Fines For Misleading Customers To Pay Extra For Services

In July 2012, Capital One was fined by the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau for misleading millions of its customers, such as paying extra for payment protection or credit monitoring when they took out a card. The company agreed to pay $210 million to settle the legal action and to refund two million customers. This was the CFPB’s first public enforcement action.

How To Apply For An Auto Loan With Capital One

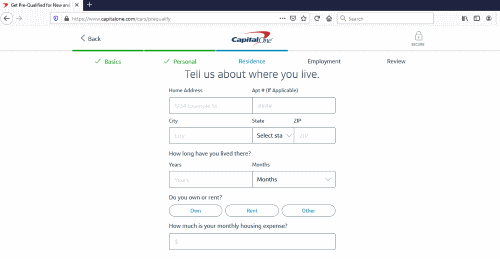

You can start your application by getting prequalified without a hard credit pull. If theres a match, you can view the monthly payment and interest rate on specific cars youre considering. You will also have the luxury of changing the loan term or down payment to create a deal that works for you.

The next step is to visit the dealership and complete a credit application. Capital One will pull your credit report and score to issue a final approval. The last step is to upload any requested documents and e-sign your contract to seal the deal.

You could also be asked by the lender or Capital One to provide these documents during the application process:

- Copy of your current drivers license.

- Proof of residence, such as a utility bill within 60 days thats in your name, bank statements, insurance billing statements or current lease agreement.

- Proof of income, such as your most recent pay stub, an offer letter for new W-2 employment income or three months of personal bank statements if you are self-employed.

Bottom Line: Capital One Auto Loans Review

If you are on the market for a new or used car, do not ignore Capital Ones auto financing program.

They make the lending and shopping process easy because you can browse new listings, receive funding, and find a dealership all in one location.

Justin Estes is a Senior Personal Finance Writer who is a recognized small business accountant, consultant, and credit card expert. His background in accounting and finance led to a passion for helping people make the most of their money and matching them with financial products that enhance their lifestyle. Justin attended Charleston Southern University where he double-majored in Finance and Accounting. Justins areas of expertise are credit cards, small business finance, accounting, and taxes.

Recommended Reading: Capital One Auto Loan Interest Rates

How The Application Works

Capital One allows you to apply as an individual or with a coapplicant. To get prequalified, youll need to submit some information about yourself and your finances, including your income and Social Security number.

If youre prequalified, you can use your finances to shop at participating dealerships for up to 30 days. The dealership will present you with a final loan contract.

Best For Shopping Around: Lendingtree

LendingTree

- As low as 0.99%

- Minimum loan amount: Varies by lender

- Repayment terms: Varies by lender

LendingTree makes it easy to compare rates from dozens of lenders and offers a variety of helpful financial calculators, placing it in our top spot as the best for comparing rates.

-

Compare auto loans from multiple lenders

-

Search by new, used, refinance, or lease-buyout options

-

Loan-payment and credit-score tools

-

Search process requires personal and financial details

If you are tossing around the idea of getting a new car but are not sure if it will fit in your budget, stop by LendingTree first. Without affecting your credit, you can shop from a variety of lenders. You can use this feature for refinancing, new cars, used cars, or lease buyouts. Just enter your desired loan type, down payment, financial status, and the vehicle you want. Then, LendingTree will match you with lenders.

You can compare the offers to find the best rates and terms for your life. If you decide to apply, the lender will require a full application. LendingTree can also help with a loan-payment calculator, free , and other tools.

Recommended Reading: Refinance Auto Usaa

Is A Capital One Finance The Best Choice For You

When it comes to finding the best auto loan option, Capital One Auto is hard to beat.

The company partners with more than 12,000 dealerships, meaning you shouldnt have any trouble finding the vehicle you want. As an added bonus, you can view personalized rates and monthly payments when you pre-qualify.

However, remember that those numbers can change when you get to the dealership. The participating dealerships will pull your credit. Plus, youll have sales tax and registration fees to contend with.

On the other hand, if you need more flexibility, you may want to look for another loan provider.

This is especially true if youre going to purchase your vehicle from an individual or from a dealership Capital One does not partner with. In that case, youll need to look for a different loan provider altogether.

Capital One Auto Finance

Exit From Mortgage Banking

In November 2017, President of Financial Services Sanjiv Yajnik announced that the mortgage market was too competitive in the low rate environment to make money in the business. The company exited the mortgage origination business on November 7, 2017, laying off 1,100 employees. This was the second closure the first occurred on August 20, 2007, when GreenPoint Mortgage unit was closed. GreenPoint had been acquired December 2006 when Capital One paid $13.2 billion to North Fork Bancorp Inc. The re-emergence into the mortgage industry came in 2011 with the purchase of online bank ING Direct USA.

Read Also: When Should I Refinance My Fha Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Read Also: Does The Capital One Pre Approval Car Loan Work

Capital One Auto Refinance Details

Capital One offers auto refinance loans for used and new cars, light trucks, minivans and SUVs owned for personal use. You can apply for these loans individually or jointly. Getting a cosigner for your auto loan refinancing can be a smart idea if you have poor credit or youre looking to get a lower annual percentage rate .

Heres a closer look at what Capital One auto refinance offers:

| Loan Amount Range |

| Based on your credit profile |

| Loan Term |

Should I Get An Auto Loan Through Capital One

Capital One delivers an intuitive and quick loan experience, but that comfort comes with a few limitations. You will only be able to shop with the dealers that enter into Capital Ones program, so your choices may be limited when it comes to vehicle type or configuration. Youre also limited by the pre-approval options that the bank issues at sign up, so youll need to contact a representative to ask about rate, term, and other changes you need to make.

Also Check: Www Upstart Com Myoffer

Finalize The Details At The Dealer

Of the nearly 17,000 franchise car dealerships in the U.S., more than 12,000 partner with Capital One, so it shouldnt be difficult to find a participating dealer near you. You could also search by Vehicle Identification Number or for cars within a mile range of your ZIP code on the Capital One website.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Can I Use A Va Loan To Buy Land

Using Capital One Auto Navigator

Auto Navigator® is a useful tool that helps check for pre-qualifying eligibility, and it helps find cars that are within your budget and desired make and model.

Customers can search for cars they may be interested in test-driving and purchasing by inputting specifications such as make, model, and mileage so that they can see their options.

Auto Navigator® also provides estimated monthly payments and interest rates using the data compiled for loan prequalification, which enables customers to see what types of cars are in their budget and an accurate depiction of their monthly payments if they choose that vehicle.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Also Check: Usaa Auto Loan Calculator

Overview Of Capital One 360 Cds

Capital One 360 CDs have no minimum deposit requirement. This makes them a flexible option for savers who are just starting outyou can open a Capital One 360 CD regardless of the amount of money you have ready to save. Interest is accrued daily and compounded and paid monthly throughout the CD term.

Capital Ones 360 CDs are very competitive with the best CD rates on the market.

If you need to take money out of your CD during the agreed-upon term, youll have to pay a penalty for early withdrawal ranging from three months of earned interest to six months of earned interest.

| Overview of Capital One 360 CDs |

|---|

| Minimum Deposit |

| $1,314 |

More From Capital One

Capital One Auto Navigator works with over 12,000 participating dealerships. After you pre-qualify, youâll see personalized loan rates and can compare payments and save customized terms on the cars you like.

Keep in mind that the vehicle prices listed on participating dealer sites are the âaskingâ price and can probably be negotiated. Before you agree to a sale price, ask the dealer for an âout the doorâ price that lists all dealer fees. These fees are not set or controlled by Capital One. Typically, dealers will charge a documentation fee, sales tax and registration fees.

Capital Oneâs website includes details on its auto financing and refinancing products, a loan calculator and a blog featuring credit score and car-buying information. Capital One also offers a wide variety of , banking accounts and investing products.

Save on Your Car

Read Also: How To Get Mlo License California

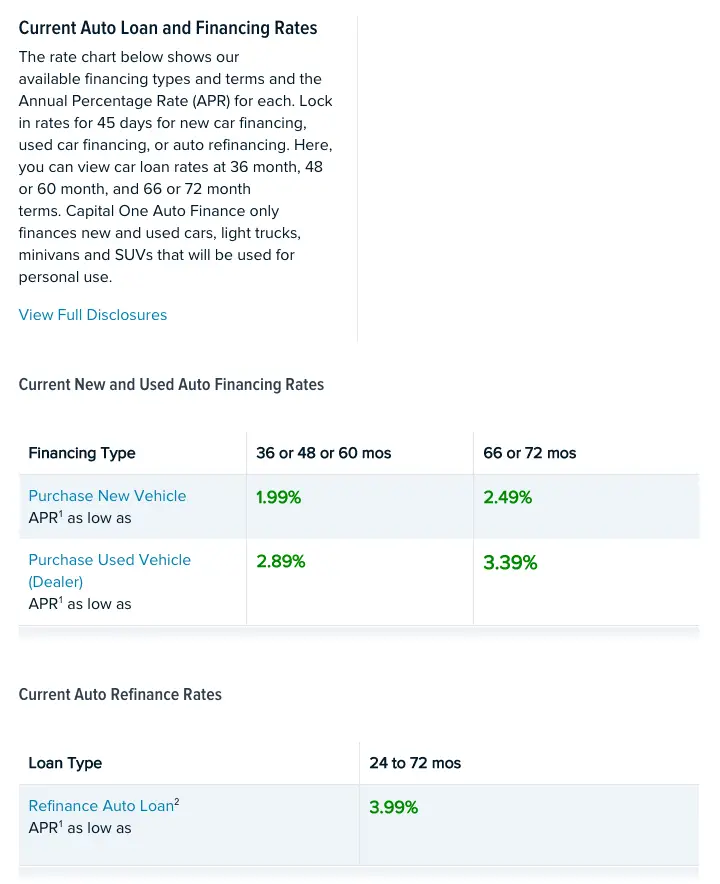

Capital One Auto Loan Rates And Calculators

Capital One auto loan calculators are tools that allow customers to estimate how much their auto loans will cost them and make better-informed car purchasing decisions. For more information about Capital Ones car-financing options, users can visit this page. For more specific questions, prospective borrowers can follow this link and scroll down for Capital Ones auto financing FAQ.

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

Recommended Reading: Texas Fha Loan Limits

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Capital One Auto Loans Summary

All in all, Capital One Auto Finance offers some excellent rates and terms for new and used vehicles. You can feel confident in knowing that you are getting a very competitive rate, especially if you are able to get rates in the mid 4% to low 5% range.

You can access the Cap One website here. Don’t forget to bookmark this site so that after you get your approval you can learn some very valuable time and money saving car buying tips.

Rates for Capital One auto loans aren’t bad for used vehicles, but with good credit you may be able to do better. Check out my Bank Auto Loan Rates page to compare auto lenders rates.

Many lenders are hopping on the “green” car bandwagon and are offering additional discounts for buying hybrid cars. I have not seen anything yet from Cap One, but it’s something you may want to inquire about.

If you’d like to learn more about alternative fuel cars – technology and tax credits, then take a look at new hybrid automobiles.

There are no Capital One auto loans for private party and/or lease buyouts, so you will have to look elsewhere however, they do offer auto loan refinancing with competitive rates.

Recommended Reading: Usaa Used Auto Loan

Applying For A Capital One Auto Loan

Since Capital One Auto Financing is only available through a limited pool of car dealerships, this lender may not be best if youre interested in a wide range of vehicles. However, if you have a credit score between 501 and 600 and are looking for a bad credit car loan, Capital One may be a solid choice.

In 2016, the Washington Post reported that approximately half of Capital Ones auto loans went to subprime borrowers. So if youre worried about qualifying for a loan, Capital One can be more forgiving. Even so, a participating auto dealer can still turn you away for poor credit.

| Capital One Auto Finance Application Details | |

|---|---|

| Minimum Credit Score | |

| Varies by credit score |

The processes for getting a car purchase loan and a refinance loan from Capital One are similar and involve these basic steps: