Jumbo Vs Conventional Loans: How Much Do They Cost

In the past, interest rates for jumbo loans were much higher than those for traditional, conventional mortgages. They still tend to be slightly higher, although the gap has been closing, You may even find some jumbo rates that are lower than conventional rates. A mortgage calculator can show you the impact of different rates on your monthly payment.

Jumbos can cost more in other ways, though. Down payment requirements are more stringent, at one point reaching as high as 30% of the home purchase price though it is more common now to see jumbo loans requiring a down payment of 15% to 20%, higher than the 10% to 15% that some conventional loans require . The higher interest rates and down payments are generally put in place primarily to offset the higher degree of risk involved with jumbos because they are not guaranteed by Fannie Mae or Freddie Mac.

Jumbo mortgages often have higher closing costs than normal mortgages.

Is Jumbo Mortgage Good Idea

A jumbo loan is not a bad idea if you can comfortably afford the monthly mortgage payments. As with any home loan, that depends on your income and your current debt load. You can use a mortgage calculator to estimate your future monthly payment and find to whether a jumbo loan might make sense for you.

Jumbo Loans: Requirements Limits And Rates

Jumbo loans are designed for higher-priced properties and usually come with more stringent qualifying requirements.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Jumbo loans are a type of mortgage product designed for higher-priced homes. Theyre typically reserved for buyers with good credit, steady income, and a good amount of cash reserves.

Heres what you should know about jumbo loans:

You May Like: What Car Can I Afford With My Salary

What Is The Disadvantage Of A Jumbo Loan

Higher closing costs Jumbo mortgages often come with higher closing costs than conforming mortgages. For example, it’s not uncommon for jumbo mortgage lenders to require an extra appraisal on homes needing jumbo financing to ensure that their values are high enough to support that level of borrowing.

Is A Down Payment Needed On A Va Jumbo Loan

Maybe. This is entirely dependent on your loan amount. For loan amounts up to $1.5 million, no down payment is necessary with a median credit score of 640 or better. For loans between $1.5 million and $2 million, you need to have a 10% down payment or 10% equity in a refinance. Youll also need a 680 median FICO® Score.

You May Like: Refinance Student Loans Usaa

And 2022 Conforming Loan Limits

The Housing and Economic Recovery Act requires that baseline conforming loan limits be adjusted annually to reflect changes in average home prices in the U.S. The regular conforming loan limit set by the FHFA was $548,250 in 2021 for one-unit properties in most areas, increasing to $647,200 in 2022. The maximum limit for certain high-cost areas was $822,375 in 2021, increasing to $970,800 in 2022.

The baseline matches the regular conforming loan limit mentioned above in most U.S. counties. This chart highlights some of the counties where they’re above the baseline as of 2022.

| State/Territory | |

| Teton County | $970,800 |

Areas that have higher conforming loan limits are ones that tend to have higher home values. You would most likely be subject to the regular conforming loan limits if you don’t see your specific county listed here.

Who Needs A Jumbo Loan

Buyers who dont meet the Fannie and Freddie loan limit restrictions are either expected to increase the amount of their down payment or find a lender that will offer a second mortgage for the difference so that they can get conforming loans, says Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, Texas. Otherwise, the borrower will need to seek a jumbo mortgage loan.

A jumbo mortgage is a loan designed for a borrower who needs to finance a loan balance greater than conforming loan lending limits. The operative word here is borrow or financeits not the purchase price. You might also hear a jumbo loan referred to as a non-conforming loan. That simply means the loan doesnt conform to Fannie Mae and Freddie Mac lending standards.

Jumbo mortgages can be used for primary homes, second or vacation homes or investment properties, and they are available as both adjustable- and fixed-rate loans.

Read Also: What Do Loan Officers Look For In Bank Statements

Jumbo Mortgage Requirements How To Qualify For A Jumbo Mortgage

Typically, a borrower must meet the following criteria to be eligible for a jumbo loan:

Lower Debt-to-Income RatioSince jumbo loans have more associated risk, the lender may require the borrower to have a lower debt-to-income ratio. Monthly mortgage payments may be larger than that of a conforming loan, so having less monthly debt obligations can help a lender determine your ability to repay the loan.

Higher Down PaymentIt is common for the down payment requirement to be higher than that of a conforming loan to mitigate the lenders risk. If you have more invested in the property, you may be less likely to default on the loan.

Higher Credit ScoreLenders may prefer that you have a higher credit score. A higher credit score may show a history of a strong ability to repay monthly debts on time and in full.

Higher Reserves & AssetsIt is common for lenders to require higher than usual reserves and assets for borrowers applying for a jumbo loan. The lender will review your reserves and assets to understand the strength of your financial profile overall.

Second AppraisalA jumbo loan may require a second appraisal on the subject property to evaluate the homes actual value and make sure it aligns with the anticipated loan-to-value.

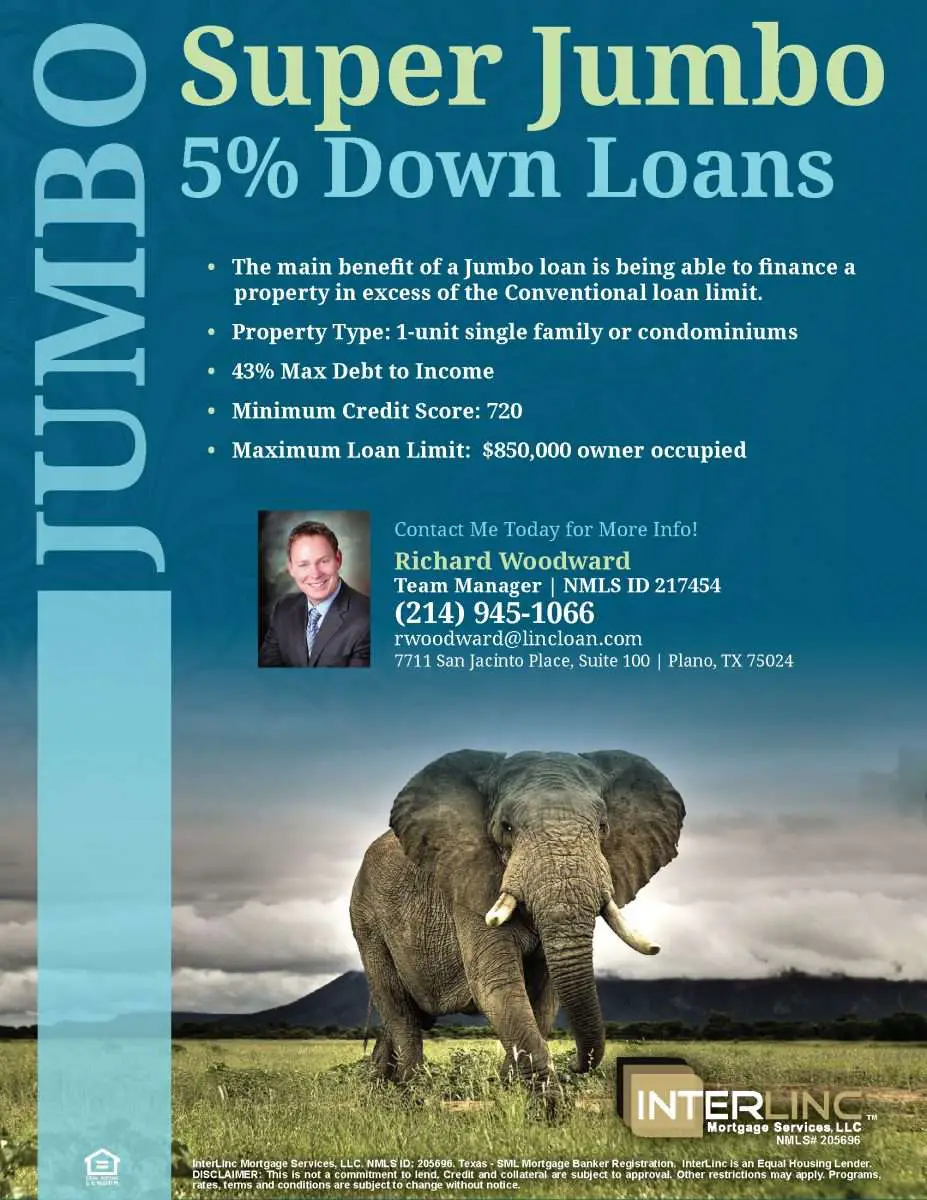

What Is The Jumbo Limit Minimum Credit Score Required

This varies from lender to lender. However, most lenders like to see a credit score higher than 700. In some cases, as high as 720. The minimum credit score a lender would most likely accept for a jumbo loan is 680. Keep in mind, these requirements are different for each lender, make sure you research several lenders qualifications to see where you can get approved.

You May Like: Texas Fha Loan Limits

Conventional Loan Limits Faqs

Will conventional loan limits increase in 2022?

Yes, 2022 conforming limits increased on November 30, 2021. Limits are set annually based on national home prices, which skyrocketed in 2021. As a result, the base nationwide loan amount increased nearly $100,000, or 18%, the largest dollar increase in history. The FHFA compares home prices reported in its House Price Index during the third quarter versus the third quarter of the previous year. In 2021, home prices had increased more than 18% compared to 2020, which lifted conforming limits by $98,950. There could be additional increases in 2023, based on home price appreciation during 2022.

Did 2022 conventional loan limits recently increase to $625,000?

No. Many lenders started offering conforming loans up to $625,000 starting in late-2021 in anticipation of a large increase for 2022. The official limit was still $548,250 when lenders began rolling out temporary higher limits. Lenders planned to hold these loans on their books until January, as they predicted that they could sell them to Fannie Mae or Freddie Mac after the official loan limit announcement in November 2021.

What is a conforming loan?

A conforming loan is a conventional mortgage that adheres or conforms to loan limits and other guidelines set by the Federal Housing Finance Agency . These loans must meet the underwriting requirements of Freddie Mac and Fannie Mae, the government-sponsored enterprises that insure conforming loans.

How Big A Mortgage Can I Afford

How much you can borrow will depend on factors such as your credit score, income, assets, and the value of the property. Jumbo mortgages are generally the best for someone who is a high-income earneressentially, someone who can afford the higher payments.

Even if lenders offer a specific loan amount, it doesnt mean you need to purchase a home up to that limit. Carefully consider how much you want to pay and can easily afford so that you can achieve your other financial goals, like saving for retirement.

Recommended Reading: Does Usaa Do Auto Loans

What Are The Va Jumbo Loan Rates

VA jumbo loan rates are often similar to the rates you can get on a regular VA loan. It just depends upon the appetite of the bond market at the time you apply for your mortgage. Your rate wont necessarily be higher because the loan amount is higher. It can be, but there doesnt have to be a correlation. Its all up to investors.

To get an idea of the VA loan rates, check out our mortgage rates.

What To Do If You Get Turned Down

While loanDepot provides options for borrowers with fair credit or higher DTI ratios, itâs possible to have your application denied. If youâre unable to qualify, itâs likely a good idea to focus on building your credit, increasing your income or paying down your debt to improve your approval odds in the future with loanDepot or another lender.

You could also consider applying with a co-signer or co-borrower. Keep in mind that this person would share responsibility for the loan, which is a huge dealâespecially if they wonât be living in the home. To get an idea of what you can afford on your own, try our mortgage calculator.

Also be sure to shop around and compare your options from as many mortgage lenders as possible. This can help you figure out where you might qualify as well as lock in a favorable rate. Keep in mind that submitting multiple mortgage applications within 45 days will have the same impact as submitting a single application, according to the Consumer Financial Protection Bureau .

Don’t Miss: When Can You Refinance An Fha Loan

How Jumbo Loans Work

Because jumbo loans are considerably larger than conventional loans, its logical that they have stricter borrowing requirements. This way, lenders can have some confidence in borrowers ability to keep up with higher-than-average mortgage payments. Although jumbo loan interest rates have decreased in recent years, they remain higher than those associated with conventional loans.

In the same way, the required down payment percentage for jumbo loans has decreased over the years and is now around 15-20% of the homes purchase price. Borrowers can apply for jumbo loans through institutions like banks, credit unions and mortgage companies.

Jumbo Loan Interest Rates

Similar to conforming loans, interest rates on a jumbo loan depend on a variety of factors, such as your credit score, loan amount, mortgage type, and your debt-to-income ratio, which measures how much of your gross monthly income goes toward paying monthly debts, including your new mortgage. That said, interest rates on jumbo loans may be higher than conforming loan rates.

Read Also: Prosper Loan Denied After Funding

Rate Over X% Assumptions

- Rates shown assume a refinance transaction.

- Annual Percentage Rate calculations assume a purchase transaction of a single-family, detached, owner-occupied primary residence a loan-to-value of 75% a minimum FICO score of 740 a Loan Term of 360 months and a loan amount of $300,000 for conforming loans.

- Rates may be higher for loan amounts under $275,000. Please call for details.

- Rates are subject to change without notice.

- Closing Costs assume that borrower will escrow monthly property tax and insurance payments.

- Subject to underwriter approval not all applicants will be approved.

- Fees and charges apply.

- Payments do not include taxes and insurance.

- Rates based on information gathered from OptimalBlue.

- Mortgage insurance is not included in the payment quoted. Mortgage insurance will be required for all FHA and USDA loans as well as conventional loans where the loan to value is greater than 80%.

- Restrictions may apply.

- Moreira Team | MortgageRight is an Equal Opportunity Lender

The Bottom Line: Va Jumbo Loans Can Be A Great Option

VA jumbo loans enable you to get a bigger loan amount while enjoying many of the same benefits that you would see with a regular VA loan including the ability to have no down payment if your credit score is high enough. Ready to apply? If online applications arent your thing, were happy to take your application at 326-6018 . Were here to answer any questions you may have.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: Auto Refinance Usaa

Jumbo Loan Limits In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you set your sights on a pricey home or an average home in a pricey area a traditional mortgage may not be enough. A jumbo loan could be the answer, but you may need a higher credit score and bigger cash reserves, among other things, to qualify.

Do you need a jumbo loan? You may if the amount you want to borrow exceeds the latest conforming loan limits set by the Federal Housing Finance Agency.

» MORE: The difference between conforming and nonconforming loans

Jumbo Loan Requirements For Each Loan Type

Some lenders break down their requirements by loan type, so youll need to meet different standards if youre buying a home, refinancing, buying an investment property, or doing a cash-out refinance.

Jumbo loan requirements can vary greatly depending on the lender you choose. Here are some typical examples of the requirements for each type:

Read Also: How Many Aer Loans Can I Have

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Are Jumbo Loans

Jumbo mortgage loans surpass the conforming loan limit, which is the maximum loan amount subject to guarantee by Fannie Mae and Freddie Mac. For this reason, theyre referred to as nonconforming loans.

In 2021, the conforming loan limit is $548,250 in most counties in the U.S., and $822,375 in higher-cost areas. Any mortgage over these amounts is considered a jumbo loan. Its important to note that these conforming limits apply only to one-unit properties multi-unit properties have higher conforming limits also set by Fannie and Freddie.

Homebuyers shopping for a higher-end home or one in a more expensive housing market, such as Hawaii, San Francisco or New York, are more likely to need to take out a jumbo loan.

The amount of a jumbo loan varies by location. A jumbo loan in certain parts of California could be a $1 million loan, for example, while one in Virginia could be $750,000, notes Mat Ishbia, president and CEO of United Wholesale Mortgage in Pontiac, Michigan.

You May Like: Usaa Auto Loan Payment Calculator

Jumbo Vs Conventional Loans: The Bottom Line

The bottom line is that theres usually no contest between jumbo vs. conventional loans. If youre borrowing within local loan limits, you can get a conventional/conforming loan. And if your loan amount exceeds that limit, youll get a jumbo loan.

Yes, jumbo loan rates can sometimes be higher than conventional loan rates. But thats not always the case.

As with any mortgage, you can find the best deal by shopping around between lenders. And with todays mortgage rates at historic lows, there are good deals to be had for conventional and jumbo loan borrowers alike.

Ready to get started?

What Is A High

A high-balance loan is one that exceeds the national baseline conforming loan limits, but falls within the local conforming loan limits for your high-cost county. High-balance loans are considered conforming loans with respect to Fannie Mae and Freddie Mac . Lending requirements for conforming loans include:

- You must have a credit score of at least 620 depending on your down payment size and cash reserves.

- You must make a down payment of at least 5% of the homes appraised market value.

- Your debt-to-income ratio the percentage of your monthly pretax income required to cover the mortgage payment and other debts cannot exceed 45%.

Qualifying for a high-balance loan from Fannie Mae comes with a couple of extra stipulations that dont apply to standard conforming loans:

- All loan applicants must have credit scores. Standard conforming loans allow for a process known as manual underwriting, which evaluates an applicants creditworthiness even if they lack credit reports needed to obtain a credit score. Fannie Mae uses an automated system that requires all high-balance loan applicants to have credit scores.

- High-balance loan borrowers dont have access to Fannie Maes 3% down-payment loans.

You May Like: How Long Does An Sba Loan Take