How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Fha Appraisal Vs Regular Appraisal

Appraisals and home inspections are typically two different processes. During a conventional home-buying experience, the lender sends one of its approved appraisers to formally evaluate the homes value based on the size and structure of the home. And a buyer can order an optional home inspection from their choice of contractor to look at the roof, plumbing, HVAC, termites, and other potential issues.

What makes an FHA appraisal different is that it requires a home inspection element. An FHA inspection is a peek at what its going to be like to actually live there, says Gromicko. FHA inspectors make sure the house is sound, that it doesnt have water intrusion issues, that the appliances function, that it doesnt appear to have any environmental issues like mold or asbestos, that the windows and receptacles function, and that it isnt infested with rodents or wood-destroying organisms.

And unlike a typical appraisal or inspection, the FHA will require any repairs to be completed for the sale to go through.

The Purpose Of An Fha Appraisal

The purpose of an FHA appraisal includes the following:

Analyzing the site of the property

The appraiser analyzes the site, which includes the locations topography, the suitability of the soil, encroachments, and other properties adjacent to the area.

Assessing the livability of the house

This includes assessing the above ground and basement areas, the structure and functionality of the property in general. Furthermore, the property is checked for any hazards.

Estimating the market value of the property

The appraiser analyzes similar properties in the area to help determine an estimate for the property being sold.

Evaluating the physical condition of the property

The appraiser does this by documenting all the repairs deemed necessary for the house. He completes the Valuation Conditions form.

Assessing the longevity of the property

This is important for a long-term mortgage.

Recommended Reading: Upstart.com/myoffer

How Much Does An Fha Home Appraisal Cost

An FHA home appraisal is paid for by the buyer. Its not something you can shop for because your lender orders the appraisal through an independent third-party appraisal management company. The cost depends on a variety of factors including how far an appraiser would have to travel to get your location, how big the house is and how much land there is to cover.

The cost of an appraisal can either be paid for as part of your deposit with a lender or your closing costs, but the fee is typically $300 $500.

Fha Home Inspection For Safety

Safety is very important during the FHA inspection. The inspector will look for hazards inside and outside of the home. This could be a leaking oil tank on the property or a toxic waste dump next door. Yes, that is an extreme example, but conditions nearby will determine whether the home passes the inspection.

If the home is in close proximity to an airport and its flight pattern, that may result in extreme noise hazards that could disqualify the home from being financed with an FHA loan.

The inspector will also make sure every bedroom has a window or a door to be used as a fire escape. The home must also have adequate access for police, fire and ambulance emergencies. This means the home could be on a dirt road, but it must be in passable condition.

You May Like: Usaa Auto Loan Rates Credit Score

What To Do With The Results

Once the FHA appraisal has been completed, the mortgage lender will review the report and may ask for repairs to be completed based on the appraisers recommendations.

The appraisal will outline exactly what needs to be repaired for the appraisal to be FHA-compliant, says DiBugnara.

The seller is generally responsible for repairs unless otherwise stated in the sale contract. Some contracts will stipulate that the property is being bought as is, says DiBugnara. These repairs are expected to be completed before closing.

Not all sellers will be willing to make repairs, however, which means that as the buyer, you may have to continue searching for an FHA-compliant property.

You also have the option of choosing an FHA 203 loan, which allows for financing both the purchase of the home and the required repairs through a single mortgage. Borrowers can make a variety of repairs using an FHA 203 loan. These fixes include structural alterations, reconstruction, modernization and elimination of health and safety hazards.

One last option, if your income and credit score allow, is to purchase the home using a conventional mortgage.

Sometimes, the appraised value turns out to be lower than the purchase price. When this happens, the buyer and seller can decide to negotiate a lower price, or, if the seller doesnt want to settle for less and theres an appraisal contingency the buyer can walk away.

Why Do Fha Minimum Standards Exist

These standards help a buyer to avoid buying a money pit, but their main purpose is to protect the lender, Aragon said.

The property serves as collateral if the borrower fails to pay the mortgage payments, thus defaulting on the agreement and requiring the lender to foreclose on the home, Aragon said. If the FHA property appraisal and inspection process wasn’t completed or performed haphazardly, a higher likelihood exists that the lender finds the property’s value as insufficient.

A lender wants to know that the home is in shape that’s good enough to allow it to be sold at a price that will avoid too much financial loss if the borrower were to stop making payments. This would force the home into foreclosure and result in a sale.

Also Check: Best Fha Refinance Lenders

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Is An Fha Appraisal

FHA mortgages are home loans that allow a lower minimum credit score and down payment than many conventional loans. These loans are funded by a bank or other type of mortgage lender, but backed by the federal government.

In order to purchase a home with this type of loan the property, whether its a single-family home, townhouse or a condominium, it must go through the FHA appraisal process.

In order to back a mortgage, the government needs to make sure the loan is a sound investment, which is why they require a special FHA-specific appraisal, says Christopher Linsell, real estate coach for The Close. This appraisal serves two purposes: the first is to assess the market value of the house. The government will want to ensure the loan amount they will be backing is equal to or less than the market value of the home. The second is that they will also want to assess the homes condition, longevity and livability.

You May Like: Capital One Auto Pre Approval

A Mouse In The House: Pest Infestation

Rodent droppings, termite tunnels or other signs of pest infestation constitute another essential part of the inspection. The home and any other structures, such as sheds or garages, are examined at the ground area for signs of termite infestation. Concentrations of wood in the yard, like a wooden enclosure for plants, are checked for evidence of termites. In all cases where wood from the primary structure makes direct contact with the ground, the FHA inspector will order an additional terminate inspection.

What Is The Allowable Debt To Income Ratios For Fha Loans

Now that you know how to calculate your own debt to income ratio, you should know how lenders use these numbers to decide on your approval for a mortgage.

They will use two different debt to income ratios to determine your ability to repay the loan.

The first number is your front-end debt to income ratio. Lenders will be looking solely at the approximate cost of the monthly mortgage payment with interest compared to your overall income.

For this calculation, they leave out all of your other debt to see what percentage of your income will go toward housing each month.

According to the FHA underwriting guidelines, the maximum front-end DTI is 31 percent.

The second is known as your back-end debt to income ratio. This adds up your mortgage payment and any other debts you might have to see how much you will really owe on a monthly basis.

The FHA allows debt-to-income ratios of 41 percent when looking at the back-end numbers.

You May Like: Genisys Auto Loan Calculator

When The Seller Is A Bank

When buying a foreclosure or real estate owned home, the seller is often a bank that will not make repairs or grant access to the home so someone else can make them.

In this case, there is often no way to make repairs. In this case, an FHA mortgage may simply not be an option and youll have to consider other loan types. For example, a 5% down conforming conventional loan has less stringent property requirements than FHA. But if the property has major issues, its likely the mortgage lender will still require repairs.

Also, check whether the property is eligible for HomePath financing . In any case, HomePath loans dont require an appraisal or repairs to be made at all!

Some lenders will allow whats called a repair escrow. Heres how it works.

- The lender gets a licensed contractors bid for all the needed work.

- The lender adds the money for repairs plus any overruns into your closing costs.

- The lender will put that money in an escrow account to pay the contractor for the repair work after closing.

This option means the home is repaired to the lenders satisfaction, and no work needs to be done prior to closing. But, keep in mind that not all lenders will do a loan with a repair escrow, and repair costs usually cant go much above $1,000.

The Bottom Line: Fha Appraisals Protect Both Lenders And Buyers

Like all real estate appraisals, the aim of an FHA appraisal is to establish the safety of a home as well as its value. This is contrasted with a home inspection which doesnt assign a value, but does a deep dive on the condition of the home and potential issues.

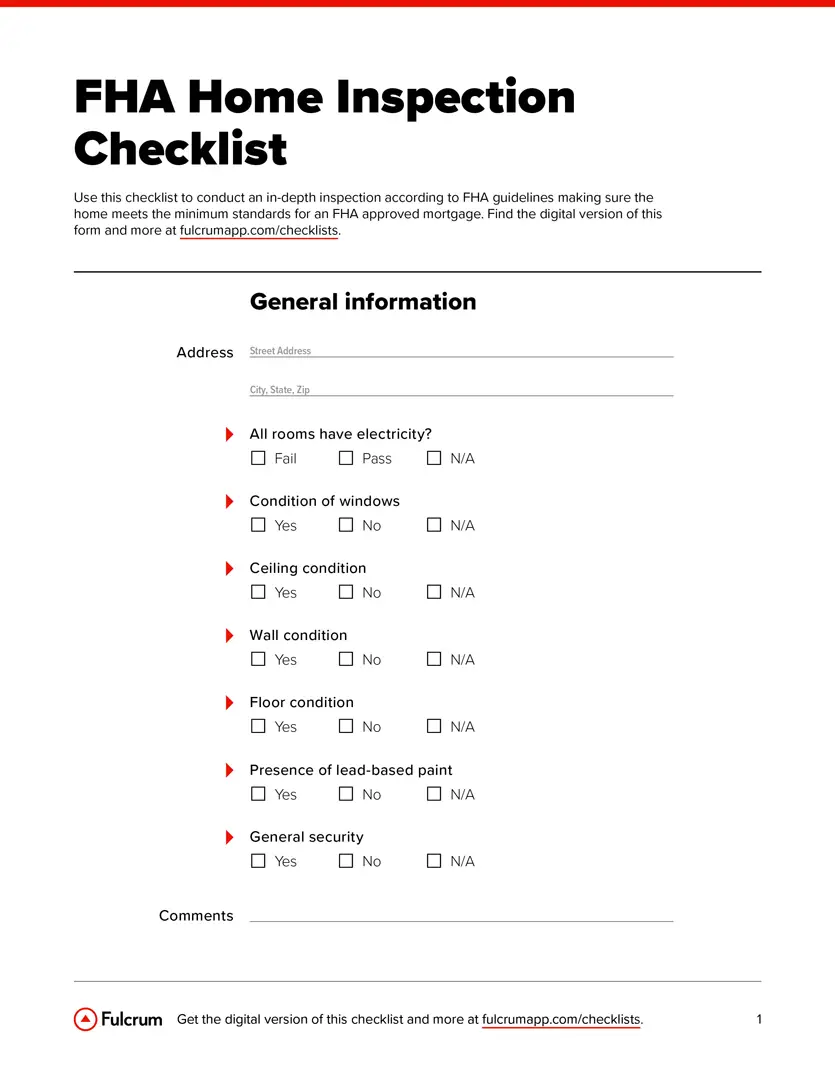

In addition to assessing your homes value by comparing it to similar properties, the FHA appraisal process includes a safety check for hazards like mold, utilities not working and lead paint, among other things. If youre looking to prepare for an FHA appraisal, the most important thing to remember is that all areas of your house should be easily accessible.

If an appraisal comes back low, you can renegotiate or walk away. If you do the latter, be sure you have an appraisal contingency so that you can get your earnest money deposit back.

Recommended Reading: Are Student Loan Forgiveness Programs Legit

What Is The Difference Between An Fha Inspection And An Appraisal

An FHA inspection is an in-depth analysis of the home. It is looking for structural issues, hazards, and makes sure the home is in good livable condition while meeting the FHA minimum property standards. The FHA inspection also verifies the true market value of the home.

A standard non FHA appraisal simply verifies that the home value is at least as much as the selling price by determining the true market value. Although the appraisal protects the buyer, its true intent is to protect the lender.

An FHA insured loan will require you to have the FHA inspection and appraisal. Read our article on FHA approved homes for more details on what is needed to meet the minimum property standards.

What Happens If The Home Fails The Fha Inspection

The home will not fail inspection but there may be things noted on the inspection that did not pass. The repairs or modifications noted by the inspector would need to be made before the loan can close. This means the current homeowner would need to make those repairs or pass on selling to an FHA buyer.

If there are repairs that cannot be made prior to closing, the lender can setup an escrow account for the repairs to be made afterwards. The escrow account will include the cost to make the repairs and borrower labor is not considered as part of the costs.

The home must be in habitable condition excluding these repairs. Meaning, if the home needs windows fixed or some floors repaired then that is fine. However, if there is no working kitchen or bathroom , then the loan will not close.

With non-FHA loans, the buyer and seller can negotiate a reduction in price to cover the repairs for the buyer to manage on his or her own after closing. That cannot happen with an FHA loan. All repairs need to be made prior to closing.

Don’t Miss: Refinancing Fha Loan

Can You Get An Fha Loan With No Credit Score

Many lenders are still willing to issue loans to borrowers who do not have credit.

You might be able to submit alternative lines of credit such as a phone bill or your utility bills. Your accounts for multiple years with paid bills on time is a good enough proof.

This makes the FHA mortgage program ideal for first-time homebuyers. They usually havent had enough time to build up their own credit score yet.

Much like with a lower credit score, you might have to come up with a larger down payment if you have no credit at all.

Fha Appraisal Vs Home Inspection

Before we go any further, two things that are commonly confused are an appraisal and an inspection. A home appraisal involves putting a value on a property and a basic safety inspection. Its used to make sure that the loan-to-value ratio after you buy the property represents an acceptable risk for the lender and the FHA as the mortgage investor.

By contrast, a home inspection is a thorough examination of a property youre looking at buying to identify any potential issues so that youll know its condition and see if youre personally comfortable with it. A home inspection includes checking all major systems and any appliances that may be included in the sale, as well as the homes roof. If necessary, its also possible to get specialized inspections for things like and chimneys.

Also Check: Usaa Auto Loan Pre Approval

Get The Right Inspection For Your Future Home

Learning the difference between an FHA home inspection and a conventional inspection could save you time and money.

So consider what kind of loan you need to move into your next house. Youll match your financial goals with the inspection that supports them, resulting in a home thats move-in-ready without surprise renovation costs or health concerns.

Wood Destroying Insect Inspections

FHA/VA loans will require the main house AND ALSO all detached buildings to be inspected by a state licensed Wood Destroying Insect inspector. Builder Buddy offers this option on the website please indicate if you have a FHA/VA loan on our online submission form so we can give you a quote on any detached buildings.

Don’t Miss: Drb Refinance Reviews

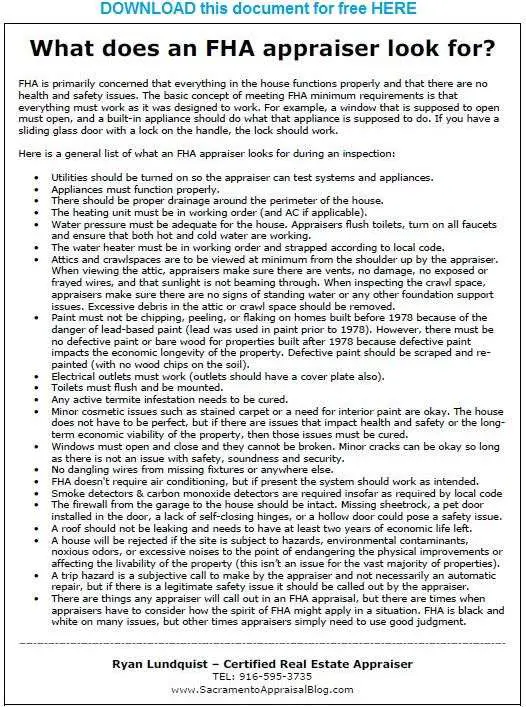

What Fha Appraisers Look At

When buying a home using an FHA loan, you will be required to get an FHA appraisal. First, the home appraisal is ordered by the mortgage lender. Next, the appraiser will perform a basic inspection on the property to ensure it meets the HUD property standards for FHA loans. For real estate to be classified as FHA approved, it must pass the HUDs FHA property guidelines.

The FHA Appraisal Process

- Inspect the propertys interior and exterior structure and quality

- Ensure lead-based paint is not present

- Check for cracks, leaks, and damage to the exterior

- Walls and ceilings in good condition without cracks or holes

- Check the quality of fixtures, plumbing, and appliances

- Make a note of any upgrades that may increase the value

- Ensure the Landscape is in good condition

- Check central heating and cooling systems

- Take photos of the front, sides, and back of the home. Along with photos of any upgrades that increase the value of the home

- Include a copy of the location map showing the comparable sales

Assigning A Home Value

The primary function of an appraiser is to assign a fair market value to your home. In order to do this, they first take a look at the condition of your home as well as its amenities. After that inspection is complete, they look for comparable recent sales of similar properties, or comps.

Similar is a key word there. In order to be considered comparable, four-bedroom colonial homes are compared with other four-bedroom colonials. You wouldnt compare it to a three-bedroom ranch property.

Comps are also typically judged against homes in the same or very nearby neighborhoods. Theres a little leeway in areas where homes are spaced farther apart, but thats the exception rather than the rule. There are often up to three comparable properties used.

Based on this assessment, the appraiser puts all that information together and assigns a fair market value to the property.

Also Check: Usaa Used Car Loan Interest Rates