a human representative within two minutes. And I had an answer to my question within five minutes total.

If you do not have your student account number nearby, they can use your social security number and date of birth to pull up your information.

- ECSI: 1-866-313-3797. ECSI Students and Borrowers.

- Default Resolution Group: 1-800-621-3115 . Debt Resolution .

For the most part, the underlying loans these nine servicers manage were part of the federal direct loan program. And unlike private loans, they do tie back to some sort of central database for the federal governments budget. For example, national student loan data system found here.

More About The Fsa Id

The FSA ID replaced the Federal Student PIN in 2015, so students who havent taken out new student loans or havent logged into the Federal Student Aid website since 2015 might not have an FSA ID yet.

Students who dont have an FSA ID can create one on studentaid.ed.gov.. Once you sign up for an FSA ID, the federal government will verify your information with the Social Security Administration. Once your information is verified, you will be able to use your FSA ID to obtain information about your federal student loans.

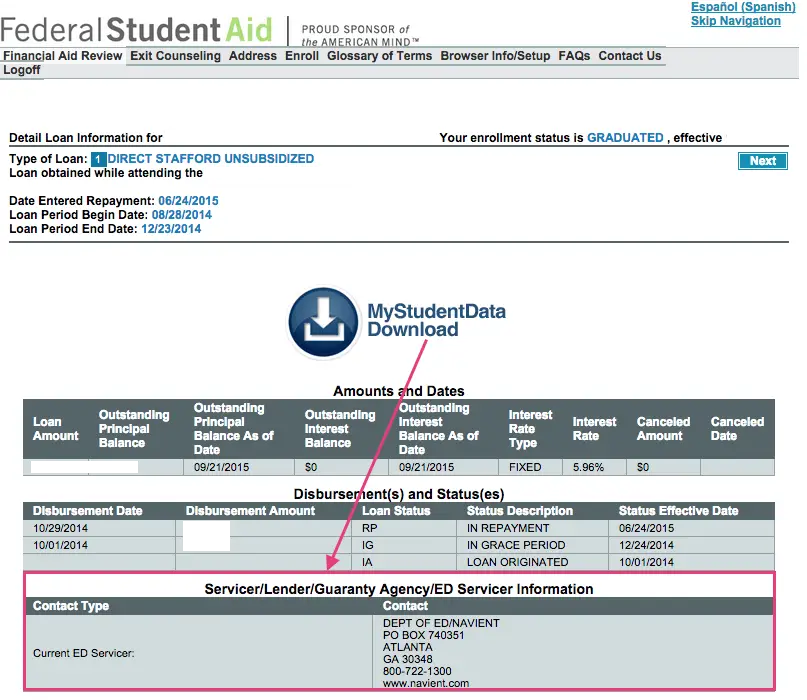

The site, managed by the U.S. Department of Education, can provide a convenient way to get a full picture of all your federal loans, including:

How many federal student loans you have Their loan types The original balance on each loan Current loan balances Whether any loans are in default Loan service providers names Contact information of the loan service providers

Also Check: Can You Refinance With Fha Loan

Use Chipper For Lower Payments

Chipper can help you find a student loan repayment plan that actually fits into your budget. You simply fill out your information and link your student loan account for us to generate your options in seconds. We help the average student loan borrower save over $300 a month off their student loan monthly payment. Lowering your monthly payment plan can game changing for your personal finance and can be done in minutes! to get on track with your student loans.

What Are Your Other Repayment Options

Using your student loan account number, you can easily view your remaining loan balances and how much interest youve accumulated. But maybe this shows you that your balance is a lot higher than expected.

Fortunately, if you have trouble with your monthly payment, there are multiple repayment options available to you. This includes loan forgiveness, loan consolidation, and refinancing your loan. To get the most appropriate payment schedule for your budget, make sure you compare plans and rates with multiple lenders.

However, keep in mind that refinancing or consolidating your student loans may leave you ineligible for loan forgiveness or federal programs.

Also Check: The Mlo Endorsement To A License Is A Requirement Of

Use Chipper For The Best Path To Forgiveness

Finding your path to student loan forgiveness is easier than ever before. Chipper helps members find better Income-Driven Repayment plans every day. Once enrolled in an eligible repayment plan, we can help you explore your forgiveness options and understand your path towards forgiveness. and get on track with your student loans.

How Do I Find My Student Loan Account Number To Verify My Identity For The Irs

Check with the lender from whom you have the student loan. Wouldn’t it be on the information you use when you make your payments? Look on the loan website.

If you are trying to enter student loan interest you paid you need your 1098E.

STUDENT LOAN INTEREST

Only the person whose name is on the student loan and who is legally obligated to pay the loan can deduct the student loan interest. If you co-signed then you are legally obligated to pay if the primary borrower defaults or does not pay. If you did not sign or co-sign for the loan you cannot deduct the interest.

You cannot deduct student loan interest if you are being claimed as someone elses dependent, or if you are filing as married filing separately.

The student loan interest deduction can reduce your taxable income by up to $2500

There is a phaseout for the Student loan interest deduction, which means the amount you can deduct gets reduced when your modified adjusted gross income hits certain income levels and is even eliminated at certain income levels –

If your filing status is single, head of household, or qualifying widow, then the phaseout begins at $65,000 until $80,000, after which the deduction is eliminated entirely.

If your filing status is married filing joint, then the phaseout beings at $130,000 until $160,000, after which the deduction is eliminated entirely.

Enter the interest you paid for your student loan by going to Federal> Deductions and Credits> Education> Student Loan Interest Paid in 2020

You May Like: Usaa Auto Loan Reviews

Trouble Paying How To Find Types Of Relief

Change Payment Plan. If youre having trouble making the monthly payments, you can apply to reduce or temporarily pause them. Normally, to see the greatest reduction in your monthly payment, youd want an Income-Driven Repayment Plan, which includes the ICR, REPAYE, and IBR plans.

This is especially true for those with high student debt balances and smaller incomes. Also, if you plan to be in PSLF, you must be on one of these Income-Driven Repayment plans.

Postpone Payments. You can also find the option to postpone payments. An eligibility quiz provides guidance on education-related or personal/family reasons, among others.

How To Find Your Federal Student Loan Account Number

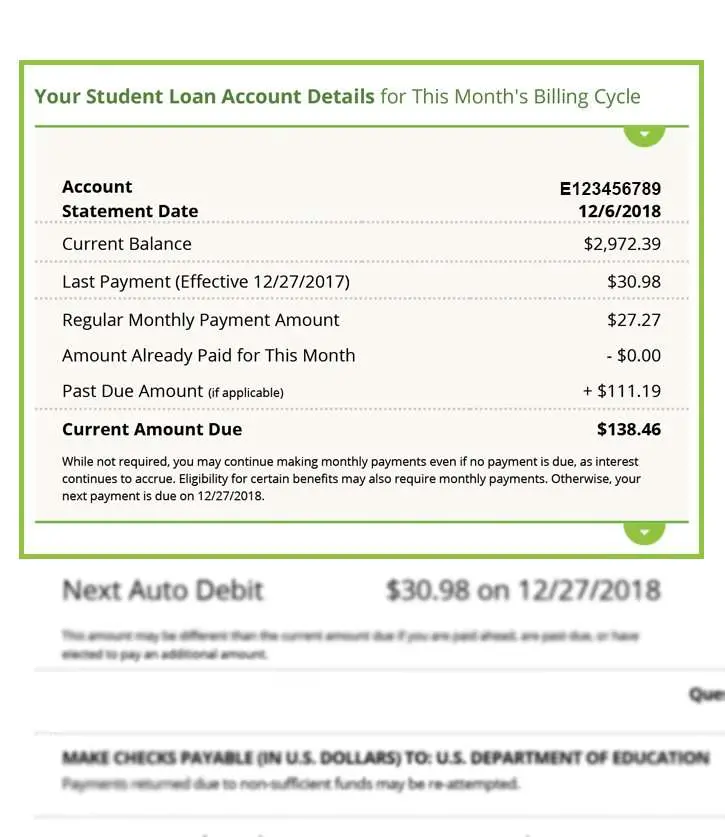

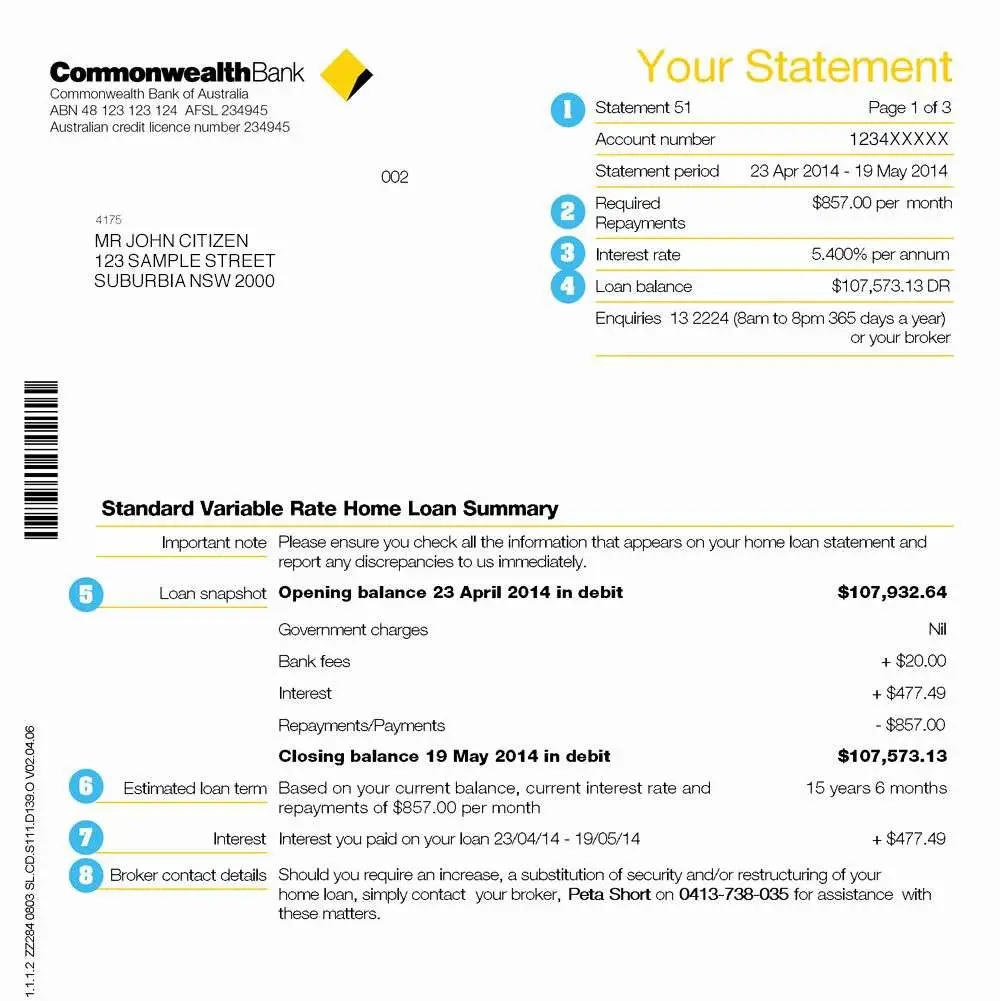

Where can I find my student account number? You should be able to find your student loan account number on correspondence from your loan servicer. Correspondence might include a welcome letter, billing statement, loan balance, or past due notice.

Look for a 10-character ID, which may contain numbers only or numbers with letters.

You can also sign in to your higher education loan servicerâs website and look for your 10-digit account number there.

If all else fails, you can call your student loan servicer. Your servicer is a private company hired by the federal government to explain your repayment options and eligibility for loan forgiveness programs such as PSLF .

Is my loan number my account number? No, your loan number refers to each individual loan. Your account number is different it refers to all your loans with a single servicer. You can have multiple loan numbers with a single servicer, but only one account number for each servicer.

Learn More:When Do Student Loans Go Away?

Read Also: Is Loan Lease Payoff Worth It

Can I Make Payments While Im In School

Yes. While you arent required to make payments while youre in school, youll save money on interest in the long run if you do. To learn more about how making payments while you are in school helps you pay less interest over the life of your loan, see What Does It Mean That Interest Is Capitalized?.

If you make a payment within 120 days after the date your school disbursed your loan funds , your payment is first applied to the original principal balance of that disbursement. This reduces the amount of your loan. For more information about payments made within 120 days of disbursement, see How Are Payments Allocated? Please note: this excludes loans that are already in repayment status and consolidation loans.

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies, loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Read Also: Usaa Personal Loan Calculator

Tips For Staying Organized And Keeping Track Of Your Student Loans

As youre repaying your student loans, its important to stay organized and keep track of your progress. Here are a few tips to help you stay on top of your loans:

- Keep all of your loan documents in one place. This can help you keep track of your loan balance, payment history, and any correspondence from your lender.

- Set up a budget and make sure youre making your loan payments on time. This can help you avoid late fees and stay on track with your repayment plan schedule.

- Stay in communication with your lenders. If you have any questions about your loans, be sure to contact your lender directly.

Making your student loan payments on time is one of the most important things you can do to stay on top of your loans. By staying organized and keeping track of your progress, you can make sure youre making the most of your repayment schedule.

Wrapping Up How To Find Your Student Loan Account Number

In summation, knowing how to find your student loan account number is crucial, even during the repayment pause. This unique ten-digit number was created for federal loan borrowers and is issued by the U.S. Department of Education. If you are unsure who your federal loan servicer is, log into your Federal Student Aid Account Dashboard or call FSAIC at 1-800-433-3243.

Then, access your online account. Once youre logged into your loan servicers website, you will see how to find your student loan account number, retrieving it quickly. But as you scroll through the data, you will find a lot of helpful resources that can help you lower monthly payments, apply for a grace period, or track your path towards loan forgiveness.

Recommended Reading: Usaa Approved Car Dealerships

Finding The Right Repayment Plan

Having ready access to your student account number is of vital importance when managing your federal student loan debts. Using this number, you can contact your loan servicer with questions about your federal loans and alternative repayment plans.

In addition to consolidating your loans , you can also look into forgiveness programs, refinancing, or income-driven payment plans. However you ultimately decide to approach your loan, remember to compare lenders before agreeing to a repayment option. Not only will this help you learn more about student loan lenders , but youll also know that you received the best plan for you.

View Article Sources

William D Ford Federal Direct Student Loan

In the Direct Loan program, the U.S. Department of Education is the lender for your student loan. There are two types of student loans in the Direct Loan program subsidized and unsubsidized. These loans are not based on your credit rating/score and do not require a credit check.

- The Direct Subsidized Loan is based on need. Interest on the Direct Subsidized Loan does not accrue while you are in school and during your grace period.

- The Direct Unsubsidized Loan is not based on need. Interest on the Direct Unsubsidized Loan does accrue once the loan is disbursed.

Loan Request Process: If you were not initially awarded a Federal Direct Student Loan and are interested in requesting one, or if you were only awarded a Subsidized loan and would like to request an Unsubsidized loan, you must complete and submit the online Federal Direct Loan Request Form.

| Students who will be offered aSubsidized loan automatically: | Students who need to submita loan request form: |

|---|---|

|

|

Don’t Miss: Usaa Car Loans Reviews

Dont Know Who Your Loan Servicer Is

You need to know who your servicer is to look up your student loan account number.

To find out who your federal student loan servicer is, log into the federal governmentâs student loan website with your FSA ID. If you donât know your login , call the Federal Student Aid Information Center at this phone number: 1-800-433-3243.

Keep your contact information up to date so your financial aid servicer can always stay in contact with you.

Who services federal student loans? Through 2021, there are eight federal Direct Loan servicers most borrowers work with:

Completing Your Tax Return

On line 31900 of your return, enter the eligible amount of interest paid on a student loan.

Remember to claim the corresponding provincial or territorial non-refundable tax credit on line 58520 of your provincial or territorial Form 428.

For more information about your student loan and interest paid, visit Student Financial Assistance.

Recommended Reading: Usaa Refinance Auto Loan Calculator

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Also Check: Can You Refinance An Fha Loan

How Do I Find My Student Loan Account Number If Its In Default

To find the student loan account number for a defaulted federal loan, call the Department of Educationâs Default Resolution Group, 800-621-3115. The representative can provide you with your ED ID, which is the account number for loans in default.

If the Default Resolution Group doesnât have your loans, ask the representative to check the National Student Loan Data System to check for FFEL or Perkins Loans in default. If you do, contact the collection agency that has your loans and ask for your account number.

You May Like: Usaa Student Loans Review

What Do I Do With My 1098

You’ll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you don’t need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, you’ll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. It’s as easy as that!

How Do I Find My Student Loans

The process for finding your loan servicer will be different depending on whether you have federal or private student loans.

If you have federal student loans, you can find your loan servicer by signing into your Federal Student Aid account. Youll log in with your FSA ID. Once youve accessed your dashboard, youll see your student loan servicer and other details about your loans.

Alternatively, you can find your federal student loan servicer by calling 1-800-4-FED-AID .

Along with identifying your loan servicer, you will also find other information on your student loans, including the type of student loans you have, the loan amounts, interest accrued and outstanding balances.

You May Like: Transferring Car Loan To Another Person

Nslsc Login Nslsc Student Loan Nslsc Contact Number Details 2022

How do I find my Nslsc account?How do I check the status of my student loan?How do I check my Nslsc payments?Do student loans go away after 7 years Canada?osap login,national student loan,student loan login,nslsc contact number,canada student loan login,osap repayment national student loan service,nslc student loan

Use Chipper For Round

Paying off your student loans doesnât have to be a long and painful journey. Round-Ups are a way to directly pay off your loans with your everyday spending! By tracking your linked spending account, we will calculate the rounded up amount from each transaction in a week . We then initiate a payment towards your student loan for the weekly amount. Get chipping away on your student loans with Chipper today.

Recommended Reading: Does A Loan Processor Have To Be Licensed In California