Conforming Loans Versus Jumbo Loans

To be clear, borrowers arent limited to conforming loans those who need to borrow more can seek out jumbo loans. But there are a number of benefits that conventional loans offer over jumbo loans.

First, conforming loans are generally easier to qualify for. Even borrowers with mediocre credit can qualify for a conforming mortgage, albeit at a less competitive rate. But lenders are generally more hesitant to give out jumbo loans since there’s a higher level of risk involved, which often leaves borrowers with lower credit scores out in the cold . Conforming mortgages typically offer lower interest rates than jumbo loans, too, making them more affordable.

Is My Credit Score Affected By Entitlement

Your VA loan entitlement does not affect your credit score. When lenders run a credit check as a part of the VA loan pre-approval process, the hard inquiry may or may not affect your credit score, but if it does, it may only adjust by a few points. If several inquiries are made in the same two-week time frame, such as when you are shopping around for rates, the formulas which produce your credit scores will recognize that you are shopping around and will not ding you multiple times. Additionally, making consistent, on-time payments of your VA home loan is a great way to build up your credit.

What Are Conforming Loan Limits

The conforming loan limit is the dollar cap set each year for mortgages that Fannie Mae and Freddie Mac will buy or guarantee. When mortgages meet all the requirements of both agencies, theyre known as conforming loans. In November of each year, the Federal Housing Finance Agency sets the conforming loan limit for the following year.

Mortgages that fall under the conforming loan limit are considered conforming loans, and loans that exceed the limit are called jumbo loans. The limit is adjusted each year to reflect changes in the average U.S. home price.

You May Like: Which Fico Score Is Used For Rv Loans

What Are Jumbo Loan Rates

Jumbo loan rates tend to mirror those for conforming loans. Currently, the benchmark 30-year fixed jumbo loan rate is 3.020%, according to Bankrates national survey of mortgage lenders.

The long-held practice was that jumbo rates were higher than conforming loans because they lacked the government guarantee, McBride says. However, in the years following the financial crisis we have seen that change as the secondary market for jumbo loans all but disappeared, loan performance was particularly strong relative to smaller conforming loans and additional add-ons were tacked onto conforming loans.

Rates on jumbo loans are also tied to the credit profile of the borrower, just like any other type of mortgage.

Credit scores are a critical input in the lending decision, McBride says. Lenders may use compensating factors such as higher income or significant assets to offset a deficiency in the credit score, and this tends to be more common in jumbo loans than the smaller conforming and government-backed loans.

How Does One Calculate A Conforming Loan Limit

The conforming loan limit is the maximum home loan amount that a bank will offer to a borrower. It is determined by the size of the geographic area in which the loan is being sought. For example, if one wanted to purchase a house with an FHA loan in Phoenix, their conforming limit would be $314,000.

A conforming loan limit is a fixed dollar amount that can be used to finance a home purchase. Its the most basic type of mortgage, and the only type that qualifies for federal loans. The current conforming loan limit is $453,100 in the United States, but its possible to have a higher limit in certain cases. This includes areas with a high-cost housing market and places where there are tighter lending guidelines.

Also Check: Usaa Bad Credit Auto Loans

Conforming Loan Limits Increased For 2021

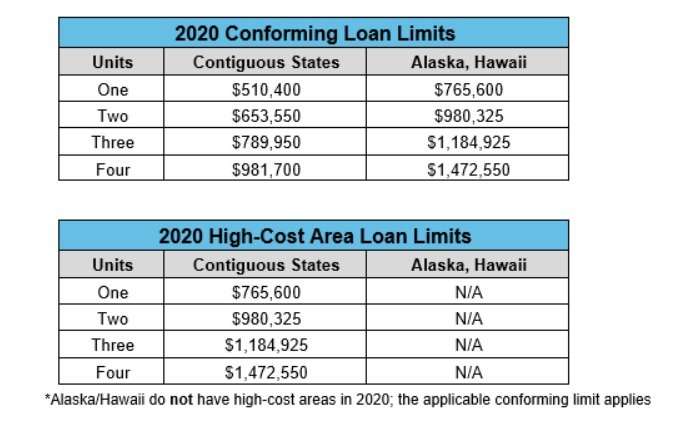

On November 24, 2020, the Federal Housing Finance Agency announced that it would raise the baseline conforming loan limit for 2021, for nearly all counties across the country.

They are also increasing the limits for certain higher-cost areas that fall above the baseline. This is in response to the signifiant home-price gains that occurred during 2020. Despite the coronavirus pandemic and economic downturn, home values in most U.S. cities continue to climb in 2020.

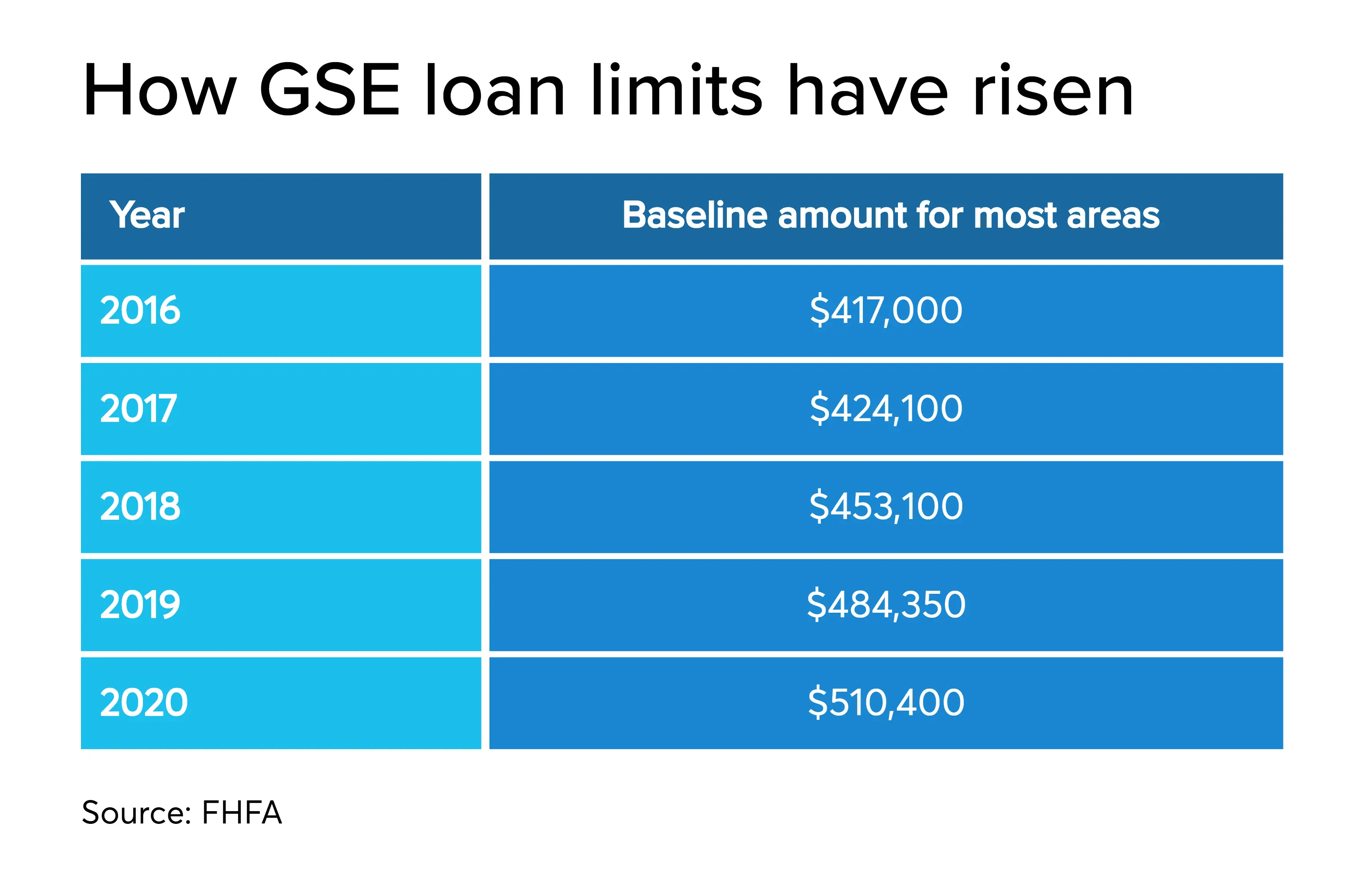

In most counties across the country, the 2021 maximum conforming loan limit for a single-family home will be $548,250. Thats an increase of $37,850 from the 2020 baseline limit of $510,400.

This marks the fifth year in a row that federal housing officials have raised the baseline, in order to keep up with rising home values.

But again, this is just the baseline conforming loan limit used for most parts of the country. In higher-cost real estate markets, like San Francisco and New York City, the limit for a single-family home loan can be as high as $822,375. And theres a broad spectrum in between those floor and ceiling amounts.

Anything above these caps is considered a jumbo mortgage.

Thank You For Subscribing

Well send you emails when your rate changes, so its easier to keep an eye on the market

- Get personalized rates tailored to your unique circumstance.

- Work with the most qualified experts to help you on your home financing journey.

- Streamline your home loan and close in record time.

Privacy Policy

Sammamish Mortgage is committed to protecting your privacy. This Privacy Policy explains how your personal information is collected, used, and disclosed by Sammamish Mortgage. Sammamish Mortgage includes its brand Rates and Money. This Privacy Policy applies to our websites , and their associated subdomains alongside our applications, Sammamish Mortgage and Rates and Money. By accessing or using our Services, you signify that you have read, understood, and agree to our collection, storage, use, and disclosure of your personal information as described in this Privacy Policy and our Terms & Conditions.

Consent

Definitions and key terms

To help explain things as clearly as possible in this Privacy Policy, every time any of these terms are referenced, are strictly defined as:

Types of Information We Collect

Information collected directly from you:

Information Automatically Collected

Employment Data

Manage Your Information

You can make the following choices regarding your Personal Information:

Sharing of Information

Location Data

Social Media

Other Disclosures With Your Consent

Other Disclosures Without Your Consent

Sale of Business

Affiliates

Governing Law

Links to Other Websites

Don’t Miss: Va Mobile Home Loans

Many Lenders Have Announced Increases In Their 2022 Conforming Loan Limits For California

Increased home prices and higher demand for more homes fueled a major surge in not only home values but also conforming loan limits. Government regulators realized the changes that were necessary to make homeownership possible for more borrowers. As a result, California 2022 conforming loan limits are increasing as much as $75,000, bringing the maximum loan limit to $625,000.

| 1 Unit | |

| 2021 Baseline National Conforming Loan Limit | $548,250 |

| $1,202,000 |

With the recent run-up in-home price appreciation affecting many markets throughout the country, we wanted to step in and provide support for borrowers, said Kimberly Nichols, Senior Managing Director of Broker Direct Lending at PennyMac. This will specifically help those trying to purchase a home or access equity in their property while rates are relatively low.

The industry is also predicting an increase for high-cost areas such as LA County and Orange County in California to be raised from $822,375 to $937,500 in 2022.

Even though the increase isnt official yet, several lenders have jumped the gun and are already writing loans exceeding the 2021 conforming loan limit of $548,250.

Higher conventional loan limits are on the horizon, and we may even be able to find you a lender that is already using the 2022 conforming loan limits.

We will continue to update this page as more information comes out on the 2022 California conforming loan limits.

Get A Home Equity Line Of Credit

To continue with the above example, lets say that you have $100,000 to put down. You may be able to take out a second mortgage to cover the remaining $101,750.

Depending on your circumstances, this second loan can be a home equity loan or home equity line of credit . Keep in mind since this is an additional mortgage, you may have to pay additional fees.

You will also have to coordinate with the second mortgage lender to close on the same day as the primary mortgage. Some second mortgage lenders are accustomed to doing HELOCs for existing homeowners, where the closing date isnt set in stone. Make sure the lender knows its for a home purchase with a specific closing date.

Also Check: Va Loan Modular Home

Max Loan Amount In California Goes Up In 2018

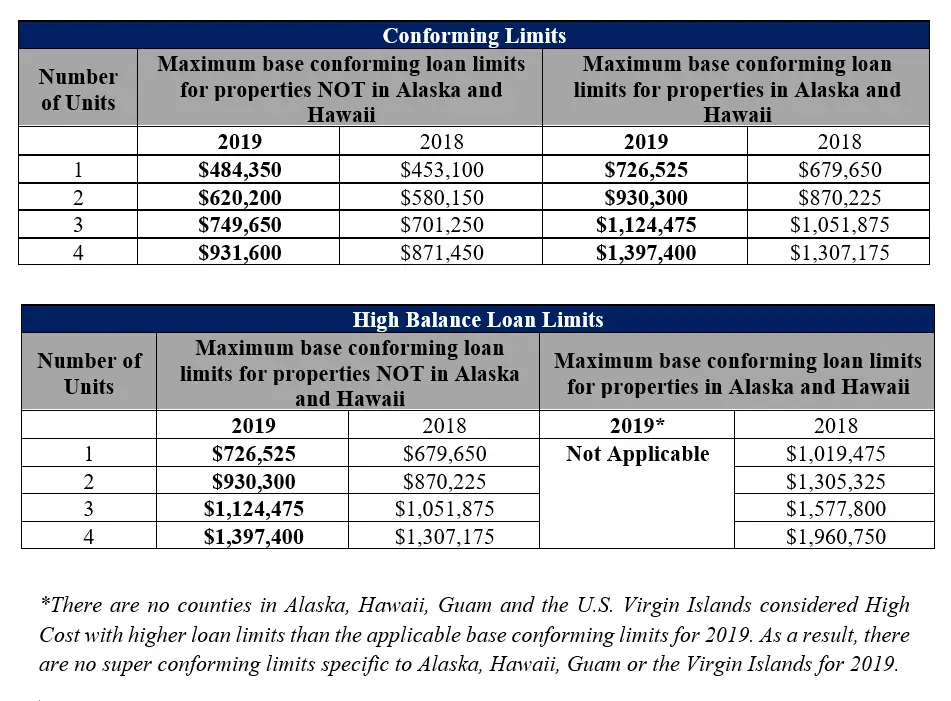

On November 28, the Federal Housing Finance Agency announced that it was increasing the conforming loan limits for most counties across the country. Loan limits in California and nationwide are being increased from 2017 to 2018 in response to significant home-price gains that occurred over the last year or so.

In most counties across California, the maximum conforming loan amount for 2018 has been increased to $453,100. In fact, this is the baseline limit for most counties across the country. And its quite a bit higher than the 2017 baseline of $424,100.

But the max loan amount in California varies from one county to the next. These conforming limits are based on median home values, which vary by location. As a result, higher priced real estate markets like those in the Bay Area can have a higher max loan amount. In these high-cost areas, the conforming loan limit for a single family property purchase is $679,650 in 2018.

Note: These max loan amounts for California apply to the VA mortgage program as well. The Department of Veterans Affairs recently updated its website with the following message: VAs 2018 Loan Limits are the same as the Federal Housing Finance Agencys effective January 1, 2018.

What Are Conforming Loan Limits Exactly

These limits represent the maximum size for mortgage loans that can be acquired by Freddie Mac and Fannie Mae.

If a lender wants to sell its home loans to either of these organizations via the secondary mortgage market, then they need to ensure they meet all of the requirements used by Fannie and Freddie. In other words, they must conform to those standards hence the term.

Recommended Reading: What Do Mortgage Loan Officers Do

California Conforming Loan Limits 2021

Here are the 2021 Conforming limits for all 58 counties in California. One-Unit refers to a property with one structure , Two-Unit is a Duplex, etc. Home values have increased over the last few years and raising the loan limits allows more people to qualify for the best available mortgage rates. The Federal Housing Finance Agency updates their conforming loan limits every year.

| County |

What If You Dont Fit In The Conventional Loan Limits

If you dont meet the conventional loan limits, even in higher-cost areas, youll need a non-conforming loan, such as a jumbo loan. Jumbo loans have slightly stricter underwriting guidelines because they offer loan amounts in the $1 million range or higher.

What is the Jumbo Loan Limit in 2022?

In 2022, any loan exceeding $625,000 falls under the jumbo category. However, there are exceptions in certain counties within California. If you live in a high-cost county, the 2022 California conforming loan limits are higher.

If you live outside of the high-cost counties, though, youll need jumbo financing for any loan over $625,000.

How to Qualify for a Jumbo Loan?

If your loan needs exceed the California 2022 conventional loan limits, youll need to know how to qualify for a jumbo loan.

To qualify, youll need good qualifying factors to ensure your approval including:

- High credit scores

- Down payments of 20% 30%

- Stable employment and income

- Low debt-to-income ratios

Jumbo loans dont follow any government guidelines, so lenders can have their specific requirements. They usually have interest rates slightly higher than conventional loans too. When youre borrowing a large loan amount, even 1/8th of a point difference can make a difference of thousands of dollars in interest.

Also Check: How Much Car Can I Afford Calculator Based On Income

Who Qualifies For A Conforming Loan

To qualify for a conforming loan, you must meet the above guidelines. However, there is one other major factor you must consider.

You must have the income you can prove beyond a reasonable doubt. Conforming loan lenders must prove they did their due diligence to determine you can afford the loan.

What does that mean today?

You must prove you have a steady and consistent income. Working for an employer and producing paystubs and W-2s is the easiest way to get approved. But even if youre self-employed you may qualify as long as you can prove steady income.

Borrowers that wouldnt qualify are those with inconsistent income, or who cant prove their income. You must be able to prove your income beyond a reasonable doubt.

Conforming Loan Limits For All California Counties

The table below contains the 2021 conforming limits for all 58 counties in California, listed in alphabetical order. In this table, 1 unit refers to a single-family home, 2 unit refers to a duplex-style home with two separate residents, and so on.

| COUNTY | |

| $848,500 | $1,054,500 |

For additional information and housing market commentary, continue reading below. You can also view FHA mortgage loan limits here.

Read Also: California Mortgage License Requirements

What Homeowners Need To Know

The loan limit increases dont just benefit home buyers they help homeowners, too. You can now access more equity, which means more cash in hand when you choose a cash-out refinance. Those funds can be used to pay off debt, finance home improvements, or even pay for a child or family members college tuition. Its your choice! Depending on your lender, you may also be able to refinance without resetting your loan term creating even greater long-term savings.

Conforming Loans To Refinance A Current Mortgage:

When it comes to refinancing a mortgage in California the Conforming loan program is perhaps the most popular. Like purchases, you can get an appraisal waiver and you can close fairly quickly due to every loan being underwritten by the AUS of Fannie Mae or Freddie Mac.

If you really want things to move quickly be sure to have your income documentation, mortgage statement, and homeowners insurance information ready to go before applying. Conforming loan limits in California has increased over the last twenty years and that is expected to continue.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

The Bottom Line: Remember Loan Limits If Youre Purchasing A High

If you plan on purchasing your home with a mortgage and have a sizeable home buying budget, its important to understand what the maximum loan limits are in your county. While other loan types, such as jumbo loans, can remove the barrier of having to stay within a certain price limit, that means forgoing the benefits of getting a conforming loan.

If youre considering purchasing a home outside of the conforming loan limits, be sure you understand whether you can afford a nonconforming loan and what this type of loan would mean for your finances after all, the larger the loan, the higher the monthly payment.

This is especially important to consider in high-cost areas. Even with higher loan limits, much of the local inventory could still exceed the high-cost loan ceiling.

In San Francisco, for example, the maximum conforming loan limit is $822,375, but the median list price is over $1,000,000. High prices like this can make it difficult to purchase a home without having to get a jumbo loan.

What would a jumbo loan mean for your finances? The upfront cost alone can be prohibitive for many borrowers. While conforming loans allow down payments as low as 3%, most jumbo loan borrowers are required to put down a minimum of 20%. Theyll also need to have a credit score in the 700s and a DTI of 45% or lower to qualify.

If youre wondering what your own personal loan limit should be, check out our advice on how to determine how much house you can afford.

Get approved to buy a home.

Special Considerations For The Conforming Loan Limit

Fannie Mae and Freddie Mac are the principal market makers in mortgages banks and other lenders count on them to insure loans that they issue and to buy loans that they wish to sell. The conforming loan limits act as guidelines for the mortgages that most mainstream lenders offer. In fact, some financial institutions will only deal with conforming loans that meet the agencies criteria.

Traditional lenders widely prefer to work with mortgages that meet the conforming loan limits because they are insured and easier to sell.

Mortgages that exceed the conforming loan limit are known as nonconforming or jumbo mortgages. The interest rate on jumbo mortgages can be higher than the interest rate on conforming mortgages.

Because lenders prefer conforming mortgages, a borrower whose mortgage amount slightly exceeds the conforming loan limit should analyze the economics of reducing their loan size through a larger down payment or using secondary financing to qualify for a conforming mortgage.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Can I Use My Va Entitlement For The Construction Of A New Home

Although the primary purpose of a VA home loan is to assist a Veteran with purchasing a pre-built residence, the VA also offers its guaranty for construction loans for those looking to build a home for themselves. This means that you can put your Veteran entitlement toward building your new house. Although many lenders do not support VA construction loans, SoCal VA Homes enables you to buy your land and build your home with zero down and zero closing costs. Find out more about our VA home construction loans.

What Home Buyers Need To Know

Homeownership is within reach thanks to the increase in conforming loan limits. The bottom line: its easier to qualify for more home without requiring a non-conforming jumbo loan.

Rates remain competitive, so be sure to start the mortgage pre-approval process soon. Your lender can provide a pre-approval letter that tells you how much home you can afford.

Read Also: What Credit Score Is Needed For Usaa Auto Loan