Suncoast Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Suncoast Credit Union offers competitive auto loan rates it even rewards buyers who opt for environmentally-friendly vehicles plus access to well-priced vehicles for sale. The catch? Membership required.

Important Information About Procedures For Opening A New Account

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: when you open an account we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your drivers license or other identifying documents.

Careers

With a name like ours, youve got to figure were all about growth opportunities. We offer you more in return for your energy and commitment by providing a three-dimensional environment centered on your development, personally and professionally. And, not to toot our own horn, but we were recently recognized nationally as a Top 100 Workplace by Fortune Magazine. Learn more about Grow Careers.

Website Accessibility

Grow Financial is committed to meeting the banking and financial services needs of all our members. We aim to promote accessibility, diversity and inclusion. Our goal is to provide an accessible and barrier-free environment in our banking locations and we strive to make our technology accessible and continuously work on accessibility improvements to our website. Read our Website Accessibility Policy.

We have adopted this policy to support our commitment to the accessibility of this website and to users with disabilities. Please be aware that our efforts are ongoing.

Making Payments Is Easy

Pay Online

Track, view and pay loans with SunNet online banking. You choose when you want to make your monthly payment, easily and securely.

If you need to make payments with funds from another financial institution, you can set up one-time payments online without logging in.

Mobile Payments

Access and pay your loans using the SunMobile app on your iOS or Android device when youre on the go or away from the computer. You can also conveniently make payments and view your loan statement through your smartphone’s mobile wallet by enrolling in moBills.

Auto Payments

Set up automatic payments so youll know your payments are made on time every month. You choose the amount and the schedule one time, and your payments will be made automatically for you.

Payroll Deductions

Making loan payments by payroll deduction is an easy way to make payments at the same time your payroll is direct deposited.

Don’t Miss: How Many Aer Loans Can I Have

Getting A Low Rate Is Simple

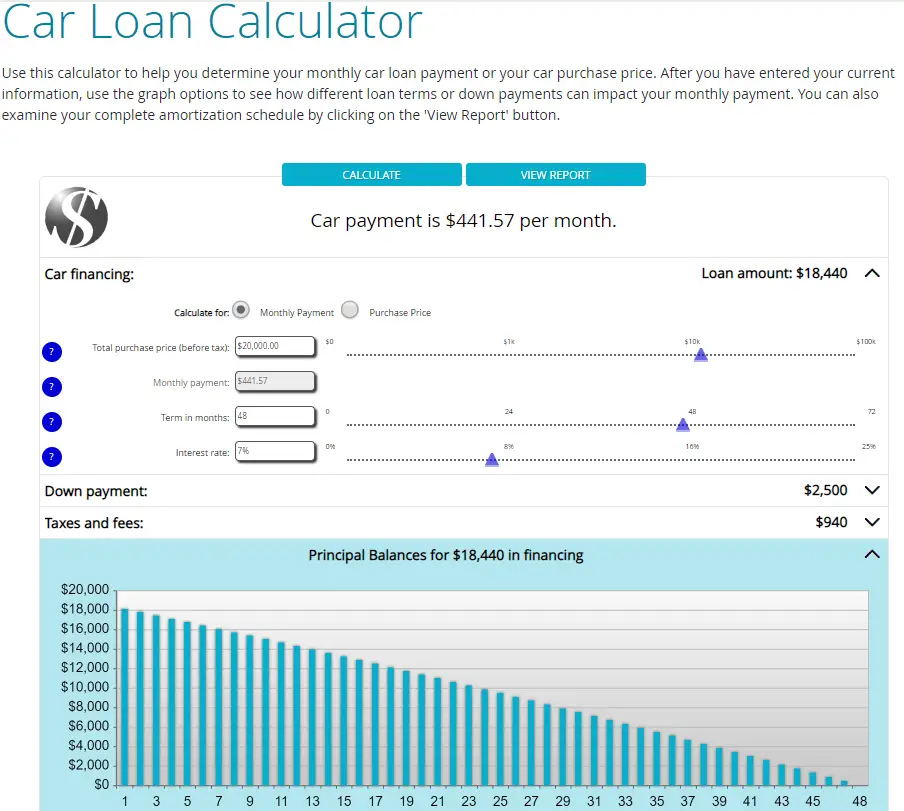

Whether you are looking for a new or used vehicle, or if you want to refinance your auto loan from another lender, we can help you save money. Suncoast members have the opportunity to get auto loan rates as low as 2.50% APR,* plus take advantage of our car buying resources to make the entire car-buying experience easier.

Save Money

Saving is easy with our low rates, starting as low as 2.50% APR*. See how much you can save with an auto loan from Suncoast.

Save Time

Getting pre-approved will save you valuable time during your car buying experience. So you can spend less time signing, and more time driving!

Find Your Car

Whether you want to shop online or in-person, our car buying resources can help you find the vehicle in your price range that meets your needs.

Best For Bad Credit: Consumers Credit Union

Consumers Credit Union

-

Only offers branches in the D.C. area

-

Lower fees only available for high-balance accounts

NASA Federal Credit Union is open to NASA employees, NASA retirees, and their family members. However, you dont have to be a world-class scientist to enjoy membership. It also offers membership to non-employees who join the National Space Society, and the first year is complimentary. After that, your membership will cost $47 a year with automatic renewal. Membership includes their magazine, the latest information on space news, and invitations to conferences and events.

NASA Federal Credit Union offers new and used auto loans and recreational vehicle loans. Auto loan rates start at 2.15% , and although there is no payment due for the first 60 days, interest does accrue. The lowest rates have terms up to 36 months. Longer terms up to 84 months are available, but the rates do increase. You can apply online in a few minutes. You can also reach customer service through email, online chat, and over the phone.

NASA Federal Credit Union has multiple branches in Maryland and Virginia, near the D.C. areas and shared branches at affiliated credit unions. However, the majority of its services are offered online, including digital baking, student loans, credit cars, personal loans, financial planning services, and car loans.

Also Check: Credit Score Usaa

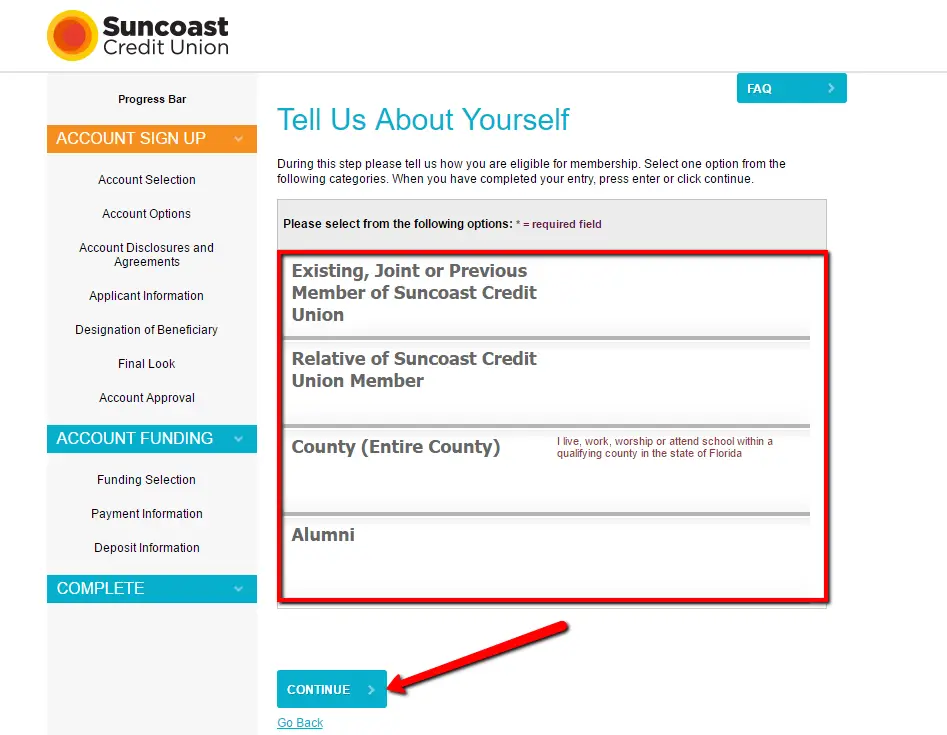

How To Apply For A Suncoast Auto Loan

Once youre a member, there are several ways to apply for a preapproved Suncoast auto loan: online, through the SunMobile app, by phone or in-person at a branch.

| Suncoast has partnered with the online used car site. Shop for and purchase a used vehicle completely online. Carvana can even deliver your vehicle to your home or office. |

Seven-day guarantee: Both CU Auto Branch and Carvana allow buyers to return any car within seven days. If you buy a vehicle through TrueCar or a dealer, then that businesss guarantee applies, if there is one.

Vehicle add-ons: Add-on products such as GAP insurance are usually available for an additional cost. Heres what GAP is.

Hurricane Ida Sba Disaster Loan

1. SBA Offers Disaster Assistance to Businesses and Residents Disaster loans up to $200,000 are available to homeowners to repair or replace disaster-damaged or destroyed real estate. Homeowners and renters are eligible SBA Approves Over $11 Million in Disaster Loans after Hurricane Ida Application Deadline Approaching Jan. 28. By

Don’t Miss: Fha Loan Limits Texas 2016

Car Servicing Through Suncoast Credit Union

An extended warranty, also called a car service contract, is offered through Suncoast by ForeverCar at a special member rate again, we do encourage you to shop around if youd like one. Here are the questions you should ask about extended auto warranties.

CU Auto Branch also has a servicing department called the , located at 4002 Wedgemere Drive in Tampa. Anyone could be a customer you dont have to get a loan or buy a car through Suncoast, or even be a credit union member to be a client at Credit Union Auto Center. Its contact number is 813-336-4160.

Know Your Credit Score

Your credit score is a major factor for the auto loan rate you receive. So before you start looking for a loan, take time to learn your credit score. This will help you get a realistic idea of what auto loan rate you might qualify for.

You can request a free credit report from each of the three major credit agencies once a year. There are also a number of free tools that offer a glimpse into your projected credit score.

A higher credit score could help you get a better auto loan rate. If your credit score is lower, your interest rate might be higher.

Recommended Reading: 600 Fico Score Auto Loan

Suncoast Credit Union Login

You can login to Suncoast Credit Union online account by visiting this link and access all the features. Make sure you have an account already with them. Launch your Web browser and navigate to Suncoast Credit Union’s Login page .

If you do not have an account, create an account. You will need to enter your email id, phone number and some personal data to verify your information.

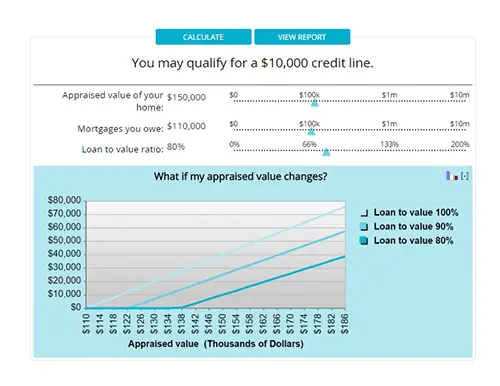

Suncoast Credit Union Money Market Rates

Suncoast money market accounts rates are some of the highest in Florida.

| Minimum Balance |

|---|

| Lump-Sum |

Are Annuities FDIC Insured?

Fixed annuities are not FDIC insured, but they have similar protections for your money. An annuity is an insurance policy guaranteed by the insurance companys claims-paying ability. The insurance companies are members of the state insurance guarantee associations in each state where they do business. Each state insurance guarantee association protects consumers in the unlikely event that their insurance company fails and defaults on their obligations to their consumers .

For example, Georgia insures up to $250,000 of the annuitys cash value per insured life if the insurance company becomes insolvent and can not fulfill its obligations to the insured.

Read Also: Cars You Can Afford Based On Salary

How Do Sunset Credit Union Auto Loans Work

TIf you borrow from Sunset Credit Union directly and have an excellent credit score, you can expect to see interest rates as low as 2.75%.

Its partnered with local car dealerships in Tampa, Florida, which can provide more favorable rates for members.

Loan terms can extend to 72 months on cars and up to 180 months on recreational vehicles.

Does Suncoast Credit Union Do Ach Transfers

With Online ACH Funds Transfer, you can send money to your own accounts at any bank or credit union in the United States. Funds will be debited same day from your Suncoast account when the transfer is set up. Funds are typically available in your external account within 3 5 business days.

https://www.youtube.com/watch?v=o9bprkH45LY

Read Also: Usaa Auto Refinance Phone Number

Endurance Wins The Dayyour Browser Indicates If You’ve Visited This Link

Rapper Jay-Z couldn’t get a record deal and sold his first CD out of his car. He ended up founding his own record label … He contacted more than 200 investors looking for his first original loan in acquiring the firm. After a year of rejections …

National Mortgage Professional Magazine

Rates And Terms At A Glance

- Terms up to 84 months

Suncoast offers the same starting APR for new, used and refinance loans, which means those with good credit looking to buy a used car or refinance the one they already have may find a good deal here, but new-car buyers with strong credit may find a lower rate elsewhere. A customer service representative declined to share the credit unions maximum APR.

The best rates go to buyers of electric vehicles or vehicles with an EPA rating of at least 28 MPG combined. For the lowest green car rate:

- The vehicle must be a new, current model year.

- Borrowers must make automatic payments through a Suncoast account.

- Electronic statements rather than mailed statements are required.

Heres a closer look at Suncoast auto loans.

| Auto Loan Type |

| 84 months |

The best way to find an auto loan is to apply for one directly and, ideally, at more than one lender. If the dealer can beat that preapproved auto loan, great youre probably getting a good deal. You could fill out a single online form at LendingTree and get up to five potential auto loan offers from lenders before you go, depending on your creditworthiness.

You May Like: How To Apply For Sss Loan

Suncoast Credit Union Review 2022

Published February 2022by Matthew Goldberg

Why trust us

Our experts continually research, review, and rate banks to help you objectively compare and choose financial institutions to fit your needs.

Highly Rated App

No monthly fees

Suncoast Credit Union is best for those who live, worship, attend school or are employed in one of 39 Florida counties.

-

Jump to section

The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies.

Member FDIC

Bankrate Savings Score: 5/5 stars

Bankrate Savings Score: 4.9/5 stars

$2,500

Bankrate Savings Score: 5/5 stars

Bankrate Savings Score: 5/5 stars

The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies.

Member FDIC

Bankrate Savings Score: /5 stars

Bankrate Savings Score: 5/5 stars

Bankrate Savings Score: 4.9/5 stars

$2,500

Suncoast Credit Union is Floridas largest credit union. It offers savings accounts, a checking account, regular and jumbo CDs, a money market account and other banking options to its members.

Are Credit Unions Better For Car Loans Than Traditional Banks Or Dealerships

If you already belong to a credit union, its often the best place to start shopping for a car loan. The credit union usually offers better rates and terms than traditional banks and dealerships and they usually charge lower fees as well. The credit union may also be more willing to offer you an auto loan if you have less than perfect credit based on the fact that youre a member and have a banking history with them.

Don’t Miss: Credit Score For Usaa Auto Loan

About Suncoast Credit Union

Suncoast Credit Union has been serving the Tampa Bay area since 1934. We are a not-for-profit financial cooperative, owned and operated by our members. That means we dont have shareholders to answer to, so we can focus on whats important you! They offer all of the traditional banking products and services you would expect, including checking and savings accounts, loans, and more.

To become a member of Suncoast Credit Union, you must live or work in one of the following counties: Hillsborough, Pinellas, Pasco, Polk, Sarasota, Manatee, Charlotte, or Collier. You can also become a member if you are related to someone who is already a member. There is a one-time $25 membership fee, and you will need to open a savings account with at least $25.

Car Insurance From Suncoast Credit Union

Car insurance is available to all members, not just those who buy or get a car loan car through Suncoast. Suncoast partners with Members Insurance Center LLC, which offers auto insurance on cars, motorcycles, boats and recreational vehicles however, you must be a member in order to see rates and terms.

Roadside assistance provides free service five times a year for emergencies like flat tires, dead batteries or if youre locked out of your vehicle. Annual prices vary by the number of covered drivers and vehicles:

- $39 One auto/any driver

- $59 All vehicles/member and spouse

- $69 All household vehicles and drivers

Note: Its always a good idea to shop around to find the best insurance or roadside assistance rates and coverage. For example, Geico includes emergency roadside assistance in all of its policies, free.

Don’t Miss: Refinance Auto Loan Calculator Usaa

What Credit Score Do Credit Unions Require For Auto Loans

There isnt a minimum credit score that all require for auto loans. It depends on the credit union, the type and age of the car, and the borrowers other qualifications such as employment history and income. The higher your credit score, the lower your rate will generally be. Typically, a credit score over 720 will give borrowers the very best rates.

Have A Questionwe Have An Answer For You

Go ahead, ask us anything. Whether youre interested in becoming a member or youre already a member, heres where youll find answers to some of the most popular questions we hear every day at Grow. So ask away. And if you dont find what you need here, you can always call us at .

There are many ways you can qualify to become a member with Grow! A few of the most common ways include being active or retired military, currently working for one of our Select Employee Groups or as MacDill Air Force Base Civilian Personnel, and if you have an immediate family member or live in the same house who qualifies for membership or is currently a member!

When it comes to making payments, we try to make it as painless as possible to pay your loan every month. We have several different ways to pay, including convenient online options.

Pay Online

Newark, NJ 07101-4733

We give you a variety of convenient options for making deposits into your Grow account electronically, in person, or mail:

- Electronically:

- Our Grow mobile banking app services allow you to take a picture of the front and back of your check. Once logged into the app, select Deposit Check and follow the prompts to ensure speedy processing.

- If you have a Grow Visa® debit card, you are able to deposit into any of our deposit taking ATMs. ATMs in your area can be found by typing in your zip code in the Locate option on our website.

Also Check: Cap One Auto Loan

Suncoast Credit Union Bill Payment

It offers online bill payment facility to all its users and provides several different methods to pay bills. You can pay your bill online at Suncoast Credit Union‘s website, mail your payment to the processing center, or pay your bill in person at any authorized location. It also provides you with the option to set up automatic bill payments online and make alternative payment arrangements. You can also cancel account and contact customer support online.

Hereâs the info you need to make your payment in any way you choose:

Online: Log in to your account and pay online at .

You can mail your check to 6801 E Hillsborough Ave Tampa, Fl 33610. Before sending the payment you should call the customer service number 800-999-5887 for reconfirmation.

Use the automated system to make a payment. The phone number is 800-999-5887.

In Person: Pay at any of the nationwide customer service centers.

| Online Login |

|---|