My Experience With A Physician Mortgage

You might be curious as to why Im so passionate about making sure you have a realistic point of view for physician mortgages. Ive personally used a physician mortgage when my wife and I moved our family from Las Vegas to San Diego in 2018.

There were a few major factors in our decision to go the physician mortgage route. The largest reason by far was the ability to put less than 20% down on the new home loan. Fortunately for us we actually had the 20% down. Unfortunately, it was all tied up in the equity of our home in Las Vegas. We decided we wanted to move without selling our current home, since we had two toddlers and life was about as crazy as possible.

Once we made our big move and sold the house in Vegas, we were able to make a large one-time principal paydown. The physician mortgage option gave us the flexibility to help us during this transition.

We also used the services of Doug Crouse. Youve probably seen his name here on the site or through our podcasts. Hes a good friend to the show but also really knows how to navigate through the physician mortgage process. He helped us lock into a 5% fixed rate on a 30-year loan . He communicated with us through every step and really made it go as smoothly as possible for us.

If you can get your finances organized and work with someone like Doug, then the process for a physician mortgage will be much easier.

Dont Miss: Who Can Qualify For An Fha Loan

Secure A Certificate Of Eligibility

Youll need this to be eligible for your VA loan. Youll need to provide proof of your military service based on your status.

VA-approved lenders, like Rocket Mortgage, can help you get your VA certificate of eligibility quickly with proof of service.

Tell your lender you need your certificate of eligibility early in the process so they can help you get it.

How Much Can I Afford With A Va Loan

Veterans Affairs loans are available to eligible active duty or retired military service members and their spouses. VA loans allow you to buy a home with zero and usually dont require you to get private mortgage insurance , which means those who qualify can afford more house than they would with a conventional bank loan. The amount you can afford with a VA loan varies depending on your finances, so you would need to use a VA loan calculator to gauge how much you can afford.

Recommended Reading: What Is The Average Student Loan Debt

How To Prepare For The Va Coe Application

The VA has a comprehensive COE application page that will list out exactly which documents you will need to have present depending on your status within the military. If you are a veteran or surviving spouse, youll need a copy of you or your veteran spouses discharge or separation papers . If you are currently serving on active duty, you will need a statement of service signed by your commander or a personnel officer.

What If I Want To Buy A House Thats Above The Maximum Va Loan In My County

If youve fallen in love with a house that tops the maximum in your area, dont despair. When you look up the VA loan limits in your county, the number you see wont tell you the maximum value of the home you can get with a VA loan. Instead, it tells you the limit of what you can get if you put $0 down.

If you have some money for a down payment, though, these limits might not apply to you. Got some money saved and want to buy a house thats over the VA loan limits? What you need is a jumbo loan.

Don’t Miss: Can I Refinance My Sofi Loan

The Disadvantages Of Va Home Loans

You’d be hard pressed to find a whole lot of drawbacks to a VA home loan. Assuming you qualify – i.e., that you are an active member of the United States military, or a veteran – then you will quickly see that the pros of such a loan far outweigh the few cons. Still, in order to make the best and most educated decision possible, you should learn about the drawbacks and disadvantages of VA loans. Knowing exactly what you’re getting yourself into is always a good idea. In general, the main drawbacks of a VA loan are:

Loan Limits

Although they vary depending on where you live in the country, there are limits on how large of a VA home loan you can take out. Those who are looking to purchase a very expensive home, for instance, may be discouraged by the loan limits that are imposed by the VA home loan program. If the home that you want to buy exceeds the loan limits set by the VA home loan program, you will have to finance the balance through another mortgage program. This can seriously negate the benefits of using the VA home loan program. Still, the limit in most areas is currently $729,000 for the vast majority of people, that amount is more than enough for what they are looking at.

Hidden Fees

VA home loans are interesting because they don’t include a ton of different hidden fees. Still, there are a few that you need to be aware of in order to get the best idea possible about what you can really afford. These fees include:

| Borrower | |

|---|---|

| 0.5% | 0.5% |

How Many Va Loans Can You Have

So long as you have remaining entitlement , access to a VA loan is a lifelong benefit. There are different scenarios that typically involve an additional VA loan:

There are several ways you can capitalize on a VA loan more than once. If you sell your current home, you can restore your VA entitlement to purchase your next home.

You dont always have to sell your house or move to take advantage of another VA loan, though. You can refinance into a new VA loan to lower your interest rate and monthly payment, which can be done with a VA streamline refinance, also known as a VA IRRRL. Another option is a VA cash-out refinance loan, which involves more paperwork but can help you tap your home equity.

The third way is to carry two VA loans for two different homes at the same time. This is possible it often happens when an active service member receives Permanent Change of Station orders but its important to remember that a VA lender will need to approve you having multiple loans. Essentially, youll need to show that you have the means to pay both of the loans back at the same time.

You May Like: How To Apply Government Home Loan

Does My Home Qualify For A Va Loan

Your VA appraiser will have final say in whether your home qualifies for a VA loan. To ensure the best chances for your property to be approved by the VAs Minimum Property Requirements , make sure your home covers the following:

Property condition:

- Mechanical systems are operating safely and are deemed to have reasonable future utility.

- Adequate heating supply that is in good working order.

- Roofing must be in good condition with no major leaks.

- Property must be free of any structural threats such as termites, rot, or fungus.

- Generally speaking, it is best to avoid homes listed as is as these homes tend to have one or more of the above listed issues.

Conventional property:

Your property must be a conventional family home. VA appraisers tend to dislike unique properties due to the complications they can create when trying to find recent comparable homes. In addition, your lender may have additional restrictions to certain unique homes including but not limited to: ranches, converted churches, and homes with geodesic domes.

Va Loan Funding Fee And Closing Costs

Borrowers should also consider the impact loan size has on VA funding fees and general loan closing costs. To offset the costs of the loan program, the VA imposes a funding fee ranging from 1.4% to 3.6% of the loan amount. Yes, you can roll this fee into your total loan amount and pay it off over time. But, you should still recognize that, the larger the loan, the larger the VA loan funding fee.

Additionally, borrowers need to pay other loan closing costs, most of which cannot be rolled into the loan balance. While these costs will vary with lender and location, a common rule of thumb calls for 3% of the loan amount in closing costs. And, borrowers need to pay most of these in cash at closing. That is, no down payment doesnt mean no cash at closing. Borrowers need to plan for potentially paying thousands of dollars out-of-pocket in loan closing costs. Generally speaking, the smaller the mortgage, the smaller the out-of-pocket costs.

Don’t Miss: How To Find Your Student Loan Debt

How To Use A Va Loan Calculator

Here are the steps to using a basic VA mortgage loan calculator.

- Enter the expected cost of the house and the amount you are willing to make as a downpayment. You can also choose not to make a downpayment. However, putting money down upfront would reduce your monthly payments.

- Enter the interest rates.

- Select the loan term. You can either choose 15 years or 30 years. Selecting a longer term would mean lower monthly payments but higher interest rates.

- Select whether or not it is your first time borrowing a VA loan.

- Look for the result. The total monthly cost combines monthly installments, insurance, taxes, interest and VA funding fees.

- You can also select the breakdown of the cost to get a detailed analysis.

Is There A Minimum Credit Score For A Va Loan

It sounds weird, but the VA doesnt actually act as the lender for VA loans. Instead, they back the loans that conventional lenders like banks and credit unions supply to veterans. So although the VA itself doesnt have minimum credit requirements for a VA loan, the lender you work with on financing your home likely will have a minimum credit score in mind. Usually this hovers around the 620 markconsiderably lower than with a conventional loan.

Recommended Reading: Can You Get Fha Loan With Collections

How Do Interest Rates Impact Affordability

Interest rates have a direct impact on VA loan affordability. Mortgage rates reflect the cost of borrowing money, and they can vary depending on the lender, the borrowers credit profile and more.

VA borrowers benefit from having the industrys lowest average interest rates.

More:See today’s VA loan interest rates

Do Va Loans Come With Fees

Yes indeed. VA loans come with whats called a funding fee, which helps keep the VA loan system afloat. The funding fee is expressed as a percentage of the loan value. As of 2017, it’s 2.15% for regular military officers and 2.4% for the reserves and National Guard on 0%-down payment loans to first-time veteran borrowers. For veterans accessing a VA loan for the second time, the fee for a 0%-down loan is 3.3%. Veterans who put a down payment on their homes will pay a smaller percentage in funding fees.

Certain people are eligible to have the VA loan funding fee waived altogether. These include veterans receiving VA compensation for service-related disabilities, veterans who would be receiving compensation for service-related disabilities if they werent already receiving retirement pay and surviving spouses of veterans who died in service or from service-connected disabilities.

If you pay the VA funding fee and then later discover youre entitled to retroactive disability benefits going back to a date before your loan closed, dont panic. Contact the VA and theyll work on getting your fee refunded.

You May Like: How Does Pre Approval For Car Loan Work

Down Payment And Assets

VA loans are one of the few loan options that dont require a down payment. Your lender may have specific requirements for a no-down-payment VA loan.

For example, they may require that you have a higher credit score if youre putting down less than 10%. The requirement to purchase a home with a VA loan through Rocket Mortgage® with no down payment is still a median of 580.

Its important to keep in mind that no down payment doesnt mean zero cost. In addition to VA loan closing costs, there are some other fees to be prepared for, even if youre putting 0% down. Heres a glance at just a few of them:

Check Your Credit Score

Its important that you request your credit report before you start the application process and find out your credit score.

Your is a three-digit summary of your creditworthiness. Borrowers with high credit scores will typically be offered the lowest interest rates, while those with low scores will be offered the most expensive rates.

You can get a free once per year from each of the three major . You may also access your credit report for free under certain conditions, for example, if youre the victim of identity theft.

Additionally, thanks to the CARE Act, you can now access free weekly reports from the three major credit bureaus, at least until April 2022.

Read Also: Can I Pay Off Personal Loan Early

Access To Other Adaptation Grants

Disabled veterans may also qualify for a Temporary Residence Adaptation grant to add modifications to your property that make it easier to navigate if you live with a family member. Like SAH grants, you wont need to pay back your TRA grant, which makes them a powerful tool for veterans with mobility-related disabilities.

Property Tax Exemption

Property taxes fund things like libraries, fire departments, and local road and development projects. Disabled veterans property tax exemptions can lower the amount you must pay in property taxes.

These tax exemptions arent a federal program, and they vary by state, so check with your local VA office to learn the exemptions youre eligible for. Some states offer an exemption to all veterans, while other states limit this benefit to veterans who are currently receiving disability payments. Disabled veterans are 100% exempt from property taxes in some states.

Va Loan Eligibility Requirements

To qualify for a VA loan, youll have to meet both general qualifications set by the Department of Veterans Affairs and financial qualifications set by the individual lender.

Note that if you meet the governments VA loan eligibility requirements though, lenders will generally apply more lenient credit requirements when considering your application than under other mortgage loan programs.

To be eligible to receive a VA loan, you must meet a minimum of one of the following criteria. Specifically, you must have served for:

- A minimum of 181 days of active service during peacetime.

- At least 90 consecutive days of active service during wartime.

- More than 6 years of service with the National Guard or Reserves or 90 days under Title 32 with at least 30 of these days having been consecutive.

Alternately, you can also meet VA loan eligibility requirements if youre the spouse of a servicemember who lost their life either in the line of duty or as the result of a service-related disability.

You May Like: What Is Residual Income In Mortgage Loan

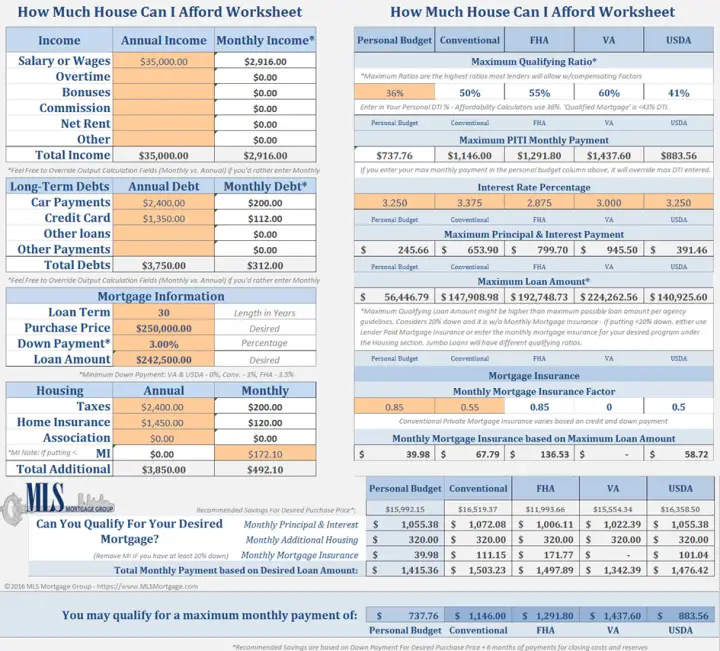

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexible loan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use our VA home loan calculator to estimate how expensive of a house you can afford.

Exemption From Funding Fees

Disabled veterans are exempted from the VA funding fee, so they dont have to pay the VA funding fee during closing. To qualify for the exemption, you must currently receive some form of disability benefits. Your level of disability is irrelevant.

This exemption can save veterans or their surviving spouse thousands of dollars. For example, if you buy a home worth $200,000, you might pay as much as $2,800 $7,200 in VA funding fees when you close. Disabled veterans can avoid this fee.

Read Also: Where Can I Cash My Student Loan Check

Will My Va Loan End Up In The Secondary Mortgage Market

Probably. Most VA loans end up being packaged up by lenders and passed to Ginnie Mae, a government owned corporation that allows individuals and pension funds to invest in the secondary mortgage market. Ginnie Mae guarantees mortgage-backed securities for government-backed mortgages, but doesnt buy them or sell the mortgage-backed securities. Ginnie Mae securities are backed by the full faith and credit of the U.S. government.

The Not So Obvious House Poor Example

There are different levels of house poor. Lets say a young physician is starting in practice and wants that million dollar home. Lets see how these numbers shake out.

With a DTI of around 35%, youll qualify from the lenders perspective with lots of room to spare. Youll be left with ~10% of income to furnish the home and bump up your lifestyle a touch above the level you were living in residency. Its unlikely there will be any leftover to save, though, so youd better be prepared to work forever. Your kids wont get any student aid for college because you make too much money. And you arent in a good position to have any leftover money to help them. So they better be prepared to take out large student loans. But youll have a pretty sweet house.

So what about $350,000 income? Is that gonna do the job? If we assume taxes increase to 30% and everything else is the same, youre left with $82,712 per year . That would probably be enough to save for a very average retirement, assuming you were still relatively young. And the rest would allow for a very modest lifestyle increase. It would be very challenging to save for college costs and build up emergency reserves. But it would be possible with discipline.

Essentially, if your home expenses create a situation where youre not able to live your ideal lifestyle, its a form of being house poor.

Don’t Miss: How To Get An Fha Loan With No Money Down